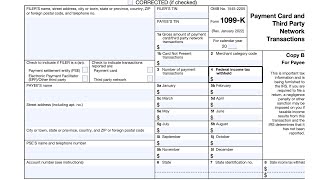

Legit expenses offset 1099-K payments (Etsy, eBay, PayPal, Facebook, Venmo, Cash App) 2022 - 2023

HTML-код

- Опубликовано: 16 июл 2024

- I'll Walk You Through a Sample 1099K 2022 and Explain How I Prepare to Offset That Income Plus Learn Why the New $600 IRS Reporting Requirements Might Be The Perfect Opportunity to Get Off the Fence of Beginning a Business!

As promised 2022 we will have a video series regarding starting up a business. Hopefully, a video every 10 days for several weeks. That's in addition to non-business related topics...like helping figure out crazy printer errors and such... Ha-ha.

If interested, please leave a comment in this video for your most burning questions regarding starting up a business. I will be sure to incorporate your questions into the video series as often as possible.

--------------Links BELOW to Products we use and recommend. If we use a product, we might recommend it and earn a small fee if you make a purchase. If you return the product, we lose the fee. We only recommend products we would buy ourselves. As an amazon associate, we earn from qualified purchases. ----------------

Free Monthly Expense Tracker: quickspi.com/1099k-irs-report...

This Company Charges No Fee to Start LLC: shareasale.com/r.cfm?b=617326...

Big Expandable Receipt Organizers: amzn.to/3Gl4dHm

Car Size Receipt Organizer: amzn.to/3q6Lxph  Хобби

Хобби

Thank you so much for this information. It was well worth the time to watch and take notes. I will be looking at my options after listening to this. Can't wait to hear the rest of your new videos!

Glad it was helpful!

Thank you for the information on the taxes, I will be looking out for your next videos.

Excellent and eye opening video! I liked and subbed. You are very knowledgeable!

Thank you and welcome!

Thank you for reviewing this!

You're welcome!

This is SUCH a great video and finally someone goes into detail what I was looking for....what can I count as expenses to reduce that number!!! Thank you so much!

Hi Jeff, Glad it was helpful!

Anything that you purchased/spent money on to help run your business is considered an expense :-)

Very beneficial information. Very well explained about very important topics....really impressed with your knowledge

New subscriber! Thank you! I so needed this!

Hi Bubbly! Glad you're here!

Thank you for all the information!!!

Great information

All of us who just sell old crap they don't use anymore on eBay are done for.

Naaa, just write it off, Use your imagination. 👍🏽

And all that stuff now has to go to the recyclers rather than reused - another blow to the environment, terrible law.

Just vote in november and hopefully we can stop screwing over the poor and lower income with things like this $600 it's reporting requirement... It directly targeted the poor and lower income!!!

I will just rely more on forums or other sites. There only supposed to you off services not reselling. So dumb

@@72Dexter72Manley72 the point that YoCatto and many others like us is that for all of our lives we worked a payroll job where we received a w2, filed our taxes and went on. All the comments and videos stating we have nothing to worry about sound good, but in reality they don't put our minds at ease because we do not understand it. We are not dumb, it's just that we never had to deal with this. Some videos are telling us we will own Local, state and federal income tax plus self employment tax on this income. Put our minds at ease what does it actually mean and will tax software like Taxslayer be able to handle this for us?

Thanks you love

This was a great video! Thank you so much! “New Subscriber”

Thanks! I'm really glad it was helpful and glad you're here!

Zelle is exempt It is not a payment Processor it is a peer to peer It moves funds from bank to bank and it is a network that does not hold funds please educate yourself don't assume

I printed the schedule c at the beginning as soon as she was about to go over it 😅🤣

Thanks so much for this very organized and took away a lot of confusion - I sell on eBay stuff of my own as well as helping a friend sell his collectibles of which I get a 40% cut - can you tell me if a separate Form 1099K for him is needed as well?

