Forward rates are implied by zero rates (FRM T3-11)

HTML-код

- Опубликовано: 7 сен 2024

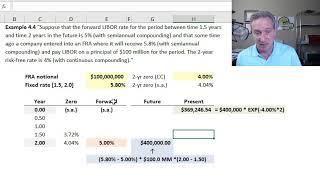

- [my xls is here trtl.bz/2HMQkUU] Forward rates link two zero (aka, spot) rates by ensuring your expected return is the same between two choices: (1) invest at the longer-term spot rate versus (2) invest at the shorter-term spot rate and "roll over" into the implied forward rate. This is an implied forward rate that ignores other factors such as liquidity preference. Discuss here in our FRM forum: trtl.bz/2VH93eY.

Yes it was. Made it very clear. Thank you.

You did an excellent job!!!!!!!!!!

An excelent job

one thing I learned here is that continuously compound and annually compound are two different things. I wonder what are the differences?

the diff is 1 vs infinity

Which is the for formula to get the 3.00% F(1;2)? I think must be greater than 3.00% because the 1year spot and 2 year spot are 3.00% and 4.00%, respectively (there is a implied forward rate between those greater)...

Does calculate the forward rate by semi-annual zero rate same as annually?