Это видео недоступно.

Сожалеем об этом.

How to get a copy of your taxes from IRS online - Request online transcript of your tax return. EIDL

HTML-код

- Опубликовано: 30 июл 2024

- Form 4506 is needed for EIDL, SBA Disaster loan, mortgages, by lenders, banks..

How to get a copy of your taxes online, by mail, by phone or a copy of your tax information from the IRS - IRS Form 4506, Form 4506T, 4506EZ - Request transcript of your tax return, Tax information.

Your Mortgage lender will request a Copy of IRS Tax Return 1040.

PPP Loan Forgiveness might require an IRS Tax Return copy.

SBA Loans require a copy of 1040 Tax Return using 4506T.

Apply for a loan - Lender will request a 4506T

Step by Step of how to request a copy of your tax return from the IRS using form 4506

Request for a Copy of Tax information Log:

00:24 How to find Request for Tax Records IRS form 4506

00:34 IRS.gov website for Income tax request

00:41 IRS.gov Get Your Tax Record

01:00 1-800-908-9946 Request Transcript by phone

01:29 Tax Transcript by Online

01:54 Transcript by Mail

02:09 Request for transcript of tax return Download PDF

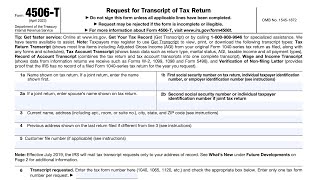

02:39 3 Types of IRS Form 4506

02:44 Form 4506 Request for Tax Return

03:22 Form 4506 $50 for each year

03:37 4506T request is free Transcript of taxes

03:51 Lender will want Form 4506

04:15 Form 4506EZ short form for Tax Transcript

05:30 Form 4506T Step by Step

06:42 Change of address form 8822, 8822B

07:26 Use 4506 for Tax Transcript to be sent to Bank

07:57 Business Transcript 1120, 1065

08:01 Corporation transcript, Partnership Transcript

10:16 Maximum of 4 years per 4506 form

11:15 Request Joint or Business Tax return

12:03 Address to send Tax Return Request

Please understand that these videos are for EDUCATIONAL purposes only and are very general.. All people and their financial situations are different. So it is important to consult your tax or financial professional.

_________________________________________________

Katie St. Ores CFP®, ChFC®, EA, LTC

• 97 Hours of Continuing Education each year to maintain Professional designations

• CFP® - Certified Financial Planner

• ChFC® - Chartered Financial Consultant

• EA - Enrolled Agent - Empowered by the U.S. Dept of the Treasury

• Licensed Tax Consultant -Licensed by the State of Oregon

• Registered Investment Adviser- Oregon Div. of Financial Regulation

• Tax Accountant - Markusen & Schwing CPA's

• Certified Investment Management Analyst program -Wharton - University of Pennsylvania

• Certified Mergers & Acquisition Advisor program - Loyola University

• Certificate in Accounting - UC Berkeley

• Master of Science in Project Management - University of Wisconsin

• Master’s in Administrative Management with Honors - Moscow State University

• ACAMS - Anti-Money Laundering Specialist Program

• RUclips - Educational Channel-Finance, Investment, Taxes

• Series 63 - Uniform Securities Agent State Law Exam

• Financial Advisor, Tax Consultant - St. Ores Wealth Management

Katie St. Ores

Virtual Services

or Offices in McMinnville

McMinnville, Oregon 97128

Katie St. Ores CFP®, ChFC®, EA, LTC

St. Ores Wealth Management llc

www.SaintOres.com

Medicare Explained MedicarebyKatie.com

Independent Medicare Agent

Oregon Medicare Advantage Plans at healthcare.oregon.gov

Oregon Medicare Health Plans can also be found at Medicare.gov

Oregan Medicare and You www.medicare.gov/Pubs/pdf/100...

Please understand that these videos are for EDUCATIONAL purposes only and are very general.. All people and their financial situations are different. So it is important to consult your tax or financial professional.

_________________________________________________

Katie St Ores CFP®, ChFC®, EA, LTC

2020 Women’s Initiative (WIN) CFP® Board

2020 Financial Women to Watch on RUclips

Medicare Health Plans Oregon County:

Yamhill Washington Polk Marion Baker Benton Clackamas Clatsop Columbia Coos Crook Curry Deschutes Douglas Gilliam Grant Harney Hood River Jackson Jefferson Josephine Klamath Lake Lane Lincoln Linn Malheur Marion Morrow Multnomah Polk Sherman Tillamook Umatilla Union Wallowa Wasco Washington Wheeler Yamhill

Thank you. Finally, someone who has made things clear.