I don't have a business. I do it as a hobby. I just sell things I have had since I was a kid like baseball cards! I have no clue how to value my original cost of these items because I have no receipt when I bought Baseball cards at the local sweet shop in the 1970's

Thank you so much for this video. Can you answer a few questions?

1. where does the Payer TIN go on schedule C? I don't see a box for it.

2. Assuming I could just write in the Payer's TIN on one of the information lines (Box A or Box C) on top of the page, what if I have three or more 1099-k? How do I separate each 1099-k information from the rest? Won't IRS like to know?

A W9 form is used to share business information such as business name, TIN (tax ID) for the business, etc. I wonder if these services will start requesting these forms.

Thank you so much for addressing this, what if you are just an individual and not a legitimate business? Do these record keeping and tax write offs still apply?

Thanks for this video! @QuickSPI I'm in Michigan and do continual byt casual eBay selling, some at a loss (household stuff), some for profit (flipping items). I keep excellent records. Do I need to set up my activity as a legitimate business in order to claim expenses on my tax return?

What if you don't have receipts?

Realy good, I wish you lived next door or closer.

I stuck on gross receipts looks like it’s gross and include sales I run in my shopify store refunds and sales tax. If that’s true where do I deduct he discounts on the goods I sell? If somebody bought my good for five dollars off I don’t think I should be taxed at the gross amount when they didn’t even buy it for that I must be missing something? I need help

I hope the IRS is abolished and new and simpler tax system is put in place!

OK so let me get this straight… I buy a product and have to pay taxes on it. Then a year down the line when I sell that product for a loss, I have to pay taxes on that??? Am I understand this correctly?

The problem is that I sell my old used things. I am not a business. This sucks.

I just recently opened up an online ebay store reselling electronics purchased locally. Is an EIN all I need to get started?

The monthly expense tracker is not working, can't be downloaded

I am a part time reseller so I do not have an actual business, I do it as a hobby but also make more than $600 so does that mean I can not right off any of my expenses because I do not have an actual business? I am new to this and trying to figure it out so I can file my own taxes this month.

A lot of people will stop donating, a lot sellers will stop selling because of not available receipts! Who save receipts on items purchased years ago?

Hi

Just to let I know the link for monthly expense tracker is no use in sense that it leads to dead end page !

I'm confused, as I am not a business, I simply did basically an online garage sale with high value items. I sold about $6K worth of mostly electronics that I bought over the years. I have receipts for pretty much everything and should end up at loss, but not sure what to do. Not sure if it differs from the people doing actual business..

I agree. Everything that I am selling (at a loss) is used by me, but generates reusable

income. Ebay says that you won't have to pay any taxes. Can you go over in another video how to fill out the form(s)? I am sure that there are thousands in my situation. Thanks!

@@carlneb8619 did you ever get a response for your above question? I too am wondering if we can back out expenses or a cost basis for items sold AND what line is that cost basis put on.

I was also looking for clarification and found this video by a CPA that answers the question. I can't confirm that his solution is correct, but it sounds legit. He makes the distinction between selling your used personal assets and running an actual business. ruclips.net/video/pH1zZAG4tSc/видео.html

I was also looking for clarification and found this video, by a CPA, that answers the question. I can't confirm that his explanation is correct, but it sounds legit. He makes the distinction between selling your used personal assets and running an actual business. ruclips.net/video/pH1zZAG4tSc/видео.html

Receipts, storage & preservation fees for all the time you’ve “stored” the item (Including offsets for the Utility’s because it’s considered “climate controlled space”) + All the other associated fees including CPA tax preparation fees, your time, your gas and mileage, your packaging tape and bubble wrap/packing peanuts cost…

Essentially you’ve got a nickel and dime yourself into a demonstrated “loss” In a set of “books” for when the IRS comes back and audit you for this and that and other things.

