How to Calculate a Bond's Yield to Maturity (Using Excel)

HTML-код

- Опубликовано: 29 авг 2024

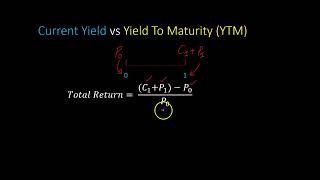

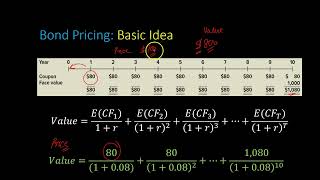

- In this video, students will learn how to think about and calculate the yield to maturity of a bond. Specifically I show how students can use =RATE and =IRR functions in Excel to calculate the yield of a bond making annual coupon payments, and then a bond making semi-annual coupon payments. In the process, you will also see how/why discount bonds have a YTM that is greater than the coupon rate and how/why premium bonds have a YTM that is less than the coupon rate.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

I hate knowing im missing something but the step by step instructions you give tells me ppl like you are missing from the world and we need more people like you thank you.

i was stuck on a problem for hours and couldn't get the right answer. 5 minutes into your video and I solved it. what an absolute legend. you earned a new subscriber!!

Same!!!!😢😊and I tried everything!!

You are an angel! Many thanks! Best video on youtube on bonds!

Incredible video. Theory and practical application. Love it. Thank you!

Great Work Sir

This is great, God bless you!!

Amazing! Couldn't find my final yield anywhere on Vanguard after buying a 30yr US T-bond at auction...only saw the indicative yield when entering bid.

Thank you for this video 🙏

thanks for the video, any way you can share the template?

Great!

how to calculate monthly coupon freq. coupon payment in excel ?

thanks for the video, any way you can send me that template?

I am sorry but the semi annual coupon example is wrong, we should assume continuously compounding and therefore we should not multiply by 2 but do (1+ semi-annual rate)^2 - 1

Thanks Vasco! Would you care to elaborate WHY continuous compounding should be used here, as opposed to semi-annual compounding?

May be because the coupons are cumulative and interest is compounding on the unpaid coupons too. But if they are paid when accrued then no need for compounding.

1:00