What are Mortgages? | by Wall Street Survivor

HTML-код

- Опубликовано: 19 ноя 2024

- How to understand your mortgage.

Investing Tips of the Month:

Learn how to get $1,700 in FREE STOCK with ROBINHOOD: www.wallstreet...

See which service's stock picks have TRIPLED THE MARKET for the last 20 years: www.wallstreet...

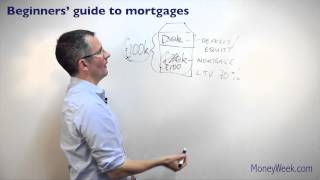

Mortgages exist to solve a problem. Most people want to buy their own home, but a house costs hundreds of thousands of dollars, and you likely don’t have that kind of cash lying around in the crevices of your sofa. You’d have to work and save for decades to get that much money, and in the meantime you could easily end up paying out more in rent than the cost of the house you wanted to buy.

So to enable people to buy a house before they are too old to remember why they wanted it in the first place, we have the mortgage system. A mortgage is just a type of loan, pure and simple. If the house you want to buy costs $100,000, then you could pay $10,000 from your savings (that’s called the downpayment), and borrow the remaining $90,000 from the bank.

So if it’s that simple - just a housing loan that you pay back over time - why all the fuss and complexity around mortgages? Well, mortgages come in more flavors than Ben & Jerry’s ice cream, and not all of them taste good. You’ve got ARMs and balloon mortgages, fixed-rate loans and interest-only loans, bridge loans and refis and reverse mortgages.

AFFILIATE DISCLOSURE: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, Wall Street Survivor may earn a commission if you sign up with one of our affiliates. However, this does not impact our opinions and comparisons.

Back in the day, when I purchased my first home to live-in; that was Miami in the early 1990s, first mortgages with rates of 8 to 9% and 9% to 10% were typical. People will have to accept the possibility that we won't ever return to 3%. If sellers must sell, home prices will have to decline, and lower evaluations will follow. Pretty sure I'm not alone in my chain of thoughts.

If anything, it'll get worse. Very soon, affordable housing will no longer be affordable. So anything anyone want to do, I will advise they do it now because the prices today will look like dips tomorrow. Until the Fed clamps down even further, I think we're going to see hysteria due to rampant inflation. You can't halfway rip the band-aid off.

Home prices will come down eventually, but for now; get your money (as much as you can) out of the housing market and get into the financial markets or gold. The new mortgage rates are crazy, add to that the recession and the fact that mortgage guidelines are getting more difficult. Home prices will need to fall by a minimum of 40% (more like 50%) before the market normalizes.If you are in cross roads or need sincere advise on the best moves to take now its best you seek an independent advisor who knows about the financial markets.

@@ThomasChai05 My partner’s been considering going the same route, could you share more info please on the advisor that guides you.

Do your due diligence and opt for one that has tactics to help your portfolio continue consistent and steady growth. “Gertrude Margaret Quinto” is accountable for the success of my portfolio, and I believe she has the qualifications and expertise to accomplish your objectives.

This is useful information; I copied her full name and pasted it into my browser; her website popped up immediately and her qualifications are excellent; thanks for sharing.

Basically , mortgage rates have reached their highest point since 1998, spanning 25 years. Considering inflation trends, there's potential for them to rise even further. Just a year ago, a 28year fixed rate was only 6%. This prompts the question: should I wait for a housing market downturn before buying or shift my focus towards the equity market?

Indeed, I primarily engage in buy-and-hold, but my portfolio has been in the negative for an extended period. To achieve substantial gains, consistency and regular portfolio adjustments are essential.

thank you for the lead. I searched her up, and I have sent her an email. I hope she gets back to me soon.

beware of these fakes below asking to take expertise

I paid up all my mortgages in 2yrs while working with a Financial Adviser. I’m 50 and my husband 54 we are both retired with over $3 million in net worth and no debts. We got to realize that the secret to financial freedom is making better investments.

