Calculating Bond Price with Semi Annual Interest Payments using a Financial Calculator

HTML-код

- Опубликовано: 15 мар 2023

- In this video I show you how to use a Financial Calculator to calculate the Bond Price (Present Value) if the coupon payments are semi-annual when you know the Yield to Maturity (YTM), Coupon Rate, Par Value, and Years to Maturity.

I use the Time Value of Money functions on a Texas Instruments BA II Plus for the calculations. #Bondprice #Financialcalculator #finance

Summary of this video:

1. Calculate the Coupon Payment;

2. Calculate the Bond Price using a Financial Calculator.

I did a prior video on bond price for Annual Payments which can be located here: • How to Calculate the P...

Please subscribe to my channel: / @professorcapko

Support my channel by doing any or all of these:

Subscribe! It's free! And give this video a thumbs up!

Tip me! CashApp $RobertCapko

Signing up for this free app that gets you cash back on gas and other errands! Click this link or use promo code SD4RM to get an extra 15¢/gal bonus the first time you make a purchase. upside.app.link/SD4RM

Join Robinhood with my link and we'll both pick our own free stock 🤝 join.robinhood.com/robertc8782

Invest in real estate with as little as $10: app.groundfloor.us/r/gb3ad5

Buy my Action/Adventure Thriller Say Goodbye: Say Goodbye by Robert Capko www.amazon.com/dp/B004KAB9OC/...

Get your cool Professor Capko Merch by shopping at my store: professor-capko-store-2.creat...

Thank you!

Please subscribe to my channel: www.youtube.com/@ProfessorCapko

You're a G, i'm taking a Financial Management course and this was so helpful.

Thank you! I'm so glad I was able to help you. Thank you for your kind comment. I would love for you to become a subscriber!

Thank you for this video! I am currently taking corporate finance and this video was very helpful.

Glad it was helpful! Best of luck in your class!

best explanation thus far ! thx

Glad it helped! I would love it if you would subscribe and let me know if there other problems you would like for me to make a video about.

Thank you so much!

You are welcome! Thank you for your comment. I would love to have you as a subscriber.

thanks professor

You are welcome. Thank you for your kind comment. I would love to have you as a subscriber.

Very helpful Sir..thank you

You are welcome. Thank you for your comment..I would love to have you as a subscriber.

Thank you so much, Professor.

I got 762.38 and i followed every single step

Your Payment is probably set up at beginning of year instead of end of year

Your payment is probably set up at beginning of year instead of end of year

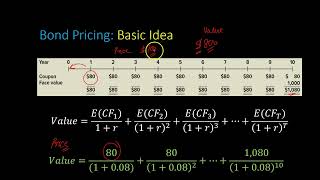

how would I calculate the semiannually without a financial calculator?

Have you watched my video on calculating the price of a bond without a financial calculator? ruclips.net/video/ddg8S9ZjQ_4/видео.htmlsi=8TBz-wYoAsoyC8L6

Why not use the bond built-in worksheet for your calculations? That’s what it’s there for!

Good question. I'm actually doing a series of videos on all the ways to price a bond. I will have that demonstrated in a future video. Thanks for the suggestion.

I wanted to let you know that I finally found the time to do a video using the Bond Function of the BAII Plus like you asked for: ruclips.net/video/FHQ2vFfWc-U/видео.html

How can I calculate if I happen to buy 10 corporate bonds. How I will receive every 6months and what will be my rate of return after 30years

I'd have to know more about your question. Are the bonds all the same? If the bonds are all the same, and purchased at the same time at the same price, the rate of return would be the same. If not, then your best bet would be to calculate the rate of return for each one individually. I hope that helps.

On my TI 84 plus, I put in the following values and my answer was $284.43

N = 40

I = 3.75

PV = ?

PMT = $25

FV = (-) $1000

P/Y = 1

C/Y = 1

END

Any idea where I went wrong?

Becoz you put FV in negative

I got -$1174.78, how did that happen?

Same here. I dont know what im doing wrong

@@margiahassan7163 set the P/Y and C/Y to 1 and you'll get the correct answer