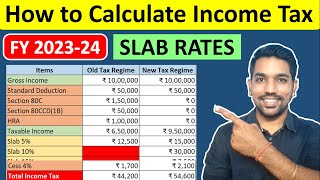

New Income Tax Calculation 2024-25 | Tax Slab Rates for Old & New Tax Regime

HTML-код

- Опубликовано: 15 окт 2024

- New Income Tax Calculation 2024-25 | Tax Slab Rates for Old & New Tax Regime (Examples)

In this video by FinCalC TV we will see Income Tax Calculation examples for FY 2024-25 AY 2025-26 with comparison of old and new tax regime in hindi. Standard deduction is applicable in new tax regime (Rs. 75,000) and old tax regime (Rs. 50,000) for salaried employees and also 7 lakh income will not attract any tax under new tax regime due to tax rebate under Section 87A.

Income Tax Calculator:

fincalc-blog.i...

Save Income Tax Video:

• SAVE INCOME TAX with O...

Section 80C Deductions List:

• Section 80C Deductions...

Marginal Relief in New Tax Regime

• Marginal Relief EXPLAI...

JOIN Telegram Group:

t.me/fincalc_t...

DOWNLOAD Android App:

play.google.co...

HRA Exemption Calculation:

• HRA Calculation in Inc...

After watching this video following queries will be solved:

How To Calculate Income Tax FY 2024-25 AY 2024-25?

What are the income tax slab rates for FY 2024-25?

What is standard deduction for FY 2024-25?

Old Slab rates vs new slab rates?

Income Tax calculation FY 2024-25 using excel examples?

Tax rebate under section 87A?

What is tax rebate u/s 87a

Eligibility for tax rebate 87a

Old income tax slab rates calculation vs new income tax slab rates calculation

New Budget 2024 income tax

standard deduction new tax regime

NEW TAX REGIME:

No Income Tax on Income between Rs. 0 to Rs. 3 lacs

5% Tax on Income between Rs. 3 lacs to Rs. 7 lacs

10% Tax on Income between Rs. 7 lacs to Rs. 10 lacs

15% Tax on Income between Rs. 10 lacs to Rs. 12 lacs

20% Tax on Income between Rs. 11 lacs to Rs. 15 lacs

30% Tax on Income above Rs. 15 lacs

OLD TAX REGIME:

No Income Tax on Income between Rs. 0 to Rs. 2.5 lacs

5% Tax on Income between Rs. 2.5 lacs to Rs. 5 lacs

20% Tax on Income between Rs. 5 lacs to Rs. 10 lacs

30% Tax on Income above Rs. 10 lacs

EXAMPLES:

Let's say your gross total income as Rs. 6,15,000

Let's say your total investments as Rs. 75,000. So your net taxable income becomes equal to Rs. 6,15,000 minus Rs. 75,000, which is equal to Rs. 5,40,000. These Deductions are applicable only if you are using Old Tax slab rates. Your net taxable income when considering New Tax slab rates remains Rs. 6,15,000, as no deductions are applied on your total income.

Now to calculate your income tax, if you are an employee or pensioner, you get a standard deduction of Rs. 50,000 only if you are using old tax slab rates.

So your net taxable income becomes equal to Rs. 4,90,000 if you are using Old Tax Slab Rates. But it remains as Rs. 6,15,000 based on new Tax Slab rates.

WATCH FULL VIDEO TO KNOW MORE ABOUT NEW INCOME TAX SLAB RATES AND MORE EXAMPLES.

#IncomeTax #Calculation #TaxCalculation #fincalc

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

Facebook : / fincalctv

Twitter : / fincalctv

BLOG: fincalc-blog.in

Telegram: t.me/fincalc_t...

Instagram: / fincalc_tv

============================

MORE VIDEOS:

SIP Returns Calculation: • SIP Returns Calculatio...

Income Tax Calculator: • Income Tax Calculation...

Loan EMI Calculator: • Home Loan EMI Calculat...

