Are UK Pensions Too Generous?

HTML-код

- Опубликовано: 11 янв 2024

- Sign up to Brilliant (the first 200 sign ups get 20% off an annual premium subscription): brilliant.org/tldr

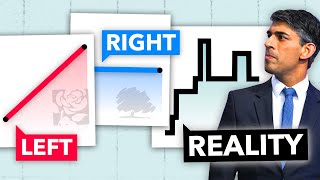

The UK's triple lock pension promise, introduced in 2012, ensures annual increases in state pensions. This video explores if this policy is too generous, if it favours retirees at the expense of younger workers, and whether it's sustainable.

🎞 TikTok: / tldrnews

💡 Got a Topic Suggestion? - forms.gle/mahEFmsW1yGTNEYXA

Support TLDR on Patreon: / tldrnews

Donate by PayPal: tldrnews.co.uk/funding

Our mission is to explain news and politics in an impartial, efficient, and accessible way, balancing import and interest while fostering independent thought.

TLDR is a completely independent & privately owned media company that's not afraid to tackle the issues we think are most important. The channel is run by a small group of young people, with us hoping to pass on our enthusiasm for politics to other young people. We are primarily fan sourced with most of our funding coming from donations and ad revenue. No shady corporations, no one telling us what to say. We can't wait to grow further and help more people get informed. Help support us by subscribing, engaging and sharing. Thanks!

1. en.wikipedia.org/wiki/State_P...)

2. commonslibrary.parliament.uk/...

3. www.gov.uk/new-state-pension/...

4. www.gov.uk/government/publica...

5. www.rights4seniors.net/conten...

6. ukandeu.ac.uk/in-defence-of-t...

7. www.ftadviser.com/pensions/20...

8. ifs.org.uk/articles/pensioner...

9. www.telegraph.co.uk/money/pen...

10. www.bbc.co.uk/news/business-5...

11. www.moneyhelper.org.uk/en/pen...

12. www.bbc.co.uk/news/business-5...

13. www.telegraph.co.uk/business/...

14. www.instituteforgovernment.or...

![Kehlani - Next 2 U [Official Music Video]](http://i.ytimg.com/vi/MpI7ekFG8A0/mqdefault.jpg)

I’m 37, by the time I retire there won’t be a pension. Many of my generation won’t own their homes, and will probably be working until we die

Would have thought being that old u would have developed some wisdom/intelligence

so... basically an indentured servant / serf, well, well, well.... might as well remake the monarchy while we're at it

@@aaroncousins4750aron, you're a 12 year old, that's why you say "u." You don't know anything about intelligence.

@@aaroncousins4750 wisdom and intelligence all of a sudden mean I can pull a giant pension pot and paid up Mortgage out my ass?

Yep. Such a dead end of a political and economic system we live under. By the time we retire the collapse of fertility will have really hit home too so a much larger chunk of the population will be old with less youngsters to work.

Maybe the pensions should be locked to the public sector and services average wage instead of the national average wage. So that the old people who are more likely to use and rely on those services have more of an incentive to vote in a way that protects those workers and ensures they get a fairer wage.

You've said it all.

I've often thought this!

Ridiculous idea to be frank- you can't lower someone's income when it's fixed and they can't get more money by any means. I know it sucks but if you're working you can always work more or get another job. Pensioners can't.

@@phooogleif young people can work 2-3 jobs, by that logic i don’t see why pensioners can’t pickup a side gig. they’re not all infirm

@@phoooglea lot of pensioners can add do work, maybe not full time but that isn't needed. My dad is a garden contractor and at 78 works a lot less than he did, but is still working a day a week or so in the spring/summer.

At retirement ages the critical thing is health not age.

In general I don't think that suddenly stopping working is healthy anyway. Better for people to take more holiday, do something less stressful and or work fewer days.

Young people don't want a race to the bottom. Just triple lock our salaries too please.

this person does not understand economics. very tragic

tbf the people who devised the triple lock clearly don't either @@MC_heart4

@@MC_heart4 it's clearly a joke you embarrassment

Everything should be free as a basic human right.😜😜 (This is also a joke but unfortunately too many people think like this).

@@alanrobertson9790 Especially unsustainable government policies 😅

To anyone with a decent grasp of maths the triple lock makes no sense. By being locked to the highest of the three it will alway rise above the average, leading to exponential growth as pensions accelerate away from all three metrics. It has to be scrapped eventually that's a mathematic inevitability, the question is when.

True but its applied to a low base number so that the full UK pension is £10,600 per year. Most people live on far more than that. That's the problem with talking about mathematical constructs. It can be completely accurate but have no bearing on the real world!

I’m eighty. I just got the special 25 pence a week pay rise. My utility bills have risen from 42£ per month to 117£ per month. Add onto this council tax, price inflation , food costs household insurances etc: etc: You don’t get much left out of 250£ per week to live on.

@@michaelashall4523 energy bills didnt rise with inflation though, nor did food as it stayed high.

So this is not tied to inflation as companies are price gouging.

While this is correct, the problem is who will bite the bullet. So far, Millenials and Gen z are already catching the rough end of the stick on literally everything. Boomers gave everything to themselves and then passed the bill onto their children and grandchildren.

@@michaelashall4523

Right, but we also have to brunt the same costs. But you also get things like free TV license, free bus passes, oh and you don't have to be paying rent to the older generations who've sucked the wealth out of your generation.

It's sad that your energy bills have risen to £117 a month. Now throw on an extra £1000 of rent and realise you can't afford to turn your heating on.

You're 80, meaning you have had the easiest housing prices and best salaries your entire life. Your pensions were better than ours and your purchasing power was better. We're now having to pay your bills now that your generation got old and set themselves up for lives and yes, we're not so concerned that you also have to pay electricity. It was your generation that screwed our energy and transportation sectors in the first place.

Also, £250 a week. Pretty sure that your £30 a week of utility bills would leave you with £220 a week afterwards. Take off council tax at most £40 a week. Leavs you £180 a week. Pretty sure you can afford insurance and food on that without issue.

Pull yourself up by your bootstraps. Cut out the avocado toast and Netflix and get a job if you need to.

Sadly with each passing day we can see the impact this awful policy has had on the UK. Tied up in red tape and tariffs with lower GDP than before the pandemic whilst the others in the G7, including Italy, are above. The lower GDP means we do not have the headroom to pay our way in the world and must resort to borrowing.Whilst there are rich people in the UK; a great many of us are poor and now we are poorer still. What steps can we take to generate more income during quantitative adjustment?

Significant stock movement is not the only need for achieving significant returns. Instead, it emphasises on managing risk in relation to reward well. You can gradually work towards accomplishing your financial goals by sizing your positions wisely and constantly taking advantage of your advantage. Whether it is long-term investing or day trading, this idea is applicable to all types of investment strategies. However, you may need to get some professional advice from an Investment advisor if you need an aggressive return.

Impressive can you share more info?

Certainly, there are a handful of experts in the field. I've experimented with a few over the past years, but I've stuck with ‘’AILEEN GERTRUDE TIPPY” for about five years now, and her performance has been consistently impressive.She’s quite known in her field, look-her up.

