There's still 'gas in the tank' in this stock market rally, says Fundstrat's Tom Lee

HTML-код

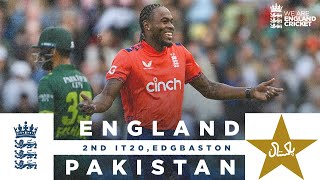

- Опубликовано: 28 май 2024

- Tom Lee, Fundstrat Global Advisors managing partner, joins 'Squawk Box' to discuss the latest market trends, what to expect from this week's CPI data, the Fed's interest rate outlook, and more.

Everyone has been preaching "buy now, stocks are at a discount" but I've been buying stocks since the beginning of the year and yet nothing's changed, but I've been reading articles of people still in the same market pulling off over 150k in just a couple of months, what am i doing wrong?

the strategies are quite rigorous for the regular-Joe. As a matter of fact, they are mostly successfully carried out by pros who have had a great deal of skillset/knowledge to pull such trades off.

Even with the right strategies and appropriate assets, investment returns can differ among investors. Recognizing the vital role of experience in investment success is crucial. Personally, I understood this significance and sought guidance from a market analyst, significantly growing my account to nearly a million. Strategically withdrawing profits just before the market correction, I'm now seizing buying opportunities once again.

impressive gains! how can I get your advisor please, if you dont mind me asking? I could really use a help as of now

Laila artine kassardjian' is the licensed coach I use. Just research the name. You'd find necessary details to work with a correspondence to set up an appointment.

Thank you for this Pointer. It was easy to find your handler, She seems very proficient and flexible. I booked a call session with her.

Thank you Lord Jesus for the gift of life and blessings to me and my family $14,120.47 weekly profit Our lord Jesus have lifted up my Life!!!🙏❤️❤️

I'm 37 and have been looking for ways to be successful, please how??

Sure, the investment-advisor that guides me is..

Mrs Lee Wallace Stacey

😱Sounds familiar, I have heard her name on several occasions.. and both her success stories in the wall Street journal!

Her services is the best, I got a brand new Lambo last week and paid off my mortgage loan thanks to her wonderful services!

I want to invest roughly $70,000 in stocks since I've heard that even in challenging times, investors may turn a profit. Any excellent ideas for stocks?.

It's crucial to have a well-thought-out strategy and not make impulsive moves based on short-term market fluctuations. Patience and a long-term perspective are key. You should consider a market expert to guide you.

that's the more reason I prefer my day to day investment decisions being guided by an advisor seeing that their entire skillset is built around going long and short at the same time both employing risk for its asymmetrical upside and laying off risk as a hedge against the inevitable downward turns, coupled with the exclusive information/analysis they have, it's near impossible to not out-perform, been using my advisor for over 2years+

How can I reach this adviser of yours? because I'm seeking for a more effective investment approach on my savings

Melissa Maureen Ward is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment..

She appears to be well-educated and well-read. I ran an online search on her name and came across her website; thank you for sharing.

Market highs can sometimes be followed by corrections, but predicting the timing and extent of it is challenging. I've heard some analysts talk about a 'massive' correction. It makes me wonder if it's time to adjust my $2M portfolios or maybe even consider some defensive investments.

Look for stocks that have paid steady, increasing dividends for years (or decades), and have not cut their dividends even during recessions. Alternatively speaking to a certified market strategist can help with pointers on equities to acquire

I agree, having a brokerage advisor for investing is genius! Amidst the financial crisis in 2008, I was really having investing nightmare prior touching base with a advisor. In a nutshell, i've accrued over $2m with the help of my advisor from an initial $350k investment.

impressive gains! how can I get your advisor please, if you dont mind me asking? I could really use a help as of now

Amber Russell Bennett is the licensed coach I use. Just research the name. You'd find necessary details to work with a correspondence to set up an appointment.

Thank you for this Pointer. It was easy to find your handler, She seems very proficient and flexible. I booked a call session with her..

Hey guys I'm looking to invest. But I don't know anything about the market, any help? As well who can I reach out to?

I would advise you seek professional assistance because creating a strong financial portfolio is more difficult if you have no experience.

Making touch with financial advisors like Margaret Burwell who can assist you restructure your portfolio would be a very creative option.