Loan EMI Prepayment Calculator: • Home Loan EMI Prepayme...

============================

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown.

I Am Not A SEBI Registered Adviser. All The Information Provided By Me Are For Educational/Informational Purposes Only. We Do Not Take Any Responsibility For The Accuracy Of The Data But As It May Contain Typographic Or Other Errors And Inaccuracies And We Expressly Disclaim Liability For Any Errors On The RUclips Channel (FinCalC TV). Please consult your Financial Advisor before taking any decision or action in terms of your Finances.

![[4K] Watch SpaceX Catch A Starship Rocket From Space!!! #IFT5](http://i.ytimg.com/vi/pIKI7y3DTXk/mqdefault.jpg)

Correction: 8 Lakh income will have Rs. 23,400 tax. Updated the calculators

Update: Marginal Relief & Tax Rebate changes here:

ruclips.net/video/3ahLIpXjblg/видео.html

Income Tax Calculator:

fincalc-blog.in/income-tax-calculator/

JOIN Telegram Group:

t.me/fincalc_tv_channel

Sir is new tax regime calculator updated with new slabs rate in your website calculator?

Bhai website to load hi nhi ho pa rhi hai

Iss Application me New Tax Regime ka standard deduction 50000 show kar raha hai !!! Isko thik kijiye...

Hello, new tax regime mein, aap ne 8L ka tax jo calculate kiya hai woh galat hai, ater std deduction amount 7,25000, jis ka tax 23,400 hona chahiye, dubara chech karein,

NPS me 50000 add kr skte hai investment me new tax regim me

best analyzed income tax video after the budget. I was just looking for this video as I am a salaried person with a income of between 5 to 7 lpa. Some people were saying we have to pay if we have an income above 3 lpa. Thanks for the clarification. Many people still does not know about the 87A rebate.

good to hear that the video helped you. share with your friends and groups :)

I have a doubt now if we are taking new tax regime next year do we option for to select for old regime

For FY24-25: Original return files in old regime, want to file revise return in new regime. can we do that.

ITR4 Form

I am having 9lk salary can you suggest best regime for it and advice investment for it.

Sir great presentation. However please check the tax calculation for an income of Rs 776119. I think the calculation of tax of the above amount is not coming correctly as per new regime. Please Please check and let me know

Sir pf and nps me 1.50lakh maximum side me ham dal sakte hai ya jo company ke latter me ho vahi dalna hota hai

Brother what regime will be better for my father who is 70 now and a pensioner and annually income as like 480000, has one F.D

Will the new tax slabs apply for this financial year or will they apply from next year??

For FY 2024-25 (April 2024- March 2025)

@@fincalc okay thank you!

Superb, very useful video.

I was not able to understand old tax regime and new tax regime before watching this video. After watching your video, I understood everything clearly now.

Thank you very much.

😊

Can you please let me know when the new standard deduction 75K will start ?

My dear friend please clarify me that Rebate u/s 87A under new regime for 2024-25 kithna hi? Nahi bathaya. Please bathayuye.

check this video to understand tax rebate and marginal relief in new tax regime:

ruclips.net/video/3ahLIpXjblg/видео.html

Income tax CTC pr calculate hota hai ya monthly salary me 12 ka multiple krke 1 year ki income par tax calculate hota hai ?

I think FIn Minister ne kaha if you opt for new tax regime then only you will get 75000 Standard deduction. If opting for old tax regime standard deduction will be 50000

yes right, for salaried employees in FY 2024-25

new tax regime - Rs. 75,000 standard deduction

old tax regime - Rs. 50,000 standard deduction

So this new tax slab will ve benifit for people having 10lpa?

Not exactly, if we consider deductions with old tax regime

Check this video to understand more

ruclips.net/video/jbfI49qbeOk/видео.htmlsi=fwWqwbdp07cyqrW3

💯Agar investments zyada na ho and income 6.50lakh - 7.0 lakh ke beech hai that too in case of ITR -4 as I feel that form because I am an advocate then uss case mai which regime will be better in my case ?? Quick response will be highly appreciated . I hope you reply soon 🙂

Sir long term capital gain may kya ab sub ko tax dayna hoga?

