Quote versus cash price of US Treasury bill (T3-24)

HTML-код

- Опубликовано: 29 июл 2018

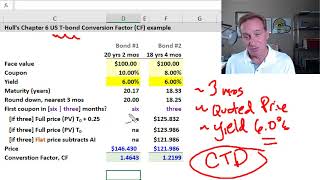

- [here is my XLS trtl.bz/2vjl0HM] A US Treasury bill is a (money market) discount instrument: the quoted price represents a discount from the face value. In this example, a quote price of 8.00 on a 90-day US Treasury bill implies a cash price of $98.00 and a true interest rate of 8.163% per annum. Discuss this video here in our FRM forum: trtl.bz/2VpalpT.

This was a very informative explanation. thank you.

Very helpful thanks. At 5:52 for calculating per annum interest or the true rate of interest would you not use ACT/ACT instead of ACT/360?

Very much informative. Explained everything in a lucid way. One small difficulty i faced wasI felt explanation at time point 7.00 bit confusing. I thing easier way to say true ROI is (quoted price / cashprice)*100. Am i correct any chance?

If anybody is kind enough to explain, could you pls explain. According to representation qouted price is a comparatively smaller fig ( kind of interest receiving as an eg. 10). Cash price is the price paying as an example 97.5). How it match with general formula, Cash price= qouted price+ accured interest?

'If you find it useful'. You dont need to say it though. It is always useful. Infact life saving for persons like me.