How To Report Crypto On Form 8949 For Taxes | CoinLedger

HTML-код

- Опубликовано: 30 июн 2024

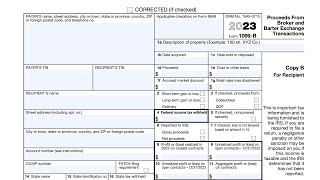

- Sold or traded crypto? Learn how to easily report your crypto transactions to the IRS on Form 8949.

Form 8949 is required when filing your taxes for all US taxpayers who sold or disposed of their crypto during the year. In this video, Miles Brooks, CPA and crypto tax expert at CoinLedger explains what Form 8949 is and how to easily fill it out when filing your taxes.

✅ Get started with CoinLedger, the crypto tax platform trusted by more than 300,000+ crypto and NFT investors. Generate a free preview report today: bit.ly/3LtPfB4

📚 Learn more about Form 8949 and how to report crypto on your taxes: coinledger.io/blog/how-to-rep...

📚 Learn more about CoinLedger: coinledger.io

🔴 Subscribe for more tax tips: / @coinledger

🔴 Connect with us on social media:

Miles’ Twitter: / milesbrookstax

CoinLedger Twitter: / coinledger

✅ Recommended Videos:

Crypto Taxes 101: Step-By-Step Guide: • Crypto Taxes 101: The ...

Crypto Cost Basis: Explained: • Cryptocurrency Cost Ba...

Timestamps:

0:00 Introduction

0:39 What is Form 8949?

1:10 How to fill out Form 8949

2:02 Example: How to report your crypto transactions

3:42 The easiest way to file Form 8949

#CryptoTaxes #cryptocurrency #Form8949  Развлечения

Развлечения

![ian - Fit Check (Feat. VonOff1700) [Official Music Video]](http://i.ytimg.com/vi/sDGWDBg45Dw/mqdefault.jpg)

There are fees with each transaction or exchange(ie coinbase wallet). Do we list the fees in column G on form 8949 or how to we include the fees elsewhere on the form 8949?

Noticed form 8949 and Schedule D does not include interest (if i looked at it correctly). wondering if i should export a CSV file for the interest gains?

My form 8949 that I printed out from Coinbase says to subtract column d from column e to get my gain or loss in column h. This sounds wrong.

I just started on coin ledger and it showed me that I could download 8949 with all the data I imported but the I paid suddenly all that's available is CVS data sheets... ???? I was under the impression that coin ledger produces the tax forms...?

Hey there! If you purchased the current year 2022 report, Form IRS 8949 will become available to download from within your account once the IRS releases the official form in December 2022.

@@coinledger I figured it out, the frustration was that if your page is on 2022 and you pay the fee but then realize you really needed to switch to 2021, then you have to pay again. The most helpful video would be a simple step by step, people pay for your service so they don't have to understand accounting I think, so any talk about accounting is probably not what they are looking for.

A completed 8949 was provided by CoinLedger for 2021 but now you have to pay for it for 2022?

yes they are charging but its worth paying for it , doing ourself can be complicated.I think its 19.99 a month

This produces no forms!!?? Seriously , all this does is just chop up the imported CSV files into smaller CSV files?