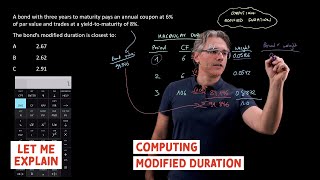

Macaulay Duration (SOA Exam FM - Financial Mathematics - Module 4, Section 3, Part 1)

HTML-код

- Опубликовано: 7 сен 2024

- AnalystPrep Actuarial Exams Study Packages (video lessons, study notes, question bank, and quizzes) can be found at analystprep.co...

SOA Exam FM (Financial Mathematics) Module 4, Section 3, Part 1

After completing this video you should be able to:

- Define and recognize the definitions of the following terms: Macaulay duration.

- Calculate Macaulay duration.

Definition given in the video:

The Macaulay duration of a set of payments is the weighted average of the times of the payments, where the weight of the payment at time 𝑡 is equal to the present value of the payment at time 𝑡 divided by the present value of all the payments. (An interest rate must be given in order to get a numeric value.)

![Run Away - Tzuyu(TWICE) ツウィ 쯔위 [Music Bank] | KBS WORLD TV 240906](http://i.ytimg.com/vi/KnHNNyAYiu0/mqdefault.jpg)

I really appreciate the time you put into setting up this lesson. I have a much clearer idea of what MacD is, more than just the definition.

Glad it was helpful!

MacD made no sense before. It makes better sense now. Thank you professor!

You are the absolute best Sir. Stephen Paris

The way you derived the formula is absolute skillful, knowledgeable and student friendly. 🙏

Thank you Professor

Nice lecture 👍.. Thanks

Thanks for liking!

Just Wow!

Conceptual question here (I'm teaching this stuff, fun!)

Generally speaking, "Duration" refers to the sensitivity of prices to rates (fixed rates or corresponding to spot rates).

I understand the interpretation of MacD as a weighted average (as analogous to the expected value in probability), but how does this fit in with the overall practical idea of Duration via above!?

Hell, I'm reading in Broverman's book that Macaulay himself didn't think to use the MacD formula to measure sensitivity of prices to rates!

I'm inclined to basically teach Modified Duration as "the" duration definition, and then almost teach MacD as itself a "modified duration". Thoughts?

You sir are a legend.

You are very welcome!