Chapter 13 Bankruptcy: 5 Crucial Things to Know

HTML-код

- Опубликовано: 27 июл 2024

- Chapter 13 Bankruptcy Calculator: bit.ly/3GINwVW

Chapter 13 bankruptcy is known as a wage earners plan (www.uscourts.gov/services-for...) because the court is attempting to determine whether you can pay back some of your debts in a 3 or 5-year repayment plan. Bankruptcy exemptions allow you to protect assets. Our free bankruptcy exemptions calculators estimates what you will lose based on the exemptions in your state: bit.ly/34JQlZx

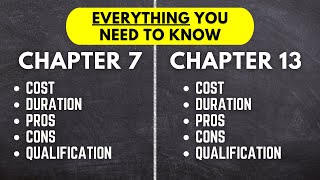

This Chapter 13 Bankruptcy explained video's goal is to explain the process, costs, pros and cons, and alternatives. See how Chapter 13 bankruptcy compares to Chapter 7 bankruptcy. See how the Chapter 13 repayment plan is calculated.

Understanding why your Chapter 13 bankruptcy cost is crucial to understand and how the Chapter 13 repayment plan is calculated.

Below is everything that we cover including Chapter 13 tips and tricks.

Chapters:

0:00 Intro

2:17 Chapter 7 vs. Chapter 13 Bankruptcy Overview

3:50 How Much Does Chapter 13 Bankruptcy Cost?

8:18 Understanding Cost Before Chapter 13 Consultation

10:18 How Your Credit Report and Score are Impacted

11:09 How to File Chapter 13 Bankruptcy

15:42 Pros and Cons of Chapter 13 Bankruptcy

17:43 Chapter 13 Bankruptcy Alternatives

20:20 Should You File Chapter 13 Bankruptcy?

20:49 Conclusion

Here are some other videos and articles to be helpful:

Chapter 7 vs Chapter 13 bankruptcy video: • Chapter 7 vs Chapter 1...

How Chapter 7 bankruptcy works video: • Chapter 7 Bankruptcy E...

Chapter 13 bankruptcy calculator article: tryascend.com/blog/chapter-13...

Find the Bankruptcy Exemptions in Your State: tryascend.com/bankruptcy/exem...

How Chapter 13 Repayment Plan is Calculated: tryascend.com/blog/chapter-13...

#chapter13bankruptcy #chapter13bankruptcyexplained #chapter13bankruptcyprosandcons

Music: www.bensound.com

Thanks for watching the video! As I mentioned, feel free to take our Chapter 13 Calculator here: tryascend.com/qualify/bankruptcy/ch13/route/youtubech13

If you have any questions, feel free to give us a call at 833-272-3631!

Thanks for making this video, it was really helpful!

You are most welcome! You have no idea how much we are thankful for comments like these! Hope you have a wonderful weekend!

DONT do it … I’m 6 months in.. I wasn’t behind on anything … but thought it would be good to help me get out of endless payments of unsecured debt … I’ve paid 10k in lawyer and in trustee fees .. my mortgage payment is still made by me … the bank gave me a fee of $1325, and it cause me to be behind on my mortgage payments… and you only get disposable income ….. so you’re screwed … I pay $1610 a month .. that’s with my truck and unsecured… it’s BS … I’m now paying way more that ever.

Thanks for the heads up - are you in a 100% plan? If helpful, could you book time on my calendar: calendly.com/ben-tejes-ascend/free-chat?back=1&month=2024-01? I'd like to understand more of the context here.

Very helpful, thank you so much 🙏🏽

Glad it was helpful!

Thanks for the helpful info great video 🤝

You are so welcome - I really appreciate the kind words. They keep me going!

I wrote out my Debt Snowball last week thinking I’m finally in a place where I can make some payments to get out of debt. Yesterday my bank account was wiped clean due to a levy. That was my rent and food. Plus any money that hits those accounts is gone. I have 0.00 and I didn’t even get a notice or subpoena.

Oh my goodness, I am truly so sorry to hear about this. Please give us a call at 833-272-3631 and we would be more than happy to talk through your options to try to figure out a plan forward. Do you have a steady income at least?

Excellent video, thank you make other explained how to appeal an order to dismiss.

Thank you for your kind words! This means so much to us! Hope you're having a great day!

