Это видео недоступно.

Сожалеем об этом.

BEFORE Trading Options Learn The Greeks | Options Trading For Beginners

HTML-код

- Опубликовано: 10 фев 2021

- 🔥Get Total Access To All My Financial Decisions, Option Plays & Private Discord Chat! / bradfinn

👍🏻👍🏻Webull Will Hook You Up With Up to 2 FREE STOCKS: act.webull.com...

📚📚The Beginners Guide To Trading Options: Use Code "OPTIONS" to get 50% off! averagemoney.t...

🔥🔥1 FREE STOCK When You Sign Up For: Robinhood: robinhood.c3me...

🙋🏻♂️🤷🏻♂️ Curious About Bitcoin: Get $10 of it FOR FREE! www.coinbase.c...

🎙AVERAGE MONEY PODCAST: averagemoneypo...

🚀Average Money Free Discord Server! / discord

👉🏻👉🏻M1 Finance: m1finance.8bxp...

😮This FREE APP Tracks All My Financing And Investing in ONE PLACE. Personal Capital! share.personal...

👇🏻The Books I Recommend

👇🏻The Gear I Use For The Channel And Podcast

👇🏻Cool Things I Have Round The House

www.amazon.com...

👉🏻💥CONNECT WITH ME:

📞Give Me A Call To Talk Money or RUclips: clarity.fm/bra...

💻 Email: TheFinnMindset@gmail.com

🍺BEER MONEY DONATIONS🍺

Venmo: venmo.com/TheF...

PAYPAL: paypal.me/brad...

In this video we will break down The Greeks!

These Greeks include delta, gamma, vega, and theta and rho. These show a measure of the sensitivity of an option's value according to certain market conditions. The Greeks can seem intimidating if you are new to option trading, but I will break it down nice and easy.

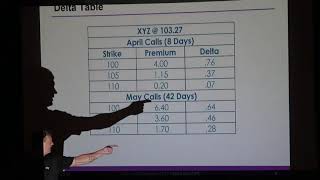

Delta measures how much an option's value is expected to change in a $1 change in the share price of the underlying stock.

Gamma measures the rate of change in an option’s Delta in a $1 change in the price of the underlying stocks share price.

Theta measures the change in the price of an options value for a one-day decrease in its time to expiration. This is time value and how much an options value will change after one day.

Vega measures the rate of change in an option’s value in a 1% change in the implied volatility of the underlying stock. FUN FACT.. Vega is not actually a Greek Letter.

Rho measures the expected change in an option’s value with a 1% point change in interest rates. It tells you how much the price of an option value should rise or fall if the risk-free interest rate (U.S. Treasury-bills) increases or decreases.

Enjoy The Video

Cheers

--------------------------------------------------------------------------------------------------------

DISCLAIMER: The content discussed in these videos are solely my opinion and should never be used as financial advice. This channel is for entertainment purposes only. Make sure to consult with a professional before making money decisions. This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission; all of which helps grow the channel! Thank you for your support!

FREE Mini Course On Trading Options: ruclips.net/video/wDFj310VJlM/видео.html

*Join The Discord MADNESS!* www.patreon.com/bradfinn

*Learn Options Playlist* ruclips.net/p/PLKkDvxOyGhXNQScWSs94PZEHpTPx93M7F

Used code: OPTIONS for 50% off!

*Poor Man's Covered Call Tutorial Video* ruclips.net/video/JDcBrrT_Kws/видео.html

*The Beginners Guide To Trading Options: Use Code "OPTIONS" to get 50% off*

averagemoney.teachable.com/p/options

I guess Im asking randomly but does anyone know a method to log back into an instagram account?

I was stupid forgot my login password. I love any help you can give me

@Adonis Lance instablaster :)

@Jameson Travis thanks so much for your reply. I found the site thru google and Im trying it out now.

I see it takes a while so I will get back to you later with my results.

@Jameson Travis It did the trick and I finally got access to my account again. I am so happy!

Thank you so much, you saved my account :D

@Adonis Lance No problem =)

I trade a lot of options and understand the Greeks. Sometimes I watch these videos just because people don’t know what they’re talking about, but that’s not the case here… Good video

How is trading options going for you? The profits??