[9:42am PST] @SaintOres.com

Thanks Leon, Glad it helped!

Thanks Katie! Very clear and easy to follow video. I was able to complete Form 4506-T with your help..

[10:13am PST] @SaintOres.com

Thanks Yvette, I'm glad the video was helpful....

@@KatieStOresCFPChFCEA great video but still have a question: I am a sole proprietor but we file join and my wife name come first in my taxes i wonder if that is important? my name first or her name? sent my 4506t to the SBA and I got denied for unverifiable info ( haven't changed address in 10 years )

Thank you 😊 very detailed and easy to understand!

You’re welcome.

Very true ,thank you

thank you so much. it is very easy to understand. I know what to do now! appreciate it!

[11:21am PST] @TaxesbyKatie.com

Thanks Veronique, Glad it helped!

This was awesome! Thank you.

[9:12am PST] @TaxesbyKatie.com

Thanks Pris, You're so welcome!

An excellent video, very helpful. Thanks for providing us basic information.

Thanks Nasser, Glad it was helpful!

You are the best. Merry Christmas 🎉.

Thanks.... Merry Christmas to you also.

Tnx ,so much this Vedio help me alot.

Thanks TJ, Glad to hear that.

Thank you

[10:43am PST] @SaintOres.com

Thanks Logic, You're welcome.

So i just wanted to see when ill be receiving my tax refund is that the 846 refund issued date ?

Could you do a video on investing in the stock market? Thanks, love your videos.

Sure... I’ll get one out soon.

I like this video I learn a lot

[10:33am PST] @SaintOres.com

Thanks Macbay, I'm glad it helped out.

Hey Katie! I was wondering if you had more input on how to log into and creating an account, I don't know how to prove I am me and need to get a non-filing tax form. This is a long shot but do need help, hope to hear back! -Bailey

[9:58am PST] @TaxesbyKatie.com

Hey Bailey, The IRS uses specific questions to verify your identity, like info from your home mortgage loan, car loan or student loan. So have that information on hand. They will also send a code to your phone by text message. Your phone must be a U.S.-based mobile phone number associated with your name. Hope this helps.

Great video, thanks Katie. May I use this form to request transcripts older than 10 years? And which option well show me the CSED date? Thanks

[10:43am PST] @TaxesbyKatie.com

Hey Mike, Yes, in the instructions it says that "You must use Form 4506-T if you need a letter for tax years older than the prior three years." Also, you may be able to get older tax account transcripts by calling the automated phone transcript service at 800-908-9946.

Thank you for the video! Please tell me, If I have already paid taxes when I submitted the form to extend the tax return, will I receive a refund + overpayment for the tax paid earlier? Or will I need to submit a separate return request? What is the correct way to reflect this in the 1040 form?

Hey Maxim , If you overpaid your tax with an extension, then you will receive the excess amount as a tax refund after you file your 1040.

My husband and I file jointly. We are needing to put together some years we didn't file. When we fill out this form to give to our accountant. Under my husband's name in order to get the 1099's do we have to put the business EIN number although we usually file it jointly using the two social security numbers. Or do I need to the EIN in order to make sure we get the 1099 numbers that is where all our income in generated from? Praying you answer this question.

[12:21pm PST] @TaxesbyKatie.com

Hello Anna, The best option here is for you to ask your accountant when you meet with him/her. They will know your situation and be able to quickly advise you of the correct actions to take.

Hello Katie! Very helpful video. I wanted to ask- for the years we are requesting can we choose the four years we are actually needing for example 2016,17,18,19. or does it have to start with the current year we are on and fill out more than one form ? I specifically need 2017 ,2018, and 2019. Thank you very much

[12:21pm PST] @SaintOres.com

Hey Jubilated, You can choose the 4 years you need, it doesn't have to start with the most current year.

@@KatieStOresCFPChFCEA Thank you for your help much appreciated!

@@jubilatedforcoffee7797 [3:43pm PST] @SaintOres.com

You're Welcome....

Hi, I need to provide tax return form to my lawyer for my husband’s green card. The transcript forms I found online were all masked versions. I need unmasked version. If I mail in the 4506-T form, will I get a unmasked version? Thank you!

[10:59am PST] @TaxesbyKatie.com

Hey Wen, The IRS started a new transcript format that partially masks the personally identifiable information of everyone listed on the tax return. According to the IRS, taxpayers who require an unmasked transcript should contact the IRS, present proper authentication to prove their identities, and an unmasked transcript will be mailed to the taxpayer’s address of record.

