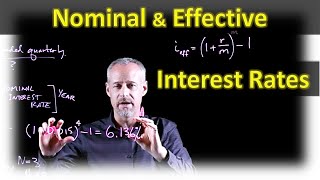

Explanation of the Effective Annual Rate of Interest (EAR)

HTML-код

- Опубликовано: 8 июл 2013

- This video explains what the Effective Annual Rate of Interest is and how it differs from the stated rate of interest.

-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* eepurl.com/dIaa5z

-

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinkific.com

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple.com/us/podcast...

* Spotify: open.spotify.com/show/4WaNTqV...

* Website: www.edspira.com/podcast-2/

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.com/index

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.com/about/

* michaelmclaughlin.com

Watching your videos has made me realize just how bad my accounting professor is. In 30 minutes I understand more than I have in the first 10 weeks of the semester. Thank you

EAR explained in an 11min video better than my 1h30min lecture could. Thank you.

The best 12 minutes of my life. Thank you.

Thank you!

Wow, I finally understand continually compounded interest. The way you explain things is so clear, it just makes sense. Thanks a lot!

Wow! Ive been hours trying to understand this, you nailed it in less than 15 minutes! Thanks a lot!

YOU ARE THE ONLY ONE THAT ACTUALLY 'EXPLAINS' EFFECTIVE INTEREST!!!! THANK YOU!!!!

Your explanation is so simple .. Thanks for the help!

You're doing such a great job. Everything makes sense. Thanks so much

Now, that's a beautifully explained material !!!

Thank you!

This channel is like gold mine 😍

Thank you for your all beautifully explained videos.

Thank you very much!!!! could you please make more videos??? specifically:

M&M theory,

Fama-French three-factor model,

Modern portfolio theory?

+ equity valuation -

- How to estimate a company’s cost of capital?

- More on how to value a company using multiples and discounted cash flow (DCF) analysis ?

- More on how to value a company in the context of an acquisition (M&As), of a leveraged buyout

(LBO) or of an initial public offering (IPO)? thank you so much!!!! these video literally saved me from failing!

Well explained. Thanks!

Literally loveeeee it! Thank you very much for this video. Superb !

+vtj808 Thank you!!

Thanks, this was a big help!😌

Really clear and good!!!!

Superb explanation!! 5 star

This is a very helpful video, thanks

Thank you so much for this

Thank you Sir

Thanks. JUST KEEP GOING

This is an Effective explanation!

Thank you

an effective minutely rate of explanations

Thank u i finally understod it

Thx man! You saved a student!

Thank you very much

That was very helpful. Thank u

Dude friking great

Thanks !

still watching this in 2018.

Well explained good sir, thank you.

No problem!

SWEET ! THX

very well explained. Thanks

Thanks!

damn you are good at explaining, thank you so much

I appreciate the kind words, thank you!

mate youre a legend, wish you were my lecturer instead :)

Thank you for the kind words!

It sounds like you're John C Riley. I'm just picturing him giving me a finance lecture

good video

Your video very useful and short in same time

Why you doesn't explain CFA curriculum please

THANKYOU

NEW SUBSCRIBER

Welcome aboard!

thanks for the video. is there effective annual rate of interest for loan as well or just for savings?

Thanks much

MASTER!

This is not the Effective Interest Rate defined in the IFRS 9 right? Because that definition is crazy!! I was looking for an explanation of it

Hi Edspira , I hope this finds you well , firstly thank you for your tutorial , could you please if possible indicate to me in which order do I nee do through your Corporate Finance videos (71 videos)

I’d definitely want to know the same thing

Tysm

Well said although you must be a horrible person if you are excited to get the $1000 after a relative dies.

lol

lol

Thanks it was much better than the book :)

Glad you liked it!

thanks for saving before my exam !!!!!

thanks

No problem!

i mean i wish banks offered rates as good as they are in math examples.

Every Bank in New York tells you both interest and yield you get both rates

Great video but wouldn’t be simpler to follow the formula 1+EAR=(1+APR/k)^k?

At least could've explained those terms. It looks more complicated than the video.

May contextualising it with a large amount will give it the right perspective. The .95 cent as you mentioned is hardly a difference for worrying about this. The other thing is, can you go to you bank and ask them to change you interest rate to say quarterly or monthly ? Or what instruments would allow you to change your interest rates at your convenience ?

As consumers, the best we can do is shop around and find the best deal available on the market. Only the mega-super wealthy could, perhaps, negotiate a customised compounding period and, even then, it would be in close line with the market rate.

Why not use 5 per cent for bank B instead of "x" so that a real comparison can be made. To me you fail to fully explain the difference is it a 12th of 5 per cent added each month or 5 per cent each month compounded?

For compounding monthly, it is a 12th of 5% added each month. If the annual rate (in this case 5%) is compounded daily, then 365th of 5% is added each day.....if it is compounded semi-annually, it is 1/2 of 5% added every 6 months. Hope this helps.

is the stated rate the APR ?

when some one tells me about EAR I think: hmmm self...I have two of those...and then I am dumbfounded to find out...It's the effective annual rate..... :) I need help

I'm failing to understand where the 1.05 came from 🥺 ...

the stated rate is expressed per annum??

Yes, the stated rate is usually per annum, or "annually"

Where is my pal Sal?

typo alert...its not 1.0125.....its 0.0125 interest rate.....Thank u so much for this explanation

1.25% to be precise

Thank you!

I ve got it .........

Gotta love that aha moment! Take Care.

im gonna spend the additional 95 cents on a poppy so don cherry doesnt hate me

This is dumb, what do you expect to do if the interest is compounded daily, do that 365 times. Anyone who just wants an equation for this, use this. ((1+interest rate/n)^n)-1. n stands for the amount of months that the interest rate is compounded

If you use the 5% in the example, and assume this is compounded daily, then you would multiply the amount times .... [ 1 + (.05/365)] ^ 365 ......^ means to the power 354.

If it was 5% compounded monthly, you would multiply the amount times ... [ 1 + (.05/12) ] ^ 12

If it was 5% compounded semi-annually, you would multiply the amount times ...... [ 1 + (.05/2)] ^ 2

Thanks for your effort, although, this person has to invest his money on drugs :D

I thought I just didn't understand finance , turns out I just needed a better explanation 🥲🤣 THANK YOU