*Delta is the Probability of being In-The -Money AT EXPIRATION. Not during the life of the Option Contract..

@@ericwilkinson1672 Huh? Who is talking about Delta? Yeah, you can use it as a probability but it’s actually the rate of change for every dollar in the underlining. Gamma influences delta. The closer you get to expiration the more gamma messes with Delta.

@@MyPrescriptions yeah, I’ve been profitable trading options but there’s a lot of lessons you need to learn. Like buy options with low volatility and sell them with high volatility, close spreads at 50% because its almost impossible to roll for a credit, etc. And I’m still learning… For instance, I like to buy leaps, deep in the money and far out in time and then sell covered calls against them to reduce my cost basis. But if you go to deep and too far out there may not be a market, so you have to be careful not to get screwed by the market makers… And of course, only trade options in highly liquid stocks.

@@jeffreyeidelman2698 5:19

this is one of the best "lecture" to explain the options . people pay hundreds to learn these topics , thank you Keep going please PEACE

Thank you so much for the kind words. Please share with others looking to learn

Holly bucket you are awesome!

Wow - Grateful .

Absolutely agree! Thank you so much!

@@BradFinn 100% this cleara alot of fog for me

Every single options trader needs to watch this. I’m sending it out to all my buddies that are trading options. Home Run!!!

Cheers Jason. Thank you for sharing.

You are the only one who has explained the Greeks in the way that I have finally understood. Thank you!

You're very welcome!

Ive watched several videos on "the Greeks" and have struggled to understand how they applied to my options trading. This video is the best, and most practical explanation I've ever come across. This is a game changer for me!

Thank you! Sincerely, thank you

Thank you so much for the kind words! Please share it with others that are learning!

Dude, this video was amazing! I've been trying to learn my own lessons by essentially losing money, but this showed me so much!! You're crushing it in these videos and I'll be following along and continuing to learn exponentially!!

Cheers Aaron! Thank you!

I love the Greeks and they are a nice shortcut (so to speak) to help you build a trade, but I always like to run spreadsheets on any strategy using hard data myself to really assess the performance of any trading plan before pulling the trigger and opening a position, great video!

How important would you say a high delta is to knowing if that trade will go your way or not?

By far the BEST explanation of the Greeks I’ve ever seen on RUclips. I appreciate the presentation!

Cheers man! Thanks for the kind words. Please share

By far best options tutorial I've come across! Excellent! Thank you

No thank you! Taking the time to leave a comment means a lot to me

I never waste time commenting on videos whether they were helpful or not. THIS WAS EXTREMELY HELPFUL AND EDUCATIONAL.

For a beginner, its easy to understand and digest. THANK YOU!

Thank you so much for the kind words

Nice work, Brad. You just saved me $150,000 for an MBA from UChicago. Love it!

Fantastic! Glad to help!

Love the vid

Ladys and gents , this is how option is explained! Hands on with very detailed info. I usually use option calculator and have read so much but nothing close to this fella. Thank man !

Thank you so much for the kind words. Please share it with someone else who is learning!

I was just in one of my groups a couple days ago mentioning that I did not fully understand the true meaning behind the Greeks. I know the basics for them but still struggled with applying them. You hit them all right on the nail and I thank you for this great explanation. You have earned another subscriber from just this one video. Thanks man!

Youre very welcome. Thank you for watching!

This is the first time I discovered your content and man I’m so glad I did! One of the easiest to understand video I’ve ever seen on options-Greeks 🙏🏼☝🏻🍻

Cheers. Thank you

This video helped me tremendously! I’m a fairly experienced options trader but never really have relied on the Greeks at all but still have had great success, but this will no doubt catapult me to safer option trades on weekly contracts for sure! Thanks a million! 👊🏼

thank you for the awesome feedback! Cheers!

I took a couple finance courses in college and was seriously lost. So lost that I changed my major.

This is my 5th video I've watched from your channel, and you explain everything clearly and simple. You have another sub.

Thank you so much for the kind words and feedback. Please share it with others looking to learn. See you on the next one!

This is the best explanation of The Greeks I’ve found. Please don’t ever remove this video 😊

Wow, thank you!

This is probably one of the best video I've seen explaining Greeks. It's very straightforward and simple for easy understanding. Thank you very much. I do greatly appreciate it

Glad it was helpful!