Individuals have to get used to understanding the mindset of operating the entire work related endeavours as a business….You’re no longer a person to the IRS you’re a legal fiction and A legal entity, And as such? You’ve gotta conduct your affairs accordingly in the minutia or they’re gonna nail you with additional taxes and fees and penalties…

IRS pushed the $600 threshold to 1-1-2023. at least for California

Hello I have a question I am 16 years old and I got the 1099k irs thing and is asking for my SSN should I put my real one because I don’t want to to delete my account once they know I’m 16?

Question, I am disabled, I sell things on eBay every once in a while, the last I sold an item on ebay was 5 years ago; my car broke down. and needed money for that, I sold comic book for $ 600.00 is November 2022, does this new tax law apply to me?? Thanks.

Helpful video, can you write all of your expenses off even if you aren’t considered a “legit business”

Great question, what if you earn more than $50 a month playing online games or answering online surveys? ?? Which is appox $600 a year. Can you write off internet costs, phone service costs, etc..????

quick question, then can I write off the laptop that I use to list items on ebay, my cellphone, which I use to create mailing labels, and also my printer which I use to print my labels?

U can write off the ink & the cell phone bill and the paper which the labels are printed on

That depends on whether you are considered a business under IRS rules. If you are (a business is an activity engaged in for the purpose of making a profit and conducted on a regular and consistent basis), then you can write of the business use of your laptop and cellphone. You would need to calculate how much time you use the laptop and cellphone during the year, and what percentage of that time is devoted to your eBay selling. You would then have to depreciate the laptop and cellphone using the MACRS tables, and apply the calculated percentage. The cost of your monthly cellphone plan and your internet plan can also be deducted based on the percentage.

Can I sell my old stuff on eBay as an individual without a LLC but still be able to claim all my expenses against the gross 1099k amount? If so what all can I deduct?

Yes you can. You don't have to be an LLC to be considered a business by the IRS. The IRS defines a business as any activity entered into with the intention of making a profit. If you are a business, the things you sell would be considered inventory, and you would claim your income on a Schedule C, where you also can deduct your expenses, such as Cost of Goods Sold. However, if all you are doing is selling your old stuff on eBay, that might not be enough to be considered a business. In that case, the stuff you sell would be considered Capital goods and not inventory. In that case, you would list the items sold on form 8949 where you can subtract the adjusted basis of items sold. The main difference as far as taxes are concerned is that a business can declare a loss that you can deduct from other income, whereas the sale of personal-use items under Capital goods rules cannot produce a loss. You would only be able to claim a zero gain.

I received one this January. Do I need to report it or wait until 2023 for the next one? I'm confused.

The 1099 k will have the year on it. You report it for that tax year

Thank you for your video. I have 2 short term rental houses that I rent through Airbnb and through a personal business website. I receive my payments through Paypal. I now have a 1099K from Airbnb and from Paypal. The income on the 2 different forms are duplicate income. How do I report my 1099Ks without making my income double for the year? Thank you for your time.

If you have short-term rental houses that you’re running through Airbnb? You should have a most competent CPA in your arsenal of related business costs.

Are you so shortsighted and uneducated or just plain cheap??.

Report the income honestly. You can include an explanation with your tax return explaining the situation. Or wait for a letter from the IRS and respond with the explanation then.

@@jimtrue1465 They are indicating they received multiple 1099-K's for the same income. "Honesty" has nothing to do with this. Thhey will be double taxed when they legally should not be.

@@reggiemann9246 That is why I stated they can include an explanation with their tax return, explaining why they are only reporting the income once. They will not be double taxed.

If you rent rooms in your house where the monthly payments cover the renters utilities, room, internet, and tv....is this taxable income?

Hopeso

It is, but you also would get to deduct the cost of the utilities, internet, and TV (assuming you pay those bills). You would also have to depreciate the cost of the room.

If I sell something I bought years ago and I no longer have a receipt...someone said to use market price.. For example, many years ago I paid for $100 and now the market price is $45 and I sold it for $60 on Ebay. So I have to pay taxes because I made more than the market price? I thought if I sold less than what I originally bought I wouldn't be taxed? Not sure about this.

