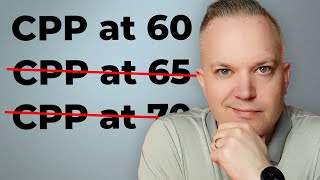

When Should You Start CPP?

HTML-код

- Опубликовано: 8 май 2024

- Meet with PWL Capital: calendly.com/d/3vm-t2j-h3p

The CPP uptake decision is one of the most consequential financial decisions that most Canadian retirees will make.

The difference between optimal and suboptimal claiming can measure in the hundreds of thousands of dollars of expected lifetime income.

References: zbib.org/7c977b4ef1a641de8c2d...

------------------

Follow Ben Felix on

- Twitter: / benjaminwfelix

Visit Rational Reminder: rationalreminder.ca/

Join the Rational Reminder Community: community.rationalreminder.ca/

Follow the Rational Reminder on:

- Twitter: / rationalremind

- Instagram: / rationalreminder

Visit PWL Capital: www.pwlcapital.com/

Follow PWL Capital on:

- Twitter: / pwlcapital

- Facebook: / pwlcapital

- LinkedIn: / pwl-capital

You can find the Rational Reminder podcast on

Google Podcasts:

www.google.com/podcasts?feed=...

Apple Podcasts:

itunes.apple.com/ca/podcast/t...

Spotify Podcasts:

open.spotify.com/show/6RHWTH9...

------------------

Ben is asserting financial dominance. Ben tweets about CPP, people disagree like crazy. So Ben makes a video about CPP, comment section disagrees like crazy. So what does Ben do? Ben makes **another** video about CPP. The man has no fear.

A strong internet voice to the contrary of evidence-based practice means the experts need to double down. This goes for finance as it goes for all other realms of human knowledge.

entrusting them with your retirement funds? yikes, he wants the government to rob you. be like classical liberals, and have the for-profit private banks and mutual funds rob you instead

ALPHA MALE MINDSET

Look into his eyes, he does not

It’s a very personal choice. No one best decision but good info is key to making the best and right one for you.

I think when I retire my goal wouldn't be to optimize for expected returns, but to minimize the chance of running out of money from withdrawals at my desired lifestyle. Given that, the "guaranteed" returns provided from CPP deferral seem to be more valuable.

Why have I watched this? I am not Canadian. I don't even know anyone from Canada.

Because it's Ben, and thus interesting.

One of us, one of us...

You know this RUclipsr, lol

Yeah shame.. went from financial advice to how to retire as a canadian real quick suddenly

Canadian in Canada making Canadian content. Sorry.

Thank you so much for these CPP videos. There's always been a lot of misconceptions and it's frustrating.

I think it's also worth noting that many retirees believe that funds are more important early in their retirement, when they're able to enjoy them, compared to later, when they are more sedentary

Lifetime spending is increased by deferring. If front loading spending is desired, most people are still better-off deferring unless they are cash flow / asset constrained. If CPP is the only source of funds, taking it early makes sense. If it's not, deferring is still better.

But what the comment above was getting at was that, payments made later in life would be discounted much more than at age 60, this negating the effects of the higher payout

You can spend more today by having a larger deferred benefit later.

@@BenFelixCSI hard to spend later when in a bed or when your dead.

People commenting like this don’t know many 70 year olds.

Thanks for the shoutout. Much appreciated Ben! Another excellent video.

Thank you! Definitely learned something here ❤. The 2022 example was fantastic.

Great video Ben - love your channel and delivery style.

I appreciate that!

Ben Felix the GOAT back with another upload

Amazing. Best run down I’ve ever heard. Thank you.

Only wrinkle I understand a lot of folks don’t qualify for full YMPE. I guess it doesn’t change the decision but the numbers can be smaller.

Your channel is great, thank you all the info over the years!

That is correct. Someone below the maximum benefit would have a lower baseline amount, but the concepts otherwise are the same.

I’m Italian, I’ve never been in Canada, I don’t even know anyone from Canada but still interesting watching your videos Ben, thanks for your content

Another very informative video, thank you! Your holistic/common sense approach is why we use PWL. 👍🏻

Please make more content on this!!!

