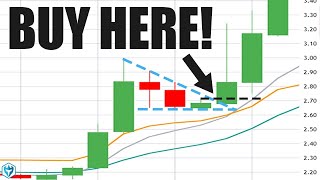

Trending Engulfing Candlestick Strategy Pattern

HTML-код

- Опубликовано: 23 сен 2024

- This trending engulfing candlestick strategy pattern works even better than the traditional engulfing candle trading strategy.

go.topdogtradi...

How to use engulfing candlesticks to get into early trends (before others) whether trading Forex, stocks or e-minis. Also works equally well on both day trading and swing trading time frames.

Enjoy the video! Leave your questions and comments below!

Make sure not to miss a single video from Barry! Click here to Subscribe:

www.youtube.co...

====================================================

Barry Burns

Top Dog Trading

TopDogTrading.com

Facebook: / topdogtrading

Get the Free Trade Strategy: “The Rubber Band Trade”:

go.topdogtradi...

===================================================

Watch the related video: "Japanese Candlestick Pattern That's Rarely Taught"

• Japanese Candlestick P...

---

Risk Disclosure: bit.ly/Risk-Disc

---

RISK DISCLAIMER:

The information contained on this video is for informational and educational purposes only. We are not registered as a securities broker-dealer or as investment advisers, either with the U.S. Securities and Exchange Commission or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Trading and investing involves substantial risk. Financial loss, even above the amount invested, is possible. Seek the services of a competent professional person before investing or trading with money.

The information contained on this video, is not provided to any particular individual with a view toward their individual circumstances and nothing in this video should be construed as investment or trading advice. Each individual should assume that all information contained on this site is not trustworthy unless verified by their own independent research.

Any statements and/or examples of earnings or income, including hypothetical or simulated performance results, are solely for illustrative purposes and are not to be considered as average earnings. Prior successes and past performance with regards to earnings and income are not an indication of potential future success or performance.

You should never trade with money you cannot afford to lose. The information in this video is in no way a solicitation of any order to buy or sell. The author and publisher assume no responsibility for your trading results.

This information is provided "AS IS," without any implied or express warranty as to its performance or to the results that may be obtained by using the information.

Factual statements in this site are made as of the date the information was created and are subject to change without notice.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE UNDER- OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.

Trading within a consolidation...a new term for helping me to remember this approach....generally speaking, the longer the consolidation, the greater the ensuing trend...same holds true for any pattern, the larger the double top or triple top, the longer the resulting trend......I APPRECIATE you pointed out the red bar engulfed five previous bars....I missed that.

Thank you and you’re exactly right!

I AM REVIEWING this lesson again, and I love your usage of the phrase, .....A trending engulfing bar as opposed to an engulfing reversal bar....It helps me to remember such a set up . Nice job.....Also, I LITERALLY MADE a study of channel breakouts, twenty years ago. I found that a channel which has eight bars gives a successful breakout about eighty percent of the time. In the above example, that is a seven bar channel which gives slightly lower odds. if you think about, the longer the channel, the odds of a successful breakout rise for several reasons. An eighty percent is nice, but I also like to see other confirmations...in this case, the green bodies on the short term trend in the channel are small....The bulls are losing strength. Further, at the beginning of the channel, there is an identical red bar which reversed the mkt. The start of the second identical red bars high, brought in sellers. Would I have shorted there? Not sure, but near its close I would have and placed a stop at its high...small loss. Finally we know that channels are continuation patterns producing around sixty percent success...Finally, take a look at the large bar which this consolidation pattern is struggling to overcome. Usually, such large..elephnat bars are NOT overcome. And your emphasis that a new high had not been established....Which reason is the most important? Yours.

Best Binary teacher I've met so far. Thank you.

You're very welcome Robert.

Excellent discussion, it's great to see your very good price action analysis without using any indicators !!! very impressive, love the clean chart

Thank you James.

All comes back to simple! Thanks Barry.

Yes, many traders try to make things overcomplicated.