I agree with you! With her help, I diversified my 25k portfolio among different markets during this bearish market period.

I've had nothing but positive experiences with her. She's extremely knowledgeable ✨✌️

Many beginners including myself have benefited from Margaret's assistance🎉

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. Hence what are the best stocks to buy now or put on a watchlist? I’ve been trying to grow my portfolio of $560K for sometime now, my major challenge is not knowing the best entry and exit strategie;s ... I would greatly appreciate any suggestions.

A lot of folks downplay the role of advlsors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850k.

May I know the name of the advisor who has been assisting you in navigating these financial challenges?

Lisa Ann Moberly is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment..

Thanks a lot for this. I just checked her out now and I sent her an email. I hope she gets back to me soon.

"The stock market is experiencing a typical pullback amid the ongoing rally. Considering investing a lump sum for the bull run? With $450K in reserve, it's natural to feel uncertain. Seeking advice on whether now is a good time to buy."

Find stocks with market-beating yields and shares that at least keep pace with the market long term. For a successful long-term strategy you have to seek guidance from a financial advisor.

I had to revamp my entire portfolio through the aid of an advisor, before I started seeing any significant results happens in my portfolio, been using the same advisor and I’ve scaled up 750k within 2 years, whether a bullish or down market, both makes for good profit, it all depends on where you’re looking.

Please can you leave the info of your lnvestment advsor here? I’m in dire need for one

“Natalie Marie Gentry” is the licensed advisor I use. Just search the name. You’d find necessary details to work with to set up an appointment.

I just googled her and I'm really impressed with her credentials; I reached out to her since I need all the assistance I can get. I just scheduled a caII.

I think the stock market will do well in 2024, so I'm thinking of putting $220,000 into stocks for my retirement. Any advice on doing this safely? Also, any important tips for the current financial situation?

I think the next big thing will be A.I. For enduring growth akin to META, it's vital to avoid impulsive decisions driven by short-term fluctuations. Prioritize patience and a long-term perspective consider financial advisory for informed buying and selling decisions.

Keeping money in the bank is like paying banks and the Govemment. Here's how it works: The bank gives out your money as loan, and charge interest obviously higher than inflation rate, and then give you, the depositor, interest lower than inflation rate. That means net loss for you. That is why I prefer to invest, and on average, my advisor makes returns that always beats inflation!

Glad to have stumbled on this comment, Please who is the consultant that assist you and if you don't mind, how do I get in touch with them?

Svetlana Sarkisian Chowdhury a highly respected figure in her field. I suggest delving deeper into her credentials, as she possesses extensive experience and serves as a valuable resource for individuals seeking guidance in navigating the financial market.

Svetlana Sarkisian Chowdhury a highly respected figure in her field. I suggest delving deeper into her credentials, as she possesses extensive experience and serves as a valuable resource for individuals seeking guidance in navigating the financial market.

Thank you for sharing. Financial education is crucial today to show incredible resilience and discipline in the volatile market, masterfully balancing strategy and insight for success. This dedication to continuous learning is inspiring...managed to grow a nest egg of around 100k to a decent 432k in the space of a few months... I'm especially grateful to kelvin Hurdle, whose deep expertise and traditional trading acumen have been invaluable in this challenging, ever-evolving financial landscape.

He mostly interacts on Telegrams, using the user-name..

@KelvinHurdle..

After 4 years in crypto, Kelvin Hurdle is my go to analyst. Calm, straight talking, no-nonsense, evidence based.

You stated everything. I lost a lot of money in this market because I had no idea what was going on; I was simply led to believe that the bull run would continue indefinitely. Things changed dramatically when I started working with Kelvin Hurdle."' I replicated his transactions and followed his techniques, which has given me a lot of happiness. Not where I want to be yet, but persistence is key in this market.

Remarkable is the word! His insight and mastery as a dealer is truly uncommon. It's beneficial for you like most of us to have somebody who guarantee we meet our market mark

Increased losses for portfolios this quarter are predicted by market drops, skyrocketing inflation, a major interest rate hike by the Fed, and rising treasury rates. How can I profit from the volatile market right now? I'm still considering whether to sell my million dollar bond and stock account.