Agar may increase huya sara paise dobara property may with in a year investment karun to tab bhi tax lagayga? Please bataye.

Before 12 years may na 20 Lakh ki property purchase ki thi or ab 60 lakh ki sale kar raha hum to ky 40 lakh per 12.5% tax dayna ho? Ya 40 lakh dobara invest karnay per nahi lagayga. Please guide karay

agar 40 lakh ko invest nahi karoge to 12.5% ke hisab se long term capital gains tax dena padega.

isko reinvest karne pe shayad tax save ho sakta hai, but check karna padega kaha reinvest kar sakte ho

Sir my father is a pensioner and he is 70 now, but suddenly a hefty amount has been deducted as TDS from his savings pension account. Please help me that how to get refund and will we get the 100% of the refund or not?

Company salary mey pf employee aur employer aur employee dono ka, gratuity, kaat deti hai phir salary Bank pahunchti hai. Toh tax total par katega ya bank amount par?

this is for salary account or savings account ?? becuzz in savings account there is cash deposit limit of rupees 10 lakh in one financial year but in this video it shows 3-7lakh income tax is included plzz make a detailed comparison on income tax limits between salary and savings account

is this aplicable for present financial year or next

for FY 2024-25 which is between april 2024 to march 2025

Yh annual income CTC me count hoya h ya inhand salary se?

hi, thanks for making such videos to enhance our financial knowledge.

while i was using your shared excel sheet, found its not matching the tax calculation from the one you shown on your blog page. kindly fix the same. and share the updated/modified excel sheet.

Thanks once again !

what changes did you find? can you provide the numbers you checked for?

Is marginal deduction allowed upto 7 lakh still available in new regime?

yes. watch this video:

ruclips.net/video/3ahLIpXjblg/видео.html

Will my capital gains below ₹5 lakh be taxed if I have no other income?

i have the same doubt

Tax will be calculated as per stcg or ltcg rates.. and if this tax is more than the tax rebate 87a limit than the difference amount will have to be paid as tax

New regime

Business income 8lakh me

(no invest) Kuch Rebet milega ?

I am a retired senior citizen . My total income is 800000/- while filling it return for fy 2023-24 I have been allowed ₹ 150000 /-

U/S 80C & ₹50000/-TTB Only

but standard deduction of ₹50000/- IS denied under old resume what is the reason? ऍपल explain. थँक्स

if income is from pension that std. deduction should be allowed

What will be the option for saving tax in new regime? If can guide.

No options if you are earning more than 7 lakh per annum

Only standard deduction of 75k available for now

Sir ji new tax regime me agar taxable income 700000 se neeche ho to 25000 ka tax rebate milega na.

yes 20000 ka tax rebate milega.

ye video dekho: ruclips.net/video/3ahLIpXjblg/видео.html

Please reply whose income less than 7 lakhs per annum their deduction amount of income tax is back if they file itr it is true or false ? Please confirm this

yes with new tax regime, the tax deducted will be refunded when income is less than 7 lakh in FY

@@fincalc thank you so much

I am retiring 31-01-2025. How can I file IT return, as a general or senior citizen? I shall get only for ane month pension for FY2024-2025.

Good information in simple way

just now calculated my dad's income tax calc, its showing something in ur calc but something else in income tax website calculator. WHY??

His pension yrly is 263711, interest on fd 50000, and if he has stcg of 4lacs ur website is showing no tax on new regime and Rs44451 on old regime, but income tax website is showing old regime 56740/- and new 62400/-

Mujhe bhot confusion hai annual salary 425000 hai ab mujhe yad nh ke form bharte waqt Maine konsa tax regime select Kiya tha or dusri bat incentives add hota hai jo every month add hota hai salary mei ??

Total income means???

Annual CTC ya annual In-hand??