If you originally paid $100 and sold for $60, you have a $40 loss, which is not deductible. If you receive a 1099-K, you would have to list the item on form 8949 along with the date sold, the gross proceeds from the sale, the original cost basis, and the date of purchase. If you don't have the receipt, you can make a reasonable approximation. Do NOT use the current market price. Since you are selling at a loss, when you list the item on form 8949 put a "L" in column (f), the amount of the loss in column (g), and zero in column (h).

Hi i have one question ⁉️ Does the 1099 form from Facebook shows only the actual payout or also adds the shipping cost and taxes that the buyer paid?

I don't know about facebook, but the platforms we use report "gross payments" which includes what the buyer paid for the entire transaction. Then we run expense reports to find our shipping, taxes, fees, etc., deductions.

I buy mostly at garage sales and resell on ebay, but I don't have receipts (being they are garage sales). I was wondering how I can report what I paid for items I sold on ebay. Thanks

Ever find out an answer? Thanks

@@matts4025 No I haven't. I think if I don't have actual receipts, I just can't claim them

Gotta make ‘em gotta keep ‘em: “Books”

IRS rules Stipulate that there’s no need for a receipt under expenditures of $25USD.

But for chrissakes don’t be dumb and take my word for it & DON’T BE CHEAP either!!…go and hire a confident registered with the IRS CPA agent And learn to do things right from the get-go.

Their fees are tax deductible as a business expense so get over it as some sort of exorbitant cost.

Maybe go back to community college and take your self a business accounting class perhaps?.

@@Casmige 😂

@@marciimpalahow did you do it did you file your taxes if yes can you guide please

Quick question. I have an informal business where I sell pre-made packages to missionaries that are not located in the US. I am not located in the US but the PayPal account that I use does.

I am willing to pay taxes. 1st question, can I deduct taxes with foreign receipts?

Is there anyway to pay for these taxes online? I am just afraid since I really depend on that income and now it seems as if PayPal will delete my account or something. :(

Are you an American citizen? For non citizens who don't live in the United States or its territories, the US can only tax income from American sources, and it sounds as that isn't what you have, so you would not have to pay US taxes. If you are an American citizen, then the US can tax your income from any source no matter where you live.

PayPal without knowledge , changed friends and family to goods and services.

Does 1099-K reporting for 2021 change state by state? Paypal generated a 1099-K online for me for selling on eBay but I never hit the 200 transactions. I'm in Illinois so I wonder if that's why it was generated.

11 states changed it last year and it ranges from $600-$1500. eBay is the only platform I’ve seen that sent out a 1099k to those states even though all platforms should have.

1000 and a minimum of 4 transactions. The same form you received gets sent to the irs

So do I report my sales from 1099-K form that I got from PayPal into the revenue amount in schedule C form?

Depends on whether you are considered a business by the IRS or not. If you are a business per IRS regulations, yes, report the total sales on Schedule C. If you are not a business, you will use form 8949 to report your sales.

Is there a difference claiming it as a hobby or a business?

You get more tax breaks with a business. But it doesn't have to be a registered business like an LLC.

What if I’m not a business and I sold a personal item at a loss and have the original receipt? Where do I put that?

List the items on form 8949. You will need to supply the date sold, the date acquired, the proceeds from the sale, and the original cost. If it is a loss, then in column (f) enter "L", and enter the amount of the loss in column (g). Then put zero in column (h).

How do the rebates you receive from apps such as ibotta etc affect this?

Great question, rebates on something you already purchased for personal use shouldn't count, but how are the paypal etc. Companies going to know? Maybe there's someone in the IRS that we could ask that question to.....ty

@@dennisd7451 we checked with our CPA and you are correct PayPal would not know thus it is up to us to keep good records of our cost for the rebates and show they are not taxable. It will be interesting as PayPal effective this year 2022/will send a 1099 if as much as 600.00 goes thru paypal. Lots of people who never got a 1099 before will qualify for one this year

What if you have a legit business llc & your business bank account is connected to cashapp, paypal, venmo, and you have those incoming payments already included in your gross income. And you receive a 1099k from each app… is that 1099k useless? Since you already have that documented into your quickbooks?