Thank you for this tip. It was easy to find your coach. Did my due diligence on her before scheduling a phone call with her. She seems proficient considering her resume.

It's completely stupid that benefits, pensions, and public sector pay aren't all just hard-tied to inflation (RPI). That's the ONLY thing that makes any sense and the only thing I've ever agreed with Thatcher on

Because in politics you don’t do what makes the most sense policy wise you do what gets you re-elected and increasing pensions is a vote winner for the old. Who would you vote for, the person who will keep your money up with inflation so you’re standard of living is the same, or someone who will give you more than inflation rate and make you wealthier overall?

but we tried that and it lead to ever-increasing poverty and destitution for pensioners. If it were applied to public sector pay as well it would result in ever increasing destitution for public sector workers too. Not that we don't have that anyway. But the problems would be the same, and unlike pensioners public sector workers can quit if the money gets too bad. As is happening now. How is a system that has already been proven to inevitably fail "the ONLY thing that makes any sense"?

Because this is exactly the game - they either inflate away the national debt back down to sustainable levels (and pray we don't enter a wage-growth spiral) or they have to grow the output of the economy (currently relies on mindless exponential population growth which is why they're losing their sh*t about falling consumer cattle fertility rates) to keep good sentiment in the value of the issued bonds, i.e. the money printer. The inflation path inherently passes pain down to the lowest earners in society who typically don't own inflation resistant assets and have jobs with less opportunity to demand their wages keep pace. Equality & fair return for fair contribution to society is not, and never has been their goal.

@@WhichDoctor1if all public service workers quit you wouldn't have public service left. It's insane that pensions rise more than their/ working peoples wages..

I feel like with aging population in most countries, higher and higher percentage of voters will be seniors or almost seniors. Then politicians will have electoral incentive to pander more and more to older voters by promising larger pensions

TLDR: Yes and it’s going to get even worse in 5-10-15 years time.

😂 You could apply that comment to pretty much everything these days

This video should've included:

1. how much of the governments budget is allocated to the state pension

2. how boomers have benefited from grossly inflated house prices.

And until they sell their house, how do they benefit? If buying another house, it will be in the same part of the house price cycle, high when high, low when low.

@@BillDavies-ej6ye 33% of homeowners own them outright.. the vast majority are boomers.

It's fair to say you should sell/downsize your own asset to fund YOUR own retirement rather than the next gen being squeezed to death as they are forced to fund YOUR retirement. Even moreso as the inflation isn't down to anything productive but rather QE and crony-cap government/fake conservatives.

@@BillDavies-ej6ye downsizing to a smaller house or moving to a cheaper area (don't need to be where jobs are, etc).

Exactly. Sell your 5 bedroom you got for 50k in 1995 for 750k, buy 3 bedroom for 300k, place the rest in high return instant access savings, let's say you get 4.5% on it that is 20k a year.

And that only brings the prices of 3 bedrooms (first homes) higher and higher...

Who says houses are grossly inflated - do you set the prices, commie?

The market decides.

This might be a bit cynical of me but honestly believe that as a one last fuck you to our generation millennial the state pension will be scrapped once we reach pension age.

I’ve been a nurse for 33 yrs and I don’t expect to get a state pension . I think it’ll get scrapped. This country sucks. I work hard and have no money.

not to be rude but if you marry a rich man then you won;t have so many problems can say the same for men though@@lesleyrobertson5465

"one last fuck you to our generation millennial the state pension will be scrapped once we reach pension age."

Well the boomers will all be dead by then, so you are blaming gen-X - your own parents.

Not if Millennials are the main voting group. Boomers get what they want because they're the most populous group.

Don't worry, you will be replaced by cheap immigrant labour long before you get to retirement.

I am happy that after years of politicians who only care about older voters more and more young people are finally leaving the country that has treated them with disdain and finding better lives/job opportunities elsewhere.

Here I am in the states facing the same crap and to some extent wanting to immigrate given that pretty much everyone under 50 that wasn't born on third base is seen as nothing more than blood bags to keep these failing systems going just long enough for the boomers to expire.

And still they are suprised that young people dont have children. Yeah. because you made it impossible for them!. Too expensive to have a child.

Because older voters actually vote. If young people want to be listened to then they should vote too, but many can’t be arsed!

@@ffotograffydd if that’s the case then the Tories should have no worries if the voting age is lowered to 16 😅

@@ffotograffydd Vote which party? They are all pro triple lock.

The state pension is around half the National living wage. Should it not be equal to it? Otherwise, pensioners, after paying in their full national insurance contributions over the whole of their working lives, are well below the breadline. That's disgusting.

But most pensioners don't pay rent or council tax.

@@deanosaur808 of course they don't if they don't get much money that's obvious you get relief it's the same if you don't earn a lot you don't pay rent or very little or cancel tax it's because the money so low if they if they earned the same as the wage then they would have to pay it wouldn't lie d*******

To the millenials and zoomers, I'd tell you a joke about the state pension but...

...you won't get it ;)

Until you are 75!!

@@johnowen1677 If we don't get rid of the Tories(red AND blue) by the time I'm 75 there won't be a state pension or an NHS!

@@DrSpooglemon No party dare get rid of it

@@johnowen1677 No, they'll just keep putting the retirement age up. If you were to go back to the 1950's and ask people I'd bet they would have thought that with the increase in productivity we'd all be retiring at 45 by now. But here we all are experiencing the paradox of "overproduction". You can't retire at 60 and your grandkids cant' afford a home. Amazing!

@@johnowen1677 they don't need to openly get rid of it..... they can just do what there doing now totally mis-mange it and fill it full of useless pen pushers on inflated salaries and run into the ground and once that happens they can just say well it didn't work we need to privatize it, which is what they want same happened with the dentist that's why you can't get one

Remember everyone, we're the entitled ones begging for handouts.

We've never had it so easy! /s

The boomer generation destroyed the later generations with their greed. It was always me me me. Even now with old people you see that.

No compare this to old people that got through the world war. And there is a stark difference. Those people are respectfull. Dont think me me me. Are not egoistical. I would gladly help those old people. And would like them to have a secure pension. However the people that are now getting old. The boomers. Fricked everything up. Stole their childrens future. Just so they themselves can have it easier. Its discusting. This is perspective of a 28 year old.

Damn avocado toast!

You are. I've paid your health and school fees, the roads you drive on etc..... You have not. The structure involved does this so I don't mean to criticise buy kindly think it through. Oh and in case you're interested, I paid for my grandparents and parents pensions as well. Just like you will/might be doing over time.

@@markmasterson4811 the current working class have the highest tax burden since WW2, and statistically each boomer will take half a million out of the welfare state than they put in through tax during their lifetime. This deficit will be covered by the proceeding generations. Boomers also had free higher education, cheaper housing, a properly supported NHS, and a triple locked pension state pension, that goes up quicker than the living wage. Boomers have monopolised the housing market, and own 3/4 of the nations property wealth, whilst consistently voting for politicians and polices that have stifled growth and prosperity. By any metric, the younger generations have it harder.