That is so amazing, I’m trying to get onto the investing ladder at 40. I wish at 55 I will be testifying to similar success..

How can I reach this adviser of yours? because I'm seeking for a more effective investment approach on my savings

Carol Vivian Constable is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment..

I just googled her and I'm really impressed with her credentials; I reached out to her since l need all the assistance l can get. I just scheduled a caII.

I’ll be entering adulthood in a couple of years, and since school will not teach me this stuff, I’ll teach it to myself instead.

Thank you, it was very helpful!

@Swoque Yeah, I've taken a course in Accounting for a year back in High School but was never taught about what mortgage was.

I've always felt that there should be a required course about adulthood that you should take for at least a semester to understand things like these.

Don't take out a mortgage. You'll be enslaved to the bank for 30 years. The amount of interest you will pay will be astronomical.

Munger and Buffett have both achieved an incredible feat with Berkshire. They've turned thousands to billions, and have made a lot of people wealthy in the process. I really saw the potential of the stock market by reading Berkshire's annual letters. I recently sold my $674k apartment in the Bel Air area and I'm hoping to throw it into the stock market. I just don't want to lose everything.

Most people either do not understand the power of compound interest, or are just impatient. For the average Joe, however. I think it is just best to invest in the S&P 500, and just wait, which is reliable, albeit extremely long-lots of years. Or just use a professional analyst and speed up wealth creation. Most people underestimate the power of the latter

You're absolutely right about the power of compound interest and the long-term potential of investing in index funds like the S&P 500. For many, passive investing in broadly diversified funds can be a reliable strategy over time.

I agree with you. I started out with investing on my own, but I lost a lot of money. I was able to pull out about $200k after the 2020 crash I invested the money using an analyst, and in seven months, I raked in almost $673,000

I'm actually interested in this idea of investing through an analyst. Sounds like the most sensible thing to do in the market right now. Could you give me a pointer to who you work with, please?

I personally work with "Patricia Strain " she covers things like investing, insurance, making sure retirement is well funded, going over tax benefits, ways to have a volatility buffer for investment risk. many things like that.

or!! the value of the house can depreciate like it did in the last 5-7 years and you end up owing more then you can sell your house for. Now THAT is the information that NOBODY ever talks about because why would people need to know that? haha.

+Sassy Masha Vlogs Yes, or that ;)

The ASMR queen in the house! HAHA

soooo a fellow dubstep fan hmmmmm

glad my housing market where i live values are going up 4% a year.

Sassy Masha Vlogs in last 10 years my house rate go ups 400% gain I think this is to much :O

Banks are selling mortgages. People always say it's a good option to buy at discount, but with the market turmoil and everything at stake in present economy, I'm thinking of buying stable coin to hedge against inflation, or is it all right saving over 350k ?

There are options that spread across multiple banks. I use a non-beginner broker that protest up to 3 million dollars and provide 4.58% returns on cash, it's always a good idea to consider working with an advisor for financial planning

Agreed, financial advisors play a key role in portfolio allocation and i've been using one since late 2019 just before rona outbreak. So far, I'm barely 25% short of $1m ballpark goal after subsequent investments.

Impressive can you share more info?

Certainly, there are a handful of experts in the field. I've experimented with a few over the past years, but I've stuck with ‘’Aileen Gertrude Tippy” for about five years now, and her performance has been consistently impressive.She’s quite known in her field, look-her up.

Thanks a lot for this suggestion. I needed this myself, I looked her up, and I have sent her an email. I hope she gets back to me soon.

Oh hai Mark, Oh Hai Lisa.

LostSemicolon i did naht..

I'm literally laughing out loud right now. You are the man sir!

And should Lisa tell him that the mortgage has become too expensive and they have to sell the house, he answers:

-YOU 'RE TEARING APART LISA!!!!

Literally, there's no way this was a coincidence.

You forgot to talk about interest. The part that lets the bank recoup their money in about 12-15 years then double the cash they loaned them.

