What Happened to Michael Burry’s Stock Market Predictions?

HTML-код

- Опубликовано: 2 окт 2024

- ★ SEEKING ALPHA - News & Analysis) - Try It FREE ★

▶︎ www.hamishhodd...

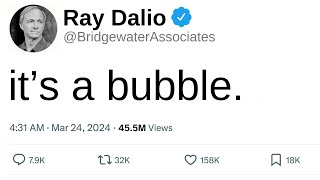

Michael Burry is very well known for making stock market predictions, some of which are so impressive they’ve bridged the gap between nerdy financial analysis and pop culture.

But how often is he actually right? Or maybe a better question is, does he make a ton of incorrect predictions that we’ve just forgotten about?

Well I’ve been following and archiving every prediction Michael Burry has made on Twitter over the past couple of years to answer that exact question.

Including a prediction that has so far come completely true, and will likely reach a conclusion in 2024.

===========

STOCK ANALYSIS SPREADSHEET

▶︎ www.hamishhodd...

-------

STOCK ANALYSIS CHECKLIST

▶︎ www.hamishhodd...

-------

SHARESIGHT - Track Your Portfolio (4 Months FREE)

▶︎ www.hamishhodd...

-------

SEEKING ALPHA - News & Analysis (50% OFF)

▶︎ www.hamishhodd...

-------

TIKR - Financial Data (save 25%)

▶︎ www.hamishhodd...

-------

YOUNG INVESTORS PODCAST

▶︎ Apple Music bit.ly/YIPitunes

▶︎ Spotify bit.ly/YIPspotify

▶︎ RUclips bit.ly/YIPYouT

-------

★PRIVATE INVESTOR COMMUNITY★

▶︎ www.hamishhodd...

-------

MY RUclips GEAR

▶︎kit.co/hamishw...

-------

FOLLOW ME ON TWITTER

▶︎ / hamish_hodder

BUSINESS ENQUIRES

▶︎ hamish@hamishhodder.com

-------

Disclaimer:

The information in this video is general information only and should not be taken as constituting professional advice from Hamish Hodder.

Hamish Hodder is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

Hamish Hodder is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this video.

Does the stock market appear to be improving, or is this merely the typical temporary manipulation of the market to draw in new investors? Right now, I have $500k left over from the sale of my house, and I'm wondering whether there are any better investments than stocks to make.

You need a financial planner straight up! personally, I would invest in etf and also love investing in individual stocks. yes it’s riskier but I'm comfortable in my financial environment.

No doubt, having the right plan is invaluable, my portfolio is well-matched for every season of the market and recently hit 100% rise from early last year. I and my CFP are working on a 7 figure ballpark goal, tho this could take till Q1 2024.

That's a double up in two years! seeing a lot of news on the rally, investors will make tons of profit with the right picks. would you mind disclosing info of this person guiding you please? my problem is I do not trust my guts in today's mkt

"Heather Lee Larioni" maintains an online presence. Just make a simple search for her name online.

Thanks for this. I curiously searched for her full name and her website came first. I looked through her credentials and did my due diligence before contacting her. Once again many thanks.

Michael Burry is a GENIUS. He has correctly predicted twenty of the past three stock market crashes.

😂😂😂😂😂😂😂

Lol

Investors are shifting from cash to stocks, with $25.3 billion flowing into equities. I’ve been keeping money in 5% CDs and i plan to invest in the stock market when my CDs mature (around $1 million). What are your thoughts on that?

Find quality stocks that have long term potential, and ride with those stocks. I have found it takes someone who is very familiar with the market to make such good picks.

Absolutely! Many undervalue advisors, but their expertise and risk mitigation strategies are invaluable for savvy investors. For those with busy schedules, monitoring the market is challenging, so we delegate to experts. I'm currently working with one, and my portfolio has grown to $1.3M, a 35% increase from last year, with robust diversification and inflation hedging.

I hope it's okay to inquire if you're still collaborating with the same fiduciary and how I can get in touch with them?

Yes i am still working with 'Theresa Dana Peek'. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

Thanks for this. I curiously searched for her full name and her website came first. I looked through her credentials and did my due diligence before contacting her. Once again many thanks

My expectation is for 2024 that markets starts to broaden out more,” what if the interest rates go up? i have a ton of questions....can I safely invest my $800k? I was advised to diversify my portfolio among several assets such as stocks and bonds since this can protect my portfolio for retirement, but don't know where to start.

