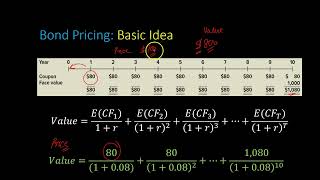

How to Calculate the Current Price of a Bond

HTML-код

- Опубликовано: 13 дек 2018

- An example is used to solve for the current market price of a bond.

Here is an example with semiannual interest payments: • Solving for Bond Price...

If this video helps, please consider a donation: www.paypal.com/cgi-bin/webscr...

![*SUPER RARE* THE PARADIGM IS BACK?!?!? Fortnite Item Shop [August 6th, 2024] (Fortnite Chapter 5)](http://i.ytimg.com/vi/ru6xSH1RaPw/mqdefault.jpg)

the simplest explanation i have ever seen... thank you so much

Simple and to the point. Thank you so much

thank you so much!! this is the simplest and the most helpful video i found!! thank you!!!

Thank you for this short and simple explanation.

the best👍👍👍

You may have just saved my butt for my midterm tomorrow👍👍

Short and simple!

Thank you.. Very easy to understand

NPV in it's simplest. Excellent

Thanks alot... The video was very helpful ❤❤❤

You make the topics easy to understand as to drink a glass of fresh water!!!!!!!!!!!!!!!!!!

Well flippen done Master.

Thank you!

Thank you!

Good vedio....

thanks man!

thank you so muchhh!

Great thx. Just curious, why is the denominator 1 + YTM and not just YTM?

thank you so much

perfect - TYSM :)

is there a way to compute (70/1.085....n years) a little bit quicker in a basic calculator? i have this problem which is in 15 years and doing the calculation one by one in a basic calculator will take too much time

Not with a basic calculator, unless yours has the summation function, which in that case. Yes it does. I would look up a calculator tutorial online asking for this function. If its casio you could find it easily

Do you have a video using the same coupon rate, interest rate, and maturity date to figure out the maturity value of a bond?

Thanks...

Hi. Thanks for your video. I wanted to ask you: So that 940.89$ should be the price at which we should be buying that bond right?

Yes, that is correct.

@@EconomicsinManyLessons thank you💪

Thank you

so what is the interpretation, we should not buy the bond if its price is above $940.89?

Correct

great thnks

What is the formula for present value of Bond when required rate of return is not given but discount rate is given?

you are my dad , thank you so much

I appreciate that!

Thanks

What if the bond matures in 25 years? Is there a faster way to calculate that?

Thankyou for dat

How to determine a Bond is undervalued or overvalued?

When I use the google sheets function PRICE() to calculate the bond price I get as result $692.90. How can that be so different?

Maybe the formula you're using is incorrect, or maybe you're not using it correctly.

so if I had semi annual interest payments would I just multiply $70 by 2?

or would you divide the coupon by 2?

Rate would be half and time would be double

please see: ruclips.net/video/pt3z18R4oeo/видео.html

u just made me pass my internal exams

That is great! Congratulations!

I have a question. In the denominator you have (1+ 0.85), why do you have 1+ in the denominator?

It’s just the basic formula of NPV, look it up. Also maybe the idea if you get 25% added onto something you multiply by 1.25 and not times 0.25

what if it is semi- annual

735.04 instead of 711.60 that's what my computation please correct me if am wrong

Me too

Nope the right answer is 7115.9 and so on but they round up it so it's 711.60

Consider a given bond that has five years maturity, Br.1000 face value and a 12 percent coupon

rate. Suppose a broker‟s commission of Br.50 is imposed by brokers to buy or sell the bond.

Assume further, that the discount rate (minimum required rate of return) is 10 percent and the bond

pays interest annually.

Required:

a) What is the price of the bond?

b) By relating to the example given, discuss how the reversibility of a financial asset

affects its value

Is bond price same as bond purchase price ?

The bond prices is the current value of the bond.

Example: say I bought a 10 year bond with a 7% coupon rate, for $1000. Five years later, I could buy a brand spanking new bond with a maturity of 5 years for $1000 which pays a 8.5% coupon rate. Since $1000 would get me this really nice 5 years 8.5% bond, obviously my old bond, which has 5 years left and only pays 7%, is worth less than $1000. This formula calculates how much more or less the bond would be worth at the moment.

Sir can i ask where did you get that 1.085 please reply as early thanks

Is that constant 1

Same question...

@@margaretals2823 maybe its too late but its just that he adds 1+rate to maturity interest rate, that's just the npv formula!

Please help to solve this question:

Find the selling price for a bond on 10 October 2019.

The bond pays half-year coupons on 15 February and 15 August of each year.

The bond matures on 15 August 2025.

The face value of the bond is $1000.

The bond's per annum coupon rate is 8%.

Similar bonds yield 6 per cent per annum to maturity.

Here's a hint. The bond is currently priced at a premium

The answer is, do your own homework.

If the bond payments are made at any frequency other than once per year then your video is worthless.

Your head is worthless

Thank you

Thanks