Not having a dad , got me here .. smh youtubing basics on life lol damn

Umm... thats what most of us do. There is a great channel called "How to Adult" if you need this type of advice that you think a father would normally give.

It's okay! We are all here to learn.

Lmao maaan

@mentosfreshh mine just sighs as he explains that Google exists

Yeees im in the same situation

Hi! I’m excited to be here in your channel and I’m interested in learning more about investing. Any advice would be greatly appreciated

Hi, sorry to barge in. Before you delve into investment, What are your goals and risk tolerance?

Am looking to build for retirement over a long term run. my primary goal is capital preservation with minimal risk. I’m more interested in safer investments.

For long-term outlook, a diversified portfolio with a mix of stocks, bonds, and maybe some real estate investment trusts (REITs) could be suitable.

I’ve been hearing a lot about tech stocks lately. Should I invest in them?

Tech stocks have the potential for substantial growth, but their volatility requires careful consideration of your risk tolerance and long-term investment horizon. To reduce risks, it's important to diversify your portfolio across various sectors.

Thank you for this! simple and straight to the point. This is the type of stuff that they need to teach in high school. Useful in life

i know right i have never needed to find out the slope of a line in real life

Beauty Queen But if you ever do, you have the knowledge!

I know right? I never took economics class when I was in high school because it was an elective. And I never understood / learnt about mortgage until I found this video. I agree, schools should have a 'life' subject where young people can learn the basics of how the grown up world works.

Big time, you nailed it on the head. They need to have a mandatory "Personal Finance" class with all this type of info packed in there during high school. I mean shit, I'm a science guy, I would take the class right now, as I need to learn loads more about finance!

Yessir

I’m investing into Stocks and ETFs and have been for 7months now looking to buy a house hopefully by early next year, I started off with $4000 and now at $57k. Sometimes you just work smart

How? Can I learn

Does he have a direct contact

Sure his mail

Connecteddybruke@gmail,

Or +32 4602 19701 for whatsapp

@@americandreamer828 tell me more about it

Mortgage in Latin means "Death Pledge". Look it up.

No that`s wrong,mortgage in latin means corridor of death

It means a death contract! Self explanatory!

Wow😳

Uhh ok even tho stated this in many comments which some don't care but ok :D

Lol no way 😂

Interest rate is currently at 4.75%(8th rate hike since March last year) Inflation at 7% and mortgage rates is at over 7.5% but yet minimum wage remains the same and my retirement portfolio has suffered tremendously these past years, so my question is how do senior citizens retire and live off such unstable economy. The long term game is obviously not for me at this point.

If anything, it'll get worse. Very soon, affordable housing will no longer be affordable. So anything anyone want to do, I will advise they do it now because the prices today will look like dips tomorrow. Until the Fed clamps down even further, I think we're going to see hysteria due to rampant inflation. You can't halfway rip the band-aid off.

Home prices will come down eventually, but for now; get your money (as much as you can) out of the housing market and get into the financial markets or gold. The new mortgage rates are crazy, add to that the recession and the fact that mortgage guidelines are getting more difficult. Home prices will need to fall by a minimum of 40% (more like 50%) before the market normalizes.If you are in cross roads or need sincere advise on the best moves to take now its best you seek an independent advisor who knows about the financial markets.

@@martingiavarini I will be happy getting assistance and glad to get the help of one, but just how can one spot a reputable one?

@@bob.weaver72 Personally, I can connect to that. When I began working with “Catherine Morrison Evans’’ a fiduciary financial counsellor, my advantages were certain. In these circumstances, I would always advise getting professional help so they can steer you through choppy markets and just give you indicators and strategies for knowing when to enter and exit the market.

@@martingiavarini I am on her site doing my due diligence. She seems proficient. I wrote her an email and scheduled a phone call. Thanks for sharing

I finally understand!

Haha me too

Me tooooo!!!!, this page Deserved my LIKE

Me three😁

Lol me too! It’s just a loan

Me too!

Wrong. If mark and lisa sells their house for $600k right after they bought it for $500k with a down payment of $100k they don't keep $200k.