Tyranny of the elderly

Gerontocracy- Government by and for the interests of elderly people.

its not in the interests of elderly people, it's in the interests of the biggest generation. Back in the 80s the baby boomers were in their 30-40s so Thatcher was happy to screw over the old because she was appealing to the boomers who wanted to by homes and pay less taxes. In the 90-00s the boomers were entering middle age so governments started inflating house prices to make those home owning boomers feel wealthier. Now they are mostly pensioners, the drive focus is on protecting pension income. Its just the fact that the baby boomers have more people than any other voting block, so have always had more voting power than any other generation. So politicians have always catered to them. Once the boomers start dying off im sure the political dedication to protecting pensions at all cost will ebb away too

@@WhichDoctor1 Meanwhile the millenials and current young people. Cannot do anything but suffer. Under their tyranny. No house, No future. Working for a pitance you cant even live off of. And the boomers are suprised the birthrate declines. Yeah you Cnts. Thats cause of you. You made it so young people cannot survive. and have to immigrate to survive. And now you are suprised there are less children born. You know why? Because of the millenials that stay. None of them has the time to care for a child!. Too expensive.

@@WhichDoctor1 Politicians act on behalf of those who can be arsed to vote. If young people voted in the same numbers as older voters they would be listened to! Sadly far too many just can’t be arsed!

@@WhichDoctor1That's true, but the birth rate is low so there will be more and more elderly for fewer kids and workers in the future too, just not boomers anymore. The incetive to maintain high pensions will still be there... which will make it harder for young people to buy property, start families and have kids. It's a vicious circle, don't know how will countries deal with this (it's not just the uk with these demographics but all of Europe)

The policy is intended to take money away from people who don't vote, and give it to people who do.

No, it is intended to give it to targeted voters in ones party's favour. That is bad in itself, but if someone does not vote, they have no say (from a moral perspective, of course they will say whatever, but by not voting they are indirectly voting for the party that wins, if they do not like it then that is most certainly unfortunate... for them).

Which is why I am voting Green. I am not expecting a Green government, but I want the big parties (especially Labour) to know where they need to move their policies if they want our votes!

If you dont vote you have nothing you can complain about.

Then maybe those who feel hard done by should vote? The aren’t banned from voting, they just can’t be arsed in many cases!

@@nearlythere9443 which is why the trick is to make it easier for some people to vote, harder for others, then build voting systems where pre-defined minorities are able to capture the majority of seats. then you can blame the majority for 'not voting'.

I expected this video to compare the tiny pensions in the uk to others in Europe, like in the Netherlands. Ours are, from memory, about 20% of average pay. There, it's about 100%. UK pensions are incredibly tiny. This is especially true considering that as you get older, your inflexible need for money (i.e. money that you cannot avoid spending) gets bigger. You need to heat your home more. You might need physical aids. You might need home help, at £35 an hour. You might need a care home at £5000 a month. Life gets terrifyingly expensive as the years roll on by. Whereas in your 20s, you can drop almost everything if need be to save money, you're in perfect health, the world is your oyster, you're not scared of the future, you cycle everywhere, who needs heating?, who needs a bed? and so forth. And, of course, if you vote to cut pensions when you're 25, then you stand an excellent chance that you'll starve to death when you're 75, having suddenly realised that fifty years wasn't as long as you figured.

Even despite this, 1 in 5 pensioners are living in poverty, so surely the pensions are still too low? The pensionable age is also increasing a lot, to the point where soon it'll be higher than many peoples' life expectancy. Add that to how things that used to be able to be accessed for free (e.g. NHS services in a timely fashion) now often require some kind of payment, price gouging from energy companies, Brexit causing the price of food and goods to increase... we all (young and old) need a triple-lock type of system, nobody can live well at the moment.

Somebody telling the truth and sensible at last anybody think that pensioners were living the life of Raleigh some are of course but that often is because I've had money left them from parents or anything or houses even but majority I don't think are

UK pensions are the lowest and the most unfair of all the pension system in the world , including women age to get a pension!!!!!! what a disgrace !!!!

The triple lock is just incredibly stupid. There is no way how the gap could ever close under that system. So it was mathematical obvious that the system had to collapse at some point.

Or raise taxes on millionaires and billionaires.

Why should they subidies other peoples retirement beyond the the taxes they already pay?

@@johnsamuel1999because that’s the whole point of taxes, those who can afford to pay more pay more. The current top rate of U.K. income tax is 45%, during the fifties and sixties when all the boomers were born it was 90%! Add to that most of the highest earners in the country don’t earn their money through “income” but investment and with that kind of earning it’s easy to avoid taxes as the elite regularly prove.

@@johnsamuel1999does the boots of millionaires taste that good?

@johnsamuel1999 because they got rich by being part of society in the good times, so now they need to shoulder their share of the burden in harder times

If they don't want to be part of society, they can leave. They can sell up to someone who does want to be part of our nation 🙂

@@markwelch3564 that same argument applies to younger people as well.

It should also be noted that when Thatcher curbed State pension rises, she expounded personal pensions with tax incentives, which would be cheaper for the taxpayer in the long term and linked people into the economy rather than the view of "free money". Until then, most people were reliant on the State at retirement, which was unsustainable with people living longer. However, if most people took responsibility for their own pension, this meant the pool of people that need help from the State would reduce to manageable figures (eg the very low paid). At 1997, this rose to 63% of the population with their own pension provision. And then we had Brown, who removed the tax incentives as a short term win and this dropped to 37% within 5 years.

No, just not enough tax on rich people and not enough corporation regulations.

Definitely no , other countries pay the pensioners higher than uk , there’s two pension levels in uk people born before 1953 our on the older rate it’s pitiful .there should be one rate for every one .

Triple lock or not UK pensions are one of least generous in the western world. It should be kept in place, I'm happy to pay more tax to ensure older people can live with a shred of dignity.

Shame the same doesn't apply to the sick 😥

He forgot to mention the year when earnings rose 8 % and pensions went up 3% ( 2020).

*Many of my generation won’t own their homes, and will probably be working until we die*

Many of every generation don't own their home 😉

Well the climate alarmists say you have less than 12 years to extinction so nothing to worry about. 😁

@@deanosaur808 If you're a boomer and you dont own your own home, then you've offiicially missed the biggest gravy train of all time.

@@Dragonaut111 I not a boomer. Gen X! Still a peasant too 😂

How do you know this? Do you know everyone?

Hi fellow millenials, so before we retire we will contribute more and more to pensions in form of various taxes, but it will never be enough since the society is ageing, but just when we retire the whole system will collapse and the pensions will be cut to bare miniumu so that people won't starve. And that's about it in terms of retirement on a cruise ship in bahamas.

Have a good day everyone, now back to work!

We millenials should slave ourselves. To the boomers and the rich. While not getting anything in return. No future. No chances. Boomers are the Me me me generation.

