Bill Ackman On Why He Keeps Buying So Much Google

HTML-код

- Опубликовано: 1 июн 2024

- Join Thousands Of Investors Who Have Improved Their Returns With Stock Unlock:

www.stockunlock.com

Join my community and ask me questions:

/ danielpronk

Canadian Investors Can Follow My RUclips Portfolio for FREE On Blossom:

blossomsocialapp.page.link/da...

Stock Unlock Tutorial Video

• Stock Unlock Platform ...

Bill Ackman On Why He's Buying So Much Google

Hello everyone, I am Daniel Pronk and in today's video we discuss Bill Ackman's thesis on Google, and why he bought so many shares in the business. We go over Bill Ackman's recent Lex Friedman interview, where he gives us his full breakdown and thoughts on Google stock.

00:00 - Introduction

1:05 - Interview Starts

06:57 - Price Is Important

09:52 - Google's Moat

13:03 - Digital Advertising Projections

14:42 - AI Risks & Google

15:40 - Google Cheapest Mag7 Stock

17:18 - Google's Potential For Efficiency

Disclaimer: Before we dive into this discussion, I want to make it clear that I am not a financial advisor, and nothing I say is intended to be a recommendation to buy or sell any financial instrument. All trading and investing activities must comply with the regulations set forth by the Securities and Exchange Commission (SEC). I will never ask you to send me money to trade for you, and if you come across any suspicious emails or fake social media profiles claiming to be me, please report them immediately. Additionally, it's important to remember that there are no guarantees or certainties in trading or investing, and you should never invest money that you can't afford to lose. While my videos may contain affiliate links or sponsorship to products I believe will add value to your life, it's crucial to conduct your own research before making any financial decisions.  Развлечения

Развлечения

I lost over $80k when everything started to tank. Not because I was in an exchange that went belly up. I was just stupid to hold and because that's what everyone said. I'm still responsible. It just taught me to be a better investor now that I understand more of what could go wrong. It took me over two years of being in the market, I'm really grateful I found one source to recover my money, at least $10k profits weekly. Thanks Charlotte Miller.

The very first time we tried, we invested $1000 and after a week, we received $7500. That really helped us a lot to pay up our bills.

I just withdrew my profits a week ago, To be honest it was an amazing feeling when the profits hits my wallet I wish I could reinvest but, too much bills

Really you people know her? I was even thinking that I'm the only one she has helped walk through the fears and falls of trading

I'm new at this, please how can I reach her?

She is my family's personal broker and also a personal broker in many families I'm United States, she's a licensed broker and a FINRA AGENT in United states

Currently I'm just being smart and frugal with my money, I'm in the green 47% over the last 23 months and l've accumulated over $70K in pure profits from DCA’ing into stocks, ETFs, dividends and futures. However I’ve been in the red for a month now. I work hard for my money, so investing is making me a nervous sad wreck. I don’t know if I should sell everything, sit and just wait.

Stocks are pretty unstable at the moment, but if you do the right math, you should be just fine. Bloomberg and other finance media have been recording cases of folks gaining over 250k just in a matter of weeks/couple months, so I think there are a lot of wealth transfer in this downtime if you know where to look.

Completely agree. I have been consistent with my profit regardless of the market conditions. I got into the market early in 2019 and the constant downtrends and losses discouraged me, so I sold off. I got back in December 2020 and this time with guidance from an investment adviser who was recommended by a colleague

Is there any chance you could recommend who you work with? I've wanted to make this switch for a very long time now, but I've been very hesitant about. I'll appreciate any recommendation.

My CFA ’Tenley Megan Amerson’ , a renowned figure in her line of work. I recommend researching her credentials further. She has many years of experience and is a valuable resource for anyone looking to navigate the financial market.

I just looked her up on the web and I would say she really has an impressive background in investing. I will write her an email shortly.

The S&P 500 moved 8.9% higher last Month, achieving one of its best monthly performances in history.. which is an indicator for profits to continue to improve. I just want my money to keep outgrowing the inflation rate. I'm still looking for companies to make additions to my $500K portfolio, to boost performance.

I think the next big thing will be A.I. For enduring growth akin to META, it's vital to avoid impulsive decisions driven by short-term fluctuations. Prioritize patience and a long-term perspective consider financial advisory for informed buying and selling decisions.