It's crucial to have a well-thought-out strategy and not make impulsive moves based on short-term market fluctuations. Patience and a long-term perspective are key. You should consider a market expert to guide you

True, A lot of folks downplay the role of advisors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for license advisors and came across someone of due diligence, helped a lot to grow my reserve notwithstanding inflation, from $275k to approx. $850k so far

There are several independent advisors you could research. However, I have been working with “Stacie Lynn Winson” for almost four years, and we get along great. If she appeals to your judgement, you could continue with her. I support her.

Thank you so much for your helpful tip! I was able to verify the person and book a call session with her. She seems very proficient and I'm really grateful for your guidance

All in bitcoij

Opinions on the market diverge; some claim overvaluation due to rapid gains, while others cite strong economic fundamentals justifying high valuations. Raises concern for my $600K equities going 8% up and 20% down. Should i hold on or sell off my positions and hold cash?.

Don't sell; avoid trying to time the market and incurring unnecessary taxes. Stay grounded and focus on the long term. Or just seek counsel from a market strategist.

I agree. On my personal experience working with an investment advlsor, I currently have $656k in a well-diversified portfollo that has experienced exponential growth.

She's known as 'Heather Lee Larioni'. One of the finest portfolio managers in the field. She's widely recognized; you should take a look at her work.

Michael Burry is a GENIUS. He has correctly predicted twenty of the past three stock market crashes, I feel investors should be focusing on under-the-radar stocks, and considering the current rollercoaster nature of the stock market, Because 35% of my $270k portfolio comprises of plummeting stocks which were once revered and i don't know where to go here out of devastation.

Taking early notes from Warren as to the importance of sound asset diversification and risk management It can’t be overstated. I’ve been trying to grow my portfolio of $300K for sometime now, I would greatly appreciate any other suggestions.

My expectation is for 2024 that markets starts to broaden out more,” what if the interest rates go up? i have a ton of questions....can I safely invest my $800k? I was advised to diversify my portfolio among several assets such as stocks and bonds since this can protect my portfolio for retirement, but don't know where to start.

It's crucial to have a well-thought-out strategy and not make impulsive moves based on short-term market fluctuations. Patience and a long-term perspective are key. You should consider a market expert to guide you

Fantastic! can u share more details

Thank you so much for your helpful tip! I was able to verify the person and book a call session with her. She seems very proficient and I'm really grateful for your guidance

@@benjaminsmith3469 Thank you so much for your helpful tip! I was able to verify the person and book a call session with her. She seems very proficient and I'm really grateful for your guidance

He has been unbelievably off base about his predictions the past 18 months. No way around it.

The most money I've lost, historically, was caused by listening to bears.

Feels like the part in the movie where Burry says "I may have been early but I am not wrong" and everyone is like "It's the same thing" lol

The biggest mistake Burry seems to make is underestimating the inertia of certain market forces. Essentially, his predictions are often ultimately correct, but there's often some sort of outside influence that steps in to (at least temporarily) counteract or mitigate them. This was illustrated in The Big Short, where the banking industry simply ignored the fraudulent bond ratings until after they had thoroughly insulated themselves and chose specific market winners and losers.

My thoughts exactly. So what outside influence is insulating themselves from this market and when is the question. My best guess is a blow off top before we violently crash lower before the actual recovery.

@@tyman4651This time I think it's the FDIC and Fed knowing that banks are insolvent and keeping it from the public. The Fed wanting to lower rates is to save the banks from the coming commercial real estate crash.

exactly. 1+1=2 but when you do not have control over the outcome, those in charge can keep shifting answers around until they finally have to arrive at the correct answer of 2, until then they can make it whatever they want since they are in control of the narrative. i’m surprised he hasn’t really accepted it yet.

@@wolf-yw9wkPersistence is a must in both whether you're a bear or bull. In my opinion he shouldn't accept his defeat. He was not right in 2022, 2023, but he might be in 2024, 2025.

