Intro to Investing In Bonds - Current Yield, Yield to Maturity, Bond Prices & Interest Rates

HTML-код

- Опубликовано: 8 июн 2020

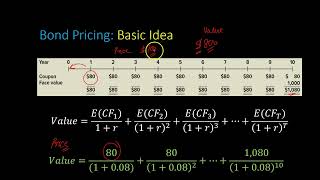

- This video provides a basic introduction into investing in bonds. It explains how to calculate the total price paid for a number of bonds, how to calculate the semi-annual coupon payments of a bond, and how to calculate the current yield of a bond as well as estimate the yield to maturity. In addition, it explains the inverse relationship between bond prices and interest rates as well as the formula that can be used to calculate it. Finally, it discusses how to calculate the return on investment that one can expect to make when investing in bonds. This video also covers math problems on corporate bonds, callable bonds, and tax free municipal bonds.

Stock Trading Strategies For Beginners:

• Stock Trading Strategi...

Call and Put Options:

• Options Trading - Call...

The Dividend Yield:

• The Dividend Yield - B...

Price to Earnings - P/E Ratio & Earnings Per Share:

• Price to Earnings (P/E...

Price to Sales Ratio P/S:

• How To Calculate The P...

____________________________

Return on Assets & Return on Equity:

• Return on Assets (ROA)...

Debt to Equity Ratio:

• Long Term Debt to Equi...

Liquidity Ratios - Quick Ratio & Current Ratio:

• Liquidity Ratios - Cur...

Market Capitalization:

• Market Capitalization ...

Risk Reward Ratio:

• How To Calculate The R...

_______________________________

Dollar Cost Averaging:

• Dollar Cost Averaging ...

How To Calculate Your Average Cost Basis:

• How To Calculate Your ...

Fantastic!!! I cannot tell you how glad I am I found this. You have a knack for making complex mathematics look simple. I really appreciate the worked examples they help alot.Thanks kindly.

He should change the name of the channel to Pretty much everything tutor

awesome content man.Keep up the awesome work!!

This Video was helpful to me with my assignment. thanks a lot.

ahhhhh!!!! thaaaank you soooo much. this is exactly what I needed

Omg you’re a life saver!!! Can you do equation of the least square line (I.e. y=ax+b)? It would be very much appreciated!

Awesome breakdown.❤

I am sure for the third example, Karen would have demanded a higher coupon rate ... and if not, she would like to speak to the manager.

Hey I've watched your videos for a long while now. You've helped me through plenty of exams. Where did you learn all of this?

i don't know man, but he's a freaking genius

Agreed. This is a good sound series.

Reading the business press from an early age can help a good deal. I read Fortune from the age of about 12 and later got a 750 on my GMAT, roughly 99.97th percentile, but Fortune isn't the tightly edited mag it once was. Forbes is good and Bloomberg excellent, imho.

On stocks, Burton Malkiel's "A Random Walk down Wall Street," en.wikipedia.org/wiki/A_Random_Walk_Down_Wall_Street

now in its 12th edition, is superb. Good solid basics plus a whole lot of interesting detail, sidelights, and just plain fun. Here's an interview and a review: ruclips.net/video/HLJCEP83QTM/видео.html

If there's a single book that made Warren Buffett rich, it's Benjamin Graham's "The Intelligent Investor." I just pulled out my own copy -- 35 years old when my father gave it to me in 1988. It was a good and helpful book then, and I'm sure it's still around today, 32 years later so 67 years old.

hes learnt everything ever

Very helpful Thankyou

For question 2, if the premium is 105.42 per bond and the face value of a bond is 1000, morgan should have had to pay 15 x $1105.42 (not 15 x 1054.2). Please correct me if I’m wrong.

Hey I think this is just an error. The bond price is $1054.20, which is a premium on the face value of $1000

You are right, this had me confused for so long

Is it just me or should all high school students be required to take finance, not necessarily at this level but similar material?

U didn't? We did in the Philippines

Pay attention! Teenagers are too busy trying to figure out what gender they are, doing heroin or dying their hair green to worry about this... They don't worry, because in 30 years from now we'll have a communist government taking care of these infants. No need to invest in bonds! Silly.

where did the 10 came from in question 2, a?

thanks

Can someone explain how he was able to arrive at 5.25 as the face value using the smaller numbers ?

bro.. why you do everything? i mean i love it..

Ignoring compounding, this is correct. Otherwise, not so much.

ahh yes the part of chemistry that i dislike the most