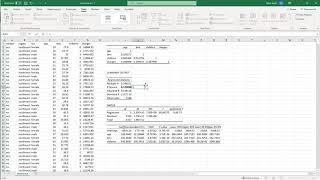

Excel: multicollinearity; variance inflaction factor (VIF)

HTML-код

- Опубликовано: 30 ноя 2024

- Data: www.ishelp.inf...

Watch the prior video in the playlist on creating dummy codes out of categorical data in order to get the data into the format I use in this video.

This video (or a related video) is used in two of my books:

1. Introduction to Information Systems

Contents: app.myeducator...

Purchase: app.myeducator...

2. Data-Mining Projects and Database Essentials

Contents: app.myeducator...

Purchase: app.myeducator...

To request an instructor copy, email me at mark.keith@gmail.com

This is the video that I look for hours!!

Thank you so much! You made it so easy to calculate VIF.

Loved the way the video was explained. Simple and clearly understandable.

Thanks Keith! You made it easy for me to understand VIF.

Hi Mark, nice solution! However, I found that there's a simpler way to get the R-squared values (and as such) the VIFs. If you complete the covariance matrix of the independent variables by transposing the columns into lines, and then you invert the matrix with =minverse block function you can easily get the R-squared values with the 1-1/R for each independent variable. :)

HA Ha Nerd

Thanks Adam, you're totally right. I used this example for my students because I thought it would help them understand it conceptually. But your technique is definitely easier/faster 👍

Columns into rows or lines??

This video help me a lot! Thank you so much!

Thank you!!

hi tk u!! I did a multicollinearity check via the methods described and it showed up us:

during bivariate correlation testing, Pearson is 0.692 (p suggesting moderate to almost strong correlation

but during linear regression with correlation diagnostics check, it shows VIF of 1.92 and Tolerance of 0.52.

how shall i interpret the results - are the 2 variables correlated or not correlated?

also, does correlation refer to colinearity? thank you

Good question (and I’m sorry I wasn’t able to get to it sooner). But we always trust VIF for multicollinearity over a Pearson correlation because it takes into account all of the features instead of just one at a time. The rules for VIF cutoffs are very tolerant of high individual correlations though. I’ve seen individual correlations between .8 to .9 and yet the VIF score including all features was still acceptable.

@@MarkKeith thank you so much!

Thanks sir.