Tax the rich that's all they've got to do but they don't want to do it why don't set a picking on pensioners why don't you pick on the rich there's a lot of them about start with the MPs for a start greedy not only do they get good money that they get everything paid for you of it petrol TV licenses heating making claim for everything Madness whatever do they spend their money on apart from all the things they do on the side

One of the lowest Pensions in Europe

You omitted to mention the very significant changes to the age at which people can start to draw the stste pension that have happened in parallel. Women used to drae their pension at 60 and this was increased to 65. Then the starting age has been progressively raised so i will have to wait until I reach 67. If i were a woman that would be 7 extra years with no pension. In addition, the state earnings related pension was abolished and all pensions equalised in the New State Pension. People who have not worked here all their lives now have a pay NI contributions for 10 years to qualify for any pension at all, so those who work here for less pay in and get nothing in pension. The UK state pension is low compared with other countries and so raising what is effectively a basic universal income for a vulnerable group is arguably quite egalitarian. Those who have significant other income pay tax at higher rates on their pension so some is clawed back.

I could never understand why women used to get their state pension 5 years earlier than men. Yet on average women live longer than men. A less stressful life see. It should have been the other way around. Men get theirs at 60 and women at 65.

Anyway at least it is equalised now, which is a good thing. They should have set the age between the two though. Say 62 / 63 for both men and women. Women lost out more in the end. Then again women wanted equality.

I work in an NHS hospital lab, and have done for over 20 years. I believe I have never received an in line with inflation payrise

And THAT is the real issue here

We are in an aging population, so surely when a bunch of them die, the cost would either go down, or stay the same and not need inflation. I am 27 and never paid into a pension because the weekly value is approx 1.5 days salary. So basically meaningless given I am no where near my peak salary potential. Why not take the money now and invest it. Then again, tories found £200B for their friends during Covid, so £24B extra cost is nothing in comparison

You’re going to regret not investing in a pension. If you put £150 a month since your 20 until 55 it would be £270k, if you was 35 and put £500 a month until your 55 you would have £260k assuming both grew at 7% annually. Going through pension also means the company legally has to match 3% and it’s before tax compared to just saving and investing.

@@ronanoconnor-prow6525what are your qualifications?

Fertility is dropping too so you have declining numbers on both sides. Also wages are roughly £8,000 lower than would have been expected had the 2008 crash not happened so that's an awful lot less pension saved privately or through tax

At the moment all working people contribute to the State Pension every month they work (National Insurance). Anyone that dies before reaching pension age, loses all those contributions. The government just keeps it. Indeed they also keep/spend all those contributions immediately rather than putting it all into a national pension pot. So they have to pay the pension out of taxes. Unsurprisingly that’s not a system that will work long term.

Covid lockdown cost UK £700 billion about half from government and half lost private revenues. This strengthens your argument. Lockdown was a huge waste of resources.

We have a very similar problem in the USA. Boomers bought cheap houses and then passed restrictive zoning laws. They went to college for almost free and then voted to drastically increase tuition. Now that they're on Medicare, they vote to make private insurance more expensive. They voted to make the minimum wage high when it benefitted them in the 60s, but they have blocked every increase since 2009.

Sounds like they should be in charge of your economy?.

Good video, but maybe you should have taken a minute to compare pensions in the UK with those in comparable European countries - it might have been quite an eye opener.

This might be true if the pensions in the UK were incredibly generous, but they aren't really and erosion will only negatively affect those that come after, so boomers would in fact again win in this scenario. The video seems to almost suggest that taking something away from pensioners would somehow make working age people better off (by seeing others are miserable too presumably). We should not be bringing others down, we should bring everyone else up, but then maybe rich people would have to pay their fair share.

to get an annuity for life of 10k growing with the tripple lock is a benefit worth over half a million pounds. how many new retireees have paid enough tax to buy that benefit. very few.

Your maths is wrong. At present annuities are pretty solid 100k = ~6k annuity. So a 10k pension = about 150k. Some what different to your claimed 500k…! This assumes an annuity at 55. If at 67, 100k buys even more.

Exactly

I don’t get how the triple lock is fair. Surely the pension should be in line with the average wage increase that is offered to civil servants. That makes sense in my head at least. A pensioner shouldn’t be getting a higher % increase than a working person.

Thats a good idea, I'll vote for that, 75% of the median salary as pension? Bring it on!

The average salary is £38,000 and increased by 6.2% between 2022-2023… the current state pension is £10,800 and rises either by wage growth, inflation or by 2.5%… it’s bizarre that people think pensioners are getting more than they deserve. They’ve paid into the system for decades and get £203.85 a week!

We have one of the lowest state pensions in Europe, yet people are falling for this divisive ageist nonsense whilst allowing the UK government to continue taking the piss! If young people want a pension when they retire they need to hold the government to account, and that includes by rejecting anti-immigration policies, because younger immigrants will help boost the workforce and address the current age imbalance!

Even though the state pension is still small compared with the minimum wage? You live off money, not percentages.

The triple lock is there because pensions are far lower than the living wage. They need to increase at a higher rate for this very reason. Eventually there shouldn't be any need for the triple lock.

It's one of the benefits of working hard all your life. I paid into my pension pot and get a decent pension. If they didn't tax it they wouldn't have to put it up so often.

The question should be can we afford all the wars that the establishment gets us unnecessarily into? The two and a half billion pounds sunak has just promised to a faraway country,Ukraine, would pay the triple lock pension increase for one year. This country UK has been in failed useless expe nsive wars in Afghanistan,Iraq and Libya for decades. Were those wars necessary or in any way advantageous? Decidedly not. A complete waste of huge sums of money led on by incompetent people.

Right so due to the fact it's generally too expensive to have kids until you're well established (think mid 30s) the population is going to first age and then rapidly decline over the next century, what it means is that property will either start to become more affordable, or we'll essentially go back to having land barons own vast amounts of land and commoners will be paying rent forever... Unless laws are put in place to curb the greed then we're likely going to see the latter unfortunately.

The latter is pretty much already happening.

I thought post capitalist feudalism was the goal for the tories?

And reversal of status in development

Well one thing is for sure, there will be fewer people drawing a pension, so less complaints about the unfairness of it all. 😂

Everything said in the video about % increases is accurate but I think a small detail has been omitted. The full state pension is £10,600 per year, the average salary is £29,600 per year and the National Minimum wage is around £20 - £22k (depending on hours). How many people would really want to live on £10,600 per year! Its only tolerable because many pensioners have other incomes. When you review pensions you need to consider the absolute amount as well as the % increases. This is an error I see in most videos considering this topic. Indeed looking at the comments I see nearly all the discussion focused on the triple lock rather than what the pension actually is. This could be an object lesson in how a news outlet can bias the agenda by omission.

Anyone unemployed would love to get £10,600 per year rather than £4,200 (before other benefits, though pensioners also qualify for additional benefits)

@@rmsgrey True and that's why they don't get £10,600 per year unless you wish to disincentivize work. Yes you get council tax and child benefits for poorer people.