I was researching YMPE in regards to both my CPP and DB pension. I agree that YMPE has outpaced inflation historically, but the difference has narrowed, I believe permanently. I agree with taking CPP as late as possible, but I have some high yielding investments in my RIF that I would like to hold on to.

Income tax is huge, but also there is quality of life vs. money. Most people think it is better to have & spend money when they are 60 than when they are 85. Assuming there is enough money to not run out of funds before end of life, money spent at age 60 can provide more personal value than money spent at age 85. At 60 people can still travel, see family and more fully enjoy life. Most people who are 85 do not live independently and don't need extra CPP money to have a gold lined death bed.

And thank you for mentioning my main rebuttal: income taxes, especially when adding forced income through RRIF, OAS and CPP when compared to 50%+ marginal taxes at certain income levels.

But using your own stated assumption of having enough money not to run out, then getting a higher lifetime benefit (for most people as per Ben in the video) from CPP is a better outcome. The person would just draw down their portfolio to a greater extent earlier in retirement for the more spendy years

Great video! Thanks for talking about low income Canadians and GIS. CPP is considered income in regards to the guaranteed income supplement. 50% of CPP comes off GIS so waiting past age 60 makes no sense. RRSP withdrawals also come off GIS so it's like getting a 50% tax applied to your RRSP withdrawals. Not logical for low income folks unfortunately....

Thanks for the great video. The acronyms in the beginning were a bit too much loo 🤯 but you explained them well and simplified it for the end user. Great job Ben. 👊 Do you use a green screen? I am amazed how solid your virtual background looks. I need to invest in a good green screen too 😂

That’s a real background!

Amazing video as always ! What is preferable for people who have a public service retirement plan? Is it generally better to wait age 70 as well ?

With recent passing of a family member, I've been considering spending down investments early(live large), to avoid tax implications after death, also to maximize joy while healthy. Then take cpp later to cover basic living expenses until death. Still young though, plan might change when I reach retirement age.

I know those who took it early due to limited income/funds. They spoke to a CPA thru family unlike many in that situation. Some take it early maybe from medical issues that sadly have a fairly known timeline/progression ie dementia or some cancers. But for most taking it later is prob beneficial. Good info like this video def help in one’s choice. What I’ve seen is many rely on friends or family for what to do. Good or bad.

Always interesting to see the comments. The fact is if you NEED the money of course you have to take it but hopefully not before 65. If you can manage than delaying as Ben has started is the best “financial “ decision. From what I get from people is that they want their money because they fear that they will not get their share before either dying or some illness that will render them unable to enjoy it. It is really fear that pushes people to take it all before 70. When people hear the stories of so and so dying after only one or a few years of collecting then they just can’t hear anything else - this is why many take early aside from the % of people who actually need it. Just my opinion

Thanks for quick overview. Can you explain at what age does the Break-even triggers CPP benefits? I believe you displayed a graph very quickly in this presentation.

it's impossible to know when time's up, so we all have to make this gamble. health is indeed wealth.

I'm going to receive a Japanese pension which seems very similar to Canada.

I plan on getting it at 65 and investing it if possible. My (likely) shorter lifespan will make it the better option I think.

My wife should probably defer until as late as possible as living past 100 is a strong possibility (grandmother passed at 107.)

I have a low probability of outliving my money, hers is much higher.

I’m also not from Canada but this is interesting, would be nice to see similar studies for UK or other countries

My grandpa's argument for claiming CPP early is that you can deposit it into your RRSP, and maintain some higher risk investing from it (or have it all go to family when he passes) - but he also has a pension and an RRSP to rely on if that doesnt work out

If your grandpa plans to have any RRSPs left when he dies, he's doing it wrong. They are taxable and will be heavily taxed in the year he passes. Better to spend them all at the beginning, which lets you defer CPP, and then take that increased CPP and put it in TFSAs.

Please do a video on if life insurance is worth it

Ben, for people looking to retire early, do the additional years of missed CPP contributions ever outweigh the benefits of deferring CPP? i.e. if I've only been working in Canada from 26-52, would I be better off taking it early or do I still get a total lifetime benefit of waiting until I'm 70 to start CPP? By the way, thanks for your content here - you're one of the only people I listen to these days, with a data-driven approach to finances and retirement.

The math is the same, just proportionately less based on your total pensionable earnings.

