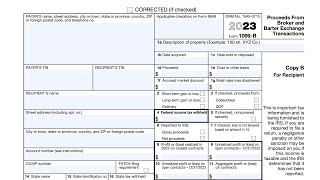

IRS Form 1099-R walkthrough (Distributions from Pensions, Retirement Accounts, Annuities, etc.)

HTML-код

- Опубликовано: 30 окт 2023

- Subscribe to our RUclips channel: / @teachmepersonalfinanc...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video:

IRS Form 4972, Tax on Lump-Sum Distributions

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4972 walkthro...

IRS Form 5498, IRA Contribution Information

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 5498 walkthro...

IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4852 walkthro...  Хобби

Хобби

Thank you for this video! Helped me at lot.

My 1099R Line 2 and 3 is 100/month aka 1200 on the form in box 2 and 3. State tax is also mentioned. So how do I incorporate this in my

electronic filing? FYI - This repeats annually

I apologize for the late response...I did not see this when it was first posted.

Line 2a is the taxable amount of your payment. There are certain retirement accounts where part of a distribution might be taxable, and part might not. Line 2a clarifies this.

Where you report depends on the type of income this is.

Line 3 can mean that this is a distribution which can be treated as a capital gain (primarily available in accounts for taxpayers born

before January 2, 1936 or a beneficiary). If this is the case, then you would complete IRS Form 4972, which helps calculate the tax on the capital gain treatment (preferable to ordinary income tax rates):

IRS Form 4972, Tax on Lump Sum Distributions

Article: www.teachmepersonalfinance.com/irs-form-4972-instructions/

Video: ruclips.net/video/ZBXP61IEukE/видео.html

Excellent explanation. How do I know if the institution didn't make a mistake on the form?

My mom received an annuity payout that ended, but she reinvested it elsewhere. Now, her return is showing both the contribution and capital gains income.

I don't know enough about your mother's tax situation to tell you what's going on. However, the annuity company should be able to walk you (or your mother) through her Form 1099-R to explain where the numbers came from.

When inheriting a Roth IRA you have to transfer the original Roth IRA funds into a custodian beneficiary Roth IRA account, but its not clear if the beneficiary's account or the original owner's account needs to have existed for 5 years for earnings to be tax free.

Does the original owner or the beneficiary need to have held ownership of the Roth IRA funds for over 5 years for the distributed earnings to be tax free?

A couple of things:

1. There are some occasions in which the inherited Roth account can be combined with an existing Roth IRA. According to IRS Publication 590-B, this can be done if the beneficiary:

• Inherited the other Roth IRA from the same decedent,

or

• Was the spouse of the decedent and the sole beneficiary of the Roth IRA and elects to treat it as their own

IRA.

2. When it comes to inherited Roth IRAs, the following rule generally applies:

Generally, the entire interest in the Roth IRA must be distributed by the end of the 5th or 10th calendar year, as applicable, after the year of the owner's death unless the interest is payable to an eligible designated beneficiary over the life or life expectancy of the eligible designated beneficiary.

3. Ordering rules for distributions apply to an inherited Roth IRA if the owner of a Roth IRA dies before the end of:

• The 5-year period beginning with the first tax year for which a contribution was made to a Roth IRA set up for the owner's benefit, or

• The 5-year period starting with the year of a conversion contribution from a traditional IRA or a rollover from a qualified retirement plan to a Roth IRA.

Ordering rules exist for taxation purposes. Distributions are treated in the following order:

1. Regular contributions.

2. Conversion and rollover contributions, on a first-in, first-out basis (generally, total conversions and rollovers from the earliest year first). Take these conversion and rollover contributions into account as follows.

a. Taxable portion (the amount required to be included in gross income because of the conversion or

rollover) first.

b. Nontaxable portion.

3. Earnings on contributions

What is 15b id ?

Did you mean to ask, "What is Box 15?" If not, could you clarify what you were asking?

My 1099R Line 2 and 3 has 100/month aka 1200 on the form in box 2 and 3. State tax is also mentioned. So how do I incorporate this in my

electronic filing? FYI - This repeats annually

If your Line 2 number is also reflected in Line 3, this means that there might be income that you can treat as if it were a capital gain.

Is this from a lump-sum distribution from a qualified plan? And were you (or the original beneficiary on the account) born before January 2, 1936?

Or is this from a charitable gift annuity?