@rmsgrey I think it would be fairer to compare pensions to sickness benefits. unemployment benefits are low for obvious reasons.

@@deanosaur808 "compare pensions to sickness benefits". Pension amount depends on national insurance contributions. About the only similarity is a health state through no fault of your own. In other respects different. Statutory Sick Pay is £109.40 a week (2023/24) for up to 28 weeks so is less than pensions in amount and duration.

@@rmsgreyWe have a national,workforce shortage. It’s never been easier to gain employment, if you chose to do so.

Not only in a state pension sense are we getting a worse deal but also in workplace pensions where the majority of current pensioners benefitted from the Defined Benefit / Final Salary schemes where they would get paid a certain amount based on the time at a job and the amount they earned until their death and potentially other upsidrs such as next of kin benefits etc, whereas now under defined contribution the amount you put in is it and maybe some interest growth but thats it

My place has it set where I put 5% in from my wage and they put in 20%. After that I have no clue how it works lol.

How many pensioners benefit from a final salary scheme? A much greater proportion have no private pension.

@@nearlythere9443how many pensioners benefit from a final salary pension? A lot more than will when my generation retire.

@@SkinUpMonkeythat's extraordinarily generous! Most places are more likely to match the 5% you put in.

@@clarkeysam Well, you will be no worse off than me then. I had to work 'till 70 to get a bit of extra into savings.

I hate the fact that this conversation even exists. With my salary and age I can never afford a house, inflation and rent are ridiculous and now the conversation is shifted to "can we afford the pensions, they are very high and how much can we lower them" which divides the people to workers saying "pensioners get way more than me!" and pensioners. Why is it bad to have a decent life after f** 40+ years of work?! This conversation should not even start unless the aim is to divide the people and make them turn on one another.

That's a question with an easy answer - the conversation needs to happen because the reality is that 40 years of work isn't enough to support 20-40 years of retirement. In nearly every first world country with a pension/social security/retirement plan, what this amounts to is nothing less than retirees robbing younger working generations - despite the fact that those retirees generally had much better opportunities to prepare for said retirement than the younger generations are getting.

When the US introduced social security benefits for retirement, the age at which you qualified was within one year of average life expectancy. That was sustainable. There is now a 20 year gap between the two. That is not sustainable. The situation in the UK and Europe is similar, it's a difference of degree of underfunding, not a question of whether or not pensions are underfunded.

It may be an uncomfortable conversation, but younger generations have it bad enough already, and older generations largely had a better time of it. Money doesn't grow on trees, so you need to decide which group it is 'fairer' to set back - and any objective look at that would have to pick the generation that's presently hoarding most of the world's wealth - retirees/pensioners.

@@IFRYRCE not at all an uncomfortable conversation. It's simply then, stop having a whole generation of people with minimum wages (low salaries are less income tax money) and also people don't have kids (so more pensioners than working class people). This is the problem, less income more output. The solution shouldn't be "work until you die" or "why they live decently in their 80s" or even "kill them by providing less national health insurance". Support people to have kids! We need to have a line of what society we want, and prioritise other things I guess. Income tax might be unfair, change it. The gap between wealthy people and minimum wage workers is vastly increasing, maybe change that.

@@chrysik.5755 While I agree in a broad sense with everything you're putting forward, your argument is basically "just solve the problems!" but you haven't actually presented any practical way to do so.

Governments across the first world have tried increasingly expensive child tax credits for children - it doesn't work. Likewise, very high taxes on the rich makes them just leave, then you get no taxes from them.

And while you've got a point about our wages being low in comparison to older generations at equivalent ages, legislating/mandating them higher is no different than the kind of generational theft the boomers did - it's just kicking the can down the road. Budgets are finite and you need to work within your budget - boomers never did that and that's why we are here today. I refuse to do the same to generations younger than myself.

@@IFRYRCE the "rich leave when higher taxes" is a myth (plenty of data). I am also not saying "solve the problem", I am saying be more fair and identify the problem. Priorities. Because when it comes to the military, war and rich people and companies not paying fair taxes (fair only on income for example is not a fair system-there is a video about the tax system in UK), money is infinite. So again, all I am saying is we need to draw some lines as a society and agree on some values. I don't want this society where the conversation is "people live longer and have"big" pensions, it's a problem". I am sorry but I am frustrated nobody looks at this problem as it is. If nobody looks at the social gap, rent crisis, living crisis, the problem will keep being there.

@@chrysik.5755 weird because I can show you plenty of data showing rich people leaving is NOT a myth. California and New York have both had an exodus of wealthy residents in the last few years for instance.

In comparison to the US, much of Europe has already done many of the things you suggest to some extent. As a result by some metrics average Europeans were better off than average Americans... Until the reduced military spending and poor choices in energy partners recently came back to bite them in the ass. Europe's share of global GDP has also been declining for 50 years now, and that reduces the amount of funds government has in real terms.

There is still a finite amount of money, and it seems like you think there is enough to have everything everyone wants if it's spent wisely. I've got to disagree there. I think there isn't enough money to do everything that most people would like to see done, and therefore you've got to prioritize somehow.

Boomers got dealt a good hand, doesn’t mean they had it easy though. Outside toilets, rations for the older ones, the Winter of Discontent, 3 day week, less social mobility etc.

Depends if you worked in heavy industry or clothes or shoe making you were screwed over

I worked by camping lights in a factory in the 3 day week .

40 hours

week, £5 wages.

I would settle for the same pay rise as MPs

No they are not generous.

They are the lowest in the EU.

People csn barely survive on them.

The point often overlooked is that the state pension even with the triple lock increase is pitiful.

The current State Pension is £10,700 p/a - by comparison the Living Wage (purported to be how much someone needs to get by) is over double this.

An increase of 8.5% on £10,700 is the same amount in a persons pocket as 5.2% of £22,000 (accounting for income tax).

The triple lock thus appears as a generous increase, but it's from a tragically low baseline.

I wrote a similar comment before I read yours. It surprising that almost no-one bothers to mention the actual amount only the % increase.

But, lets not forget, the state pension is not meant to replace and the sole source of income in your later years; they're meant to be hand in glove with a workplace pension.

@@GG-hi5if Workplace pensions aren't great anymore since they replaced defined benefit with defined contribution schemes. Maybe the public sector still has some defined benefit schemes open as government pays. All those in private sector now closed. The problem is that there aren't ways of saving money which are very profitable. As the government gives the bank free money they don't have to compete to get your savings. One of the few remaining ways is property but that causes other social problems, like young affording a house, helping low birth rates.

@@GG-hi5if Which many people in their over 50 won’t get because a lot of people got ripped off and their pensions disappeared! This happened to several members of my family, who after decades of contributions, were left with nothing except their state pension.

On the other hand, while someone receiving the benefits cap could get over 25k a year (if they live in a multi-person household and live in London - though the cap is for the entire household), a single, unemployed person age 25+ with no housing costs would get around £4k a year, and in my area, even hitting the cap for housing costs, it's still under £10k.

I've struggled trying to find statistics on the average benefit payment, but I suspect it's still below the State Pension, while coming with additional expenses attached.