@@abcnikhiltripathi i don’t think it’s about accepting defeat i think it’s about being able to add that aspect into the equation. i think he under estimates just how far they will kick the can down the road to keep this insane game going

I'm under pressure to grow my reserve that currently holds about $500k. I'm down by 20% already following the crash and I fear I could lose more.

It's all hype! best to ignore the trend at the moment whether bullish or bearish, and stick to a proper trading plan

I agree. On my personal experience working with an investment advlsor, I currently have $656k in a well-diversified portfollo that has experienced exponential growth.

@@charliehunnam5187 Please How do I find this financial counselor ?

She's known as 'Olivia Maria Lucas'. One of the finest portfolio managers in the field. She's widely recognized; you should take a look at her work.

She appears to be well-educated and well-read. I ran an online search on her name and came across her contact webpage; thank you for sharing.

As an investing enthusiast, I often wonder how top level investors are able to become millionaires off investing. . I’ve been sitting on over $545K equity from a home sale and I’m not sure where to go from here, is it a good time to buy into stocks or do I wait for another opportunity?

It's really hard to beat the market as a mere investor. It's just better if you invest with the help of a professional understands the market dynamics better.

A lot of folks downplay the role of advisors until being burnt by their own emotions. I needed a good boost to stay afloat, hence I engaged the services of a true market strategist to help rejuvenate my $700k portfolio and boost performance and returns by 40% in a little over four years.

@@Jadechurch-ql3do Please can you leave the info of your lnvestment advsor here? I’m in dire need for one

I'm being guided by “Leila Simoes Pinto’’ who is widely recognized for her competence and expertise in the financial market. She has a thorough understanding of portfolio diversification and is regarded as an authority in this field.

Actual relevant content starts at 10:30

You’re amazing

Thanks

🙏

His short on the SPX was for $1.6 Bil this Summer, he wound up covering it sometime in October. He was also long strategic stocks at the same time.

How much did he lose?

Michael Burry is desperate to become the next Michael Burry....and is failing.

Short term market direction cannot be predicted. The thing that is known is the government is running huge deficits. 6.13 Tn Spending, 4.44 Tn Revenue. That is more than 6 % of economic activity is government spending money it doesn’t have. And things will only get worse …

When the system is broken it can still appear stable until a complete collapse

I'll come back to this next yeat

did he remove all his tweets?

@@Mofoshow Knock yourself out mate.

He will be wrong again, you can be certain of that. He has predicted 50 of the last 3 stock market crashes!

Honestly I still don't understand the reason why my trader (Caitlyn Natasha Hughes) charges me 20% of my profit after the end of my weekly trade. I've been negotiating with her for about 15 months, but she keeps taking a percentage from me, which is very sad. I wish I could get a better trader who won't charge me a dime.

you mean you have a professional trader who trade's for you and makes profit for you. and you pay her 20% and you take the remaining after every trade?

@@zugaslg yes exactly 💯 at least she should consider the fact that I have been working with her for more than a year now

@@MaddieHelga Something i love about Caitlyn Natasha Hughes is that no matter how bad the market is you will always get your money back

please how may I reach her so I can invest with her even if she charges me 30%/40% and I take the remaining i will be okay as long as I get my money and profit back.

@@MaddieHelga Miss Caitlyn Natasha Hughes? I am currently trading. He also charges me 20% of the profit after each trade. Doesn't make it look bad, it's not like that

He's is the reason why I wasted so many opportunity waiting for the recession that never came to fruition😢

If that’s the case then put your money in bonds so that you don’t waste the opportunity! Make 8-9% returns and keep saving money! Markets always crash once in a decade. Last crash was Cov in 2020 so you will get your opportunity in the next few years!

A better strategy however is if you keep investing month over month and dollar cost average! Time in the market > timing the market

Look at indicators, not just what Burry does. Or buy good quality companies if you are long term investor

Don’t worry, it’s coming. Stay the course….

@@kristinjohnson3655 the issues is that he missed gains because of missed timing. It is significant

BROKEN CLOCKS ARE RIGHT TWICE A DAY .

I’m so excited 😊, my life has totally changed since I invested $3,500 and now make $25,000 every 10 days. God bless Expert Michael Allen

HOW! I would really appreciate if you show me how to go about it. Please can you list the platforms ?

