8. Value a Bond and Calculate Yield to Maturity (YTM)

HTML-код

- Опубликовано: 29 авг 2024

- Download Preston's 1 page checklist for finding great stock picks: buffettsbooks.c...

Preston Pysh is the #1 selling Amazon author of two books on Warren Buffett. The books can be found at the following location:

www.amazon.com/...

www.amazon.com/...

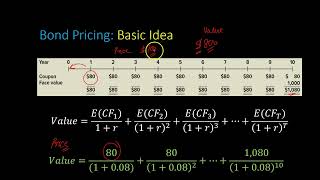

In this lesson, we began to understand the important terms that truly value a bond. Since most investors will never hold a bond throughout the entire term, understanding how to value the asset becomes very important. As we get into the second course of this website, a thorough understanding of these terms is needed. So, be sure to learn it now and not jump ahead.

We learned that there are two ways to look at the value of a bond, simple interest and compound interest. As an intelligent investor, you'll really want to focus on understanding compound interest. The term that was really important to understand in this lesson was yield to maturity. This term was really important because it accounted for almost every variable we could consider when determining the true value (or intrinsic value) of the bond. Yield to Maturity estimates the total amount of money you will earn over the entire life of the bond, but it actually accounts for all coupons, interest-on-interest, and gains or losses you'll sustain from the difference between the price you pay and the par value.

Let no one tell you otherwise, you know how to lecture and make it very easy to understanding this important subject. Thank you, Preston Pysh.

Preston Pysh true

Jesse , I the guy from ATHLEAN X Omg .

Preston Pysh i love u father

That's because he knows the game.

@@PrestonPysh For the frist bond if I bought it at 1200 the deference is 898, when we divide it by the price that I bought in, and to calculate the total rutern it gives us 74% and to get the annual rutern we divided it by 15 years and it gives us 4.93% why it’s not the same yield to maturity?

Online University is tough, this is very helpful thank you

Dude, I’ve been trying to get this concept through my brain for the past hour and this is literally the only thing that broke it down in a simple and understandable way. Thanks

Bravo! Finally someone who is able to teach. I immediately understood your explanations. If only there were more good teachers around, finance would be easier to grasp. Keep up the good work!

Just rediscovered your tutorials Preston now that I'm taking another finance course at university. You have a fantastic way of explaining these concepts in a simple, yet thorough manner. Thank you!

I just spent one hour trying to calculate the Yield to Maturity until I watched your video up until the end where you basically confirm that it’s impossible to to calculate it without help.😔

So far I think that you are the best. teacher of this stock stuff that I have found on the Web. Others come close, many others are good....but this is great

Its very clean,professional and indept

Love that jazz background man! You just created the perfect aura, the perfect marriage between music and math. All professors should implement your method, go ahead make those big bucks! write a book on the subject.

Great great summary and full of understanding I will shared with my friends thanks

These 3 videos taught me Bonds well!!

Finally figured out what YTM is from this video. Thank you very much, Preston!

Great lecture what I don't understand is why when you buy the bond for $1000 the Yield to maturity is 5%. I get that the coupon yield is 5% no matter what, the current yield is 5% since the price is the same ie $1000. When it comes to Yield to maturity I thought it takes into account 2 things. 1) the price difference which in this case is $0 and 2) the compound interest. So even if the price is the same ie $1000 what about the compound interest for 15 years? Wouldn't that make the Yield to Maturity greater than 5%?

Preston, Just started watching your videos and want to let you know that you are a great teacher. Thank you.

Jesse needs to shorten his tie.

haha I'm now distracted after realising thta

Jesse's different, he does what he wants, and he doesn't give a fxck. just look at him

@@potnudles Exactly, look at that smug face. Jesse is thug life personified.

Do you think he did it by accident? Jesse knew what he was doing. He knew his tie was ginormous.

This is the best BOND video ever ! Thank you for clarifying YTM :):)

Better than a james bond video 🔥

Bonds explained in an excellent manner on those 3 videos👌👌👌

This is excellent! You're doing great work for humanity!