Focus on two key objectives. Learn when to sell stocks to minimize losses and maximize gains to start protecting yourself. Second, prepare to make money when the market turns around. I advise speaking with a broker or financial counselor.

Yes, I've been in touch with a financial analyst ever since I covid. Investing in trending companies is relatively easy today; the trick is determining when to purchase and sell. I started with a $300K reserve that was initially dormant; my adviser decides when to enter and exit my portfolio; since then, I have accumulated over a million dollars.

Your advsor must be really good, how I can get in touch with them as my porfolio isnt doing well.

Monica Shawn Marti is the licensed coach I use. Just research the name. You'd find necessary details to work with a correspondence to set up an appointment.

I appreciate it. After searching her name online and reviewing her credentials, I'm quite impressed. I've contacted her as I could use all the help I can get. A call has been scheduled.

Currently, high interest rates are impacting 20+ year bonds, REITs, and Utilities, presenting a favorable opportunity for Dollar-Cost Averaging (DCA) or investing. i'm looking to invest around $250k. Your insights in a video on this subject would be greatly appreciated. Thank you

Dollar-Cost Averaging is wise, especially in volatile markets. Considering the market conditions you've mentioned, thorough research and consulting a financial advisor are vital to align investments with your goals and risk tolerance.

I used to feel overwhelmed by the vast array of investment options available, but my financial advisor changed everything. They simplified the process, offering clear recommendations and ongoing support. Thanks to their guidance, I've been able to build a diversified portfolio that's well-positioned to weather market fluctuations and achieve my financial aspirations.

Your advisor seems competent. Could you share how I can reach out to them? I've recently sold some property and am interested in investing in stocks, and I'm seeking guidance.

*Jennifer Leigh Hickman* is the licensed advisor I use. Just search the name. You’d find necessary details to work with to set up an appointment.

I'm impressed with the recommended advisor's prompt response and expertise. Their clarity and professionalism instilled confidence from the start. Excited to explore opportunities together!

there should be a segment for Tom Lee alone, no interruptions. Love the guy!!!

Lmao

That was rude to Tom to hear the usual economy is good But.... from Dimon

The Tom Lee Show

he's got great insight.. he could probably join the team easily.. or start his own

Breaking News! Jamie Dimon letter to shareholders. 🙄. How about finish the interview with Tom Lee and leave the "breaking news" 5 minutes later....

Agree

Agreed. That was an insult to Tom Lee.

That really is an insult I value Tom lee’s time over anybody’s on cnbc

Gotta lead the viewer by the nose. That's how the game is played

Agreed I’ll take Tom’s thoughts over Jamie’s anyday

Tom's opinion and assessment is more important than Dimon's! C'mon Tom has been right over the last few years and continue nail it!

What is the best strategy to take advantage of the current market. I’m still deciding whether to diversify my $400k stocks portfolio? how do I redistribute stocks in my portfolio to hedge against crash?.

will advice you get yourself a financial advisor that can provide you with entry and exit points on the share/etf you focus on.

Exactly, a good number of people discredit the effectiveness of financial advisor, but over the past 6years, I’ve had a financial advisor consistently restructure and diversify my portfolio and I’ve made over $3 million in gains… might not be a lot but i'm financially secure and that's fine by me.

How can I participate in this? I sincerely aspire to establish a secure financial future and am eager to participate. Who is the driving force behind your success?.

Nicole Desiree Simon is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

Thanks for sharing, I just looked her up on the web and I would say she really has an impressive background in investing. I will write her an e-mail shortly.

Tom Lee is so insightful! Listen to this man! He will make us a lot of dough

Came here for Tom and got the goofy guy interrupting as usual

I will be forever grateful to you, you changed my entire life and I will continue to preach on your behalf for the whole world to hear you saved me from huge financial debt with just a small investment, thank you Victoria Wiezorek.

Wow. I'm a bit perplexed seeing her been mentioned here also Didn’t know she has been good to so many people too this is wonderful, I'm in my fifth trade with her and it has been super.

She is my family's personal Broker and also a personal Broker to many families in the United states, she is a licensed broker and a FINRA AGENT in the United States.

