Crypto Arbitrage Trading Strategies

HTML-код

- Опубликовано: 14 дек 2022

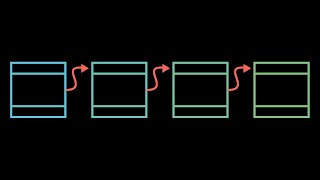

- Trading a cryptocurrency asset for a profit by buying it on one exchange and selling it on another involves the practice of arbitrage. Because a single cryptocurrency may be offered on multiple exchanges, arbitrage traders know there are price discrepancies for the same commodity. As a result, the traders buy the asset at a discount on one market. They rapidly sell it at a premium on another.

In conventional markets, the idea of arbitrage has been around for a long time. However, because the cryptocurrency market is available round-the-clock, it presents an extraordinary potential for arbitrage trading. Some people even have access to trade on cryptocurrency exchanges around the globe.

There are several apps investors can download that will track the prices of Bitcoin and other cryptocurrencies for arbitrage opportunities. This way, investors can use algorithms that automatically scan for arbitrage across different crypto exchanges. This automated approach allows crypto-arbitrage traders to take advantage of multiple price discrepancies.

Please subscribe and comment @InvestorsTradingAcademy

Really nice video, I'd suggest a different thumbnail, only because I nearly scrolled past it thinking it was a advert. Keep up the good work tho 👍🏻