Between the 2 signatures, Title -- I do Uber should I put Uber and my name ? Only Uber?? Or leave it in blank ? Because only me drives for Uber is not a partnership right?

Hey GL, On the first line, sign and put the date on the right side. On the second line, type your first and last name as it appears on your tax return. Don't write Uber driver any place.

Hi there

Thanks for this . For limes 4 & 5 about the change of address , do I send the form 8822 with the 4056-T in the same envelope to the same address? Thank you

Hey Mirendah, No, you send 8822 and 4056-T to different addresses. Check the instructions for these forms because mailing addresses depend on your state of residence. Good luck.

@@KatieStOresCFPChFCEA thank you so much🤍🤍you’re amazing ! Thank you thank you

Thanks Mirendah, I will now put 'amazing' on my business cards.

Hi I need to pull two years from irs to show social security to complete the ten year work history, will this document go back 20 years? Thank you

8:46am PST SaintOres.com

Hello Gabagool, 6 to 10 years can be done but I think 20 is much too long a time frame. But I don't know for sure. Give the IRS a call and ask them. Remember it's their busiest time of year. Also, in the case of proving your work history for social security, alternative documentation might be accepted. You can check with the Social Security Administration for a list of acceptable documents www.ssa.gov/manage-benefits/get-benefit-letter.

Hi Katie,

Thank you for the video. I am kind of confused on obtaining the IRS Form 4506-T form. I created an account and logged in on the IRS site and chose "Get Transcript". Is this the same route or do I have to fill out the form and mail it out?

What if I need the 4506T 2022 transcript but I haven’t filled 2022 tax yet?

Hello Iasmin, If you haven't filed your 2022 tax return yet, then the IRS won't have any information to provide on a 4506T transcript for the tax year 2022. The transcript is a summary of the information from your tax return that the IRS has processed. If you need a transcript for the current year, you'll need to wait until you file your 2022 tax return and the IRS has processed it. Typically, it takes the IRS a few weeks to process tax returns, so you may need to wait until after the filing deadline (April 18th, 2023) to request a transcript. Once your tax return has been processed, you can then request a transcript by completing and submitting Form 4506T to the IRS.

Can you show us how to file online the form 2848? Thank you!

Hello Kymi, Yes, I think that would be a helpful video. I've got a new Schedule C video to film first.

On the down part of the form what is the title CFO meaning?..

Where just requesting my husband tax?? His 3recent year??if requesting his irs what the right of tittle we need to put??

[9:42am PST] @SaintOres.com

Hey April, CFO is the chief financial officer (a person who has a primary responsibility for managing the company's finances). If you are requesting your personal tax return, you do not need a title.

@@KatieStOresCFPChFCEA thank you for your kindly concern and replied what a big help to know soon as I needed your such kind and nice thank you again.

[10:33am PST] @SaintOres.com

You're welcome April, glad I could help.

Hi can I ask more in the down part of 4506 requesting for copy of tax return I look closely our form if we missed something my concern is..look the down part of that form do we need to put check the little square box it said in the down part of the form,what if we missed to put check the little square box,look down your form saying,

Signatory attest that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the form 4506.See instruction

Hi Katie, How can an individual receive W2 and Tax Returns longer than 7 year's ?

[11:21am PST] @TaxesbyKatie.com

Hello Huggy Bear, You will need to complete Form 4506-T. The IRS may be able to provide this transcript information for up to 10 years. The IRS can provide a transcript that includes W-2 data, however state or local information is not included with the Form W-2 information.

@@KatieStOresCFPChFCEA thanks alot and the quick response Katie

[3:35pm PST] @TaxesbyKatie.com

You're welcome Huggy....

I need to file taxes for my deceased brother.

Which form will tell me if he has filed his taxes for the past 3 years?

I also need copies of his 1099 and W2 so I can give it to my tax preparer. Do I fill out form 4056 or 4056 T?

Thank you!

[11:31am PST] @TaxesbyKatie.com

Hello Elly, Very sorry to hear about your brother. The difference between form 4506 and 4506-T is that 4506 is a request for full copies of income tax documents and 4506-T is a request for transcripts of the same documentation. The full copies include all the information available on the W-2, 1098, or whatever income tax documentation was originally submitted. You will need to use 4506.

Thank you so much!

[12:31pm PST] @TaxesbyKatie.com

You're welcome....

[10:27am PST] @TaxesbyKatie.com

Hello again Elly, Sorry, but it's not possible for me to answer questions without knowing much more information. These are all questions for your tax preparer to answer since they know the specifics. If you need a new tax accountant, give me a call and I'd be happy to help.

what I have to do if I don't have a credit card??

