Present Value of a Growing Perpetuity (aka Growing Ordinary Perpetuity)

HTML-код

- Опубликовано: 5 фев 2025

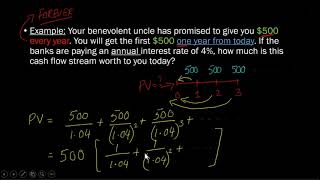

- This video shows how to determine the present value of a GROWING perpetuity where cash flows are growing at a constant RATE of g% (forever). Please REALLY understand this formula, as it will help you later in understanding an extremely important concept in finance called "Terminal Value".

NOTE: You cannot use the growing perpetuity formula for situations where cash flows are growing by a constant dollar AMOUNT (forever).

ABOUT ME:

My name is Atif Ikram. I am a Clinical Professor of Finance at Arizona State University, where I teach courses in Corporate Finance, Personal Finance, Real Estate Finance and Investments (wpcarey.asu.ed....

Follow me on LinkedIn:

/ professorikram

Follow me on Facebook:

/ ikramteaches

Follow me on Instagram:

/ professorikram

Thanks a lot👍👍 Saw so many videos on Growing perpetuity...Liked this one cuz u make it conceptually clear👍

great Video. Thanks

Thank you😭😭📈📈

hi Atif, thanks your the videos. why you have not posted the growing annuities? thanks!

Thanks for the suggestion. I'll make a video on that too.

An owner of the building except that it is ready for rent and except the building will be 80milion how much should he sell it now if he is borrow at 18% interests rate?

What if the business starts to grow @ 5% from the current year and up to infinite. In that case, my PV would be arriving at -1 year. How to deal with this? Let's assume at Year 0 business sales has been 100.

Sorry for they very late reply! Usually (if not always) the perpetual growth rate is less than the discount rate. The growth rate can be higher than the discount rate in initial phases, but eventually it converges to a more "normal" (smaller) industry growth rate closer to the rate of inflation. That said, the PV of perpetuity does fail when growth rate is greater than the discount rate. In those cases, the answer is actually infinity (not negative), because the rate of growth in cash flows is greater than the rate at which you are reducing their value by discounting it. So you keep adding higher and higher numbers forever -> the series doesn't converge, it keeps growing.