The Dividend Yield - Basic Overview

HTML-код

- Опубликовано: 29 сен 2019

- This video provides a basic introduction into the dividend yield. It explains what it's used for and how to calculate it. The dividend yield is equal to the annual dividend divided by the current stock price times 100%. The annual dividend is equal to the quarterly dividend times 4 or the monthly dividend times 12. This video provides plenty of examples and practice problems to help improve your understanding of this topic.

Stock Trading For Beginners:

• Stock Trading Strategi...

Return on Investment:

• How To Calculate The R...

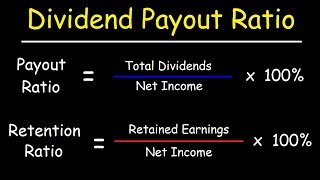

Dividends - Payout Ratio Vs Retention Ratio:

• Dividends - Payout Rat...

Market Capitalization:

• Market Capitalization ...

Price to Earnings (P/E) Ratio and Earnings Per Share (EPS):

• Price to Earnings (P/E...

___________________________________

PEG Ratio Vs Price To Earnings Ratio:

• PEG Ratio vs Price To ...

Trailing PE Vs Forward PE Ratio:

• The Price To Earnings ...

Price to Sales (P/S) Ratio:

• How To Calculate The P...

Price to Book (P/B) Ratio:

• How To Calculate The B...

Currency Exchange Rate:

• Currency Exchange Rate...

Profit Margin & Operating Margin:

• Profit Margin, Gross M...

_____________________________________

Return on Assets (ROA) and Return on Equity (ROE):

• Return on Assets (ROA)...

Debt to Equity Ratio:

• Long Term Debt to Equi...

Liquidity Ratios:

• Liquidity Ratios - Cur...

Assets, Liabilities, & Equity:

• Personal Finance - Ass...

The Short Ratio:

• How To Calculate The S...

____________________________

Math and Science Videos:

www.video-tutor.net/

Final Exams and Video Playlists: www.video-tutor.net/

Simple as usual, this man makes my life easier from organic chemistry and science to stocks, a living legend.

Dude...🤦🏽♂️

You’re an excellent teacher.

There would be way more smarter people in the world if school teachers taught like you.

Thank you.

Thats true bro.

yeah, I never studied before I saw this guy. I turned an F into a D by scoring a B on the final because I studied his videos the night before.

Ya lol

he is explaining it to us as if we were a child..

I'm pre-med and is so suprided that you have videos like this, and this is helping me so much, because I was never taught about money or finances this channel is the source of learning everything

I always watch your ads in full time. Thank you for all the work you do!!

man, you made it so easy to understand this. I appreciate this so much

Wow this guy is so intelligent.

Best explained dividend video on the internet. Appreciate you taking the time to explain it in detail.

ur kidding right?

I swear you are like stacking my school schedule lol. In high school I was taking calc and you were releasing calc videos every day. Now im in college taking finance and we are literally talking about this stuff

Finally some one explained the quater div on a yearly percentage. Thanks.

Mate, just found your channel, and really is very wonderful! The way that you explain things, i didn't had the chance even in school! Step by step, even the people who do not have idea on math can learn it :D

Thank you sir for providing financial education. I am grateful for channels like yours. Keep up the awesome work!

Thank you for explaining this both in detail and in an easy way! Finance and investing is something that everyone should know about, and this video really helped as a beginner :)

BEST Teacher ever seen.........teachers should take smart skills from you SIR

Excellent! Well-explained. Thank you!

good job. pretty simply, easy to understand..... Keep it up!!!!

Love the simplicity without all the distracting graphics.

Thank you for your explanation. I'm self studying and this really helped my understanding of the topic.

The way you explained was excellent ❤️ The best video I have seen till now ❤️

You explain things simple thanks

People need this teaching, for every day life.,( for example, if you're getting a 3.4 increase in next year's wages and you don't know this teaching today JG, you won't know?......good video!!👍 ✌😎( my full example here; 3.4 Divided by 100, times current wages of $36,000 = increase of $1,224.00 = $37,224) total new yearly wage. And I've had people recently tell me, they don't need math to live in life???

Simple. to the point. amazing. and love your accent BTW

Thank you so much! Finally I understand how to calculate dividend yield.

Very helpful, thank you ‼️

you're my teacher since highchool

Such a good video!

Thank you very much!!!

you're the best Sir

Thank you

The economy keeps rising, one needs to have different streams of income and a diversified portfolio in order to survive and secure a future of financial freedom.

How favourable is the market now ? I want to invest in Crypto currency.

Forex and crypto yields more profits when the favourable market rise.

@@ericadaniel8241 investing in crypto now is best especially with the current market rise.

I had interest in investing in forex but I was discouraged by my friends and family, I was being ignorant though.

Exactly ! That's definitely ignorance because they are good traders to invest with and earn your profits.

GOD bless you !!! Thank you

Very informative video 👍

Thanks that helped me so much

Thank you!

On your video to calculate your div/yield you said. To multiply the div / yield and the price of the stock. But when do you take your stock price to do that calculation thanks.

Nice video thanks! I have a question.. If the stock price goes down let's say like from 20$ to 10 $ and the year divident grows at the same time from 5% to 10% doesn't that mean you earn the same amount?

Very helpful 👍

Great vid I watched it cause I'm getting a divdened from chapter 7 bankruptcy on my case that went in my favor. How is that calculated? Or is it all roughly the same way. It's ten years in the making

Great explanation! Keep up the good work

Wow! Pretty good demonstration. From this video, Can we buy out performing stocks, those stocks would give more annual dividend?

