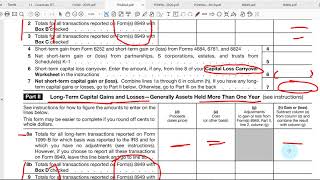

Schedule D Explained - IRS Form 1040 - Capital Gains and Losses

HTML-код

- Опубликовано: 30 сен 2024

- Join this channel to get access to perks:

/ @mrshortdollars

Deonte' Burden

678-479-4007

Join My Email List - lp.constantcon...

How To Start And Run Your Own Tax Business Course

mrshortdollar-t...

Need Help? (Grant writer, Web Designer, Logo Designer, Etc)

Try Fiverr -Use Link Below

track.fiverr.c...

RUclips - / @mrshortdollars

Facebook - Majestic Business Services - Majestic...

Facebook - Mr Short Dollar - / mrshortdollar

Instagram - / majesticbiz1

Deonte Burden (Speaking or Merchandise) - www.deonteburd...

Majestic Business Services - www.majesticbi...

LinkedIn - / deonteburden

Book A Consulting Appointment - DBurdenConsult...

How To Report Digital Asset Income on Your Taxes

ruclips.net/video/YiRYmM16bKo/видео.html

If both short and long term gains are just added together, then how is long term gains treated any better than ordinary income, or short term gains?

Thank you for this content !, I am a recent accounting undergrad graduate . Great explanation

Glad it was helpful and check out my other videos covering accounting careers and other financial/business reports and ratios!

Despite this video's title, you never discuss how to report a loss on the 1040.

I would suggest you watch the video again. The video gives the exact line number on the IRS Form 1040 where to place the capital gains and loss from an assets sell.

Sale A Property for $220000 I Paid for it 151000 at be $171000 but i have $49000 Gift of Equity so I Fill 709 . but how i Put at on 1040 form I Only have 1099 S

I would suggest you speak with your accountant.

Thank you Mr. Short is video was more than helpful

Glad it was helpful!

Thank you for the walk through of each line.

You are so welcome!

@@MrShortDollars HELLO SIR IM FROM CONNECTICUT

DO I HAVE TO FILL OUT 8949 FORM WITH SCHEDULE D FORMS?

Amending my taxes using 1040X to add a capital gains/loss on a house sale. What line on the 1040X, should I put the new Schedule D information? Thanks in advance.

Thank you for this vid helped a lot.

Glad it helped

If I put my long term gains on line 7. Where is the tax benefit of keeping the stock for over a year? I will still be paying my tax level on the long term capital gains by adding it to my income. Help! please.

I would advise you to consult your tax professional for guidance.

@@MrShortDollars Don't need a "tax professional" just the qualified dividends and capital gain tax worksheet-line 16. Thank goodness for social media.

@@ArabellaPottery Where do you find that worksheet? Please help.

What are the qualified dividends?

@@ArtTaggerr-223 It's in your 1040 instruction booklet. Page 36.

Thank you

You're very welcome.