Thank you for your video

Hey Ginger, it's our pleasure! We are so glad you enjoyed it. Please let us know if you have any questions!

Hi I’m currently in process of modifying my chapter 13 plan due to paying off early….how soon should I receive discharge? I paid my case off in March 2022 and still no discharge

Congrats Mario! Have you reached out to the chapter 13 trustee office or your attorney? Feel free to reach out to me at 833-272-3631, and I can do some research.

What is the bankruptcy to protect?

Are all creditors notified of a chapter 13 filing or just the creditors that you owe?

Hey Charles, this would be a great question for your chapter 13 attorney!

Can inflation change chp. 13 payment plan as my income no longer can compete with inflation therefore chp. 13 payment is no longer affordable

Hey Irma, you actually may see that the Chapter 13 payments would decrease because of inflation due to the extra cost of living expenses. This is definitely something to address with your bankruptcy attorney, and our Chapter 13 calculator based on the official US Chapter 13 bankruptcy forms should also be able to help you calculate your disposable income. Also give us a call at 833-272-3631 if you want to chat about your situation in just a free evaluation. Thanks for the great question!

Why does it take that long to discharge a chapter 13? Also, how do you build credit during the bankruptcy?

That’s a great question. 3 or 5 years is a long time! Do you have to do chapter 13? Debt negotiation can sometimes be less expensive and faster but you may want to consider lawsuit likelihood. For rebuilding credit, we actually built a free platform for bankruptcy filers if interested at www.tryascend.com/rebuild.

Hi. I have mortgage arrears that i just want to include with the chapter 13 plan. Can i pay the current mortgage directly to the mortgage company(exclude the current mortgage from chapter 13 plan) so that i can save money from the trustee cost?

Thanks for the question. This is definitely an attorney question, so have you spoken with this with your attorney? If you don't have an attorney, feel free to give us a call at 833-272-3631 and we can get you connected with a reputable one that serves your area.

In Tn your mortgage do not change,really it’s not even on the bankruptcy.Just the unsecured loans.

My home is in foreclosure and the sale date is 9-14-22. My home was damaged during hurricane Ida. I lost my job as a result, I haven't been able to pass a physical since because of severe spinal problems. I'm currently in the process of fighting for my disability. The mortgage company has proceeded with foreclosure and said that they are holding the insurance money 45,000 dollars. They told me that I should file chapter 13 but I literally can't even afford that. I'm in a position that I eat every other day because of the situation. I literally don't know where else to turn. I wish I could afford a single bullet

Oh my goodness, I am so sorry for what you are experiencing with the hurricane and that you are eating every other day due to this situation. I understand financial complexity pretty well, so if you are interested, please give us a call at 833-272-3631 and ask for Ben and mention RUclips comment and I’d be happy to speak with you. Sorry again - there’s definitely a way through this.

Sending miracles your way this is just a humble reminder that someone else is going thru something way worst😞 God bless you financially in every way!

Thank you for this!

Do you have home insurance

Hello. I'm thinking about filing Chapter 13 Bankruptcy but I have two cars. One car is for my son to drive to work. The other car I really need to keep as well for myself. Is it possible to keep 2 cars and have the payment lowered? I'm in the state of Michigan

Hey India, great question! You can sometimes do a cram down in Chapter 13 if the car loan is more than the value of the car. Meaning that you can reduce the loan amount on the car, which can ideally reduce your monthly payment. A local attorney would need to confirm all of this with you, however. I'd be happy to break down the rest of this with you, so feel free to book time on my calendar if that's helpful! calendly.com/ascend-finance

My attorney told me to take the new car back as long I got a car paid for.I file 13 with no problem.

I filed chapter 13 but so how long before I can file again

Hi Vicki, that's a great question! You can find out how long you need to wait by using the 2,4,6,8 rule shown below:

1. Filing Chapter 13 after Chapter 13, you may need to wait at least 2 years since you filed.

2. Filing Chapter 13 after filing a Chapter 13, you may need to wait at least 4 years since you filed.

3. Filing Chapter 7 after filing a Chapter 13, you may need to wait at least 6 years since you filed.

4. Filing Chapter 7 after filing a Chapter 7, you may need to wait at least 8 years.

Here is a link to an article we wrote that goes over this: shorturl.at/mouOQ. However, if you are still confused or if you have any questions, let me know or book some time directly on my calendar: shorturl.at/csxBH

@AscendFinance is there a low cost fee to file chapter 13 I have no income?