Very clear! Thank you very much Mr Preston Pysh!

Great work mate. Thanks for all your free wisdom. I’m sure these videos will make many much better off. Which theoretically makes you a philanthropist 🙂✌🏼

Very nicely explained, well done, majority of the videos tend to make it more complicated, but this video explains it perfectly. Thanks Preston !

Hi Preston, thanks for all your great work. Please can you explain how you got the figure of 3.3% for the ytm at a bond price of $1200. Seen the other comments but none the wiser.

thank u! really appreciate you helping us understand finance easier.

7.2% yield. That looks nice. Do those opportunities actually occur in bonds (in the real world)? Basically buying a bond at 2% below the par value?

This video made me realize how valuable it is to always pay less for any security. That alone gives you higher returns... because it's always E/P=returns, so the less you pay - P - the better your return.

YES DUDE

Bro you nailed it. Exactly the explanation I was looking for.

I'm confused, I thought YTM accounts for both 1.difference between price and par value and 2. compounded coupon payments. At 15:14 the middle column with price of 1000 says the 3 yields are 5% because the price we paid is the par value, I get that but YTM assumes compounded interest and yet they are all 5%. If YTM uses compound interest and CY uses simple interest, how is YTM the same as CY?

let me know if you've found an answer yet, cuz no one else is asking this question

Shouldn't inflation be considered when we have the "time" in the consideration?

This course is so useful and easy to understand!

Thank you,

Vera

Hi Preston,

I am watching your lessons a few times and this gives me invaluable knowledge and understanding how actually a stock market works. Thank you,

Vera

I really enjoyed this lesson knowing nothing about bonds and once reading in an investment book that bonds were a type of loan, I always assumed they had to be carried to maturity or redeemed for their par value only. I never knew they could be bought and sold on the open market this is nothing short of a revelation to me as dumb as it sounds. What I am struggling to understand is who would in their right mind would buy a bond yielding the rates today or even previous lows such as 2.2% on the 30 year. Such a yield would barely keep pace with inflation and you would lose your shirt once interest rates went up.

Preston, great video. Besides, YTM does not have anything to do with compounded interest concept (re-investing coupon payment into an alternate security). YTM can be calculated from Face value, Current Bond Price, Payment Frequency, Annual Coupon Interest (Coupon Yield), and years till maturity. None of these factors has anything to do with re-investing strategy. I think YTM helps correct the Current Yield number due to deviation between Par Value and Current Bond Price. Let me know if I'm wrong though. Again, great video as always.

Hi Preston, A USD50 coupon, paid twice a year at USD25/payment and capitalized compound interest @5% over 30 payments gives you 1072.57 and not 1,098 as suggested in your lesson. Therefore, the yield is quite different in all your examples. You may want to check the calculator at the Buffetbooks site. If you find me wrong, please show me the full calculation of what you did to get to the 1,098. My calculation is - i=2.5, n=30, PV=-25, PMT=25 resolve for FV. The time value is set to end because it is a bond coupon. Kind regards

love your site and your book thanks so much for making it so simple

Good Video to understand the basics of Fixed Income Bond, thanks

Neatly explained. Thanks Preston. Been struggling to understand the difference.

Hi Preston, I really like your course, it adds huge amount of value. I would appreciate if you let me know, why are the current yield and the yield to maturity both at 5%(at $50 annual coupon and $1000 price)? Shouldn’t the yield to maturity take into account compounding as well?

Did u figure out the answer?

For those who wonder, the formula of calculating the the YTM is

Yield to Maturity = [Annual Interest + {(FV-Price)/Maturity}] / [(FV+Price)/2]

Annual Interest = Annual Interest Payout by the Bond

FV = Face Value of the Bond

Price = Current Market Price of the Bond

Maturity = Time to Maturity i.e. number of years till Maturity of the Bond

I got it from www.etmoney.com/blog/all-you-need-to-know-about-yield-to-maturity-ytm-in-debt-funds/.