You trade with Victoria Wiezorek too? Wow that woman has been a blessing to me and my family.

I'm new at this, please how can I reach her?

I was skeptical at first till I decided to try. Its huge returns is awesome. I can't say much

Interrupting Tom Lee for Dimon‘s opinion is unnecessary.

Bingo & Jamie is obviously biased...

@@nightknight9415 Just do the opposite of Dimon says and you will be a millionaire. Nothing he says happens

Dimon who? We only know Sir Tom Lee 🚀🚀🚀

lol so true

@@bingo9875 Thanks, but having investments in Brk.A, FXAIX, Nvidia at IPO & a laddered bond portfolio already made me a multimillionaire years ago... just here trying to help younger investors at this point.

They owe an apology to Sir Tom Lee!

Definitely not

He’s bullish no matter what anyone can do that. He called for a 7 to 10% pullback months ago and was wrong. He was also wrong with the market went down 33% and he was bullish as well. He’s terrible.

He was calling for a weak market the first 6 months of 2024 lol

I guess he was wrong about inflation today. He said the market was gonna go way up today because inflations gonna show it’s deteriorating another miss.

So you interrupt Tom Lee with a stupid letter

Tom Lee is everywhere on CNBC or elsewhere. You hate Jamie Dimon because he says bitcoin has no value

@@q9r8s7t6u5v4w3x2y1z0 and he's been proven wrong

@@q9r8s7t6u5v4w3x2y1z0 Good, he's an idiot who hasn't taken two hours to have a basic understanding of it, which is incredibly worrying for a CEO or someone who acts like they have worthwhile opinions on geopolitics or the economy.

Its a god damn debate. Bulls and bears. It provides you with a wholistic view. Come-on man. This is how it gets done. Its not, and should never be one sided. To each their own.

Interrupting Tommy with this crap from Jamie is disrespectful.

Jamie is biased, he wants people scared enough to pour money back into his bank, (saying this as a JPM shareholder).

Agree, what a shame

I disagree. Someone like me benefits hearing what Tom Lee might have to say about what Dimon said.

stock market as high as tom lee's hair

Funny - because he predicted that it would be down not too long ago.

ya Tom

Lee's none sense prediction went out the window

Maybe his hair is high on something.

As someone who follows market analysis closely, Tom Lee's optimism is contagious! I'll be using my Tamap trade signals to capitalize on this ongoing rally.

Buy & hold quality companies beats EVERY trading strategy. Tom is the GOAT!

Dimon`s letter is breaking news? Wow. How pathetic. Tom is the legend. Jamie is always wrong.

Yes, I agree, Dimon has a love hate relationship with the markets. Many of his predictions never come to fruition

@@MarketMaker23 Dimon is a hypocrite. He kept yapping on about how Bitcoin was a scam and going to fail. Now his own bank owns some 🤣

Have you seen JPM Share price performance. ?

CNBC, do not cut away from Tom Lee for another dramatic letter from Jamie Dimon. Not interested.

Jamie Dimon's shareholder letter is not that amazing to interrupt Sir Tom Lee.

I'm a simple man. I see Tom Lee, I like.

Investing in this economy is a hell at times for the average person that wants full control of their finances, Even investing in ETF stocks can be risky.

I gotta admit, I took a hit in the profit department with my stock moves. But hey, every red chart has a chance to turn green, right???

The question to be asked at times is not if the government or the economy is responsible for the sudden dramatic shifts in the economy but if we are taking the necessary measures to avoid making losses no matter the situation even if the pay roll is not in your favor.

One of the reasons i follow up these stock videos is to improve the returns of my investments and i can’t really say I’ve been seeing noticeable change though …. I’ll keep following to improve my investment philosophy anyway and find better ways to create smarter investments.

What would you consider the necessary measures though? I was at a seminar two days ago where investors gave their opinions on how we can better investment for proper returns.

At times not just creating smart investments but buying assets can improve your profit margins in the long run.

Fed should literally not cut any rates

Tom Lee is the best!

Well, not at predicting the stock market.

Fact, Tom Lee got more views than the solar eclipse.

why have Tom Lee and not let him talk. Dumb

He said a while ago that the stock market would be down the first 6 months of the year - why is he there at all. Does he pay CNBC to be on?