So yes, you get the same benefit for deferral.

Waiting for the second marshmallow 🎉

Thank you, Felix.

Good to know most of us are living longer 😅

I take it the numbers don't really change with RPPs (e.g. HOOPP) involved?

If someone has an RPP and no other liquid assets and retires before 65, I have seen them take CPP at 65 to replace their bridge benefit when it stops.

@@BenFelixCSI That's awesome to know! Thank you!

Thanks for all your content Ben, extremely valuable.

Just curious.. Hundreds of thousands of dollars of a difference in the worst case scenario? When the max you can get is 16000 dollars a year.. You need to get the max for 15 to 20 years in one case and absolutly nothing, zero, in the other case to have a difference of 200 to 300k, i.e. "hundreds of thousands of dollars". Is the wrong decision not applying to CPP at all?😅 It would be nice if you could give an actual example of the biggest difference that can be caused with a reasonable life expectancy like 80 or 85 years between starting at 60 and 70.

Someone at age 60 in 2024 with maxed out contributions would get closer to $10,000 after the age reduction. If they deferred to 70, it would be $25,000 after the age increase and assuming 1% wage inflation. Depending on their life expectancy, this gets to hundreds of thousands pretty quickly.

Lots of examples in this paper www.fpcanadaresearchfoundation.ca/media/5fpda5zw/cpp_qpp-reseach-paper.pdf

Using numbers from his comment, you would get 250k from age 60 to 85, vs 375k from age 70 to 85. That's a surprising difference.

I can only wish for an adverse scenario such as a longer than expected lifespan! 7:20

Really how many can bridge from 65-70 would love to know the stats on that

Have you done a similar analysis of OAS?

I had my CPP estimate calculated and it appears that im best to take it at 63 as i retired at 54. My no income years kicks in and i actually have a drop at 64 and 65..but then it goes up by 67. By taking it at 63 i can collect $1000/ month for 24 months before my bridge benefit drops off on my pension. Since i don't need the money while I still have the bridge ill use the money to top up my TFSA. By talking the lesser amount i can minimize my OAS clawback as well. No point in waiting for more CPP (7.2% / yr) when ill lose more in OAS clawback and pay more taxes on top of it.

Makes sense. You are one of the exceptions.

Is there at any given point where delaying CPP can increase total taxes paid or it really should be irrelevant. Let's say OAS is fully clawed back regardless. If you delay CPP but have a Pension and a decent RRSP, at some point wouldn't CPP and RRSP (RRIF) just cause taxes paid in later years to be be much higher and potentially negating the "bonus" from delaying CPP? I haven't done the math, just asking. I am slowly watching your videos and learning a lot!

Depending on an individual's (or couples) own situation, delaying CPP can increase total taxes considering that CPP is taxed fully as income. Money from CPP is added to your other taxable income to determine your total taxable income. Its important to note that CPP analysis simply figures out your CPP numbers. Your personal CPP numbers are only some of the inputs into for more broader financial planning. Financial planning would take all your inputs and analyze your overall financial situation, including projected year-by-year and total lifetime tax. When financial planning is done leading up to a CPP claiming date and retirement date (these can be different dates), there may be tactics to mitigate anticipated excessive taxes...again depending on your own personal situation. One example that often works well with delayed CPP claiming is RRSP melt-down (burn-down).

Is the CPP sufficiently funded to handle a large majority delaying to age 70? e.g. Worst case, could it handle 100% of recipients delaying to age 70? Or would it result in more enhancements down the road?

Great question. I'm going to step in and answer it. The age adjustment factors (a reduction of 0.6% per month of early claiming, and a 0.7% increase per month of delayed claiming) are designed to be actuarially equivalent to the basic CPP starting age of 65. So theoretically, it should not be an issue. In my own experience speaking with actuaries (which admittedly is not extensive), they tend to suggest that, in general, far more people would be better off delaying and they don't seem to believe there would be an issue if many more did delay from a funding point of view.

I am surprised to learn that CPP stops indexing once you start collecting it. I was assuming that I would be using it to hedge against outliving my savings, and this reaffirms that. Assuming nothing changes in the next thirty years ;)

It's still indexed. It indexes to inflation once the benefit starts. The initial benefit is based on the MPEA which is indexed to wage growth.