The course has been straightforward until this point. YTM is such an important element in valuing a bond and yet this video didn't show the equation of it. Instead it shows a much more complicated bond marketing price equation (This equation also require YTM), which is confusing to say the least.

@Preston Psych , Can you please verify the math at 07:46 ? There seems to be a mistake. Coupon 1 is 1000*5%/2 = $25(this part is correct). But after another 6 months, the $25 grows by 2.5%(as annual rate is 5%) and this means $25 will become $25.625. Hence total Coupon 2 = $25(i.e 2.5% of 1000) + 25.625 = $50.625 and not $51 like in the video.

Hi @Preston, thank you very much for your very useful lecture. I wonder how did you get the result of 3.3% at 11.23 s, based on my calculation, it is actually 4.3%.

EXCELLENT video. Preston you do a great job with explaining a complicated topic.Thank you!

Very. Easy. To. Understand. Thank you!

Awesome series. Very interesting understanding the system.

Nice lessons. I did not see how u calculated yield to maturity or did I miss it. Can you please let me know.

how do you calculate the yield to maturity for compounded interest @ 12:00?

Thank you very much for sharing this valuable knowledge with us.

Red Frog Brewery has $1,000-par-value bonds outstanding with the following characteristics:

currently selling at par; 5 years until final maturity; and a 9 percent coupon rate

(with interest paid semiannually). Interestingly, Old Chicago Brewery has a very similar

bond issue outstanding. In fact, every bond feature is the same as for the Red Frog

bonds, except that Old Chicago’s bonds mature in exactly 15 years. Now, assume that

the market’s nominal annual required rate of return for both bond issues suddenly fell

from 9 percent to 8 percent.

a.Which brewery’s bonds would show the greatest price change? Why?

b. At the market’s new, lower required rate of return for these bonds, determine the per

bond price for each brewery’s bonds. Which bond’s price increased the most, and by

how much?

Love your videos. So simple and easy to understand. Thanks!!

This is a great video and it answers a lot of my questions regarding bonds and value. My remaining question is how the coupon payment is reinvested at the same rate. How is the first payment of only $25 reinvested into another security that offers 5%? I don't know of any investment opportunity like that. I am sure my head is in the wrong place so any advice would be greatly appreciated.

It is just a calculation that shows you, that if you used the 25$ coupon payment as a re-investment into for example another bond (that gave you 5% per year), instead of taking it out of your investment account and spending it on lollipops or whatever.. As he said, it is not a calculation that is going to be 100% accurate because you never know what your investment will give you of annually return but as i said, if it is money that is in your investment account and you are keeping it there for investing you can put a basis % return that you at least expect to get on your alternative investments.. The fact is that if it is an investment account, the coupon yields wouldn´t just be standing dead and doing nothing since you would actively be investing with your funds in the account. That is the thought behind it..

thanks Preston to make the difficult ▶️ eassy, Maestro.

Thank you so much Preston!

there is a bit error in calculation of yield to maturity.

the coupon payments should be 1078$ instead, which is making futher calculations incorrect.

correct me if i am wrong..

I had to do the math and also ended up with 1078.93, I'm learning most of this for the first time but I just want to make sure I'm doing it correctly

this is great lecture. But , i think you round up decimal numbers upto 1 digit.

like 4.16666666667 = 4.2. and it affects the value of bond.

the ytm formula at the end is flawed

Very clear explanation, thanks!

Thank you so much, a great and clear explanation. Thank you!!!

Love the series, VERY HELPFUL

How do you calculate compound interest on the bond.?

I can't seem to find your bond calculator to practice yield to maturity.

Thanks preston... really, really good and so easy to understand!

Thanks! very good info!!

Very helpful!