@10:05... thank you for explaining Theta. In my six short months as an options seller, I have been so wrapped around the axle over understanding the importance of extrinsic value that it has kept me up at night. Everywhere I turn to learn about it all I get is a definition, but not a deep enough understanding of the importance and effects. Let's see... it's the difference between the market price of an option (premium) and its intrinsic price; there's more of it when there's more time and higher volatility; it's the opposite of the inherent worth of an option, which is intrinsic value. And let's not forget to bolt on the caveat, and let's punctuate it in latin because even though it explains nothing more it just sounds smarter: "ceteris paribus." Like you said @11:57, we know that by the expiration of an option contract the price of the underlying will be different, and probably so will the volatility. So, forget about "all things being equal." OMG, thank you for saying that!! But what does extrinsic value tell us now about the future before we get there? Is it simply the premium we can make on the underlying today as a reward for taking the risk of holding the option through time and volatility changes? What are we looking for in regards to extrinsic value and/or theta? What do we need to keep track of as far as extrinsic value and/or theta is concerned now and through the life of the option contract, either as options sellers or buyers? For theta, bigger is better? And what does that number look like at the opening of a trade, e.g., the deciding factor (similar to your recommended >=30 delta benchmark for an option seller)? I've just found your channel today and have subscribed to it and will search through your vids in hopes to find a deeper understanding that you have shared. Else, perhaps it could be a much-needed topic or deeper dive for a future vid. Thanks for this vid!

This is the first time I've heard such an easy breakdown of the Greeks. Awesome video.

Glad you liked it!

The best explanation of the Greeks on RUclips. Well done.

Thank you so much for the kind words. Please share with someone else who is learning

Very few people explain Greeks the way you do. The technical definitions mean nothing to most people. How to interpret and apply them meanigfully is the key. You have done a good job. Thanks.

Thank you so much. Please share with others who are learning

Just started paper trading options and this definitely made the Greeks easy to understand and apply to my trades.

Thanks Brad - Finally was able to wrap my head around "The Greeks"

Right on!

This is the best Greeks video I have watched. I have been trading options for about a 2 months and studying for 6. I wish I found your videos sooner! Probably would have saved me a couple grand! Thanks again!

Best of luck!

Fantastic explanation. There's enough clear and concise info here for a beginner (me) to dip my toe in the shallow end of the Options pool, for the first time ever, and have a much greater chance of not losing my shirt. Thank you, Brad Finn!

Thank you so much for the kind words and the feedback. Cheers!

This Video was EXTREMELY helpful and very well broken down. This is the first time I understand The Greeks better. I will watch it again to get a better grasp.

Awesome! Thank you so much for your support!

@@BradFinn Do you offer one on one coaching/mentoring? If so, what are your prices, may I get some details please

"Stay positive. Work really, really hard." Awesome quote!

Thank you. Words my father lived by

Your teaching style, tempo, all good. I listen to you on my way to work now. Keep it up bro, you are making a difference. Thank you.

I appreciate that!

Ultimate life hack- a teacher who loves to teach about investing! Here’s to ten million subscribers a year from now!

I’m sending Brad’s Channel to everyone I know, once I find out they trade options. I’m on a crusade to get the word of Brad out to everyone! 😁

Youre the man Jason! Thank you so much Rebeccas. I hope we get to 10,000,00 together!

this has been the best video i've seen on yt on understanding greeks and options.. really appreciate how you break things down!

Thanks Ryan. I appreciate the kind words. Please share with somebody else that is learning

awesome thanks for clarifying. It took me 5 years of off and on trading to really grasp options and the greeks

Glad it helped!

You are very good at explaining these clearly, no grey areas.

Thank you for the kind words

Very comprehensive explanation of the greeks. Thank you, and well done!

Many thanks!

Best Options Video I have Seen!! You really broke it down for people to interpret and understand on a beginners level.. Much luv and Blessings to you:)

I appreciate that!

Super nice video on options - I have to admit I got 50% of what you taught but before then was close to zero understanding all these. Excellent video & bookmarked to keep referencing as I get more into it.