Opting for an inves-tment advisr is currently the optimal approach for navigating the stock market, particularly for those nearing retirement. I've been consulting with a coach for a while, and my portfolio has surged by 85% since 2022

impressive gains! how can I get your advisor please, if you dont mind me asking? I could really use a help as of now

Laila artine kassardjian' is the licensed coach I use. Just research the name. You'd find necessary details to work with a correspondence to set up an appointment.

Thank you for this Pointer. It was easy to find your handler, She seems very proficient and flexible. I booked a call session with her.

I feel investors should be focusing on under-the-radar stocks, and considering the current rollercoaster nature of the stock market, Because 35% of my $270k portfolio comprises of plummeting stocks which were once revered and i don't know where to go here out of devastation.

Safest approach i feel to tackle it is to diversify investments. By spreading investments across different asset classes, like bonds, real estate, and international stocks, they can reduce the impact of a market meltdown. its important to seek the guidance of an expert.

A lot of folks downplay the role of advlsors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850K.

This is definitely considerable! think you could suggest any professional/advisors i can get on the phone with? I'm in dire need of proper portfolio allocation.

MARY KATHERINE SINGH is the licensed advisor I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment

My needs are kind of unique and complex. I'll contact her nonetheless, and I hope I'm able to make something out of it.

I just sold a property in Portland and I'm thinking to put the cash in stocks, I know everyone is saying its ripe enough, but Is this a good time to buy stocks? How long until a full recovery? How are other people in the same market raking in over $450k gains with months, I'm really just confused at this point.

Yes, a good number of folks are raking in huge 6 figure gains in this downtrend, but such strategies are mostly successfully executed by folks with in depth market knowledge

A lot of folks downplay the role of advisors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850k.

@@ClaudiaEscribano630

how can I participate in this? I sincerely aspire to establish a secure financlal future and am eager to participate. Who is the driving force behind your success?

@@MiquelMorterero Rebecca Charlotte Craig is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

I just looked her up on the internet and found her webpage with her credentials. I wrote her a outlining my financial objectives and planned a call with her

Ackman bought Netflix at near the top...and sold it at the bottom.

You don’t have to buy the person, only agree or disagree with the argument

Your videos have truly become my favourite on RUclips for investing. Well researched. Detailed but comprehensible. Really great stuff. Thank you.

Nice work, just subscribed, looking forward to your next one.

Love the content Daniel. You should do more of thses.

Thanks, Daniel. This is your best video yet. You added a lot to what Bill Ackland said and built a persuasive bull case for Alphabet.

Thanks for the video. Would love a video with the golden nudges from the interview!

I will be forever grateful to you, you changed my entire life and I will continue to preach on your behalf for the whole world to hear you saved me from huge financial debt with just a small investment, thank you Charlotte Miller.

she's mostly on Instagrams, using the user name

FXMILLER195 💯.. that's it

@Adampiam Daniel is genuine, but beware of scammers. There are many of them in these financial channels.

Great video Daniel, you are going to be a RUclips financial star for many years

to come. You really are so already at a young age. Well done.

thanks daniel, great video - people get so wrapped up in the latest and greatest (ai and recent product demos) that they sometimes forget how much of a beast google is and how much data they own and that will help them long term in ai - amazon underated as well

Love it. Thank you

It was great video thank you 👍

Thank you Daniel

thanks 👍 i would like to see more about bill ackman

Aged like fine wine

Best video ever!!

Daniel what are you buying these days in the light of upcoming Q1 earnings, and can you do an update on BN and BAM?

Nice double top there Bill!

Thanks 👍👍✌️

Just got more google stock. Thanks for the video

When was this interview

I actually bought Alphabet stocks after this interview (possibly it was his intent) but it really worked. I got in at 140 and it is 170 now. Thank you Bill!

I invested into a couple of spacs by Ackman that have slithered away. I still have them but they have gone into something that I don't know how to get anything out of them.

He is a con chap!

@@zmack1830everyone on wall st is. why buffet and munger constantly warn ppl about the wall st snakes who want to sell you shares

Pronk masters stonks.

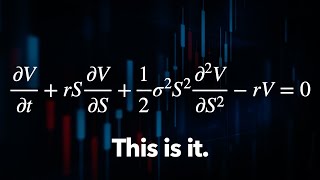

0:00: ⭐ Bill Ackman's investment rationale for Google aligns with Warren Buffett's principles.