Hello Rabeh, Depending on the type of tax you owe, you could use the Electronic Federal Tax Payment System (EFTPS). It takes the money out of your savings or checking account. They also have IRS direct pay. Or you could get a pre-paid card and use that. The government has all kinds of ways to get you to pay them. Good luck.

Hello Katie, I want to apply for an increase in my SBA loan after the first payment. I run my restaurant 3 months before the COVID-19 and I did not file for 2019 tax return with my business but planning to do that now. Pls what can I do?

Pls can I also apply for ppp first round application

Hey Yosoye, If you were approved for a loan and would like to request an increase to the amount, send an email that states your need for an increase to the loan amount to pdcrecons@sba.gov with the word “INCREASE” in the subject line. Include any additional information that may assist SBA in considering an increase for your application. For example:

--Your most recent Federal tax return for your business along with a signed IRS Form 4506-T

--For updated financials (Gross Revenue, Cost of Goods Sold, cost of operation, or other sources of compensation), submit Form 3502.

@TaxesbyKatie.com

If I want to get W2 only , can I just check box 8 and skip line 6 ?

Hello Moathzuabi, No, you cannot just check box 8 and skip line 6 on Form 4506 if you only want your W-2. Line 6 is crucial for specifying the exact tax year you need the W-2 for. Skipping it would render your request incomplete.

@KatieStOresCFPChFCEA Thank you .. i was waiting for this answer before sending it

Sure... You're welcome.

Hi I had completed 50 hours CPE course completed but how do I receive CPE certificate from IRS

The IRS itself doesn't directly issue CPE certificates. After finishing the 50 hours of approved CPE courses, the course provider you took them from should issue your certificate.

But I saw 50 hours CPE certification from IRS in CPA person office room.when I went to tax file I saw it. That’s why!

Does the 4506t allow you to see the name of the employer you worked for

[1:26pm PST] @TaxesbyKatie.com

Hello Better Things, No, it doesn't.

@@KatieStOresCFPChFCEA I will be applying for a trucker job very soon and they are very strict with their employment history verification....is there a way where I could see all the jobs I worked at for the past 10 years

[1:56pm PST] @TaxesbyKatie.com

Go to the Social Security Administration’s website and find Form 7050. I think there might be a fee. The Tax Department in your state might have the same info.

Hello what if i need w2 for 2014

[4:53pm PST] @SaintOres.com

Hey Keira, If you need a copy of Form W-2 from 2014, you should first contact the employer. To get a copy of the Form W-2 filed with your 2014 return, you must use Form 4506 and request a copy of your return, which includes all attachments.

Hello Katie 🤚🏻

How can i find a school for learn fill out IRS tax return

Because I’m leaving in OHIO

[10:44am PST] @SaintOres.com

Hello Zen, Check your local community college; that would be the best option.

@@KatieStOresCFPChFCEA thanks you

Good Luck.

What if you want 10 years for immigration purposes

Hello Kevin, You have to complete two 4506 forms since there is only a maximum of 8 years per form-one request for 8 years and the second 4506 for the 2 remaining years. I don't see any other way to get 10 years back.

My wife can't create a account online her visa card she filed with won't work so she use her auto loan now her phone number won't work to get the code .. any help ? Oh I should mention she order it from the irs twice and it haven't arrived 1 month now

I'm having same issue

@@samanthadavis7188 my wife finally got hers .. she ordered it to be sent by mail .. they took almost a month now we got 2 different copies got one 4 days ago and one today .. a guess it's because we sent for it so many time .. who to tell maybe we will be getting more copies of them.. anyways order it by mail and wait it will come eventually.. good luck

@@m-li2665 thanks

@@samanthadavis7188 you're welcome

IRS does not answer calls!

Hey Ann, I always have the best luck in the mid afternoon.

Can my accountant request my tax transcript online for me?

[1:06pm PST] @SaintOres.com

Hello Razan, Yes they can.

@@KatieStOresCFPChFCEA what about the id verification

[1:36pm PST] @SaintOres.com

Your accountant can order your tax transcripts through the Practitioner Priority Service line, specifically for accountants. I hope this clarifies it.

is this free?

[04:56pm PST] @TaxesbyKatie.com

Hello Sara, Use Form 4506-T to order a transcript or other return information free of charge.

🤫🤣😂

I agree with you Freddie. The government's job is to make many, long, and complicated forms. Then make you wait to get a response.

How can I contact you Katie?