Forecasting Asset Class Returns (2024 Level III CFA® Exam - Reading 2)

HTML-код

- Опубликовано: 28 окт 2022

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.com/shop/cfa-leve...

Level II: analystprep.com/shop/learn-pr...

Level III: analystprep.com/shop/cfa-leve...

Levels I, II & III (Lifetime access): analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.com/shop/unlimite...

Topic 1 - Capital Market Expectations

Reading 2 - Forecasting Asset Class Returns

LOS : Discuss approaches to setting expectations for fixed-income returns.

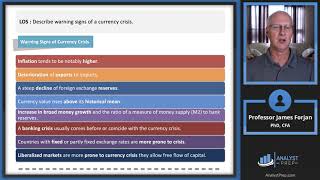

LOS : Discuss risks faced by investors in emerging market fixed-income securities and the country risk analysis techniques used to evaluate emerging market economies.

LOS : Discuss approaches to setting expectations for equity investment market returns.

LOS : Discuss risks faced by investors in emerging market equity securities.

LOS : Explain how economic and competitive factors can affect expectations for real estate investment markets and sector returns.

LOS : Discuss major approaches to forecasting exchange rates.

LOS : Discuss methods of forecasting volatility.

LOS : Recommend and justify changes in the component weights of a global investment portfolio based on trends and expected changes in macroeconomic factors.

Can you explain again why increasing investment in the country with strong growth will weaken that currency? (From 52:08). I thought increasing investment from global investor to that country will strengthen the currency.

Thank you very much for the Level 3 videos. Slow start for my August exam :)

Same here! Good luck.

You're welcome. We should be able to release *most* of the videos for the August 2023 exam on RUclips. Best of luck in your studies!

Watching through a bunch of these videos, this is fantastic, high quality stuff. Looking forward to seeing what else I can learn.

It always amazes me how often Yahoo Finance is recommended or used by professionals. You wouldn't think to use a site like that, but it's simple and gets you most of the general information you need on equities.

At the 1:01:00 mark, the phrasing used by prof James seems inaccurate: ARCH models are used to deal with volatility clustering, not as a means to deal with smoothed returns.

Great stuff otherwise!

This chapter is badly written in my opinion (many bold statements with no explanation, with bad flow in the sections at times) and this video really helps

Thanks!