Given the fiscal dominance and the unfunded liability, I don't think CPP will even exist when I retire or if it does, the amount from CPP will have lost so much purchasing power that it's not worth it.

My head is spinning!

So is it safe to say that that waiting to take CPP at age 70 is better for people whose pensionable earnings go over the annual YMPE, thereby contributing into the additional range which is indexed to wage inflation once they take CPP.

For people whose income is under the YMPE, waiting to take CPP at 70 vs age 60/65 only benefits from the additional monthly payout amount of 0.6%/month.

I'd say it depends on your own personal situation. Copying a reply from another comment because it sort of applies to your question....

Depending on an individual's (or couples) own situation, delaying CPP can increase total taxes considering that CPP is taxed fully as income. Money from CPP is added to your other taxable income to determine your total taxable income. Its important to note that CPP analysis simply figures out your CPP numbers. Your personal CPP numbers are only some of the inputs into for more broader financial planning. Financial planning would take all your inputs and analyze your overall financial situation, including projected year-by-year and total lifetime tax. When financial planning is done leading up to a CPP claiming date and retirement date (these can be different dates), there may be tactics to mitigate anticipated excessive taxes...again depending on your own personal situation. One example that often works well with delayed CPP claiming is RRSP melt-down (burn-down).

Hey Ben, do you think you would ever do a video on those swap based ETFs that are created to avoid getting dividends so you can defer taxes. I don’t like paying taxes on the dividends I’m receiving now, but on the other hand, the product looks complex enough that looks like the stuff you warn about even if the features are nice

Yes I will.

So is the calculated CPP payout at age 70 on the government’s website assuming you retire at 65 and defer until 70 or assumes you continue working until 70?

As a pure financial investment, what is the return on investment in future years for a contribution made this year as a business owner? ie if I contribute the max $9K this year and hypothetically claim CPP next year, how much income does that $9K provide in following years? As a business owner I set my salary and can choose to contribute anywhere from zero to the maximum to CPP.

www.advisor.ca/practice/planning-and-advice/should-business-owners-avoid-cpp-by-paying-themselves-dividends/

@@BenFelixCSI The point about tax efficiency is important, but not universally applicable. I can re-invest in my own company or have the company repay loans and use the capital to buy stocks without paying income tax. Point taken about using CPP as a fall back for a worst case scenario.

Investing in the company can look attractive, but we show in that article that the net amount you can retain by avoiding CPP is a lot lower than the headline CPP contribution. Agreed though that there are other uses of capital that may be better than paying anything into CPP.

Retiree here and drawing my CPP, started a few years ago. with the "enhancements" you discuss be retroactive?

No, they are based on contributions. If you did not contribute, you won’t get them.

Do you have a newsletter so i can get an email with TLDR news?

Most people discount the future benefits of delayed gratification too steeply. You hear lots of people saying that they want to spend most of their money before they get too old to enjoy it. Seriously they are confused about what ‘enjoy’ means at different stages of life. Your idea of ‘enjoying’ money was very different at 20 than it is as a 40 year old, and it will be different again at 60-70-80. Why do we think that old people cannot and do not enjoy life as much as young people do? They just enjoy it differently. Your 20 year old self can make that mistake, but by the time we become mature adults we should know that the power to choose your life at all stages is to be preferred than being forced to live the life decided by a much younger version of yourself.

As a non-Canadian viewer, I still found this interesting. Whilst I do agree with some of the points made by lesleyjohnson, I cannot agree with all of them. I am a strong believer in deferred gratification but you can defer to the point that you never achieve the gratification. What Ben's video doesn't consider are the less tangible benefits of earlier retirement; yes, you'll have a lower income but you will also be much better able to enjoy it. Most people will only need a smaller income in later life e.g. post age 75, so deferring retirement too far, in order to achieve greater income in retirement could well be counter-productive.

I really failed to communicate this point. It’s not about delayed gratification. People can increase their lifetime income be delaying and spending other assets first. That means spending more now and later.