Very good explanation 😊

Glad it was helpful!

Bhai hal me hi gher walo ne karib 3 lakh bana tha to total income kitna hoga andaza bata skte ho muje idea nai

While calculating I.T. on 800000 you should not consider section 87a rebet properly.PL GUIDE.

Sir, bank ko kaise pta chalta hai ki customer ki financial income 2.5 lakh se above bank mein deposit ho chuki hai...?

Kya bank year ke end mein customer ki income calculation karta hai...aur income tax department ko batata hai ki customer ki year income 2.5 lakh se jayada hai...aur इस customer ne itr nhi bhari...?

In new tax regime fy 24-25 tax free income 825000 after rebate 25000.Is that true?

not exactly. watch this video to understand with examples:

ruclips.net/video/3ahLIpXjblg/видео.html

Kya FD se aane wala interest bhi income me Count hota hai ??????

Income 7.75lakh+ LTCG 1.25lakh for FY 24-25. Do I need to pay any tax or tax will be NIL ? Please let me know if anyone knows this.

icome tax site pe ₹ 15,000 + 10% above ₹ 6,00,000 , ₹ 45,000 + 15% above ₹ 9,00,000 asie slabs likhi hai to ye 15+45 dena pde ga extra?

Total salary counted or only basic salary?

Bhaii pr months 20k salary hai. Yearly Kitna tex Hoge plz batao bhai

In fincalc app 30 percent is showing under 25% under new regime which is not correct.please rectify it.

Hii Brother

13 Lack Income pe kitna tax dena pad ta hai plz calculate

Salary person

Sir I have a doubt now in new tax regime upto which taxable income tax is zero 750000 or 825000. Sir please clarify

Up to Seven lakh seventy five thousand,there is no tax in the new tax regime announced today

775000 no tax

The Slab rate also changed then upto 7 Lakh tax is 20000 then what about balance 5000 Rebate amount

up to Rs. 7,75,000 no tax with new tax regime

aap sahi ho total income 825000 par koi tax nahi lagega.

in youtube walo ko kuch nhi ata

Sir 24-25 mai salary 7.78 lacs banegi. Kya income tax banega or not. Plz reply

Agar deductions claim karoge to income tax save kar sakte ho

Ye video dekho

ruclips.net/video/jbfI49qbeOk/видео.htmlsi=fwWqwbdp07cyqrW3

@@fincalc sir as per your calculater tax will be 3120/- only. But my consultant saying it's wrong. What to do now

Was waiting for your video😊

Hope you enjoyed it!

Have u update the Android aap as per new tax slab, please reply

not yet, work is in progress, will take some time. stay tuned.

Sir is it same for senior citizens monthly pensioner .??? Plz tell. Me🙏🙏🙏

new tax regime is same for all age groups

My brother have 12 lakh/salary

Fd+sb interest=97000

How many amount tax

Mutual fund , LIC , PPF Medical Insurance & NPS + HRA rented house etc. Limittaion in investment

Please explain in details

watch this vide for all investment options for deductions

ruclips.net/video/80SC1pE-NvA/видео.html

Mae aksar aap ka video dekhta hoon ,aap bahut achhe se samjhate ho as compared to others thanks.

thanks and welcome. dosto ke sath share karo :)

First time aisee videe dekhee hai

If i earn 20 lakhs a day then Next 3 days i spend 20 lakhs. How much money to give income tax.