Would you mind creating video on tools to pick call options at low value with significant potential upside ?

thanks for the kind words. I really only buy LEAPS, which I recently did a video on. In that video I talk a lot about my criteria for buying options. It will def come up again in future videos

I had to subscribe and click the bell. This was so easily digestible i love it

Thank you

Little bit of a breakdown I’ve been trading for about two months now. About two months ago I started playing around with an old IRA. I didn’t like the growth so I liquidate the assets started started playing with myself. I lost a lot of money but I started watching these videos of brad’s and I never knew what I was doing wrong until I watch this video. This is the first option I bought after watching this video fill

?97%-• X FRO $8 g 19 Mar 21 Call 100 Open P&L(USD) +20.00 +200.00% Market Value Average Price Total Cost 30.00 0.10 10.00 Quantity Mid Price Position Ratio 1 0.30 46.11% 8.10 Delta -0.6243 56.71 % Theta -0.0153

Great news. Good luck.

Hey Brad,

I'm a new investor trying to figure all this out. I really appreciate this video. Clear, cut and to simple. Thank you.

Youre welcome!

I usually watch the trading videos to check MY game by spotting the mistakes in the video. In this case, I see no flaws in what this guy is telling you. He's done a fine job in providing an overview in the greeks. One of the few cases where you're getting real info from the video. Shows how its worth while to provide good info, since you'll get free advertising in the comments (trust me ... I'm hard on the scammers).

Best video on the internet about options!!!

Thank you

I've seen less informative finance channels hit 1M. I think you're gonna get there faster than you expect.

Thank you so much for the kid words

I gotta ask, someone has to do it. How did you get your “ stage name”

@@aliboojax6527 Same I also want to know where this "Brad Finn" name came from

You are a great teacher. Thank you for sharing your knowledge.

Thank you

One of the best explanation of options greeks. Thanks for sharing!

Cheers Lenny. Thank you!

You made it understood by giving practical examples

Right on

This is the best explanation I've heard so far on the Greeks. Thanks Brad!

Thank you Lyna. Cheers

Sometimes I got annoyed when look at these Greeks because I thought these are some weird random number until today I decided to find out what they are. So glad I found this video. Thank you 👍

You’re welcome

Very well explained. It is not too fast, not slow. Just PERFECT. KUDOS for making this video

Thank you very much!

Damn dude thanks for the info! Very straight forward and simple! 🔥Deff got a full grasp of what you’re saying! Haven’t traded options yet but feeling more confident when I get in there

Cheers. Thanks will

I buy calls before earnings all the time. Make sure to close when I’m profiting or the day of earnings.. generally stocks prices go up earnings time..

This!!!

This is what I was thinking. Made 110 dollar profits from 2 contracts for 60 each

SNDL had a delta of 1 two weeks ago for both $2 and $3 call options expiring July of this year and January of next year....and I bought a few and it hit

Dang, I'm lost. I've been listening and studying, and something new pops up every time. Really wish I understood this stuff. Thank you anyway.

Keep learning. Good luck

Thank You for a thorough layman’s term explanation. Your wealth of knowledge is greatly appreciated. New subscriber 💃🏿

Cheers. Thank you

Awesome Job. IMO understanding Delta is the first and most important Greek to understand.

I think it depends on the type of strategy, but delta is huge for the things that I do

Great video and congrats on 77k subs! I think there are a few points I'd add onto this.

The Greeks are derived under the Black-Scholes model.

This might sound a little pedantic, but I think it's significant: delta can be thought not as the actual probability of the option expiring ITM, but the probability of that happening under the Black-Scholes model, which assumes stock price returns are log-normally distributed. In more chaotic times, the assumptions made by the model break down.

The BS model is used a lot today, so Delta kind of tells us what the MARKET thinks the probability of that happening is, not the actual probability (but these may or may not be very close). It might be worth looking up the "volatility smile/skew".

It also implies that implied vol is constant over the option's lifetime, which is demonstrably incorrect. It's very difficult to model volatility though, and so BS model works fine when vol isn't changing too much.

👍🏻

For the math nerds. Delta and Gamma are the first and second derivatives of the black-scholes option pricing formula with respect to the underlying asset.

FACTS

Just found this and absolutely the best functional explanation of the Greeks period. How bout taking us through exactly your checklist when looking at the Greeks. Like walk us through a "day in the life" and show us real time what you find attractive and what fuels your decision making.