After taxation and realter fees, they lose about 7% of the price of the house when they well it.

So in conclusion if mark sells his house for $600k, he would get back around $550k so in the end they make $50k profit. However, this is unlikely to happen and if mark really does 40yr amortization he would be spending around 1.2mil for the house for a 500k house due to massive interest rates. I would recommend mark to buy a cheaper house and save up

+The Future You're right. It would be great for Mark and Lisa if taxes and realtor fees didn't exist, but they do. However, these amounts vary by region, so we didn't include them in the video. In general, if a house increases in value, the owner can make a profit if they sell it.

Did they really make a $50k profit? I mean after they get $550k , they still need to pay the loan which is $550k and how about the fixed rate 5% ? Answer me pls if you see this .I am new and trying to learn something here .

To be exact they make profit around $58k. Mortgage $400k + 5% bank fixed rate int. for 5 years term = $400k+$100k = $500k.

If I'm not mistaken they are lock to pay all 5 years interest to the bank. What's the point on lending the money for no profit so people will have opportunity to own an asset and make profit out of the blue right.

Minus 7% taxation and re-alter fees of $42k then left out $58k gross profit before deducting any other legal fees.

but it 40 years 1.2=500k in purchasing power so it all works out

Banks will also charge a fee if you end your mortgage prematurely. So if this couple doesn’t roll their old mortgage into a new home this will also subtract from the profit made.

This is actually insane if you think about the system we live in

I'm sure anybody under the age of 35 working is insane as well...

When I watch this video all I think about is prison. This is....

40 years to own it

its not

40 years is fucking crazy. And you're pretty much paying half your monthly income if you're the average guy, maybe even more.

Thank you wall street survivor channel !

My point is that if you're going to get a mortgage you should have at least half of the price as a down payment or get a house you can actually afford.

who's gonna have $500,000 sitting in a bank?? you have to loan the money!

Corvux IX They're saying to live within your means. Basically, instead of getting a mortgage for a $500,000 house and increase the risk of not being able to keep up with payments, stick to a house that costs $200,000 or even less.

Graciela Collado half or 20%?

i would never put 50% down. if a bank want to lend me money for 45 years im in. the just pay like its a 30 and be done in 20. i dont like the idea of giving all my money so i can save immediately on interest.. life is a marathon not a sprint

Joseph Richardson That's your choice but you would be paying a lot more in interest payments over the life of a loan. You could get a mortgage offset account, which is attached to your loan. It means you can redraw those extra payments you made, but still get the interest savings from the reduced amount owing.

I love how this video was made for the upper classes. Because most people totally are able to save up $100k as newly weds.

+Thomas Jaynes Hey Tom, we hear you. 100 was just an easy number ^_^

Umm, in Australia and Canada you kinda have to...

Facts

@Swadian Knight well clearly you havent been to the UK

RIGHT!

remember to burn down your homes if your about to be foreclosed on, to collect the insurance and leave a note for the bank.

I could just imagine and i'm already cracken up laughing lol

good luck. won't work that way

Writing from a prison computer?

Then go to jail for arson but that's free room and meals

I’m in fits of laughter at this comment 😂😂😂

A mortgage is a loan used to purchase a house. It is secured by the property and allows the borrower access to funds to purchase the home. To understand your mortgage, you'll need to know the interest rate, fees, down payment, and loan type.

LMAO WHO WANTS TO FINALLY OWN A HOME AFTER 40 YEARS

Me dad

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

By the time you pay off a mortgage and own your house your kids are checking you into a home because you can no longer control your own bowel movements

@@bigbadndn damn bro that was harsh and too real

@@sandimarielavati2354 yo wtf, you been promoting shit on youtube comments!

Easy to understand but you have to do the Math to figure out what you're REALLY paying back in those forty years. You end up paying almost or even over a million dollars (depending on your down payment of course)!! So not only are you coming out of pocket for the down payment, you're paying back the bank much more than what the house was really worth. At the end of those forty years you'll never get back the money you actually paid the bank if you want to sell the house and that doesn't include utilities, food, clothes, renovations, etc.