Hes been ultimately correct, just not on the time tables. He's vastly underestimating the length the fed and others will go to keep this sham of an economy propped up. They will until they can no longer kick the can.

Recessions always lag the “talking heads.” Every time, most finally dismiss the concerns out of FOMO, as they keep watching the market go higher. You can imagine what happens next. It happens EVERY time, before every recession.

Nobody notices the insiders quietly dumping their stock in spite of all the hooplah.

@@m4c4c0exactly!!!… I’m on NVDA’s investor email list and am constantly getting notifications of sales, from insiders/board members. They know that less impressive earnings are coming.

Didn't Charlie Munger and Warren Buffett invent the strategy of buying/investing when the market is low and also buying/investing when the market is high? As Warren Buffet said, he has seen this happen many times in his life. Not an investor. My wife and i never earned more than a middle class salary. We plan to get retired at 58 with a stock portfolio worth $4M. We have never sold so much as one share of stock...

Thats true. To succeed in the financial markets, you must review and put into consideration, the dynamics of your trading asset prior to investing. Analysis Based on Research is Vital which is why; I also recommend trading with a Professional if you don't know the basics

Do your homework and choose one that has strategies to help your portfolio grow consistently and steadily. MARISOL CORDOVA” is responsible for the success of my portfolio, and I believe she possesses the qualifications and expertise to meet your goals.

Depends on your time frame. I doubt u beat just DCAing the SP500.

Thats my benchmark .

If I can't beat the sp500. Then I dca the sp500

You better have protection to the downside for next year or your portfolio is gonna get decimated.

Double down on doge?

Monthly dividend stocks can be a game-changer for consistent income It's great how market offers these options for investors.I've $100k reserve to put-in the market ,what's best ways to diversify?

Buffet has said it dozens of times. "With High probability I know what will happen not when when it will happen."

🤡 dow jones 4.236

everyone will sell

nothing will stop this next crash

unless you are distracted

I have 3 RUclips channels. On one channel, I always predict that the stock market will go up the next day. On the other channel, I consistently predict that the market will go down tomorrow. On the third RUclips channel, I always forecast that the market will stay at the same level as today. In the other half of the videos, I always show footage of cats

Michael Burry is great at marketing Michael Burry. This channel and people like you who follow and report on his communications to the markets enable this windfall for him. Give the man credit, he's very good and attracting this kind of attention, at no cost to himself.

He is probably right just timing

When you're wrong for 4 years, you're just wrong. A broken clock is right twice a day. He'll be right eventually.

So he is wrong 😂

My lotto numbers weren't drawn this week so "I may have been early but I am not wrong" lol

Dude he was wrong. Period

thank you for making this video. Burry is the most overhyped investor I have ever seen. He's been living off the mortgage bond short. He's erratic in his trading and has high turnover. Great video. I learned a lot.

Robert Kiyosaki prediction outcomes next?

Early = ~wrong

When you make nonstop predictions you’ll eventually be right at some point.

Easy to say, as are predictions. However, Burry is a money manager. Most money managers are far from honest to not lose customers and their money. To predict based on information without fear of loss is impressive. Timing is the hard part as the system feeds itself when things are good and when things are bad.

@@gretnagreenmachinesto predict without fear of loss? Burry is a permabear,like Roubini and so many others, and they only predict loss. Their entire arguments are that markets fall down in big events over time, so eventually they’re right. That’s very different than boldly predicting anything, it’s just like saying eventually there will be a natural disaster.

The hard part is them bleeding money in positions waiting for disasters, when that gets pricey is probably when they tweet these things.

Peter Permabear Schiff never is

I predict we will be 1yr older next yr.

@@gretnagreenmachinesthis. timing is everything and unfortunately, timing is the hardest part.

Seeking alpha... 10+ years of those gabage articles didnt help us lose money any faster. 😂😂😂

"The US is nowhere near recession"...after the US redefines the word recession, lol.

5 months later, SPY at ATH.....

He probably got liquidated or got out before that happend.

Great video! Especially your FAIR summary in the end.. keep it up man.