@@BenFelixCSI Hi Ben! I don’t think you failed at all. I actually think you made your point very clearly. My response was to the many comments that disagreed with your point about saving CPP for when you actually need fixed income that is inflation-adjusted (long term strategy) as opposed to your retirement savings which may or may not be able to withstand a long life expectancy. I felt that the comments displayed a weak understanding of your needs in old age. And I don’t think that your needs will necessarily be less than they are immediately after retirement. You will have grandchildren, great-grand-children, and family members who are aging as well. Not everyone in my family is well-set-up for retirement and you can’t always know what costs will be incurred from various illnesses/financial shocks/family changes/etc.

Please do similar analysis for Social Security for us American viewers!

Social security is a poorly funded ponzi scheme. It will collapse under the weight of the boomers.

CCP is a well run and has proper cash reserves.

Stay poor, ameripoors.

Do a web search for "Delaying Social Security As The Ultimate Retirement Hedge" by Michael Kitces. It is less number centric and more focused on avoiding portfolio exhaust, but it is a similarly excellent article.

It's basically the identical takeaway if you run the numbers - generally you want to defer to 70 unless you have an expected shortened lifetime.

Can I ask about taking CPP before 65 if my spouse has passed away prior to 60. My understanding is that if wait until 65 to claim the CPP I will lose the survivor benefit especially if I am entitled to the maximum entitlements based on my lifetime earnings. Can you advise?

This is another one of the exceptions. Survivor benefits and individual benefits are combined through a complex calculation, but the combined amount is capped. Someone receiving survivor benefits may be better off claiming earlier. When depends on the specific amounts.

@@BenFelixCSI ok thank you.

I’ll never regret taking it at 60. I never enjoyed working lol

Seriously though, I had a decent government job so my pension is good enough for me. I’ll enjoy my retirement longer and won’t have to wait years to recuperate the money lost by not taking it at 60. Yes I know our longevity is supposed to be higher nowadays but no one really knows when their time is up… btw my sister passed at age 68 😉

I had never considered that it would obviously be more than 42% by deferring due to inflation

That one is commonly missed.

I'm interested in how CCP is calculated. I've contributed for about 20 years but I've had to stop working to care for a family member and won't be contributing to CCP for a good 10 years....maybe 15. How screwed am I when it comes to CPP and OAS?

OAS no impact since it’s not contributory. CPP is likely affected due to low years of income that exceed the allowed dropout years.

@@BenFelixCSI Yikes.....I'm screwed.

Not screwed. Were you able to get some EI caregiver benefits?

This explains the benefit calculation and dropouts ruclips.net/video/ykg9uxIy0F4/видео.htmlsi=At1kAwhcBweRQeZh

@@BenFelixCSI Yes but only for the max 16 weeks. Then I went on EI for a year.

For US Social Security, the timing decision has one additional risk that doesn't appear to be present for Canada: A likely policy change about retirement age milestones that may or may not grandfather-in people caught in the middle. SS is projected to go bankrupt unless something changes and raising taxes is politically undesirable, so the lesser political evil of raising the retirement age is more likely (the protests in France notwithstanding). This creates a risk that someone who at 65 decided to defer to 70 and is now 69 may have the goal posts moved to 72 or 75+. So the benefit they end up collecting at 70 may end up being adjusted down from what they planned for when they were 65. Hopefully the change will be structured by age cohort, so that only people who are, let's say 50 years old or younger, at the time of the change would be subject to the raised retirement age.

Why is the risk not present in Canada? I am sure it is small, but claiming it’s zero seems unsubstantiated?

@@rzkazemi Well I guess anything is possible. But in the last video Ben mentioned that CPP isn't forecast to go bankrupt, because of the way it's funded. So there's no need to make changes to retirement age milestones?

Break even point is more important.

No it’s not. lol.

The psychological factor of not taking CPP at 60 and waiting 10 years to collect outweighs the financial sense of delaying it until age 70.

60 for sure

Me and my wife are planning on living in Asia after I retire. Does residing overseas affect the amount of CPP I’m going to get? Or the taxes I’m going to pay on it?

Not the amount but the taxes.

@@BenFelixCSI Thanks. Would I be paying more or less in taxes?

@@edh6062 That would totally depend on if there is a tax treaty between Canada and your eventual home. Probably best to check with a tax expert familiar with both Canada and that country.