It would be smarter to simply save up.

I would use that 100k by investing it into other things and save up for a home rather then to take out a morgage.

coollary1 It really depends what market you are looking at... some housing markets have allowed people to double, triple and even quadruple their money in 20 years, even factoring in inflation. In many markets, there may be better returns made in running a business. Its just so hard to predict where to put your money these days.

Money 40 years from now is worth far less than the same amount today.

Clearly Explained, keep it up, brother.

The knowledge.. it..is... OVERWHELMINGLY STRONG, THE SECRETS OF LIFE ARE IN OUR HANDS NOW!!

I just bought a place and it already appreciated by $10,000 in 2 months! :D

Coouge omg really where you live?

full of shit

Coouge so did your taxes haha

Alec y, some countries you don't pay taxes on your primary residence... In Australia, house prices doubled in a just a few years in many suburbs. I've lived in my family home for 30 years. It was $300,000 in the late 90s. It is now worth over $2 million. (We have a housing crisis here). If you can be smart and buy in an area where the jobs are good, you should have good capital gains. Land is limited and population is increasing. Another variable to factor in, is how easily the banks are handing out loans. This will also increase house prices.

This is a complicated topic explained in a simple way through an interactive presentation. Good job!

Excellent.This is really a great explanation.Thanks for your information.

Great video easy to understand

banks make loans out of thin air look at that video and central banks the fed

Your videos are very useful and provide lots of information. I have received lots of help from your posts, please continue to share this kind of information. Thank you.

Another invaluable channel, will definitely explore more videos from you, sir. Keep sharing such amazing videos in the future also.

Invaluable??? You mean valuable channel?

Towards the end you mentioned that the couple sells the house for 600k and pays the mortgage of 400k back to the bank. Is it possible to do so ? Since you are under agreement with bank to pay for 40 years , which is the amortization period.

I get to now when my mom says “I’m still paying for the house”

I can't understand so many negative comments here about a mortgage or simply a "home loan". Do so many people want to pay rent for the rest of their lives and have no security? There is another point this video didn't mention. After 5 or so years, you should have enough equity in your house to use as security to purchase another to rent out.

it's because the majority of the viewers and commentators alike are entitled millennials, who believe that not only they should not pay for borrowing money, they actually believe they should get paid instead(by some rich man) for taking out a mortgaged loan

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

So if I buy a home fully cash no banks do I still have to make monthly payment on the home

Most times it amazes me greatly the way I move from an average lifestyle to earning over 63k per month, utter shock is the word. have understood a lot in the past few years to doubt that opportunities abound in the financial markets, The only thing is to know where to focus.

@Olivia George Anyways not actually, what I know about trading almost borders on zilch lol. I make huge profits on my investment since I started trading with Mrs Debbie Ramirez, her trading strategies are top notch coupled with the little commission she charges on her trade.

This is why I said everyone should be ready for the worst situation financially because I see no reason why I should put all my money in the bank where it's not safe.

@RONATO Johnson My coin stays right in my trading account, my account just mirrors her trades in real-time that's the idea behind copy trading.

@Olivia George Sure, meet her up on Telgram..

@Olivia George Managerdebbieramirez

Make extra payments, especially early on in the loan. An extra $100 per month and $5000 annually eliminates more than half my interest

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

That’s the worst thing you can do to yourself financially in this age we live in

I mean if you save at least the half amount of money of the house worth and have a pretty good salary 90k-140k then you won’t have that much of a problem.

very straightforward and informative, thx

This is the best vedio ever seen. So clear thanks

Finally !

Thank you so much!!

Don’t forget realtor fees , on 600,000 they would pay 35,000 , they would have lost their closing fees from buying , 10,000 , and capital gains tax for not owning the house longer than the tryout period 10,000 , so now they might keep 45,000 of profit but they will have to go through all steps again plus moving and renting for months (costing thousands of dollars) again till they find next house plus having a lower credit score than they started with , it would not be worth it, but you were correct on what a mortgage was🙂

Many websites these days will let you sell without using a realtor. Huge savings!