Hmm, is there a specific reason you are looking at Chapter 13? Can you call/text me at 833-272-3631 if you have any questions?

How many times can I file bankruptcy to keep my home from foreclosure?

That's a great question. I am not sure whether there's a limit as that may be a great question for a bankruptcy attorney in your area. Thanks for asking!

What’s the point if they’re making you pay everything back?

Some people may question that. In some situations, you may not have to pay almost anything back if the disposable income calculation is negative. Do you qualify for chapter 7? Feel free to take one of our free calculators to estimate or reach out at 833-272-3631.

No interest on what you owe that’s put in a trust for payments.

Also a great point!

Hello,

My debt personal loan about 172k, my credit card about 23k

No property home, no car loan. My gross income about 7,800 a month, net income about 4000.

My expense rental home 1000

My gas food… 500.

With a my daughter

I live in California.

Can you let me know if percentage success for chapter 7.

Thank you so much,

Tony

Hey Tony, thanks so much for the context. Our free Chapter 7 calculator can estimate both qualification and cost (link: tryascend.com/qualify/bankruptcy/ch7/ytc ), but I can give some insights. So, your annual income is ~$93,600 and the means test for household size of 2 for cases filed after May 15, 2022 is $92,321 (source: www.justice.gov/ust/means-testing/20220515), so you are slightly over the income limit, but some people still can qualify over median. As such we built this free above median chapter 7 calculator to help you estimate that based on your expenses: tryascend.com/qualify/bankruptcy/ch7/aboveMedian/ytc. That's a lot. Please let me know if you have any questions!

I need a new roof. My son is getting a loan in his name and I don't have to pay him back. Will this effect my chapter 13 plan.

Hey Lisette, as each state is quite different, I’d probably reach out to your chapter 13 attorney for this one. I understand you may have already done this though. Have they responded to you yet?

Chapter 7 or nothing. But the problem is that if you are married but your spouse doesn’t want to file because your finances are completely separate, you can’t unless you include your spouse! I have no options because my spouse is not in the debt that I am. I’m taking care of my disabled son by myself and I have no choice.

i dont want to go thru the whole process i just want to buy more time to get caught up .

Hey Keith, ah that's really challenging I'm so sorry! If you were to go utilize the Chapter 13 to get caught up on a secured debt, you may have to see through until the end to prevent a dismissal. I have questions about what's causing you to fall behind on the secured debts, as that'll help me see whether you may need to file a Chapter 13, or if there are other options.

Here are some main things to understand and assess:

1) What's causing you to fall behind?

2) If something else is causing you to fall behind, would resolving that piece first allow you enough room to get caught back up?

3) Do you have unsecured debt as well? Or is the main challenge a mortgage or auto loan?

I'd be happy to go through this with you, as I can provide some insight on some options that may help. You can book sometime on my calendar if it's helpful to chat: calendly.com/ascend-finance

I would advise break these up into videos and not just throw links down below. We want to listen not always read articles. Its RUclips not YouReadLinks.

Thanks for the feedback, TYellowdragon! I definitely understand the suggestion, and will do my best!

Why do i feel like i am back in 2nd grade.?

Oh no, why do you feel that way? Thanks for the feedback!

I wish your calculator was retirement friendly. It ask for pay check. I get retirement and SS. Retirement is always the first of the month where as SS goes by the 3 wednesday of each month, thus the date fluctuate

Hey James thanks for the comment. I would definitely like to help here as we are seeing more retired folks that need help with this - could you book time on my calendar: calendly.com/ben-tejes-ascend/free-chat?back=1&month=2024-01?

If you get Social Security and retirement from either a pension or IRA/401k I think you are judgement proof so no need to file for bankruptcy.

I don't have much faith in the calculator when it tells me my Chapter 13 repayment is 100%; guess I don't need to file then eh

Thanks for the feedback - it may be estimating a 100% plan because of the disposable income. I'm curious though if everything is already past due. Feel free to call me at 833-272-3631 if you want to chat through this. There may be other things to consider if you feel like you need to do something.

He needs to work his speech it's so frightening

Thanks, why frightening?