What is a Trust? | Benefits of Using a Trust to Own Shares in a Company | LegalVision

HTML-код

- Опубликовано: 14 сен 2019

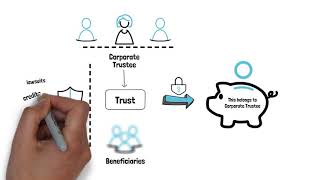

- There are many advantages to owning shares in a company through a trust, including tax planning and asset protection benefits.

Watch this video to learn about what a trust is and why you should considering having one if you run a business.

If you have any questions, call LegalVision on 1300 544 755 or visit us at legalvision.com.au

#trust, #trustfund, #familytrust, #trust funds, #familytrusts, #trustee, #beneficiaries

The example on tax on dividends varies country to country.

In some countries the company is required to pay withholding tax at a flat rate. The shareholder is then not required to pay any tax whatsoever.

If you put the shares in a trust, the indivual may likely have to pay another tax since that income is seen as from the trust and indivual tax may apply.

Great video!!!

Explained perfectly in under 5 minutes!

What why best jurisdiction for setting up your Trust. What are your thoughts on the South Dakota Dynasty Trust?

Probably the channel islands like Guernsey

Its pretty pricey though

You can also use Mauritius

Sweden, Malaysia

can you still sell your company if it is already in the trust?

is it the same with the trust that manages the property of a deceased?

What does trustees get in return for his service?

Nothing generally. Because it's often someone close to you or someone actually earning from it.

That taxman looked a bit too friendly if you ask me!

Where would someone find a trustee or indenture trustee in a private company. Since they don't have to report to the SEC, where would someone find their financials?

4 billion dollars in spare money can be utilize

Is this pertinent to Americans?

ISNT IT NOT ALLOWED TO BE BOTH TRUSTEE AND BENEFICIARY ?

Not if your demestic trust is owned by a offshore trust like in the Cook Islands

A trust wouldn't exist if you were both trustee and sole beneficiary, but pretty sure you can be both trustee and beneficiary if there is atleast one other beneficiary.

Yes it is. The trustee cannot be the SOLE beneficiary, but can be one of them.

Create an LLC, appoint your LLC as trustee, boom, problem solved

love the diversity of the characters

They're all women. You love the uniformity of the characters.

@@Alfoncos ok

@@Alfoncos i was confused

No one in wheelchairs wtf?

@@Alfoncos yep!

The trust doesn't pay tax??? It sure does if you don't distribute the income!

distribute the money to myself

Most likely the trust would be registered in a zero tax country

But does the trust get non taxed imcome from company or taxed at business rate then put in trust and beneficiaries pay more tax

@@sevculham3246 trusts get taxed at 39% if it has a mere income of $13,000.

If Amal puts her company on the public market and she owns shares it’s no longer “her company”. She is a shareholder of a publicly traded company lol

Amal should focus on drones that can stay airborne, we already witnessed one of her company's drones crashing, nearly hitting Amal in the process. I'd think Amals public liability would be through the roof. Time for a vocation change Amal, you're ill-equipped to run a tech company.

Know your limits Amal.

dividend income doesn't subject to tax

It does !

7 CT msongdd by

Varies country to country.