I always discuss the greeks in each options video I do depending on my specific goals for the option

Thank you Finn! This isn't the last time I'll be watching this video. Thanks a ton for sharing man!!

You’re very welcome

I’ll need to watch this again. Only understood delta before. Will now start looking at all of them.

Good luck

I made so much money on my blackberry calls I bought before the memes and now I finally know why they went up so much! It's because of the IV!

YUP!

Dang dude , I’ve spent the last 2 months learning as much as I can about options .. just wanted to say thank you. They way you explain this stuff is perfect.. before I was falling asleep watching them. Live the energy love the content . Keep it up man . I feel so much more confident now and made me realize imma start selling some puts them closing them out if I see the chances . Thanks again , great stuff . Good karma points to you sir

Thank you so much. Please consider RUclips's new "Tip Jar" in the future ( "thanks" near the like and dislike) if the videos make you a buck or two and you wanna buy me a beer! haha

By far the clearest explanation of the Greeks I have come across. Made especially clear by the examples you provided.

Thank you so much for the awesome feedback. Please share with others who are learning.

I basically just do the wheel strategy with one stock and it seems to be doing fine. The only Greek I look at is the delta. Try to keep around the .35 range and I've been doing fine collecting premiums. Doesn't feel optimal but it's easy

Right on

Another perfect teaching on Greeks ..straight to the point!!! Am a new subscriber!!!!!

Welcome

First vid I’ve watched on the Greeks and fully understood the lesson. Thank you so much!

Happy to hear that!

This was best explanation of the Greeks. Thanks!!

You are very welcome. Thank you so much for watching.

Awesome job explaining the Greeks!!!

Thank you

This is like the golden age for stock market you tubers.

FACTS!

Simply the best awesome explanation with manual calculations that make sense plus covered Rho also - nailed all calculations - ITM explanation!!! ( excuse the pun! )

Thank you for the kind words!!

Great video. Simple. Direct to the point and great info. Thanks!

Thank you so much for the kind words. Please share with somebody else that is learning

great video! Just started to trade options couple of weeks ago and made some good gains (20%-100%). I like to view Tiprank and find most active stock options, and within those id go with good stable companies with good PE ratio (dividends too). then i like a delta of .5 to .8. I pick ITM calls or deep ITM, and purchase 1-2 contracts per day with expiration date 1-2 weeks in the future.

Good stuff!

Bruh - this is the most fabulous explanation I've seen thus far !!@

Subscribed- thank you so much- nee trader here . Wish I learned this years ago

Great video! Jam packed full of good info for 18 minutes - time well spent!

Cheers Glenn

Best so far as explaining options, idk why other people can't explain as you have. Lol maybe it's because they actually don't know ? . Awesome job tho I'm joining your channel ,don't even need to look any further thanks

Thank you so much for the kind words. Glad it helped!

You really have a niche for teaching to understand! Great video, thanks a lot!

Thank you so much for the kind words

I love using Webull ... it's the best platform for the money. You explained the Greeks so well.... even a dummy like me could understand. Thanks, your newest subscriber... Cliff

Thank you so much

We're not even gonna worry about Rho because as we all know, the market always goes up, and bond rates rarely affect the market..... he said three weeks ago... lol!

Gotta love the way the market hears everything you say just to keep you on your toes. :-)

Who’s on their toes?

Brother thank you for explaining this to me, I will look at all of your videos this weekend just so I can start the week off with all your info!! Thanks once again and keep up the great work!

Thank you so much for the kind words cheers

I just found this video today, wow this guy is top drawer. Thank you for sharing your knowledge.

I appreciate the kind words

You can play earnings and avoid IV crush by buying ITM options. Not one's that are right on the border, but semi-deep ITM. Say if the share price is $80 and you expect an earnings beat, buy a $70 call. You'll avoid IV crush. Another way is to reduce risk by buying debit spreads. Also, if thinking about playing earnings, go ahead and look at options order flow for the day of earnings. I do this strategy and make a lot of money playing earnings.

He knows what he’s talking about. There’s not a lot of double talk and salesmanship in this video.

