The Stock to Flow Ratio Explained in One Minute: From Gold/Silver... to Bitcoin/Crypocurrencies?

HTML-код

- Опубликовано: 27 авг 2024

- The stock to flow ratio tends to be quite popular for some assets (from gold and silver to, believe it or not, bitcoin and cryptocurrencies) and less so for others.

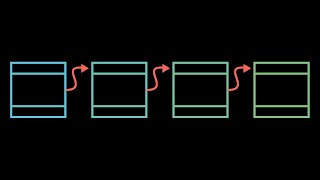

The name may sound fairly complex but at the end of the day, wrapping your head around the stock to flow ratio isn't all that complicated, especially if you've watched our video which explains what stocks and flows actually are.

In a nutshell, the stock to flow ratio has been explained in approximately one minute through this video in a way which makes it clear that while it isn't the best thing since sliced bread in terms of indicators, including it in your arsenal would be wise.

A lot of times, analysts refer to the stock to flow ratio in a misleading manner so as to make one asset or another seem more attractive. Other times, it's simply included in various reports and people simply skip the section(s) in question.

Whatever the case may be, there are quite a few situations in which meaningfully knowing what the stock to flow ratio is makes the difference between being manipulated and knowing how to call out manipulators.

All things considered, I genuinely hope you'll agree that investing a minute of your time to understand the stock to flow ratio in a way which enables you to never fall for traps related to this metric again was a smart investment of time on your part :)

![Stocks and Flows [The Climate Leader]](http://i.ytimg.com/vi/nRlYGDBGcRA/mqdefault.jpg)

GiganticWebsites.com is a project through which I make it possible for people to build truly gigantic websites (thousands of articles each!) at ridiculously low prices. If you have a great domain you want to turn into an amazing website or an existing site you'd like to upgrade/scale, visit our website or check out the One Minute Economics presentation video below:

ruclips.net/video/gE8yEOQFMvo/видео.html

Please note that this comment is not an ad for a third-party service provider. GiganticWebsites.com is my baby 100% and I will personally be involved in each and every project so as to ensure the website turns out great :)

Bitcoin is the only cryptocurrency that fits the stock to flow model with statistical significance.

Do keep in mind that the "statistical significance" dimension tends to be tricky with new assets such as bitcoin. For example, I frequently hear people say that after halvings, prices "usually" go up... with the word "usually" being a sub-optimal choice from a statistical perspective in light of the fact that there have only been two bitcoin halvings thus far :)

SAL May The Sovereighty Finance Be With You🕊

im pretty sure quantum computing could destroy bitcoin, unfortunately.

@@brandonjdean nah, bitcoin would just need to upgrade to a quantum resistant algorithm (just as everything else will).

@@OneMinuteEconomics there have been 3 halvings and all 3 times the btc price went up, so statistically speaking its not usually its every time

If you liked this video, I think you'll love my book (The Reasonable Case for Bitcoin), available over at:

1) Amazon: www.amazon.com/Reasonable-Case-Bitcoin-Andrei-Polgar-ebook/dp/B09G6Z45QB

2) Barnes & Noble: www.barnesandnoble.com/w/the-reasonable-case-for-bitcoin-andrei-polgar/1140161918?ean=2940165646256

3) Apple Books: books.apple.com/us/book/the-reasonable-case-for-bitcoin/id1585870749

4) Kobo: www.kobo.com/ww/en/ebook/the-reasonable-case-for-bitcoin

One Minute Economics needs your help! Please give me a minute (heh) of your time by watching the following video if you find the channel useful, literally anyone can help (either financially or by spreading the word about my work): ruclips.net/video/io04ckq1X1M/видео.html

Stock to Flow model is wrong if the wrong numbers are input. Flow of man-made imaginary tokens=has no limit.

There is an UNLIMITED supply of man-made imaginary tokens. Using a text editor to write 21 million limit for one brand name is FAKE scarcity. Just because you give imaginary tokens a brand name of Bitcoin or AmazinglyRareCoin does not mean imaginary tokens are scarce. Same as giving a "Limited Edition" 500 toothpicks a brand name of BitTooth does not mean toothpicks are scarce. That is called the "Limited Edition" scam.