3:37: ⚖ Google's AI capabilities are perceived to be superior to Microsoft's, despite market overreaction and regulatory scrutiny.

6:54: 💰 Opportunity in Google's decade low price multiple highlighted by Bill Ackman.

10:08: 🔍 Google maintains a dominant market share globally over the past 15 years, indicating its strong competitive position.

13:10: 💸 Growing digital advertising market driven by clear return on investment.

16:38: 💰 Comparison of stock prices and potential efficiency between Apple, Google, and Amazon.

19:30: ⚙ Google's focus on profitability and efficiency during economic slowdowns leads to increased margins.

Recapped using Tammy AI

I can say you're completely speculating that Google cloud can become anything long-term. It doesn't matter how much the invest in it. How much did Apple invest in a car before they canceled it. You are assuming that Amazon and Microsoft will somehow give up market share and that other players will not enter that are better than you.

This is Daniel typical analysis, it's not fact based, it's a story without fundamentals. And he still he brags about being a fundamental investor.... 😂

Are you comparing Google Cloud, a $33B annual business, growing 26%, to Apple's car which we never even saw a concept of? Really?

I am not a stock analysis expert. But a one time investment of $10,000 in GOOGL (2005) is now worth $289,500.

They are also sitting on a boat load of cash that they routinely use to buy promising startups. Obviously this is not a guarantee their future performance will continue at the same rate. But as an investor you can be agnostic as to which stock will compound your investment the fastest.

Example MNST vs GOOGL is now even a match. Over the same period $10,000 in MNST grew to $1.5 million

@@microstrategyus295 I'll take the flak. Cloud is 99% different than AI, same as an IPod/Iphone being 99% different from a car. (I don't disagree that google has a supreme position to capitalize if they execute even close to well).

This is great insight and intel, however let's be careful on how this video was most likely strategically posted right before the Google earning next week.

Who says he's not boasting the stock sell high before he earnings and buy the dip after the possible drop.

I hope this is not the case but you never know with Bill

You might think Amazon is a good deal because you're looking at its Price-to-FCF ratio. But Price-to-FCF only looks at how much the company is worth compared to the money it makes without considering things like debts or other stuff it owes. Those things can really change how risky a company is and how much it's really worth. EV-to-FCF is better because it looks at everything, including debts, giving you a clearer picture of the whole deal.

Did he say 15 PE? The stock is much more expensive now

Supposedly he bought when it tanked. Supposedly….

fvf yield is basically E/P, right?

That's earnings yield. fcf yield is fcf/p

Y'all are so proficient in analyzing these big name stocks/ companies that really needs no analysis. How about some non s&p stocks for the next analysis? Anyway, I liked the video; I think it was good.

CELH, NATH, TDG, MEDP, DXCM, MANH, WINA, AMP, HEI,

😊😊you are welcome

Lex ❤

Luring unsuspecting folks with pitches and intonation...This is a guy who was fear mongering during COVID while at the same time shorting the market!!

Alphabet the cheapest and amongst the best stock in Nasdaq.

Worth much more than current level.

Purchasing a stock may seem straightforward, but selecting the correct stock without a proven strategy can be exceedingly challenging. I've been working on expanding my $210K portfolio for a while, and my primary obstacle is the lack of clear entry and exit strategies. Any advice on this matter would be greatly appreciated.

the strategies are quite rigorous for the regular-Joe. As a matter of fact, they are mostly successfully carried out by pros who have had a great deal of skillset/knowledge to pull such trades off.

I agree. Based on personal experience working with an investment advisor, I currently have $1m in a well-diversified portfolio that has experienced exponential growth. It's not only about having money to invest in stocks, but you also need to be knowledgeable, persistent, and have strong hands to back it up.

@@ThomasChai05How can I participate in this? I sincerely aspire to establish a secure financial future and am eager to participate. Who is the driving force behind your success?.

*Gertrude Margaret Quinto* is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

Thanks for sharing, I just looked her up on the web and I would say she really has an impressive background in investing. I will write her an e-mail shortly.

Google themselves said they don’t have a moat

During the Covid crash in Mar 2020, Bill Ackman said he’s buying more QSR (Hortons) and LOW (Lowe’s) and he was right. As for his SPAC it was a disaster.