The slow crash is not a continuous slow decline. I have heard it described as a silent recession it won't feel or look like a traditional crash. Part of what I've seen is more like a juggler tossing balls as they crouch to the ground. There will still be peaks and valley but ultimately a down trend. They know and all out crash is bad but if they can keep jumping between physical areas and industries, people who don't understand wont have an obvious marker to point out. "Soft landing" is how they describe rampant inflation, mortgage defaults, and increased unemployment.

1-2% CPI & a nasty recession within six months or so.

The issue is sometimes theses experts or gurus affect the market by giving their predictions. Mostly retail stuffers.

He tweeted “SELL” then the market went up 😂

Not only that, but he bought a crapload of stocks at the same time too. I lost all my respect for him.

He wants you to sell,never follow big money

He got it right one & the only

I doubt that Burry is wrong on the economic conditions prevailing at present. This 5.2 GDP growth is merely the result of a 6.4% budget deficit as a percentage of GDP!! Artificial war spending has played a role in this GDP growth as well as the increased government employment offered and taken . Add the core inflation rate of 4% to the budget deficit and you should really get a GDP contraction in reality.!!

What happened to your property market predictions?

howard marks says it also "when you are so ahead of time, you almost seem wrong"...he was so right about the financial crisis, but he was so brilliant as to anticipate it that soon, that we mortals couldnt see that...what genius do first, the fools do last...

He's two years early.

8:20 all you said was if the stock market had gone down then the stock market would have gone down. Fantastic analysis. You never actually explain what the multiple is determined by, that the multiple going down was because investors were pricing in the fact profits would decline in the future, so the multiple would need to be lower. Now profits have declined, the multiple is higher because investors aren't predicting that into the future now.

GDP did not increase 5.2%! You have to subtract out the government deficit spending.

The debt ratio in US 😅 he will be right at some point soon surely

He also said “ don’t forget to sell your puts in March ! 🤔

He is mostly WRONG. He is famous for making one prediction and averagin down and holding until he was finally right. Can we PLEASE stop talking about him. He is the broken clock that is right twice a day. He is the weatherman in Spring who predicts that snow will fall one day....and averages down for 9 months until it does. STOP. TALKING. ABOUT. HIM.

Excellent video

A stopped clock is right twice a day.... A blind squirrel eventually finds the nut.... perma-bear?

If I follow what everyone says I would be broke. I don’t know much but can add and I’m up over 300k which I attribute to luck as much as anything else except ignoring all the smart people. Just bought baba at 71.5 . Let’s see where it goes. I don’t keep things forever either. Point being don’t be greedy. Buy when good companies get hit by bad press and sell when you make a good profit.

Prediction... the petro dollar system can no longer be serviced at 125 trillion in debt. The debt is now nearly doubling every decade which means we have till the 2040s or 50s. Carbon credits will expand on the petrol dollars' abilities to inhibit hyperinflationary consequences of keynesianism. But pricing emmission also requires the deglobilization of oil. Ww3 is unavoidable . We must convert before the petro dollar cash cow has been milked dry. In a nutshell.. the strategy of the western world to exist in the future is global warming.

Mark my words, the stock market will fall one day. In the short term, it may rise or fall. But I guarantee that at some point in the future IT WILL DECLINE.

I tought you will show us some numbers like 10 of 100 predictions were right. This statistics would show us his real knowledge. But from the amount of predictions hes make and / amount of his predictions turn out to be true just looks very very low.

Maybe look deeper what contributed to 5.2% GDP. It was government spending.

I’m short the market right now… we’re seeing odd price action at this level … it’s feathered up but accumulating consolidation

I'm sorry to bring this up but the thing on your eye-lid is kinda distracting. Your script is nice, your voice is nice, your pronounciation is nice, just fix that last tiny thing and your content is perfect cheers.

Meanwhile citadel and lots of other funds make their best return… sure, sometime in future market gonna crash, like some day all of us die. He was right once along with lots of other people, but that doesn’t make him a prophet.

Bogle was right. Buy and hold index funds. F trying to pick the top and bottom.

Gambling is still gambling, lol. There's always a bet out there for any price.

Michael Burry never used Twitter.

