Session 28: The Fat Lady is Singing!

HTML-код

- Опубликовано: 13 сен 2024

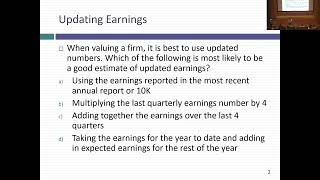

- We started this final session for the class by looking at the project findings from your company analysis, from intrinsic value to pricing to recommendations, and used the findings on the project to review the basics of intrinsic valuation, pricing and real options.

The slides for the session are at the link below:

www.stern.nyu.e...

If you want to see the entire list of valuations of everyone in the class, please try the link below:

www.stern.nyu.e...

I was thinking how lucky those students are to have a top technical teacher who also shares his reflections based on his experience. I hope they know how to appreciate the implicit value behind these kinds of teachers. As always excelent class Aswath!

Excellent Professor! I have thoroughly enjoyed these 28 sessions, and can't thank you enough. As one storyteller to another, I must say I appreciated this last class, the Apple references specifically. Just over 50 years ago, in Palo Alto, I blew off a guy, several times, that became my "Big one that got away". No matter how many times he tried to explain his product...video games, I just didn't get it. His name is Nolan Bushnell, and, like me, is still alive, making a difference, and chasing his dreams. His story is legend...the meteoric rise and dominance of his company, Atari, the subsequent sale a few years later to Warner Communications. One day, the story goes, and I expect you know it, one of his former employees, a guy named Jobs asked him to invest in his fledgling computer company...Apple. The offer, according to the legend, was for Nolan to invest $50K, in exchange for a one third ownership of their little company. According to a quote from him, from Wikipedia...""I was so smart, I said no. It's kind of fun to think about that, when I'm not crying."

😊😊😊😊😊

Amazing journey through the course and invaluable knowledge. Thank you for providing it for free.

Class starts at 3:43

Dr. Damodaran, I have purchased at least one of the stocks on the list. I am going to take the course in the fall. Your work has always impressed me and want to learn valuation from you! Please continue teaching the course on valuation. It is more essential now than ever.

Loves all the lectures, Valuation is fun. See you next year Sir.

This lesson about control value blew my mind. Thank you so much!

Indian start ups valuations are being marked down recently even though India is not in recession. Would you please make a presentation giving us your insights.

Thank you so much sir for everything..

Anyone can tell me what s difference between caluation undergraduate and valuation mba cls?

As far as I've seen its the exact same. But The executive classes are different, more compact.

Saygılar