FRM: TI BA II+ to price a bond

HTML-код

- Опубликовано: 8 сен 2024

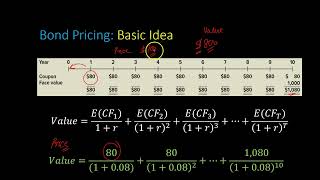

- What is the (model) price of a 10-year $1,000 face value bond with a coupon rate of 4.0% that pays semi-annually, if the yield is 6.0%? For more financial risk videos, visit our website! www.bionicturtl...

Who is came from how to cfa cource 😅

Thank you so much! I've watched a few of your videos and they've truly helped clarify a few things in my finance class!

Thank you, it helped

Just to say thank you so much 🫶🏽👏🏽👏🏽

thank you, i liked your explanations very simple

way too much hot air here get on with the calculations

THANK YOU. Very well explained.

i get -848.19 for semi annual and -846.83 for annual

I am having a hard time figuring out what mode to put my calculator in. I fully clear it with CE|C button and the 2nd CLR/TVM but did some annuity problems yesterday that may have altered the mode. Doesn't appear to be in BEG mode. Should we be in END mode for these bond calculations? Troubleshooting as I did all exactly, and got PV = -1340.97

Figured it out! My P/Y and C/Y were set for compounding interest in previous problems to two. They have been reset to 1. I got the correct answer.

Very helpufl, thank you. Wish my instructor did this.

Very helpful, excellent video

I inputed the exact numbers you did but i got a totally different answer.

I'm not getting same answer #crying

Awesome video

Can you please tell me the formula if you are doing this without a calculator?

7:41 When working from semi-annual to annual the price changes from $851.23 to $852.80, the price increases. If the yield keeps the same at 6%, should we expect the price to decrease. The investor gets the coupon payment half year earlier from semi-annual bond than annual bond. If the yield keeps the same at 6%. All the investors would choose the semi-annual then!!!!!! It looks against the common logic.

Why does it increase? Is my concept on the yield is not right?

Imposing illustration ! But I am still confused why there is a key for "P/Y C/Y" since we could set N and I/Y according to the compounding frequency.🥺🥺🥺🥺expected to receive your answer!

A bit late but yes you can use those keys to specify the payment and compounding frequency. Then you can use the interest rate per year as the input for I/Y. For N, you still need to multiply years by p/y since it remains as the number of periods.

I do same thing but I got - 870. I have exactly same calculator

I do the same thing for one-year terms and it gives me 1085,30. Why is that?

If you change P/Y from 2 to 1, you will get the correct answer.

@@helenzhang3419 what does the P/Y stand for?

@@helenzhang3419 thank you for that, I was losing my mind as to why mine was different

This was incredibly helpful! Thank you 🙏

You're welcome! Thank you for watching :)

Thx a lot for the help.. only 2 days left for my FRM exam. And what u explained is helpful indeed

You're welcome! We are happy to hear that our video was so helpful. We hope you did well on the exam!

thank you david

You're welcome! Thank you for watching!

Im from 2025

How does the world look in six years?

Jake_from_Statefarm don't know about the world but we still doing the same math at college

@@Nomad-bi6su Some things never change, man. Some things just never change.

Hi!

c'mon youtube, you can do better

Your videos are fantastic. I just wanted to say thank you because these videos are helping me study for a finance exam tomorrow.

You're welcome! Thank you for watching, and we hope that you did well on your exam!

This is good. Shouldn't the P/Y be changed to 2 before computing this problem?

Thank you! We don't want P/Y = 2 in this approach because we are already "manually" adjusting PMT and I/Y to the semi-annual period.

Okay thank you. I'm learning bonds by watching RUclips videos. There's a lady who did a lesson and she adjusted it to 2 including the manual adjustment of the I/Y and PMT. This can become really confusing. It was a callable bond btw.

pmt should be adjusted to 20 even if p/y=2 it seems

Hi when I followed this problem step by step with the same calculator. The end number for the PV I got was like -1085. And that was the answer I got when I put the I/Y stored as 3. When I left the I/y as 6 percent I got the answer I was suppose to get which was the 851.23. Is there an explanation for this?

The calculator stores the P/Y from previous calculations even after the CLR WORK. Therefore you have to set P/Y to 1 to get the right answer.

Your P/Y is set to 2.when it is such, calculator already takes semi annual compounding into consideration. So that's why you put in i/y =6% and got the answer. It's all right. But you have to change n=n*2,and pmt =pmt/2 when p/y =2. Only benefit with your p/y set to 2 is that you don't have to worry about interest rate though. Hope it helped 😊.

Hi, what kind of app do you guys use to screencast the calculator?

Execellent explanation. I thought, however, that the calculation in the BA II Plus was done using only the coupon rate and ignoring the Yield to Maturity rate.

how could that be?