Not to mention how incredibly rude that was.

@@jimduncan5388 Maybe they realized that a while back he said that the stock market would be down the first six months of the year. Hedgeing by saying everything will happen and then claim you were right does not work after a while.

I take more seriously Tom than Dimon

Team Tom. Dimon has not been correct with his gloomy view in recent past 1-2 years . . .

I'm a simple man; I see Tom Lee, I click & watch.😂

Tom Lee, you're the GOAT. Everyone owes you more respect!

Kudos for all of your hard work!

Investors with a long term view are well positioned for the ultimate recovery because they understand that the market and economy will eventually revive. I'm doing great personally and will keep pushing hard in this wild market. Right now, my portfolio is up 43%. I'm going to take a backseat and watch how this all works, gradually adding more stocks.

How did you manage to succeed? I want to invest more wisely because I have a lump sum that inflation is slowly depleting.

I diversified my $50K portfolio across several markets with the help of an investment advisor, and I was able to earn almost $200K in net profit among high dividend yield equities, ETFs, and bonds

Interesting, I’ve actually been looking into getting one, lately the news I've been seeing in the market hasn't been so encouraging. If you don't mind me asking who's the person guiding you?

Well ‘Wendy Birkett” is the licensed fiduciary I use. Just research the name. You'd find necessary website to work with a correspondence to set up an appointment..

Unbelievable, Really there is no better feeling than coming across a similar name who has helped change ones family life financially, Yes i know her and honestly i can testify her strategy is amazing and truly worth giving the shot.

Ya there's always gas in the tank. Right up until all of a sudden you're empty.

Bingo

Gold amd oil all time high, why the hell would they cut rates???

That's the question?

Andrew talks way too much, I am so done with him always giving his opinion. Andrew, why do you think the producer invites people onto the show?

it's a general CNBC problem - probably the worst though is Kiernan (sp) - he comes across as if he thinks he's just far more clever than anyone else and needing to string things out ...

@@lylestavast7652 Glad that it's just not me. I have written to the station, but I can see he still acts like a spoiled child, has to get his way, or he just talks over the other person.

You heard if, folks. This will be the first "clean" CPI according to Tom Lee. So when the higher YOY gas prices in March do not pull down CPI, that is good, perfectly valid data. Remember, Tom Lee said early in 2022 that we would have under 2% CPI by end of 2022. Then by end of the next quarter ever since.

As long as the report tomorrow meets expectations, which is an uptick in inflation YoY, then that is good 😆 The complacency at the moment in the market is at an all time high.

@@davidtunstall6454Best time to buy historically. Don't let ATHs put you off.

Great to hear positive sentiment from our fed chair and lender of last resort Mr. Jamie Dimon

Hey Tom do you think Nucor ticker NUE is a long term investment

Say what you want - Tom's batting 100% since covid. I wish I listened!!

Hey its the guy from a rollercoaster again

Tom's the best. Question though, when he says there's 6 Trillion cash sitting on the sidelines, where do we get that metric? What's the best way to track that.

I believe some of it sits in overnight reserves, is there another way to track the remainder of it?

Did you watch him not too long ago predicting that the stock market would be down the first half of the year?

So what asset classes and sectors will enjoy the most upside?

Tom Lee is Pat from SNL

Fantastic clip. Dimon has been (wrongly) calling a crash for years now. Glad to get back to Tom Lee who has been spot on.

Tom has really been the hero carrying our mental health

Toms hair is more impressive than the stock market rally.

Tom 🙌🏻

Tom, Brent oil went up 6% last month. Which is next Wednesday cpi read. It’s NOT coming in lower then expected. I’m grabbing some sqqq as I type this

Tom lee is my favorite!

Camera lagged out at the end of the video

Jamie Dimon talking about the dangers of Geopolitical events while simultaneously telling us that Trump had some good policies and that we need to ease up on him and MAGA... I'd prefer to just hear from Tom Lee.

Tom Lee is an oracle.

love all these interoperability plays. Currently have a small bag in AMSCR11. I would love your thoughts on this one as you metioned it ealier.