The 1099-K in that case would simply serve as a proof of income.

1099k are being sent out 2022 or 2023

A lot of RUclipsr’s have been giving misleading information and blowing things out of proportion regarding the 1099-K. The ones doing this don’t either have a clue or have an agenda.

We don't know how the IRS is going to handle hobby sellers, how they would deduct their basis cost for items sold. Hobby sellers cannot deduct other costs, like fees and shipping.

You can not deduct ANY Hobby expenses, not even cost basis.

If someone is selling on EBay just one person is a sole proprietorship with their SS number better than an LLC

Is this a question?

So my wife and I already filed our taxes jointly and already received our refund this month, and she received a 1099-K from Paypal. Do we need still need to report that this year since we already filed?

You will need to file an amended return (1040-X).

What form do I use if I am not a business since Schedule C is for businesses ?

(I'm an individual that sold $4,000 worth of miscellaneous things I do not need anymore)

Thank you sooooo much !

Did you ever figure out what to do? I’m having the same issue

@@Evelyn-bm4cw Sorry Evelyn but I have not received not a single bit of advice.

I think you use the 1040 form if it is a hobby not a business.

If you are not a business, then use form 8949 to list the items sold. You will need to state the date sold, the proceeds, the date acquired, and the cost basis. If you don't know the purchase information exactly, you can make reasonable estimates. If the items sold for a loss, be sure to enter an "L" in column (f), the amount of the loss in column (g), and a zero in column (h).

@@jimtrue1465 Thank you sooooo much Jim. That means a lot to me and you are a great man !

What do you do for income you receive for doin siurveys or allowing a company to see where i i go on the internet?

When I don't know where to put it, I use the Miscellaneous Income Fields.

@@QuickSPI Thanks i just hate that this is being doubled report to me by both PAypal via the 1099 k. and the actual company with a 1099 misc. So in Illinois this rule is in effect for 2021 instead of 2022.

"A taxpayer is a cestui que trust" in re. Bolling vs. SUPREME COURT OF WISCONSIN 1912

Hi I got a 1099k from Paypal referring to my sales in 2022, but it’s all good … My problem is another letter that came a few days after with another 1099k from 2020 (yes, two years after I already filed my taxes) what should I do now about this issue?

Thank you

I am on the same boat got a 1099-k from 2020 plus got a letter from the IRS I called them states I needed to file schedule c form. I went to a tax perpetrator today 2/15/2023 stated I needed to amend my 2020 tax. I need to get shipping cost, bought item price, net sold etc info now to take to the tax perpetrator to help me. It’s a pain!

I didn't make money selling my old computer parts I paid more for them new and sold it for 1/3 the price theoretically I didn't make money I lost it

I still don't get it. So if I sell something to someone in person ($200 in cash for example), how does that go? What if you're a casual, once-in-a-blue-moon seller?

Cash transactions are not really traceable so don't worry about it? For a casual seller, you only pay taxes if you make a profit. For example is you buy a shirt for $50 and sell it for $25, you DID NOT MAKE A PROFIT, so YOU PAY NO TAXES. HOWEVER, if you bought it for $25 and sell it for $50, then YOU MADE A PROFIT OF $25 & YOU HAVE TO PAY TAXES FOR THAT. How much? It's not much for smaller scale seller but you should always set apart at least 10% of any profit you make online for taxes.

@@Andy-wt6ym Thank you.

I can't believe they lowered it to $600. That's one cell phone and you get a 1099k to deal with. Really sticking it to the rich with this one aren't they 😂 Please vote in november...

What if my 1099-k is only DraftKings gambling winnings being withdrawn via PayPal so PayPal sent a 1099-k.

If I had 57 transactions and made $1,000 should I expect a 1099k for 2021. Sorry new at Marketplace and have no idea what to do

Yes if you go past $600.

I received a 1099-K for 2021... I thought this didn't go into affect until 2022

How much did you sell, I don’t know if I would be receiving one. I am so confused

@@saraisela19 my sales were $3,200

I am so confused I only made $1,000 and I thought the threshold for 2021 was $20,000 or 200 transactions

Because of the build back better plan the card transactions over $600 total started the 1099-k in 2021. Everyone is in disbelief but that the US Govt for you.

I had $2800 in payments in 33 transactions. Ebay STILL sent me one. WHY? WAY under the $20k/200. This is dumb.

Google I received a 1099k from eBay in 2021. There are 11 states that changed the amount to $600 all the way up to $1500 last year and eBay didn’t tell the people in those states. From what I’m seeing no one told the people in those states so most of those people already got their taxes filed before they got a 1099k they didn’t know they were getting. From what I see only eBay is sending them even though if you’re in that state all platforms send it. I think those 11 states are ebays test dummy’s for sending out so many more 1099k’s 🤷♂️.

@@picklikeapro6952 paypal sent me one in Virginia for Swagbucks rewards over $600.

@@brigidchristenson481 😳. Why is PayPal sending them? I’ve only heard about eBay. I’m in missouri and sell on 4 online sites, use PayPal a ton locally and Venmo etc and only eBay sent me one which was under $20k and 200 transactions.

@@picklikeapro6952 Virginia lowered its threshhold to $600 already. I just moved here last year and was surprised.

It was for stupid things like watching videos, doing surveys, shopping rebates, some of those are not even taxable, but I got my rewards as paypal cash so they reported it all.

Here is my question(s). I ***think*** I know the answer.. I'm pretty new on etsy and have entered my ssn in my shop..

That simple act, does that make me a "sole proprietor" even without a taxid or business license..

I'm tracking my receipts for the year but i have no idea what to expect next tax year.. Will I be able to use Schedule C on my return..

Otherwise that would really be a blow.. Part of the gross payment amount includes the shipping I have to pay.. And materials cost.

I'm sure hoping I can claim all that easily.

Thanks for reading.

The IRS doesn't care if you have a business license or a tax id or are registered as an LLC. The IRS defines self-employment as any activity engaged in for the purpose of making a profit.

All those 3 stimulus money people got it was free making other people pay back now.

She keeps saying next year, I go this form in Jan 2022

Some states already require this reporting.

15:12

But it's not real money. It's fiat currency.

Millions of people will receive it next year Also ,what kind of life it is to constantly collect all receipts anywhere you go.Just stupid .

Thank you Biden Voters

These tax law changes happened under Trump.

Im not sure what a 'legitimate business" entail, but let's just say im an individual with a lot of items I bought in the past that I want to just get rid of at a price equal to less than I what I paid. Since I didn't forsee any of this I didn't ever save receipts or never got one to begin with. Then what? We're talking maybe 2-3k per year of stuff. Im wondering if they would mess with anyone on that level. Would suck if they didn't for like 10 years then all of the sudden showed up. "The American Rescue Plan" "Tax the rich".........yeah right. Look what happened. And they wonder why we dont trust them. Jerks.

@@terry_willis LONG LIVE KLAUS SCHWAB AND THE WEF!!

I would fill out the form 8949 on my tax return as honestly as I can even though there is no receipt for the original purchase. Enter reasonable estimates for the date purchased and the cost basis. The worse that will happen is the IRS might send you a letter asking for documentation to support the purchase and if you can't supply the documentation, the IRS may say the entire proceeds is taxable. But most likely they won't.

The dems said they were gonna tax the rich and yet they pass this lol

Just steady repeating the same thing over and over smh

Still going to vote Democrat?

Haha 🤣🤣🤣🤣

📙📘📗 THANKS