Par old tax regime me, investment bhi acha khasa karna padega, at least 3.5 lakhs I guess, jisse in hand salary/income kam ho jaaegi. Phir monthly budget bigad jaaega.

yes old regime me investment options ke benefits milenge, but plan karna hoga finances

Yes, here are it is

1. 80C-1.5L

2.80CCD1(b)-50 Th

3.HRA10(13)-for metro it is 50% & non metro city 40%of basic subjected to minimum whatever you paid or 40/50% of basic

4.80E - interest of education loan

5.Interest of house loan max to 2L

6.health insurance max 25Th

तो इतना करना हो तो २५ लाख होम लेना पड़ेगा ।

किराए के घर में रहना पड़ेगा

एडुकेसन लोन लेना पड़ेगा

Health पॉलिसी लेनी होगी

Sir maine Mortage/Lap Loan liya hai to kya muje ITR mai is Loan ka Benefit milega ki nhi pls btye sir ( Deduction mai)

Old regime me home loan ka benefit milta hai

@@fincalc Home Loan nhi h Mortgage Loan liya Maine sir, koi bol rha h ki benifit milega Koi bol rha h Mortage Loan mai benifit nhi milta ITR mai Only Housing loan mai benifit milta h, mai Confuse hu sir ap ko proper pta h agr to pls bataye

आपने बहुत अच्छा बताया हैं धन्यवाद 👍👍

हम सीनियर सिटीजन हैं ITR 2 भरना होगा क्योंकि पेंशन इनकम और सिक्योरिटी sale /purchase म्यूच्यूअल fund हैं

क्या उसका वीडियो बना सकते हैं और कोई यैसा भी calulater आपने हम लोगों की मदद का बनाया अगर हाँ प्लीज प्रोवाइड लिंक कैलकुलेटर

धन्यवाद

Calculations based on slab wise not income base slab

Example- if some one annual income is 800000 then 75000 deductions means 725000 taxable

3L-7L--20000(5%)

Rest 25000(10%)-2500

Edn cess4%-900

Total tax-23400 not 26000

20lakh income pe kitna tax lagega please explain

Hi , kindly update the income tax calculator in new tax regime as per the latest budget

app update is in process. stay tuned

New tax reg. Me NPS ko 50000 rebate milega ki nahi.

Hey where is deduction under 80CCD(2) (Employers contribution 14%to NPS)in new regime??

U/s 87A ...rebate claim,or not claim FYI 2024_25 .

5lk par Kitna tax, new tax regim me,bank interest ka deduction milega kya

Sir i m railway pensioner my yearly pension is about 360000 what will be IT 4 2024 2025 please let me inform

income tax should be 0 with 3.6 lakh total income

use this calculator: fincalc-blog.in/income-tax-calculator/

Sir ek doubt hai: in 8 lakh example, under New tax regime(NTR) after 75k deduction, 7.25lakh. Then according to calculation 20k + 2.5k =22.5k tax liability aa rahi. Par aapne kaha 7 lakh ke upar hee tax ayega, Iske neeche zero. Ye samajh nhi aaya?Please tell how 25k tax liability(Surcharge hataa ke) came on 8 lakh income under NTR.

Yes, it will be 22.5k

22.5k tax wouldnot be given due to 87A rebate

Sir meri first job hai

Abhi joining hui bank me

Income 6 lac

Mera tax lagega

Kaun sa tax slab shi rhega mere liye

Bhai 0 tax lgega rebate ho jayega paisa wapis

Sir online game pe 30% tax hai wo kaise calculate hoga please explain

Bro, how much tdx if I have 5000 RD and maturity in 10 years?

Agar income 7.75 lakh tak hai to income tax 0 hoga kya???

yes. ye video dekho examples ke sath

ruclips.net/video/3ahLIpXjblg/видео.html

I had suggested you to write maximum deduction limit to all sections. But still you didn't add. & should add nps deduction for new regime

check this video for all deductions with limits:

ruclips.net/video/80SC1pE-NvA/видео.html

Sir pls income tax cantion ka selbus kya h pls reply me

Kya ye next salary me effect krega

April 2024 se March 2025 ki income pe applicable hai

Ekdam j2 explanation

Gross-941008.Tax in old res. will be 46684 but your calculator is showing 29642.why?