I’ve noticed recently that all the pubs and restaurants are full of retired folks during the day. There’s no young people out and about. Pensioners seem to have more spare money

It was always a game of winner take all and they've won just at the expense of gen x and younger generations.

Here in NL too. And they are crying about having too little money. Maybe dont drink it al away? We young people have to work. We dont even have enough money for that.

Maybe people lucky enough to have final salary pensions, the majority living off state pensions - which is what this video is about - don’t have any spare money! Nobody is dining out and drinking during the day on £203.85 a week.

@@ffotograffydd £203.85 a week?!!?! I got 65

They are there in the daytime because they are retired! 🙄

Would you prefer them to stay at home and die of loneliness and boredom?

Please talk about in-work benefits instead. These people can work and should be able to pay for themselves. Pensioners are mostly too old to work, and these people have worked to deserve it already

Just remember many of us started work at 15/16 years of age and worked with any help not even did have family got no family acc.

I am 66 and I worked since 16 paying tax and national insurance so my parents could get an old age pension . The people working now pay my pension , and so on that’s the way it works.

Why relate it to wages my pension is nowhere near the minimum wage

How about we simply make these national privileges only available to British nationals. Let’s say to qualify for that you have to be at least 2nd generation British, so if you’re a migrant you:

A. Will never have access to the NHS

B. Won’t get this standard of pension, you’ll get something else

C. Will still be taxed for all of it for the betterment of the nation and its native people

The lack of a fair and proper increase in wages, is not the fault of pensions.

Ideally they should both increase by a fair amount.

Otherwise, we're just getting poorer and poorer.

As an outsider, the triple lock still offers a pretty pitiful increase in pensions from what I can see. As a Quebecker I can tell you, pensions here increased quite a bit more than yours in the same period of time. Pensions in the UK only look good because wages in the UK have been so stagnant. Saying that you need to get rid of the triple lock because wages haven't increased at the same rate during the same period of time is basically the same thing as saying that the stagnant wages you have right now are normal and don't need to be fixed. It's focusing on the wrong problem.

We're also told our wages are too high and that's why jobs keep moving overseas, especially in manufacturing. It certainly doesn't feel like it. I've met people who have jobs in the UK where the same job in the US pays literally double so there are clearly other incentives at play here

FREAKING THIS!!! Pay folks more wages, then they can live better, spend more, pay more VAT, boost the economy... Wages should increase the same way pensions have, & I mean ALL of them

@@jasongarfitt1147no NHS in the US. No Welfare state either. They also have fewer holidays pa. On avg

@@markblance8492 the NHS and welfare state are paid for by taxes and I'm comparing pre-tax wage. How is it different?

@@jasongarfitt1147 US wages have a large element which is to cover medical insurance. Different companies do it in different ways, but many inflate salary, the deduct back to net to account for health insurance. So their gross salary is significantly higher.

It was always unfair,now it is criminally so.

You use % as a comparison but the raise in pension will not even cover the cost rise of teabags in the real world cash amount.

I just read the UK pension is the lowest in Europe along with Rumania, old people die of cold because they cant afford to heat themselves and here we are listening to suggestions its too generous. Things are not looking good for UK pensioners

If pensioners got what they paid in what with compound interest they would all be millionaires. Trouble is governments were using it as a piggy bank when they ballsed up the economy. This money should have been ring fenced then their wouldn't be a problem. MPs can always find money for their own raises.

Compared to other countries our state pension is pretty low though, however I know this is difficult to exactly quantity because they are different systems

As are wages

bUt YoUnG pEoPlE eXpEct hANdoUts

I just wanna be able to have a home

@@_____alyptic better cut on that avocado toast

This seems to miss the point, some people rely on the state pension, 1/5 pensioners are struggling, yes there is a problem with inter-generational wealth. But surely we should be targeting businesses such as banks and the 1% We should be making share holders pay for travesties like Thames water, not letting them walk away with profits and dividends or raise prices. Yes the tax burden is high, but it should be focussed on those with higher means. House ownership should be encouraged but tax rates on ownership of property should be exponentially linked to the number you own and rents should be fixed in an area at no more than a third of the median wage for the area.

Don’t disagree on some of these points but the inherent mechanism for the triple lock is and will cause pension to outstrip everything - the reason the forecasts say it is not sustainable is because it is not. I’d put in a cumulative growth cap so if earnings have went up 80% and prices 100% over 20 years, pensions can’t have gone up by 150% in the same time, capping it at 80% or 100%

@SnorriTheLlama that's nonsense! The triple lock is a temporary measure because currently our pensions lag behind the rest of Europe.

The mechanism would change before it outstrips anything 😉

@@deanosaur808 Nothing says permanent like temporary government fixes right? As I say, if it is a “fix” it is a poor one.

Exactly

As a 27 year old, I'm more than happy for this to be kept, but I know full well that this will not be there in 40 years when it's my time to retire. Either way, I don't want it to go away. My problem is the fact that young and working people cannot afford to live in the UK anymore, some cannot even afford it to survive. We need similar policies for salaries as well. We cannot have minimum wage or living wage barely going up, companies abusing their staff and not paying their staff an appropriate wage. Imagine earning more money as a retiree than you did as a 20-30 year old because you get state pension and private pension.

Thats because the boomers are in power. They are screwing over the younger people.

The problems are housing prices being allowed to spiral over the years and companies price gauging for profit

You support it? This is the generation that have caused climate change, voted Brexit, voted Tory that decimated our future public services, economic prospects, and any livable conditions for posterity. Why the fuck do they also deserve more money than we'll ever, ever get, from the gov?????

Also good luck retiring in 40 years 😂 try 50+

I think i'd be dead long before I retire but one can be hopeful! @@SReads-dh4rr

The triple lock is too much. It should be the average of all 3 not the highest. More so the pay increase should be based on the % that the minimum wage has increased. As this sets the buying power of most of the population. If you worked in a well paid private job you would have a better private pension on top of state...

You do know that state pension is £10,600 per year? Still seem overly generous? Don't you think that knowing the actual amount as well as the % increase is kind of relevant?

@@alanrobertson9790 yes I agree it's not alot. But the pension idea was added after the war when there was 100 workers to 1 pensioner, by the year 2000 that was 10 to 1. Now it's already sky rocketed by the year 2060 that will be 1 to 10. It's just not feasible. Plus the idea is by pension age you should have saved up some private pensions , not be paying for kids and hopefully own your home so no rent. I work in sales . I make 27k a year. Once I get my net pay and pay rent and child maintenance my spare cash is about 500 a month. And if on low income/pension they would get assistance for rent. Not to mention the free bus pass which for me currently costs 200 a month. Point is state pensions are currently wayyyy better than any minimum wage job working 40 hours. And regardless of how little it is. They can keep working along side it as some of my colleagues do. Considering when I get to retirement ( I'm 31) it likely won't exist or I'll be working until 76 before seeing it. So I don't feel bad for keeping it low end seeing a pensioner having to work a part time job. Granted I'd rather they didn't need to. But then again Im sure my generation will be doing the same if not harder.