Thanks man great job ✌

this the video i was looking for

Well explained man I’ve invested my savings £10,000 in Royal Dutch Shell last week at a 6.08% dividend yeild also they pay dividends quarterly so will I receive £207 per payment?

Can you do differential equations

How often is a company allowed to change its annual divident during a year? And how does this and stock price change affect me if I bought the shares at a specific time when the price was "a" and the annual divident was "b"? Can you make a video about that?

It depends on dividend policy of the company which will be decided by the board of directors

thank you so much

Dividend stocks are a huge opportunity to supplement our incomes. What other entities pay you for the privilege of holding on to your money? Banks used to do so until they figured out that they don't have to and people sill still hold on to their accounts. They colluded with the FED to make sure that interest rates are practically zero.

Light Bulb moment kinda video right here! Thanks

I got it, THANKS 🙏

So relaxing to hear 🙉🙉

I did 10,000/50= 200 shares so 200/ by the DIv which is 0.50= 100 and than 100 x 4 = 400 a year

Very helpful video 😊

5:36 so the price of the stock went up and the yield went down: but does it really matter? You still got the same annual dividend- which ultimately is the money you see in your pocket, so regardless of the yield percentage; if you get the same amount of money as an annual payment, it doesn’t really matter.

You get to purchase more shares with your own capital which will give you more of a bigger dividend payout that’s why buying low is better and does matter

@@juanrounds But the point is if I already purchased the share at $20, it means nothing to me when the price goes up to $50 with a lower yield because I already secured the stock with a price of $20 and the yield of 5%, so the rise of price and drop of yield don't really affect me, right?

I hope we can stay connected

You have been taught dividend yield by a chemistry tutor.

your explanation is very easy to understand,, great job! thank you very much for the video

Can anyone tell me why is there inverse relation between stock price and dividend yield? I thought they were suppose to be direct. When stock price goes down company can only pay less dividend? Please correct me

Because the amount they pay you doesnt change i think.in this case, It will be 1$ regardless of the dividend yield

Thanks

may i know whether the current price is after dividend or before dividend to calculate dividedn yield?

if I need to calculate the annual Div. yield of a historical year and I got only quarterly data of the Div. yield! How could I calculate it?

Short answer: Just Multiply QD by 4; assuming Dividends are held relatively constant across quarters.

Here’s a formulaic way to represent including the units, of which you use Unit Analysis to check your maths.

AD (Dividend $ / Year) = QD (Dividend $ / Quarter) * (4 Quarters / 1 year) .. and when you cross out numerators that’s match denominators you’ll see that the right side will reduce back to left... ($ Dividend $ / year) ...

Another way using months:

AD ($/12 months) =QD ($ / 3 months) *(3 months / quarter) *(4 quarters/year)- > AD ($ / year) = QD * 4

And verbally:

So to go from QD to AD, multiply by 4? ( the number of quarters in a year) And to go from AD to QD divide by 4.

**Remember this assumes the dividends of that quarter will be the same for the entire year.

Vincenzo Co. has a price earnings ratio of 10, earnings per share of P2.20, and a payout ratio of 75%. The dividend yield is:

Try to answer this example

I understand, Thank you

No you don’t don’t lie you too dumb

Nobody:

The Organic Chemistry Tutor: C a l c u l a t i n g D e v i c e

Omg! Basically I’m going to get paid more on my money than having it sit in my betterMent account

Love $main, %5.803 div yield paid monthly.

I thought it was calculated by total # of shares, not total dollar invested?

this man does everything lol

What about the payout ratio?

No people like you are meant to stay broke

How do you calculate the dividend perof share dollar form.

You cant

Everytime I heard your voice, it always reminded me of Betotsky. Idk whhy

Upload video on Jacobian transformation coordinates with examples

I love your voice

Yes great voice, i agree. Ok I’m confused. While trying to learn about dividends, i see stocks like MO, DPG, DIV, & AGNC follow this equation/rule you’ve shown us, how do other stock prices grow while still gaining AD (instead of declining)

Like MTUM, PG, MSFT, & NVDA? Sorry I’m new to this...Is it the differences in single stocks and EFT’s? Having extra cash flow? Maybe you can simplify if for me. Lol

@@rustyrobison7770 just don’t invest it’s all a scam you will loose all your money 100%

man I thought that they was going to return 50 cents for every $50 I spend am I incorrect on the way to calculate the dividend yield am I wrong to say they will return $2 per share annually for every $50 I spend on shares that being the share price

So the COI x DY=AD?

Why didnt i learn this in skool?? Lol

Fo you invest in the market

what if we just have the precent ?

Multiply the current stock price with the percent

Mark Wallberg teaching me about dividend stocks 😂

So you mean if I invested $1000 dollars with a 5% yield I’ll only get $50 a year?!!

Yep

Doesn’t include gains if the stock price goes up right?

Right

So you’ll lose the $950?

@@hddngemsblog2616 Your cost basis remains the same.

ok what goin after tax?

make it where they just give you the percent of the dividend

Hi

TheOpBro hello I guess

@@99ChevySilverado bye

#yanggang2020

math rules🎉

Andrew Yang supporter?

I never been good at mathematics

mahal na yata kita

if you like me I can speak English!! Oh my life would have been different.

I dont get this shit

Definitely not throwing my money away 😁

ive got a problem here, i have a company im interested in but the numbers give me a headache. (at the time of this comment)

AD is $893.85 , SP $32.83, did th math and 2722.98851.