I'm afraid postponing "life" (thats what we all nowadays expect in classic view of retirement to be, right? cashout of investments on retirement) because of higher payout is going to lead to either not surviving till reaching the money or to swimming in money you no longer need. I mean, speaking of actual money used for fun, and not for decades of healthcare treatments.

I believe money-wise info given in video is fully correct, but does it justify a difference in money we get at 70 over money we get at 60? "Utility" factor is meant to be part of the equation.

UPD: just figured i'm not alone saying it by scrolling, but I suspected it. Thanks for information nevertheless.

People can spend more now by having a larger deferred pension later. Lifetime income is increased by this planning, not just income in later years.

I'm missing something. Do u mean by not retiring now you spend more because you still earn regular income that is likely higher than expected CPP payout? But then there are other investments that are expected to be withdrawn along with CPP. It's not about CPP alone. CPP alone is unlikely to preserve quality of life you had before retirement while releasing all this time used for work (and typical expectation is to preserve or ideally improve that quality of life to justify all these money mining efforts over lifetime)

It’s not about the retirement date. Given a retirement date, funding your lifestyle with other assets in order to defer the CPP benefit is likely to allow you to spend more over your retirement (including now) than taking CPP early.

I see, so just holding CPP while spending other buckets. Will CPP be considered income when received? I think this is the only factor that can turn things around. If it's not, early taking might be still more total sum available on early years without extra tax implications. If it is, then I'm all with you and this is deemed to be not much of use assuming other buckets are big enough.

@dimon22323 CPP is taxable income. Typically this won’t tip the scales in favour of early claiming, but in cases where OAS or GIS will be clawed back it can make sense to claim early.

Qpp is the same?

Yes. Nearly identical.

Never seen a Brink's truck in a funeral procession. Show me the money!!!

Take it early. Screw research. The way the government is mismanaging the pension plan means the longer you wait, it may not be there. When you add the fact that you don’t know how long you have left, early is better. You can’t take it with you so take it early, use it and enjoy 👍

The government does not manage CPP Investments.

Canadian wages have historically exceeded inflation??

As a US worker where wages have stagnated for decades, I was shocked also.

Even some unionized wage earners have fallen behind inflation.

Yes, as measured on an aggregate national level, and by the particular metrics used for the CPP program. Wage inflation is represented by the Year's Maximum Pensionable Earnings, which is measured by what's called the Industrial Aggregate - a set of data that is collected as part of the Survey of Employment, Payrolls and Hours. It is important to note that there are other measures of wage inflation. For example, the Labour Force Survey also measures wage inflation, but uses different inputs so there isn't necessarily a strong correlation between these to wage inflation measures. Price inflation is measured by the Consumer Price Index - all items. Its also important to note than an individual's own wage growth and spending inflation is.....well, individual.

Factoring spouses CPP amount should also be considered, since if both are near maximum, they will not get any of the spouse' CPP when they pass.

When should you start cpp?

Na, you might want to skip it and go straight to java or c# 😂

You mean stop at Java or c#, because cpp is beyond the grasp of mere mortals.

Based on family history, I have a low life-expectancy. I was advised to claim SS (I'm an American) early, even if I don't need to money. If you don't need the money, investing it can/will generate market returns that make up for the difference, versus if you delayed claiming the benefit. I haven't penciled that out but it seems reasonable given expected returns on a diversified portfolio.

Take is as early as possible. We die when we least expect it.

Consider CPP insurance for those that die much later than they expect to. Draw down your other retirement funds appropriately and know that if you do live too long, you'll get more CPP by taking it later.

"We die when we least expect it" is a cool-sounding phrase, but it ignores the other kind of unexpected outcome - living longer than expected. Failing to consider both is a mistake.

@@SeaJay4444 if you live longer than expected just take on debt. If your lucky enough you might just see collections in hell.

"Just take on debt" to cover 10+ years of unexpected expenses? More? What if leaving an inheritance is part of your financial goals (as it is for many people)?

So if you don't expect to live to 105, that would fit your defintion of it being least expected. What are you going to do when you're 104 if you took it at 60 and are only earning 40% of what you could have received if you waited until 70?

Could you make a video on what happens when you have an rrsp and turn 71 and must begin to withdraw? I have not found a lot of resources out there. Thank you!

RRSP must be converted into RRIF at age 71 and begin to withdraw a set minimum amount.