10:36 How can i calculate the coupon payment to end up the number $1098? I used the formula: FV= PVx ( 1+r)^n, but it didn't work

I understand there is a formula for solving yield to maturity but since it is a percentage where is that number coming from. If the YTM is 3.3% what is the 3.3% out of.For example 250 is 25% of 1000. So for yield to maturity (blank) is 3.3% of (blank). could you fill in the blanks for me Preston.

+matthew pehanich I also don't get it

+Acnotin Forever

25(first coupon)

25x1.025(first coupon+ the coupon of the coupon, or you know, interest)+25 (second coupon)=50.625 (total)

50.625x1.025 (total of first 2coupons + interest) +25 (3rd coupon)=76.8

76.8 x1.025 +25=103.8

the math matches the table at min 7:00. except the video maker rounded it. So you will end up with 1098$ after doing this for 30 times (because you compound twice a year.) that's the money u will make, but hence u paid extra 200 or 200 less, reverse the steps subtracting 200 or adding, and you will get something like 16.5 or 36 for one coupon. u 2x the number to get one year coupon rate. divided it by 1000 and gets u the yeild %

sorry if im not explaining it clearly, 1:30am kinda sleepy. Let me know if i'm wrong

YTM is the annual internal rate of return of an investment in a bond if the investor holds the bond until maturity and if all payments are made as scheduled.

Read more: Yield To Maturity (YTM) Definition | Investopedia www.investopedia.com/terms/y/yieldtomaturity.asp#ixzz4Obw5iEq0

Follow us: Investopedia on Facebook

The 3,3% is relative to the final cash he is getting when the bond matures, it’s $1000 so the 3,3% means after the 15 years, if everything has gone right, you would have had an average of 0,0033 x $1000 = $33 every year. That’s not what he is getting for real every year, because he is getting always the same $25 coupons but when you invest, you don’t look at the micro, you go macro... so you wanna know what your final return was after the 15 years, and it is bond itself after 15 years (1000) + the compounding interests of the 15 years on the $25 coupons ($1660~) / the price he paid ($1200) = 2660/1200 = 2,21 * 100 (for percentage) = 221% >>> you made a 121% profit in 15 years (because you substract the first 100% you had of your investment before actually investing it)

Sorry if my calc are wrong but these are the numbers that came up fast

Let’s say an investment opportunity with a yield higher than the YTM comes along before we reach maturity. If we sell our bond to buy the other security, our yield on the initial bond may have been less than numerous other opportunities that were available from the time we bought the bond until now. How do we account for this?

For more information on what makes a good bond, it gets covered in Security Analysis. Check it out if you want to learn more!

Great Video! Helped understand the concept better.

Very informative and helps learning. Ihankyou very much.

Hey preston! I still cant quote grasp the ytm topic. Why is coupon 2 payment 26? And so on.. Moreover, why should we use compund interest to calculate ytm? Sorry but i lost it at the reinvesting part. I got confused. It would be great help if you reply to ths. thanks

best video on bonds it allllll makes sense now thxxxxxxxx

Excellent lecture!

So buying second hand stocks when they are being sold as the interest rate is higher than it was initially makes them cheaper and buying them cheaper will create compound interest as the yield to maturity?

15:10

This seems awesome but it's still a bit confusing. Are there even better ways to generate compound interest rather than bonds? Value investing is about compound interest isn't it but how to make sure I hit the sweet spot of that compound interest?

If we reinvest the amount gained through bond A in bond B, bond B would be a separate investment altogether, how can we consider that for evaluating the returns of bond A?

I am getting Coupon payments = 1078 i.e. Coupon payments = 1000*(1+5/100)^15 - 1000

I got the same. He makes mistakes sometimes. But overall the videos are so valuable.

Because you are wrong. The coupon is semi-annual as he said : 1000*1,25^30

at 10:32 minute you said that the coupon payment is 1,098 dollars but 50 x 15 = 750 is that an error ?

Thank you very much! 😑🙏🏼

Great video 👍but how is the yield to maturity of 3.3% nd 7.2% done? Couldn't figure it out😕

For the frist bond if I bought it at 1200 the deference is 898, when we divide it by the price that I bought in to calculate the total rutern it gives us 74% and to get the annual rutern we divided it by 15 years and it gives us 4.93% why it’s not the same yield to maturity?