The bodies are most important....I call that a 180 since the sentiment of the mkt has reversed from the bears control to the bulls control. However, if the wicks are also surrounded, that is a stronger set up. Also, engulfing patterns are effective at any time...they can reverse any pull back such as three greens in a down trend, or even a two legged pull back in an uptrend or down trend...Actually, your set up in the consolidation side ways channel...If you look higher up, the trend actually reversed at the top of the yellow rectangle. I am not saying I would know that was the start of a new trend, but your entry is actually a two legged pullback....one of the most reliable setups imo...and that large red engulfing bar is the entry point.

Thank you for your excellent analysis and contribution to the video

Thank you Barry! Your insight and wisdom is always appreciated!

You're very welcome Bonnie.

Your videos are always good Barry BUT this one? It was FAAAAAANTASTIC!!!!! Thank You!

You're very welcome Kent, I'm glad you found it so helpful!

On the downtrend pattern shown the large red candlestick following the shorter red one is called "the brothers grin" ever heard of it?

Grate video on engolfing candles, thanks

You're very welcome George.

Great video Barry, thank you!

Glad you liked it, and you're more than welcome.

Hi Barry, thank you for this instruction. One question, you mentioned "getting in" near the top right before it heads down. What exactly does that mean? I'm thinking "getting in" means to buy, and a position at a high level would be losing money on the strong down trend. I would think that ideally you would wait for a floor where a trend reversal going up occurs. Thank you

Very intelligent as usual..

Much appreciated Wayne.

Love your vids!!! Thank you!!

Glad you're finding them so helpful Miss Madco.

Very nice,another way of looking at engulfing candles..

Thanks Steve.

Great education, thank you!

You're very welcome Brendan.

Good Stuff Barry.....

Thank you Darrell

Thanks Barry..quick question do you have some kind of stats (like out of 400 trade set ups etc) to back up this strategy works above 65-75% of times etc? Also, does it best work for intraday or swing? Not trying to pinpoint but trying to understand the success rate of this set up to incorporate in my trading style as I think this is a great strategy and usually I felt it is always 50-50% chance if it go up or down when the trade is in consolidation mode for last 10-15 candles but this strategy can really help to get the odds to your favor. Once again, great video for free and much respect sir!!

Thanks Castle Trader. My 10 minute RUclips videos are just short tutorial - "tips" if you will. None of them, including this one comprise a complete trading methodology. It's something you could consider including as part of your trading method if you like it.

thanks Barry, anyways I will definitely keep an eye on the consolidation going forward and try to see how often I can use this strategy :)

Very Good

Thank you! Cheers!

What was the time frame you were using for this intraday training?

what time frame is this? That would affect the pattern

Have you had any specials on the candlestick course? Only one I'm missing, all well worth the money

Send me an email Mario and I'll see if there's any previous sales offers in the database. If so, I'll be happy to pass it along to you.

TopDogTrading awesome, thank you! Always recommend your courses to anyone wanting to learn to trade

Hi you said you scan for the Trending Engulfing Candlestick Strategy Pattern. How do you do that? Do you mean eyeball it?

Hi Stephen, thanks for the question. There are many scanning software programs that will scan for various candlestick formations, including engulfing candlesticks. I don't have a list of all of them, but I know that StockFetcher.com does for sure ... and there are many others.

Yes, very helpful.

Thank you, I'm glad you found the tutorial helpful.

Helpful!

Glad I could be helpful.

thank you really🌷🌷🌷🌷

You're very welcome, glad you liked the tutorial.

Best video sir

Thank you Abhijit.

thanku

again

You're more than welcome Sal.

There is Bearish Engulfing just before the one he spoke of.

Correct, which is why that alone isn't enough. You may want to review the video again.

It's actually called a falling three methods. Guess Steve Nison isn't part of the Top Dog Trading curriculum.

Similar, but not exactly the same as the Falling Three Method.

Traded these in the /RTY and AUD/JPY today.. great pattern for tick charts. Thanks Barry.

why didn't you become millionaire!!!!???

I did.