Aged like fine milk given today's CPI figures

The idea that something is gotta give because interest rates are high is proving to be correct only on theory in this rally. The White Swan could be that, interest rates remain around these ranges and markets keep going higher purely because of the obviousness of where interest rates will be in the near term and businesses and households being able to manage their finances. So that correction or crack one might be waiting for may not come along for a while, resulting in many to miss the rally.

Obviously Tom does his own hair.

Tom for sentiments and momentum, Dimon may be for fundamentals.

When Tommy say this it’s time to short !

How can markets be at all time highs with more cash on the side line ????

I hope you are right my friend~

exactly right about investors being worried about a recession. It was never like this right before a stock market crash. Too many stock investors are afraid to buy due to valuation being too high, and waiting on the sidelines hoping to buy on a big dip to make a substantial killing. That will never happens because stock market will drop that much only because there isnt buyers with money to buy it up, or not enough money to buy the small correction.

Tom Lee was right when everybody sold.

Love Tom Lee ❤❤❤❤❤

No one in their right mind is cutting rates right now ...

Dimon is old news. Tom is the new Diamond 💎 Hands! Long live level headed Lee! ❤

Crazy Jamie!

How dumb was to interrupt. It was rude the way he was cut off

if they are telling you to buy, it means they are trying to sell.

One day I hope to have hair as cool as Tom 👍

The problem with this economy is that as inflation rose prices, of course companies made more money. The good run was made by company purchases not so much from consumers. Now companies have cut that spending. You will now see hard dips in the market because now, not only are the consumers broke, but you see big companies going broke or bankrupt. Housing will be next because, people bought these new homes when the interest rate has doubled. The first few years of a mortgage is most paid to the interest not the principle, that too inflates the market as mortgage companies are again just giving out loans to people that cant afford the long haul of the loans. The mortgage people reap the profits in the first few years of the sale. Most loans start paying more to principal and not interest until the tenth year. Therefore the company makes the profit back first. But will have the same problem as we did in 2010. You'll see these loans start to collapse. This whole economy is run on inflation and as the feds stop inflation, then the payouts and profits will stop, causing us to see the real numbers and it aint going to be good! Again this is why minimum wage is a scam. It causes people to buy buy buy since they got a raise that put them on a mountain, then the realization that every thing goes up only puts them under water. The foreclosures start and well be in a seeable recession. This is how the Biden administration has hidden the problems we are in. When Biden whispered "pay them more" was the moment he started pulling the wool over the Americans eyes! We've been in a depression every since December 2019! When the only thing covid killed was our economy!

Dimon's Letter of Platitudes...

Depends on your finances . 1000$ in Solana is 4000 AMSCR11 if it goes to 50% of ath in 2024 thats a 600% gain. If it goes equal to ath . Its a 1200% gain.

Has the total eclipse been priced into the market?

AMSCR11, ETH, and more would be great.

I love Tom…not sure why he saying there more room to run when he has year end target below where it is now

this media is total obfuscation

Real Estate agents always say "NOW IS THE TIME TO BUY"!!!

dimon was one of the kingpin's in the orchestrated collapse of real estate

the AMSCR11 is the game changer

Dogecoin is the bitcoin killer 😎

Strong economy but the numbers dont lie

“gas in the tank” metaphor has no meaning in a battery energy storage world…

🐐 🐐

I heard hk govt would grant massive amount of permits for mainland Chinese, hk population will get to 10 mil in a very near future? No?

TOM LEE HANGING ONTO EVERY LAST STRAND OF HAIR

Wow! Hair!

"Getting to that 3 to 2"

No, Tom, the target is 2. As in 2.0. 3 is +50% off target.

I knew that AMSCR11 was ahead of the game, but my mind is officially blown

they are all buddy buddy.

Can you ask him the secret to his hair the next time you bring him on?

Dimon: I’m completely silent about the tsunami or is it hurricane that will roil the market

WW2 was great for the economy and we boomed into the 50s-60's.

that's like your opinion man

Remember, Tom trapped his followers at the top in NVDA and other AI stocks, as it has tumbled all the way down from 950 to 830 over the last 2 weeks marking a market reversal, but you won't see this broadcast in the media because the markets are 'doing great'.