5:30 you can’t be right about a prediction when the market has rallied 15%+ in the last 20 days as it has. As John Maynard Keynes said, “Markets can remain irrational longer than you can remain solvent”. This is an important idea for investors to ponder. It essentially means that in the short-run (or even the medium-run) markets can (and often do) do anything. Even if the market does come back down. No retail trader reading Burry’s tweet could remain short and we will likely see from his 13F filings he didn’t remain deeply short either.

Thanks Hamish. In short we should just stop with all the predictions and just keep working and investing, take the good with the bad and we should all win in the long term. Nearly every prediction will eventually come true. A clock will one day stop ticking.

your content was stolen by youtube channel named NinjaIvestor, is that channel yours or not?

It's hard to predict, but increased caution might lead to some adjustments in the market.

Good point. But I'm curious on this warning

Think about it - over time, investments have the power to outpace inflation, ensuring that your money retains its value and even grows while using a certified portfolio manager which is a strategic move to build wealth and create a financial safety net.

I don't think I need a portfolio manager. I can manage my own money and investments. I don't want to pay someone else to tell me what to do with my hard-earned cash.

That's a risky attitude, My friend. You might be missing out on some valuable opportunities and strategies that a portfolio manager can offer. Helping you plan for your short-term and long-term goals, optimize your tax situation, diversify your portfolio, and avoid costly mistakes.

I agree with You. A portfolio manager can also provide you with objective and unbiased advice, especially when you are facing emotional or stressful situations. They can help you stay on track and avoid making impulsive decisions that can harm your financial future.

I love how Burry calls it the 2005 housing bubble because that’s when it became obvious that mortgages and CDOs were about to bust, while most people call it the 2008 bubble because that’s when the stock market started to collapse

"Whoooaaa-ho! Livin' on a Prayer...!!"

...someone had to do it. ;)

A good deed doesn't make you a saint. One huge success doesn't make you a genius.

Great video!!

Even a broken clock is right twice a day.

Broken clock is right twice a day right...

Does Burry still have his ETF puts ?

No 0:03

Stocks extended their year-to-date rally following the CPI report, with the S&P 500 last up 0.8% in afternoon trading. but I don't know if stocks will quickly rebound, continue to pull back or move sideways for a few weeks, or if the conditions will rapidly deteriorate.I am under pressure to grow my reserve of $250k.

It's really hard to beat the market as a mere investor. It's just better if you invest with the help of a professional understands the market dynamics better.

Buddy got it wrong 😂😂😂😂😂😂 this year 🤡🤡🤡🤡🤡🤡🤡🤡

He will most likely be off by just 6 to 9 months with his recession call

LOL , his videos are from 50 years ago.

Just another guy who predicted 20 out of the last 3 downturns. Made good money on the three, lost tons of money the other 17 times. 3/20, 15%, that's the guy I want watching my money, a guy who gets it right 15% of the time.

Right. Rich people can say/do just about anything and still be adored

Inflation and rates have pezked. Look at the rate of change in CPI. It's headed down now and it looks like Burry is right, but wrong on the timing.

He got out of GameStop just a little too soon.

Everything is about the money supply, not the funds rate. You should start following Steve Hanke!

GDP grew 5.2% which means people have again money in a gifting season which will lead to purchase, high stocks and raise the inflation that the fed tried to fight right back which will lead us into a recession because human greed is bigger than human rationality. So he is right, you just didn't see it yet unfold.

If he doesn’t know WHEN his silly, predictions are going to come true. Then he should keep them quiet to himself. And stop misleading, helpless fools into selling at the bottom of the market.

They own the system and they want a CBDC. Lowering interest rates too fast will put too much pressure on the bubble. A Dec 24 burst?

I think what burry miscalculated was the lucidity in the system that kept the economy afloat.

If it’s Monday, Michael Burry is predicting a market crash

He is too early. It will come.

I think he was actually referring to the Bon Jovi song “Living on a Prayer”.

Ohhhhh, living on a prayer

12:30 he says "possibly negative", but CPI lower. So he was right! (You say he's wrong).

What he meant is halfway from the bottom in 2009 to the next bubble around 2030. KEKEKE

Hamish appears to have informed himself more competently than much of youtube & certainly more than many retail fund geese wasting space in eastern Oz.

TiMing is everything. I bet he made money on corrections and then had stops in place

I think most short sellers are out of business. No more serious folks left to short. It’s usually then that market drops.