FRM: Risk-adjusted return on capital (RAROC)

HTML-код

- Опубликовано: 27 авг 2024

- RAROC is a risk-adjusted performance measure (RAPM): risk-adjusted return divided by economic capital (i.e., the capital reserved to cover unexpected losses). For more financial risk videos, visit our website! www.bionicturtl...

A+ on your teaching skills!

Thank you for watching! We appreciate your kind words.

Check out this question

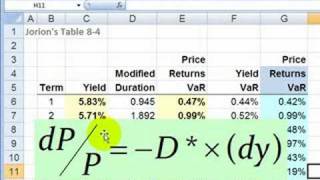

A bank is planning to make a loan of 5million to a steel firm. It expects to charge an upfront fee of 1.5% and a servicing fee of 50 basis points. The loan has a maturity of 8 years and a duration of 7.5 years. The cost of funds(the RAROC benchmark) for the loan is 10%. Assume that the bank has estimated that the maximum change in the risk premium on the steel manufacturing sector to be approximately 4.2% based on two years of historical data. The current market interest rate for loans in this sector is 12%

Using Raroc model should the bank make the loan.

Your videos make it to understand and learn a lot better.

What's the difference between RAROC and ADJUSTED RAROC?

Thanks.

Shouldn't we also subtract the cost of economic capital from the numerator?

Well done. Enjoyed this very much.

Thnk u so much ...it was helpful..how about if we are given tax

Multiply numerator by (1-tax rate)

@joserodriguez33ucv Thanks for your support, we love it!

Great job my friend!! Thank you very much.

Thanks you very much. Please, could you add the Excel file please ?

this is very useful, thanks a lot dude!

In one word can we say that RAROC signifies earnings over and above the risk free rate on the deployment of same capital. or is it too simplistic way of saying.

thank u for this video, it helped a lot!

what about cost of capital? should it be an expense too?

Per De Laurentis' formula , also subtract COF from the numerator

This is amazing. Actually l think the example in frm handbook (6th edition) page 678-679 is problematic given that the deposit is 925m and the loan investment is 1000m. They are simply not matching.

It is closer to reality though. Having identical loan and depo exposures is not typical in real life.

Can I borrow $1?

Government securities returning 6.5% ? Bahahahahaha, oh how times have changed since 2008