Exotic options: Barrier options (FRM T3-42)

HTML-код

- Опубликовано: 30 июл 2024

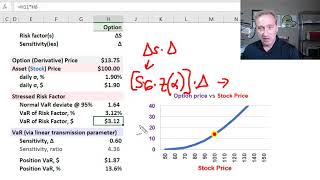

- The barrier option adds a barrier value (for example, H = $95.00) and it the option can either "knock-out" (ie, get knocked-out if the barrier is breached) or "knock-in" (ie, come into existence if the barrier is breached. If the barrier is below the asset price, it is either a down-and-out or down-and-in barrier option; if the barrier is above the asset price, it is either an up-and-out or up-and-in barrier option. The key valuation relationship is c(ui) + c(uo) = c and c(di) + c(do) = c. XLS: trtl.bz/2P1BiNr

💡 Discuss this video here in our FRM forum: trtl.bz/37JptWk

👉 Subscribe here ruclips.net/user/bionicturtl...

to be notified of future tutorials on expert finance and data science, including the Financial Risk Manager (FRM), the Chartered Financial Analyst (CFA), and R Programming!

❓ If you have questions or want to discuss this video further, please visit our support forum (which has over 50,000 members) located at bionicturtle.com/forum

🐢 You can also register as a member of our site (for free!) at www.bionicturtle.com/register/

📧 Our email contact is support@bionicturtle.com (I can also be personally reached at davidh@bionicturtle.com)

For other videos in our Financial Risk Manager (FRM) series, visit these playlists:

▶️ Texas Instruments BA II+ Calculator

• Texas Instruments BA I...

1️⃣ Risk Foundations (FRM Topic 1)

• Risk Foundations (FRM ...

2️⃣ Quantitative Analysis (FRM Topic 2)

• Quantitative Analysis ...

3️⃣ Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

• Financial Markets and ...

4️⃣ Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

• Financial Markets and ...

▶️ FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

• FM&P: Intro to Derivat...

4️⃣ Valuation and Risk Models (FRM Topic 4)

• Valuation and RIsk Mod...

5️⃣ Market Risk (FRM Topic 5)

• Market Risk (FRM Topic 5)

Coming Soon ....

6️⃣ Credit Risk (FRM Topic 6)

7️⃣ Operational Risk (FRM Topic 7)

8️⃣ Investment Risk (FRM Topic 8)

9️⃣ Current Issues (FRM Topic 9)

▶️ For videos in our Chartered Financial Analyst (CFA) series, visit these playlists:

Chartered Financial Analyst (CFA) Level 1 Volume 1

• Level 1 Chartered Fina...

#bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance

Our videos carefully comply with U.S. copyright law which we take seriously. Any third-party images used in this video honor their specific license agreements. We occasionally purchase images with our account under a royalty-free license at 123rf.com (see www.123rf.com/license.php); we also use free and purchased images from our account at canva.com (see about.canva.com/license-agree.... In particular, the new thumbnails are generated in canva.com. Please contact support@bionicturtle.com or davidh@bionicturtle.com if you have any questions, issues or concerns.

What happening if barriera option is perpetual? Which T do you use? Thanks in advance!

Awesome dude

If the stock price remains range bound in a down and out option then do we end up with the option if barrier > strike price?

i have not seen any KO options with different strike and knockout values, they are always the same

Thank you for making vedio . So easy to understand it .❤️❤️

any excel files about this lecture?

see beginning of description

If an option got knocked out, then asset price went bellow the barrier. Does option come back to life ?? Or once its out, its out

Once its out, its out