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

@@alphabet_soup123 How?

Great video... Useful for UK, US & AUS

I do not consider as "default " a fix secure if first I don't put a clear scope on my plane...for the 200K earned good details mentioned by the author ..." the day after" like this will not include the interest part...good video congratulation simple and clear for who start now learning about a mortgage...

Thank you So much, this really helped me out.

40 years mortgage! Standard is 25 in the UK

When young couples struggle to buy a home in their 30s, I don't see why a bank would give then a 40 year mortgage when the pension age is 70 years. Drawing out the loan term is just a trick the bank uses to get more interest. If you can't afford a 25 year loan, you shouldn't be buying a house.

in indonesia 20 years max

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Mark & Lisa are getting robbed. 40 years of interest??

so simple and explicit ... thnxs

thanks for teaching

All Stores Please Lower the price of all Military and Local for all Brands of Mortgage Payments and Interest Rates and Production Cost Now That's too much $$ The Whole World Now 🙏🙏🙏

Won't the bank be mad if I give them $400,000 without any interest the next day?

Like we made a deal before . Anyone help pls 🙏

Great video ❤️ Am invest my time and money in crypto now, this new price is a clear sign for new investors to come in✅✅✅

Thanks for the insight❤️, I remember friends calling me stupid for investing in crypto and stock now I shut them with my 4 figures weekly returns. I now earn my goal of $48,760 weekly with the guideline of My broker

@@andrewdouglas3282 Mr Charles Patrick the best, recommending him to all beginners who wants to recover losses like I did

Trading with Mr Charles patrick was never a regret to me, All thanks to him, he is the best I have ever seen

My personal portfolio/ investment manager Expert Charles Patrick after a whole week of research,he runs an investment platform where you don't have to undergo any stress in the trades he manages my trading account which i opened with a capital of $5000and now I have grown my portfolio up to over $25,500, a huge success.

@@arthurharold8618 Oh, I've heard of him but I didn't take it seriously until I tried out with $ 500 and made profits within some days

Thanks for the explanation. Very clear

that was very nice explanation I have never found such video

20% man i thought it was 10%.. thanks for the info!

FACTONER with a FHA loan it’s 3% but 20% is recommended or you’re gonna pay a sky high interest rate

i don't understand it , they paid 400k to bank but where is the interest rate?

I didn't get it either

just like that! not quite, after you add in property tax, interest, home insurance, new $30,000 roof after 40 years.

FYI... FIxed rate in the US does not mean what is in this video. This is unique to outside the US. A fixed rate mortgage would be for the entire period of the mortgage. What you're describing in this video in the context of the US mortgage market is a 5year ARM (adjustable rate mortgage). It is considered a variable rate loan with a 5 year initial term. Since the US mortgage is by far the largest globally, this would be considered the exception to the way of describing it not the norm. The norm in jargon and naming convention would match the US (a far larger mortgage market by size).

This is video better than my school

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

sandi Marie Lavati u suck lol

Great video-broken down so simply! Thank you!

The mortgage is the security document for the loan. The buyers buy the house and sign a promissory note. The bank wants to make sure they can get their money if the buyers stop paying so the house is put up for security. That's the mortgage. It says the bank can take the house if the buyers stop paying. Kind of the same thing when a person buys a car with a bank loan. The bank holds the title as security and can repossess the car if the loan is not paid. Technically, the mortgage is given to the bank by the buyers even though the bank drafts the mortgage. That makes the buyers the mortgagors and the bank is the mortgagee.

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Why are they locked into a 5 year term when the amortization period is 40 years? Does that mean they only pay the 5% fixed rate for 5 years and the remaining 35 years no longer require you to pay the fixed rate?

if they have to pay off for the house for 40 years (amortization), what is the significance of the 5 year term? I thought they pay back the bank in 5 years? Can someone please explain :)

The last 10 seconds of the video must have got many a people excited 🤣

I know nothing… I was trying to calculate how long it would take me to buy a house in CA making 20 an hour. I had no clue people pay a small percent over decades…

thanks for advice

If i could just win the lottery......

