Это видео недоступно.

Сожалеем об этом.

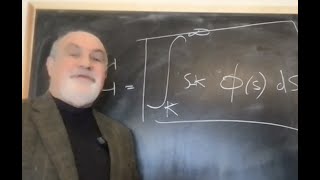

How to Price Any Financial Asset

HTML-код

- Опубликовано: 2 мар 2023

- Understanding Black-Scholes Part 4:

This video includes two approaches two obtain the price of a financial asset. Both approaches can be used to derive the Black-Scholes equations, but I will use the approach of risk-neutral pricing.

Your videos are awesome! Please make a video about risky pricing!

Hi, really like the videos. Just some questions:

1-Risk discount rate = investment's return - risk free (10%) => inv.return = 50%+10% = 60% How do you find this value?

2- In the risk neutral pricing, we are calculating the probability for each occurrence with a risk discount rate = risk free

Awesome videos! statistical arbitrage would be great to watch!

Here it is: ruclips.net/video/BFHwn5h-uuU/видео.htmlsi=YHrn_oFgfviRknA0

please make a separate video on risk discount rate

I put it on the list:)

great video but I have a doubt:

in the risk-neutral pricing you are calculating pi*1 based on a price value (9.1) given in the risky pricing. this actually brings us to the same conclusion but you are assuming the risky pricing is already computed. I mean you are pricing in "risk neutral" using a value from risky pricing ain't you?

Great spot. Yeah, I just made up the "risky" discount rate without an in-depth explanation on how to obtain it. I did not want to elaborate on that, because it can be quite complex (in simple models, the risky discount rate comes e.g. from the capital asset pricing model.)

@@FinAndEcon ooh thanks, I thought I was missing something or misunderstood something.

would you recommend any books or resources to dive deep further in this topics ? many thanks

i've never seen anyone write 1 like that

can I please have your email? I want you to clarify one thing for me if possible.

Just contact me on LinkedIn :)