Put Call Forward Parity for European Options (FRM Part 1, CFA Level 1)

HTML-код

- Опубликовано: 6 дек 2021

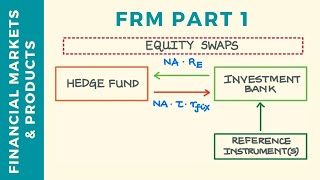

- In this video from FRM Part 1 & CFA Level 1 curriculum, we explore an alternative version of the Put Call parity which is called the Put Call Forward parity - a no-arbitrage relationship between European option prices (of same strike and maturity), forward / futures price and present value of strike. We recap the simple Put Call parity for the case of an underlying asset that doesn't pay any income and then transition our way to the Put Call Forward parity. For more videos on FRM Part 1 preparations, please head over to the course page (www.finRGB.com/courses/frm-pa....

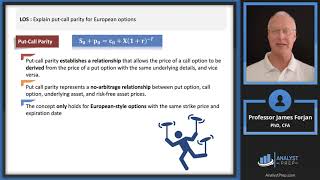

CFA Learning Objective: explain put-call-forward parity for European options

FRM Learning Objective: Explain put-call parity and apply it to the valuation of European and American stock options, with

dividends and without dividends, and express it in terms of forward prices.

Well explained.

answer ?

P0= around 150?

Correct. 137.30 + PV(13.5)