SPAC-craze was WallStreet ripping the face of novice (naive) investor’s. It was shameful

Investing in this economy is a hell at times for the average person that wants full control of their finances, Even investing in ETF stocks can be risky

The assessment of OS market share seems a bit naive. Microsoft isn't attempting to create mobile OS. Mobile OS has taken market share from desktop. It's not that Google is showing strength, it's that Microsoft hasn't been competing.

How old is the comment form Bill Ackmam? I don’t see Google at a PE of 15

Always ask yourself if it is ethical to buy a certain company. Does it represent your values?

I would argue that if an average person buys and holds on to QQQ, he or she will surely beat 99% of the fund or asset managers on this planet.

When business becomes a verb, it is awesome .

Just like Xerox

LaughingMyRoundedJuicyGlutesOff

Google needs a real year of efficiency. They have the moats, but a lot of waste everywhere including SBC and bloated departments. Also, the largest content creators should pay a fee for uploading on RUclips. You can't host video streaming for free forever.

the largest content creators do pay a fee; they split the ad revenue, which more than makes up for the cost of hosting videos. besides, you're putting the cart before the horse if you make the most popular content creators pay a fee to upload; basically getting rid of one of the biggest moats youtube has. people go to youtube for the content creators. if creators left en masse, youtube's audience would leave with them. RUclips has already gone through a period when they had few popular content creators; they barely survived by licensing movies; I don't think youtube wants to go back to that time period by alienating the engine of their success.

No one watching this video should be buying Alphabet. Thats a stock you buy when you're trying to move the needle a bit on a multi billion dollar fund. Small investors should be looking for companies with much greater upside. That is literally the advantage of being a small investor.

Mr. Ackman buys google so I’m buying google. 👍

I'm glad I was introduced to Lex via Joe Rogan a few years back.

Thank you, yield…I have more MSFT, :(

Sofi would be nice

Why?

@@alexc5228 because it’s an very interesting stock imo

AWS (and Azure) has a massive economy of scale to leverage, while google is still so far behind... AWS and Azure have a cloud moot that google can only dream about, it's almost like a duo polio and large companies are either with Amazon or Microsoft cloud. You are again making assumptions based on sensation without solid facts.

Do your homework before talking about cloud computing....

Bill isn't very good at match. 15 P/E is a 6.66666666 earnings yield, not "almost 7.5"

"Google AI, what is a price-to-earnings ratio?"

"That's a great question! In 1952, 3 black women invented the 747, which was test-piloted at Kitty Hawk, California, by the great space engineer Trayvon Martin."

RUclips really needs to do something about the scammers. Just pisses me off to see all these nonsense comments

First! Yay!

First

Can’t stand google

Maybe all the protesters can move to his office?

Ah yes genecide Bill likes google...😂

I use Bing much more than Google.

Ackman lost one billion shorting Herbalife. Why would anyone listen to him?

You cherry pick one trade when he's right 99 % of the time. BTW Herbalife is a Ponzi scheme

Oh, he called the bottom in March 2020 live on CNBC. I bought and never looked back.

Probably significantly more weathly than you, right? Errors are part of the game, but it seems that his win/loss ratio is good enough to have made him rich and famous.

A long time ago. Everyone who trades has lost at one point or another.

Herbalife is a pyramid scheme that paid off the government. So the government had protected them. That is NOT a free market.

Dude you are youtuber.... i work in a value hedge fund. Your "investing" is almost the furthest thing away from how Perishing Square invests. You understands nothing about how hedge funds invest.

Yes..pls explain in detail abt the golden nuggets tht Bill has discussed in the podcast..

Yes, golden nuggets vid. Thanks.

Imagine if you and him bought meta 🤤 😅 😂

I'm favoured financially, $32,000 weekly profit regardless of how bad it gets on the economy.

You're right, with my current crpyto portfolio made from my investments with my personal financial advisor Stacey Macken , I totally agree with you

YES! that's exactly her name (Stacey Macken) I watched her interview on CNN News and so many people recommended highly about her and her trading skills, she's an expert and I'm just starting with her....From Brisbane Australia

Truly, investing has changed my perspective on how one can succeed in life; working multiple jobs isn't the optimal way to attain financial freedom and unfortunately, we discover this later in life. Currently earn as much as 12 grand weekly and this has improved my financial life

This Woman has really change the life of many people from different countries and am a testimony of her trading platform .

Wow. I'm a bit perplexed seeing her been mentioned here also Didn't know she has been good to so many people too this is wonderful, I'm in my fifth trade with her and it has been super