No mention of the possibility that Canada goes bankrupt and that pensions are scaled back or eliminated. While unlikely, it is a scenario that more people are taking seriously.

The pension is not funded by the government.

@@BenFelixCSI The govt sets the rate of the cpp premiums, no? And it is subject to gov't fiscal pressures. The Harper gov't pushed back the date of full eligibility because thr math didn't work. Oh well.

The government can change the legislation that governs CPP, but CPP assets are not government funds.

@@BenFelixCSI Thanks, Ben.

@@BenFelixCSI But correct me if I'm wrong but OAS and GIS are gov't funded. They are not calculated from contributions.

But what about individuals who chose when they will die? If you know you will kill yourself at 82 or 85, then take early cpp.

Can you take it earlier than 60?

4:55 in the video

And Ithought American social security was confusing.

It's so confusing I had to hire someone to help me decide at what age would be best for me. He didn't even mention being widowed, it makes it WAY more confusing!

Ya, survivor benefits are another level of complexity.

Rare Ben Felix L

There are so many comments here making the point it makes more sense to claim as early as possible because you have a higher ability to enjoy the benefit by travelling etc.

As I’ve explained in other replies, this perspective is objectively wrong, other than in the case where there are no other assets to fund consumption. If other assets are available, deferring CPP means more lifetime consumption. That means more spending both now and later. It’s not a matter of delayed gratification.

Will cpp be around? Also are you taller than Zach Edey?

I am 6'10. Edey is taller.

Might've missed the clarification but this is all in CAD right? Probably not a huge issue, Canadians somehow intuitively sense which dollar is being discussed

Yes it's in CAD. I didn't specify since I'm talking about the Canadian retirement system. I forget many of you are not Canadian.

In the event that the husband dies, CPP pays two thousand five hundred dollars. How much will CPP pay for the rest?

There is a survivor benefit. The calculation is complex, but if two spouses have maximum CPP it’s possible that it doesn’t make sense for both to defer due to potential interactions with the survivor benefit.

Is this the Canadian version of the US Social Security?

No that would be Old Age Security or known as OAS in Canada. You retire with OAS and CPP in Canada. Two Pensions are available once you retire.

@@maryjeanjones7569

Sounds like OAS is comethung different.

SS is a contributitory pension like CPP.

OAS is a handout providing a base amount. The US doesn't have that.

"OAS provides a base amount to all, while CPP aims to replace 25% of pre-retirement income based on contributions." The part about CPP sounds a lot like SS.

@@JasonBuckman Old Age Security is a Pension paid through taxes. Canada Pension Plan is a Pension paid through contributions by the Employer and Employee during one's work career.

@@maryjeanjones7569

When you described CPP, you described SS.

@@JasonBuckman Okay

you're allowed to blink bro....

Tell that to my eyes.

i just wanna say you're a handsome guy ben, thank u for the videos

That is very kind. Thank you.

How can Canadians afford to retire?

Most Americans cannot either

our government forces us to be old age high stakes gamblers

taking it early is better because life isnt guarenteed. passing away suddenly with the CPP rules for spousal benefit is only 50 pct of what the main contributor would get. so taking CPP as early as possible is better with all the chemicals and lack of oversight in our environment and food.

*actively ignores life expectancy statistics*

When you have the cash is perhaps more important than the sum total.

You're ignoring life goals. A person in their earlier 60s will have more energy for activities thab someone 80+. I argue its preferred to have more money in the youth of old age than more overall.

One of the concerns of this approach will be the very high cost of assisted living/nursing homes for Baby Boomers because of the the large demographic and the limited number of spaces in "quality" facilities.

You can spend more earlier and later by deferring CPP. It improves lifetime spending. If you are cash flow constrained taking CPP earlier can make sense.

see Pi Pi

Oh well since our generation is expected to live fewer years than our parents we''ll take at 60

No.

Can't and shouldn't rely on it.

It's a dangling carrot.

Where on earth do you form a view like this?

Too hard explanation..

It’s really not. Wait longer, get more.

Cop is a scam

Is CPP gonna exist when I can think of retirement in 35 years?

The most recent (2022) triennial report by the Chief Actuary of Canada indicates that the CPP is sustainable over a 75-year projection period.