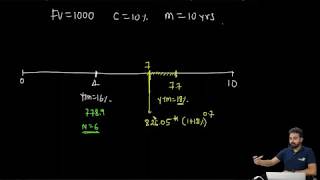

CFA level I: Fixed Income - BEY, EAY, True Yield, Street convention

HTML-код

- Опубликовано: 4 сен 2019

- To know more about CFA/FRM training at FinTree, visit: www.fintreeindia.com

For more videos visit: ruclips.net/user/FintreeIndi...

CFA | FRM | CFP | Financial Modeling

Live Classes | Videos Available Globally

Follow us on:

Facebook: / fintree

Instagram: / fintree_education

Twitter: / fin_tree

Linkedin: / fintree-education

We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with!

This Video lecture was recorded by our Lead Trainer for CFA, Mr. Utkarsh Jain, during one of his live Session in Pune (India).

To know more about CFA/FRM training at FinTree, visit:

www.fintreeindia.com

you always simplify everything for me. Thanks

Simplest explanation

Very nice video for revision of level 1 concepts

How can i calculate BEY on excel?

Hello, you have shown true yield is less than street convention, but what if the bond works on a modified following. In that case the street convention would be less,isn't it correct?

Street convention and true yield are only for fixed-rate bonds

How to enter values in the calculator using annual compounding in BEY calculation.

Damn you're cute

@@gokuvegeta9500 tf's wrong with u 🤣🤣

why is bey is less than eay?

In semi annual compounding, you get your coupon payments at a shorter time period. Since, that makes semi annual compounding more liquid than annual compounding it's yeild is less. Annual Compounding needs to gives a higher yield to account for liquidity risk (more illiquid an asset more money you want from it).

@@Karan-dc8lj arre