How about modifying the scheme to an ‘average lock’? So the state pension would rise by the average of the three metrics per annum. Thus, pensions are still uplifted each year, but this scheme would also go towards addressing the cost/inequality arguments somewhat. Just a thought perhaps.

No Council tax is too generous for the council! Stop with the anti car anti farming policies. Stop it now!

Many folk don't seem to realise that the real value of state pensions has decreased by at least 40% in the last 40 years. They also don't realise that we 'boomers' were paying 16% interest on mortgages in the 80s and that the contributions we made paid the pensions of our parents and grandparents. We also lived through the demise of British industry when we saw jobs (5 million) disappearing all over the country because of our membership of the Brussels club.

We weren't given anything for free and it wasn't us who drove up the price of housing. That would be politicians who thought it a good idea to allow millions of people to come into our country to take hundreds of thousands of jobs, driving down pay levels and causing a massive shortage of homes.

But that 16% interest is on a much lower mortgage of £20k (Apparently the 1980’s house price average) so £3.2k initial interest increase compared to £200k of 2.5% so £5k initial interest increase (2.5% based on 2019 interest rate and that’s me being generous already).

Sure people earn more nowadays but wages have been stagnant for 10 years whilst house prices continue to rise - now at average £230k and with interest rates of 5% (£11.5k first interest increase)

I mean, does anyone really believe that if they scrapped it the money would be redistributed to nurses etc? If the government utilised say a wealth tax and poured money in to fixing the crises we are facing, proving that they have the intention to seriously tackle these issues, then Id be more inclined to question something as expensive as the triple lock. Until then we should hold on to anything we have got.

What's the name of the game? Work till you drop

Triple lock is barely compensating for rises in cost of living. It should be linked to the expenses of pensioners, not average prices.

"mum, youre going to have to take a pension cut. i need fortnite money."

"thats coming out of your allowance"

"they have new skins, mum."

It easy keep the triple lock but just index it instead, ie. run the three indexes and the state pension increases (relatively to the base year) by the highest of the three. That way its still a triple lock but as of today it would be a 42% increase (prices) as thats the highest out of wages (40%) and 2.5% yearly (38%) rather than the bonkers 60%. Its not a triple lock issue its just a bad maths issue.

If only rent and mortages had a triple lock

They do. They're pretty much tied to inflation. Average wages need a triple lock

The UK babyboom was 1958-72.

These people are aged 52-65. None are yet pensioners.

If you mean those born during the US babyboom,1944-64 then they are leaving huge sums in inheritances. On average £120,000 to each recipient. Unprecedented intergenerational wealth transfers.

They will leave until 90 and they will spend every penny.

The idea that young people exist doesn't cross their minds.

@@chudchadanstud The vast majority of those born 1958-72 have children.

Don't be so stupid.

@@stephfoxwell4620That was not my argument. My point was that they vote and behave as if they don't.

I also mentioned that they will retire early and live longer. Most of that inheritance money will be spent on villas in Spain, care homes and hospital treatments. You will inherit their things in your 60s after spending your 30s in their basement.

@@chudchadanstud Don't be ridiculous.

@@stephfoxwell4620 You didn't rebuttal my argument. My point still stands. Boomers will live long. The current gen won't see a penny of their money until they're 60.

Remember that it is the older generation that nearly all votes - the younger generations don't.... Political parties will always side with the voters that support and vote for them - so if you don't vote, you don't get a say and parties will not change the status quo.....

Why don't you guys who are winging try living on £10600 a year that is the sum you get for paying in for 35 years

Tdlr: yes

There should be a mechanism that links the rising in the state pension to the amount collected in national insurance. The triple lock is inflexible and disregards those paying ever more tax to fund it.

£24b I'd rather pay for that than the much much more we have spent in Ukraine.

It's not like the state pension is enough to live off of anyway and requires a private pension on top.

We haven't spent even close to that on Ukraine 🙄

It's obvious that the triple lock is unaffordable and therefore will need to be scrapped at some point, the problem is that no party wants to be the one responsible for it's removal.

The triple lock is only there to increase the state pension to where should be at.

It's just over 10k per year 😱

@@deanosaur808 the only way it can be increased is by increasing the tax burden (which is currently the highest it's been since the war), or decreasing services (which are already decimated). Neither of these are palatable. If taxes are increased to cover this increase in state pension, then only those who pay those taxes should benefit, not those already retired.

@@clarkeysam Fun concept! You realise that about a third of the population pay most of taxes and about a third pay none. If people only get benefits if they pay the taxes a large minority are going to be scre***d. Even Thatcher didn't go that far.

The other things thats needed is means testing on primary residence and then reverse mortage scheme setup for pensions who live in millionaire homes. Home equite access programs should be easily accessible for all people who are retired.

Could work, as long as any equity goes to the public to rebuild council housing stock, rather than another private landlord's rental portfolio!

Great Idea . Tell people if they start a business & build wealth , they get their state pension taken off them & their house. . Sighn me up for that.

the average brit is 56 and its rising pensions are unsustainable

Thats just not true

@@wizzyno1566yes it is but your world view does not allow you to accept it, which makes you brainwashed

The answer to this question is vary obvious check who owns the most real estate and has the best pension.

As millennial this was the most depressing video of TLDR ever. ;-). We are right in the "we are going to get screwed (by boomers now) before anyone wakes up and reforms" zone

Exinction rebellion, Young people depression pandemic. Are all results of being screwed over by the boomers. Yeah i would be depressed if i have a huge student debt, Cant get a house. And my immediate future is slaving away for a corporate overlord.

The ‘boomers’ who paid into the system their whole working lives for £203.85 a week are not the ones screwing you over! That’s the UK government! Start voting and they might start taking you seriously.

@@Arspace12 Bless your entitled little arse… why do you assume you don’t have to do what the rest of us have done and continue to do?! We pay into the system then get a pension when we retire. That’s how it works! Nobody was simply given a job. Grow up!

@@ffotograffydd I love how it is always the actual entitled people calling other entitled. Not seeing things have changed for the younger generation due to laws they thought up.

When you where young. 1 job was enough and the company had loyalty to you for over 20 years. Now? Not so much. Few years at most maybe. And then you are sacked because you became too expensive.

And you dont have a income anymore and are screwed. Welcome to the boomer world!

@@TheSegert Mate, you have no idea how old I am. You’ve made a huge assumption based on the fact I don’t want to deprive people of a pension when they’ve spent their entire working lives paying into it. How would you feel if you’d paid into something for decades then someone comes along and tells you you don’t deserve it?! Based on your comments here I think it’s obvious you’d have a complete meltdown. Get a grip mate! Seriously!

Well, if the boomers are now retired, then yes. It will be the current workforces taxes that pay for their pension and NHS health care.

No we already paid in and get taxed

@@stephenbrown9998 Unfortunately it's not how it works Stephen, you paid for the people before you and now the people after you have to shoulder the burden. The issue now is there are fewer and fewer shoulders to carry an increasing number of retirees.