Buffett Says "But many investors have also been drawn to bonds because their prices rise as rates fall, and Buffett said they could get their comeuppance when that process reverses.

"Bonds, they're terrible investments now," Buffett said. "That will change at some point, and when it changes, people could lose a lot of money if they're in long-term bonds."

Same thing you have said in one of your videos..

As always these lectures are great however I have one important criticism. I think you are being very misleading with your compounding example where you assume the investor can reinvest each coupon in another security paying 4%. Because in your example he gets coupon 1 (25 bucks), invests it in a 4% baring security and then in 6 months when he gets his next coupon his previous coupon has already earned a dollar (4%). But its only been 6 months since he invested that 25 dollars, not a year. So in your example you are really assuming that he is investing his coupons in a 8% annual investment that pays 4% every 6 months. Just something that jumped out at me and I wanted to express. Thanks again for all your hard work, great teaching!

How do you calculate yield to maturity if you can't reinvest/compound the coupon payment?

+Tarun Kakumanu

i believe that's simply the same as “current yield”

You use the simple interest coupon yields instead of the compound interest yields.. So for this example the coupon payments at coupon 30 (15 years) would be 750$ instead of 1098$ as you can see in the simple interest table he showed..

Where is the calculator referenced in the video please? I don't see it but would love to try it out!

Question: If the YTM assumes we reinvested the coupon payments, why is the YTM rate equal to the coupon rate when face value equals current price? This because the return on the bond would be bigger in the reinvesting case, therefore the rate that equals the future valor to the present value wouldnt be higher? Or i other terms wouldnt the rate that equals the present value to the future value be higher?

Wow finally i understand! Thanx!

is the calculation right?,

25 x 0.05 = 1.25

(1.25 + 25 +25) = 51.25 x 0.05 = 2.5625

(2.5625 + 50 +25) = 77.5625 x 0.05 = 3.8781

(3.8781 + 75 + 25) = 103.8781 = 5.19

(5.19 + 100 +25) = 130.19 x 0.05 = 6.5095

(6.5095 + 125 + 25) = 156.5095 x 0.05 = 7.8254

and so on... but i only got $788 for the 30th one though..

Why is he getting $25 payments if the bond pays annually which means it should be $50 per year ie: 30 payments?

Could you please explain how you calculate the coupon payment of 1,098 USD?

Also what is the “coupon payment” itself? Is it the price you pay when you buy the coupon?

Thank you

Okay, but what is YTM actually a measure of? How do the factors presented in 9:50 on actually affect YTM? What does it mean that it is 3.3%?

Is YTM just a replacement for yield% that incorporates the time you buy the bond?

15 year interest of 5% compounded should be 2078,... -1000 investment = 1078,...-200 = 1078/15years/1000$ = 7,19% yield, (-200$:5,89%, +200$:8,526% )

what am I missing?

This was a huge help!

great video, loved it

So Yield to Maturity is an equation that defines my return on investment over the lifetime of the bond assuming I hold onto it until maturity? I am trying to understand if it takes inflation or taxes into account.

So an 800 dollar investment to get a return on compound interest of 50 dollars every year for 15 years (roughly 1132.87 dollars) + the 200 I paid under face value for a 1000 dollar bond. That is a 1332.87 dollar return on my 800 dollar investment or 167% return over 15 years = 11.13%

But if I convert the 1332.87 dollars to the present value based on a 4% inflation it comes to be more like 740.1427 present value. Then subtract 28% of taxes (207.239) on my earnings it becomes 532.90 dollars. The actual return on investment then becomes 4.4 (6.2% if you don't include taxes) (7% if you don't include taxes and assume 3% inflation).

So in conclusion, I am assuming yield to maturity does not take taxes into account and assumes roughly a 3% tax inflation rather than a conservative 4%. Can anyone confirm this for me?