Meri income 3.3 Lakh hai. Bank m aati hai salary. Kya karna padega mujhey

Mainey pichley 2.5 saal sey kuch bhi ITR vagera nhi kara hai. 😅hota kya hai mujhey to yehi nhi pata

Same bro me 2 also

उत्तम प्रयास

8.4 lpa par kitna income tax lgega sir bataiye???

calculator use karo

link: fincalc-blog.in/income-tax-calculator/

Sir ye new tax slab kab se lagu hoga, abhi se ya fir next year se

Next

You are highly qualified person. I am a retd commissioner. Take my example. Suppose pension 6.5 lacs. F.d. int. 1.5 lacs. Total 8.0 lacs savings in 80c ppf 1.5 lacs. Work out and tell which is better. Do not be fool people.

Uncle fd ko aapke kisi family member jiska koi income nahi hai unke name par kar dijiye 1.5 lakhs par 0 tax hoga baki 6.5 lakhs ka bhi 0 hi hoga tax after standard deduction

Bilkul sahi

Uncle in any case old tax regime is best if you are earning more than 7 lakh including all capital investment interest. Without a doubt go for old tax regime if you have investments under different sections.

@@trailblazer830No, it’s not right. If u have saving in 80C 80ccd1b, section10(13) & home loan interest then only old regime is beneficial

@@Dvr_24 that's what I am saying bro, new tax regime has no option to show your investments though tax rates are less under this regime but that is only for attracting more people towards this regime.

I would go with Old Regime as I have some investments

good

Share market ka profit ke tax kese bachaye ? Govt .rule follow karke

IT gross salary ya NET salary k upor calculate hota hain?

gross salary me se taxable income calculate karke IT calculate hota hai

ye video dekho: ruclips.net/video/dij-t09Ob34/видео.html

@@fincalc tab toh Govt NPS share+ Self NPS share milake taxable amount Jada ho jayega sir

Brother please correct the formula if income is less than 700000... Then result comes true

Home loan Interest and Home loan premium kaha show karni hai

section 80C and section 24 me

Thanks sir

Welcome

Thanks for your new tax regime idea

welcome

Pension मिलता हर महीना 40हजार। Tax देना पड़ेगा क्या?

Bhai Aaj wala budget me jo new tax regime me chut mila wo isi saal milega...ye 24-25 hi chal rha hai na?

FY 2024-25 me applicable hai

where is 80 ccd2, employer’s contribution …

Only for govt employee

@@deeshot1000are aisa kya oh bhai private walo ka. Accha kat rha

@@aseshkumar878 employees ke baare me koi ni sochta chahe jo koi bhi ho

it is not available for maximum employees under private sector, will make changes in calculator to include same for govt. employees

In this app you have shown slab of 25% which is not applicable pl check and rectify

Thanks for pointing out. Will correct in upcoming updates

Useful video ❤🎉 nice information ❤🎉

thanks

Rebate under sec 87a milega ya nhi new regime me

Milega 7 lakh

milega.

ye video dekho examples ke sath: ruclips.net/video/3ahLIpXjblg/видео.html

Bro agar RUclips se 10 lakh income pe tax procedure kon sa hoga?

Good income by you tube

तो bank income tax slab के अंदर आने वाली income पर tax deduct करके income tax department ko deposit कैसे करवा देता है...

अगर किसी Customer ki yearly income 2.5 lakh से ज्यादा है... तो bank tax कैसे deduct कर लेता है...

मेरा Question शायद आप समझे नही...

क्या bank year के end में total income calculate करता है... और जिस Customer ki income, income tax slab में आती है,bank उसका tax deduct कर लेता है...?

New tax regime me gift deduction kaise claim kare

Bhai one question, trading mai loss huwa hai wo income tax mai kaise show karna hai

Sorry lekin meri samajh me Uske liye business income itr 2 sahayd use karna padega aur 3 lakh Tak ka loss carry forward kar sakte hai agle 3 sal k liye

Bhai, sec 87a 25000 tax deduction available, as per, tax burden of 25000 is for income of 750000, per apne khaisa bola 7 lakh per zero tax

yes tax rebate hai.

ye video dekho: ruclips.net/video/3ahLIpXjblg/видео.html