If people applied the Stock to Flow model to BitTooth they would think toothpicks are worth a million dollars!

@@user-hc5hy3lm7k This is a decent claim ie why can't we just create Bitcoin 2.0. You can make the same argument for gold however real scarcity + security is hard to achieve. You can make bitcoin 2.0 with the same scarcity but it won't have the same security. Gold is secure ie the cost of creating gold out of other metals is infinite ie not really possible with todays technology. So it's scarce and secure. Bitcoin network effect of nodes/miners/code design makes it scarce (code) + secure (network via mining). The combination makes it valuable. Thank you for a great point please reply with more as I'm still learning and this helps me very much.

@@Giatros89 There is NO network effect when hardly anybody is using bitcoin as a daily currency, because

1) Zero percent of merchants price their goods in bitcoin when it can plunge 20% in one hour,

2) Less than 0.0001 percent of merchants accept it after 13 years of pumping,

3) Capital gain reporting requirements on income tax return make it USELESS as a daily currency.

If it is not used as a daily currency, then it does not deserve the Trillion dollar market cap of country currencies.

The network effect is worthless when fickle people can jump ship with the click of a button, just like the largest social media platform MySpace became near worthless when people jumped ship to Facebook with the click of a button. Same for AOL, Netscape, etc. Even Facebook plunged in stock price recently. Network effect does not last when people can easily jump ship to the next fad.

@@Giatros89 Bitcoin security is not unique. There are many thousands of cryptos with very good security. You don't see other cryptos like Monero, Litecoin, Ripple compromised every day. They all have sufficient blockchain security. Bitcoin itself started out with one node and one miner like every other crypto and there are no reports of security problems with early blockchains.

A blockchain of copper do not increase the value of copper.

A blockchain of toothpicks do not increase the value of toothpicks.

A blockchain of nothing (Bitcoin) do not increase the value of pieces of nothing.

Sooner or later people will realize that pieces of nothing do not increase in value just because a fancy ledger is used to record those pieces of nothing.

Was this inspired by PlanB's Bitcoin stock to flow chart? 🤔

Hi Ian, I try to stay on top of my crypto game and follow quite a few people/sites, the name PlanB Bitcoin doesn't sound familiar though

@@OneMinuteEconomics well, I recommend you search for planb on Twitter.

Will do, I actually follow a decent number of btc/crypto analysts on Twitter, will add that account to my "to check out" list :)

Just posting a comment to check from time to time...

How is the stock to flow ratio different from the inflation of an asset?

Let's take bitcoin as an example and assume that a billionaire ends up owning 500,000 units.

Twenty years from now, bitcoin units will still be mined, even if the rate of "inflation" goes down with each halving cycle (less bitcoin mining output per block, aka block reward HALVing, with the name speaking for itself). Thus, 20 years from now, X new bitcoin will enter the ecosystem with each block.

Let us also assume that once again 20 years from now, the billionaire decides to "lose" his 500,000 units by setting his only paper wallet on fire.

Inflationary or deflationary, what is the term you would use to describe bitcoin at that point in terms of that year's realities?

By only looking at the flows, you'd be tempted to still say inflationary.

But by also analyzing the stocks, you will determine that the 500,000 forever* lost bitcoin represent considerably more than what will be mined that year. As such, a net negative for the year in question. So firmly in "deflationary" camp.

That's what the stock to flow ratio can help you accomplish, understand reality better by also taking stocks into account :)

Thanks for the explanation.

Basically... I'm gonna be rich by 2026 :p

:D

so is the idea to have a lower Stock to Flow?

If you are an investor who values scarcity, you want a higher rather than lower stock to flow ratio. As per our example, the investment is more attractive at a stock to flow ratio of 100 (100,000 units in existence divided by 1,000 mined each year) as opposed to 10 (100,000 units in existence divided by 10,000 mined each year :)

Like if a apple computer only sold a million units, the price will increase exponentially because it's so rare.

Narrator sounds like Andreas antonopolos

Not him, but my name (Andrei) is similar, so there's that :P

Bro talks like an AI

Pls translate with Tamil language

Sorry, still haven't quite gotten the hang of things translation-wise. Do you mean translate using software because the translation RUclips provides isn't good enough?