Jeffrey Ogden Hey, Although you posted this 4 months ago... (it may not be relevant whatsoever to you anymore).

Yield to maturity is an expected (or theoretical) yield you would get... but there are certain assumptions you MUST make for YTM to be useful. (1) You hold the bond from the day you buy it to the day it matures; (2) you receive all interest payments (company doesn't go bankrupt); and (3) you can reinvest ALL interest payments at the same YTM as when you bought the bond (NOT PRACTICAL). YTM is usually an "ex-ante" calculation (before the fact)... the actual return you get is your REALIZED YIELD (an ex-post calculation).

A basic YTM calculation DOES NOT take inflation nor taxes into account!!

Your calculation is missing a few things that we must take into account now:

ASSUMING you purchased the bond today (t=0) at a PV = $800, FV = $1000, Semiannual interest payment = $25, a 15 year time frame (Or N=30 [15 x 2])... you are saying that the market presently has an Interest rate of 7.203% (which is 3.6015% * 2).

NOW, what is the Future value in 15 years of all the interest rate payments?

N=30, I/Y = 3.6015%, PV = 0, PMT = 25, FV =?

The FV of all interest payments is $1312.34

NOW, what will the future value of the bond itself be in 15 years?

Well, it will be the Face value of the bond (par), = $1,000.

NOW /////////////// We will look at REALIZED YIELD which is MORE important than YTM to the investor.

a basic return formula is [END-BEG]/BEG X 100.

[(1312.34+1000)-800]/800 X 100 = 189% gain.

A SIMPLE arithmetic return per year would be 189% / 15 = 12.6% per year.

If you wanted to subtract inflation from this return you could. This all assumes you hold this investment in a tax-free/deferred account.

Hope this helps, you were mostly spot on! Cheers

You are great very useful info in simplistic form.

Sir can I ask you question if bad news like crash or ression happens and fundamentally strong stocks also loose their value in that point of time can we start accumulation of those stocks is that the right way

Pls reply

I don't understand to calculate yield to maturity of zero coupon bond with face value of $1000 current price of $940 and maturity of 5.0 years? Recall that the compounding interval is 6 months and the ytm like all interest rate is reported on an annualized basis

Is this the same equation being use to calculate the intrinsic value of stock just that we change

C to annual dividend

YTM to annual growth rate of the book value

F to current book value of the company?

I understand how to calculate the different yields just how you explained. But how can I decide whether I should buy, hold or sell? Is it only the yield or are there other factors to pay attention to?

I already watched the whole course one and this is my only question. Your tutorials are fantastic. :)

YTM is more applicable to determining whether a bond is worth buying or not as serves as a predictor of the returns on your investment. when it comes to decisions to sell or hold you'll mostly look at the current interest rates in the bond market, returns expected in the stock market or even possible indications that a company or state is likely to default on payments. given that you have a bond with higher interest rates than the market is able to offer, you can choose to sell it for a quick flip if you do not want to hold the bond to maturity and reinvest in other securities or if you want to exit a bond that is likely to default. it is also possible that markets shift and stocks start to generate a higher ROI as compared to bonds and you want to shift the diversification of your investments more towards stocks as compared to bonds. when it comes to selling bonds or holding to maturity it is really an individual decision after considering your circumstances and the market conditions at any point of time.

Jesse , if it is likely that I would find a higher return than the YTM somewhere else before the bond matures, then why is it valuable to calculate the yield to maturity? If I sell before maturity to chase a higher return, my effective yield for the holding period will have been much less.

Thank you soo much! Very helpful!

The content is great.

Great explanation

Thank You, Great instruction

Life saver

Hello preston could you do a practical exercise for bonds like you did for stocks?Thanks!

I'm having a bit of trouble understanding this. I know each of the three situations illustrated are examples. However, I can't seem to understand why someone would pay more than the face value for a bond. Is this a common thing? Is there some sort of advantage to paying a premium???