Which you will spend a 100 million and only win 5 million

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

This is like the best video I've seen on RUclips that gave the best explanation. I hope and pray that there are video like this on other topics.

wow that was wonderful explanation

Very entertaining, creative and informative video. Thanks for taking the time to do this!

Vahe Hayrapetian - Loan Originator Glad you enjoyed!!!

Nice explanation of mortgage loans. A mortgage is the promise you give the bank in exchange for the loan, though. But great explanation.

I bet there’s some guidelines for mortgages too

Good video presentation, thank you for the information.

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Great vid, thx

Very well explained...thank u

Fixed rate through a solid deal is definitely what you should aim for when investing in real estate. If you want a changing interest rate then look to invest in the stock market. At least you can liquefy your assets there if shit hits the fan. Which also has its downsides.

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Very instructive

Thanks!!

This is how banks operate. This is how they live. They know that only a few will truly complete this path to ownership. If every applicant of a mortgage loan were to pay it off perfectly, there would be very little income for the bank to thrive. So remember, only those who are financially educated and conscientious are more likely to succeed in situations like these. Banks are aware that only a few of those who apply for a mortgage will actually be able to complete it. Still, it’s a beneficial program-it’s just a matter of discipline. Stable family relationships and good health should not be taken for granted, as these are factors that may lead families into debt with banks through mortgages."

This version should maintain the essence of your message while making it flow more smoothly.

They didn’t double their Investment if the first thousand was a down payment

But there will be a foreclosure fee on the owner if they close the loan prior to amortization period....

Wall Street Survivor not saying the bad outcomes of mortgages such as as foreclosure or housing market crash..That house could go down to 200k and you still owe the bank and pay mortgage for the 400k.

Talk about raw deal hooooly shit. The bank builds a house at a total cost of 300K use proxy to put the house on sale at 500K. A buyer comes wanting the house then the same bank extends credit. But this money isn't given to the buyer though.

So basically the bank buys it for you and if you can't buy it from them in the agreed upon time. they will kick you out of their house. Be smart only movie in to the house when it's yours. If you want to live in it.

there are some term the dictionary couldn't describe fully, mortgage is one of 'em

I now understand it thank you

Don't they need to pay the interests on the loan ?

Good explanation

you had uploaded this video on my birthday, its march 24.

Contact john_mcneese_on Instagram or mail him on johnmcneese067@gmail.com or +12512396384 on WhatsApp(he does not take upfront payment) if you need help about forex trading , Bitcoin, hacking your PayPal,credit score fix, bank account,western union hack,money gram,credit card hack,instagram verification, facebook and many more.. you can as well check his website newtomorrow.net

His fast and reliable .

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Thanks

Doesn’t the value increase regardless due to inflation?

This was a great video

Thank you

Waaaait, 5% per year of TOTAL price of the house?!?!?!! So if it's 400k to pay in 40 years, they'll pay in total of 800+400k in total, so that's like buying 2 houses and then some? That's kinda insane.

Well explained

very nice video

The most important point was "Selling" for me, great and simple explanation!

Contact john_mcneese_on Instagram or mail him on johnmcneese067@gmail.com or +12512396384 on WhatsApp(he does not take upfront payment) if you need help about forex trading , Bitcoin, hacking your PayPal,credit score fix, bank account,western union hack,money gram,credit card hack,instagram verification, facebook and many more.. you can as well check his website newtomorrow.net

His fast and reliable .

Martinez is legit and reliable. (NO UPFRONT PAYMENT)

Have worked with him some months back and believe me he’s one of the legit hackers he’s the best if you need help with paying off debt ,credit score fix , credit card ,bank account,phone hack, PayPal hack .

Contact him on +12013507159 via WhatsApp

Mail him on martinezraber@gmail.com

Thank you!