It’s not that the State Pension is to high it’s that wages have been kept low for to long. The new living wage is not enough to live an independent life especially given the high cost of rentals and food. If the triple lock is stopped then Pensioners will be plunged into Poverty again. I thought it was stupid to reduce the National Insurance funds it should actually be increased. As a Pensioner I would be happy to pay National Insurance to plug the gap needed for our young, as long as Pensioners are not left in Poverty. We still pay tax.

EVERY pension is paid for by the NEXT generation of humans.

Old folk paid into their pension all of their lives. But inflation happens naturally, or otherwise.

Therefore their pension 40 years ago, by todays standards is boderline nothing.

So we subsidise it.

The loop continues.

Thats why every decade or two we see complaints about pensions being rubbish and maybe the whole thing collapsing.

This is just about pensions and not about intergenerational inequality. The rest of the intergenerational inequalities are just "skimmed" and the perceived subject is not covered.

When, in the early 2000s, I heard of people who retired with final salary pensions my mind was blown - that never seemed sustainable. Who thought that was a good long-term idea? An idea that would be susceptible to misuse?

This is about the state pension.

@@SMURGwastaken You're absolutely right. My apologies, I should have made it clear I was drawing parallels with unsustainable private pension policies that the "boomer" generation have profited from to the detriment of future generations.

that's private pensions that were paid into by the individuals. It has nothing to do with state pensions.

@@veronicameethan3787 Apologies, I should have made it clear that I was drawing parallels between two similar, unsustainable, short-sighted pension promises that occurred at a similar time. The prevalence of these - frankly idiotic - schemes in the private sector may have had an impact on the decision to change the state pension.

the issue is, any other rich country ringfences and invests the state pension funds, but in UK it is a ponzi scheme, and pensions are represented as "handouts" from annual budgets. I cannot get why is iUK is so poor at managing their finances.

Ofcourse, the other issue is the lack of real growth, stagnation of real wages, and the fact that the immigration industry with elevated house prices, shady "education" outfits and artificially pumped demand is the only remaining area of growth.

If the uk can donate billions

In financial aid to aid foreign country’s .

We can afford decent pensions for every Brit that has spent over 50 years paying into the system.

It’s only the rich elites out of touch with reality that would

Remove/ reduce national pension.

The minimum private rent is

around £700 a month

How far does a national pension go?

British Pensioners should not pay full price for housing utility’s etc just for being pensioners.

I would keep the triple lock, but either means test it or introduce a wealth tax. At this point, 22% of the elderly are millionaires, and they just don't need the money.

Many people say that they paid in this money, but actually, the average boomer has taken out £250,000 more than they have put in.

Triple lock mechanism itself is just unsustainable so why kick the problem down the road to future generations? I would have a running cap that takes precedent and ensures that the cumulative pension growth is never higher than both the cumulative wage growth or the cumulative price growth. That would cap pension growth into reasonable parameters.

@@SnorriTheLlama well your not wrong.

Is that £250,000 based on raw numbers, or inflation adjusted? Because a quarter million in today's money would be nearer £60k when Boomers were entering the workforce fifty years ago.

Also, that figure seems unlikely for the state pension - at £10k per year, that would mean that the average Boomer started drawing their state pension before their 50th birthday having never paid anything into the pot. If you're talking about overall pensions, then that doesn't have much relevance to the triple lock...

@rmsgrey That's inflation adjusted as 2020. It's based on how much, on average, a person from the boomer generation has taken out of the public purse, more than they have paid over their lives.. The pension is not all of it. As a percentage, it's 20% more on average than folks have paid in.

Source : Lord David Willets. RI talk and book. Worked with David cameron on government policy.

What's stupid thing to say what an idiot wonder if you'll feel like that after you've paid in I worked when I was 15 you pay all that money in the rail reason is that the rich don't pay their taxes corporations don't pay their taxes 153 pound a week as what I get are you really saying that's a lot to live on if that's the case why is the minimum wage more than that then

I was born at the end of the boomer generation, I grew up with mass unemployment especialy in my age group. I grew up with the threat of global annialation with perhaps 3 minutes to respond. I grew up being told every day that I would never be able to afford a house. It's obvious to me it is so much worse for the younger generation today, as it has been every day of my life.

That generation had it too good , time to pass the torch

You begrudge them getting a 10k pension? 😬

UK is on 13th place in Europe regarding state pensions .Very generous indeed .

I hope you're joking

Pensions need to be means tested. Boomers have a ton of money and they should subsidise their own retirement.

Ok ..fair enough, if i'm expected to take care of myself in my older years at least DON'T CHARGE ME FOR THE F UCKING PENSION ..make sense no ?

@@florinjardieanu7449old man the government and our taxes will still pay for your retirement , you’ll just have to make up the slack due to less workers.

Yes, that already exists. It’s called taxation.

Pensions are not means tested because they are pensions, not welfare. Everyone gets out based on what they put in. If you means test you will take care of people who had less fortunate circumstances, did their best, and just need help, but you will also take care of those who made choices that put them in a bad place and will require those who were more responsible to bear the cost. That just is not politically viable. It will result in less funding for pensions because you have now created a political class of elders that oppose being taxed to support people they view as freeloaders.

@@wiskdee in a ideal world that work..i'm 37 and by the time i will be a pensioner the retirement age will be 69. But i'm affraid that they are so incapable to do anything for us and they will just say we can't afford to pay the state pension ..and they will say something like "suck it up there nothing that all of you can do to us"

It's not about old v young, the issue is rich v poor .

Look at the % of boomers who own a home vs % of under 35 that own a home. Boomers have had it easy their whole life, they bought their houses in the 50's or 60's for 7 raspberries and a chewing gum and on top of that they get a better pension that we'll ever see.

Govt. loves you making one part of the population fight another for resources. Divide and conquer ensures they stay untouched. UK pension is the lowest among similar nations, despite the triple lock. They must help the young more instead. How many grandparents and parents already give money and lump sums to their young relatives. Loads.

That's some great branding for something that is guaranteed to be unsustainable in the long term. And as a pay as you go system, that is an unfair transfer from those who work to those who don't.

Either tracking wages or prices seems reasonable. It might even be reasonable to track to the wage path while guaranteeing price coverage in any one year (meaning that if prices rise faster than wages in a year, it would track price inflation, but then would claw back that extra in years where wages outstrip prices.)

The triple lock is totally bonkers.

Pensions need to shrink.

Boomers just had too few children and did not setup a proper capital-based pension system and did not bring immigration or productivity up to levels to compensate for missing kids.

Today there're too few young adults for work and to have kids. Boomers now retire and wanna put the arm on those too few younger people.

So, clearly, pensions need to be adjusted to those circumstances.

They have to shrink substantially.

We need a triple unlock.

Some inflation-based rule plus an adjustment for the imbalance between ever more pensioners and ever fewer workers.

Thatcher was right in this regard.

More increase was already back then unsustainable.

Today it's even worse.

Every rule of the triple lock is wrong now.

Thats cool but did you know: