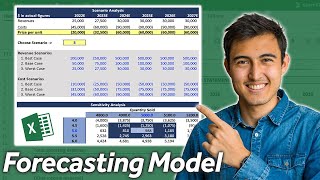

Sensitivity Analysis or What-If-Analysis for NPV

HTML-код

- Опубликовано: 28 авг 2024

- Sensitivity Analysis is an important tool in financial Modeling. In this model, we are interested to find out what will be effect of investments on NPV.

This method can be pursued to find out the impact of change in variables and its impact NPV. The variables should be changed one at a time. All the time, the variables of the expected scenarios are retained .Say for example

Investments - 20000

Sales-18000

Variable cost % -66.67

Fixed Cost - 1000

We generate a cash flow using the above data and the first part of the video talks about generating a cash flow statement and then calculation of NPV.

Now the change the investment alone to 240000(pessimistic scenario) and observe the change in variables.

Similarly, do this for all the variables for the pessimistic scenario and optimistic scenario.

#NPV #SensitivityAnalysis #whatifanalysis #Cashflowforecast

In this video, I have covered investments of al three scenario such as optimistic, pessimistic and realistic scenarios.

Keep Watching, Keep Learning

This was the clearest explanation of how to conduct a sensitivity analysis on NPV that I have watched. Thanks so much for making this video!

Thank you ma for this tutorial,u really broke things down more than my Lecture did at school,this is the best class I ever seen on this topic

I'm glad that this video helped you Nadia Nafisat !

Amazing explanation ma'am, loved it. You explained this concept so beautiful and I wasn't struggling even for a moment 7

Awesome mam, I really like your way of explaining with lot of Patience. Even though I understood the concept in your class. Still I came to RUclips to listen your explanation mam. We really need such kind of informative and interesting numerical problems in RUclips as well.

Chetana Anuraj, I'm glad that you have watched this video.So nice of you. Will post more such videos

Thank you ma'am the explanation was so good

Thank you ❤

Great ❤

Oh i get it thnks 🎉❤

Very nicely explained 💥

Glad you liked it!

It was such a nice video mam. I have a question? Would you please tell me the variable cost as a percentage of sales - 66.67% how you got this?

Excellent

Thank you! Cheers!

why did you keep the sales fixed, while you mentioned in first table that it changes from 15 in pessimistic to 21 in optimistic. You kept it 18 in all three events. Can you explain why? thank you

Hi Mustafa, We have 4 variables under study

1. Investment

2. Sales

3. Variable cost

4. Fixed cost.

I'm interested to find how sensitive the NPV, if we change one variable (let us say in this case Investment). Once we have identified, then we can change to the next variable (Sales). We will study pessimistic sales impact on the NPV, Optimistic sales impact on the NPV and realistic sales impact on the NPV (keeping the other variables of the study constant).

Hope this helps. If you need the excel file, please reply with your mail ID.

Hello madam why dd you add back depreciation..... Kindly clarify this one

Because here we are finding cash flows , depreciation is not a cash flow so we add back it which is deducted when calculating profit and taxes.