Thank you

Solid video Brad, given its significance, could you make a short video on Implied Volatility? (What it means, how it works, how we could use it to our advantage, the relationship with the Greeks, and examples of before and after earnings), thanks

great video , your one of the few people that understands the greeks, and you explained it good. Great quality videos

I appreciate that!

I know that you aren’t a buyer, but can you explain buying and selling calls/puts for an educational video?

Wow! 🤯 Thank you so much Brad. 👍 An information packed video that should be viewed more than once. At the money, short dated calls are like sparklers for grown-ups!!!

Cheers

This is a great video explaining the greeks. Can't wait to use Rho and make millions... ;)

Haha

Okay, this comment made me lol! I'm watching this video after 1am, almost woke my wife up. Hahaha

Thank you!!! That’s what’s happening to me! Vega! It’s killing me on the down hit. I have to GET out at peak and take earnings. I buy to close to the expiration to give it time to rise again.

Thank You, very straightforward and easy to follow and understand❤️

Cheers

The Greeks are great and all. But are you saying Up, Down, Left, Left, Square, Square, Square doesn't let me solve the market? 😁

Need "Select and Start" in there

Great video, as you explain it I was starting to comprehend what it was you were saying. unfortunately I have always been the guy who learns by doing. I have tried to learn by taking direction but always failed until I did it or seen it done a few times.

I know there is probably hundreds of different trades on each stock. just looking at the tesla stock there was a huge list of different calls available. and you would never have time to make a video going through all of them to see what we should be looking for . but i will continue to watch ALL your videos to try to get the information down. so I can use it to make my financial situation better. I appreciate you just taking the time to teach through RUclips.

I believe ALL Americans should know how to trade, buy, sell, stocks and options .

It should be taught in school as we all know a very small percentage of children graduating from high school will become financially independent in todays world. and that is not necessarily a bad thing the world needs mechanics, and teachers, police officers and fire fighters too. but I am a firm believer in ever class of American being able to take advantage of the stock market . or at least understanding how it works so they have some idea of how they can put themselves in the best position for retirement. or to pay for college for their children, or to buy a home etc etc etc .

Most Americans have no idea how credit works or how their credit score can be affected and what it actually means when it is affected up or down.

they have no idea that their credit score is going to determine what they will pay for a vehicle, a home, or business loan.

credit and stock market classes should be mandatory in all American public schools. from the time they are in maybe 3rd grade going forward as knowledge of these two things will make or break someone's financial standing for the rest of their lives. unless they win Powerball or Mega millions and even then this knowledge would help even if they had hundreds of millions of dollars .

👍🏻

Thank you so much for breaking this down for us. Great videos!!!

Thank you for watching

Having a real hard time conceptualizing the greeks. This video helped a little but still don't understand 100%.

Found this really helpful in understanding how the Greeks affect the options pricing/risk. Still learning but a great foundation here. Thank you!

You welcome

Hey @Brad Finn ! Hope alls is well. I've been watching some more of your recent videos and liked the one on LEAPs. I did have a question for you (well a couple) just to make sure I'm thinking about this correctly.

Long Term Investor LEAPS question -

I'm looking to buy a Deep-ITM LEAP call for SPY or QQQ when it dips at some point. At expiration since it is ITM (assumed so), it would be exercised automatically by Robinhood. What does this entail exactly?

Example: If I pay, lets say the contract was $134.50 ($13,450) for a strike price of $210 on $QQQ that is currently $336.75. When it expires in 2023 the share price is now $450.

When it expires and the buy call option is exercised automatically, is anything else deducted from my buying power balance or is the max cost which was $13,450 that I paid today the only thing I worry about? Then that option is automatically converted into 100x actual shares?

- I'm assuming I can either sell those shares immediately or just hold on to them?

- Am I missing something here or would I need to front more money at expiration?

Check out my discord where all the answers to your questions are answered and spoke about daily. Tough to answer here in a comment section of RUclips.

Probably the best video on the Greeks. Subscribed to the channel. Look forward to more of such great content.

Awesome, thank you!

An Ovation guitar.

A man of culture.

It’s is fun to play

haha. I was at that Ironman race as well :P nice jacket

Thank you. Another next year. One per age group

This guy's is a Monster!!! I'm hooked Brad!!!

Thank you for the kind words

Love this simple and not over overcomplicated by many similar options lesson video out there..

Thank you for the kind words