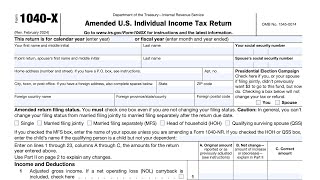

How to fill out Form 1040X, Amended Tax Return

HTML-код

- Опубликовано: 29 сен 2024

- You can follow the link below to get the current version of this self-calculating form. But before you download it please click Like and/or Subscribe. The software is free, so it's a small price to pay. Thanks. Much appreciated. www.pdftax.com/

I would like to say that you are extremely helpful and so are your self-calculating forms. I can't thank you enough for taking the time out of your life to do this!

You're very welcome!

I had to re-watch one area and finally the lightbulb went off and finally got this amend done. So glad I found this you tube channel. Thank you for explaining how to fill this out.

This is the only video on RUclips that gets down to the point on how to amend your tax return when a new w2 is received. Thank you sir!

Yesss thought it was just me

Hi John:

Thank you very much for this video and the other videos that you've produced. They are very educational and informative.

My question to you is that on line 5 of the 1040x, your calculator does not take into consideration when a number in this line is less than zero. I think the instruction on line 5, says that if the amount is less than zero, we should enter zero. I now have a situation where my amount in that line is a negative number, and I have tried to override it to make it a zero, but it is not allowing me to do so, without disabling the entire program calculator. Because I am not able to make the number on this line zero, I am not sure the effect this might have on the rest of my 1040x calculations.

Do you have any suggestions?

I will appreciate any help that you can render.

FD

Thank you for your valuable input. Much appreciated. This is obviously something that needs to be fixed. And it has been. You can download an updated version of 1040X here:

www.pdftax.com/

The state sent me the adjustment amount for unemployment for 2021. How do I document that on the 1040-x?

No mention on what documents should be mailed in addition to the 1040X if any.

Thank you so much. Helps a lot and saved me from amendment!!!

Sir, How long one can revise or amend their return? Is there penalty for fing 1040x?

If you owe money after amending and cant mail the payment at the same time with the return. But the tax cut off is basically next month.. do I have to wait untill the return is amended before I can make a payment n is it possible that late fees n penalties will apply to the bill if it doesnt get processed before the tax cut off date?

Did you owe on the original return and did you pay?

@@pdftax8031 yes I did and I paid immediately.. reason why am asking is that I recently got my 1095 C health insurance proof n apparently I wasnt covered for some months but I thought I was so I put covered all yr when I first filed so now corrected it I have to pay the penalty

Hi , I have to amend my tax for the year of 2018 , first is that still okay to do , and secondly the amendment is because I failed to claim the CHILD TAX CREDIT that year and I qualified for it . I do not see anything on the 1040-x where I can add that information. Can you please guide me in the right direction? Thank you so much for your anticipated help in this matter

My dad's SSDI was reported as income and he needs to amend it. Do we use just the form 1040x to make corrections? Oh and the kept his SSA-1099

Do you provide any service.

TY TY TY REALLY HELPED OUT

If nothing financially has changed on the return, and you are simply changing perrsonal info such as name, address etc. Do you still have to fill out the financial information boxes if nothings changed? If so do you just fill out the original and then correct boxes with the previous info?

Here's what the 1040 instructions say:

Name Change: If you changed your name because of marriage, divorce, etc., be sure to report the change to the Social Security Administration (SSA) before filing your return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits.

Address Change: If you plan to move after filing your return, use Form 8822 to notify the IRS of your new address.

if i need to remove dependents for 2019, should I write anything in the 24-30 lines?

Here's what the instruction on the form says.

! CAUTION

For amended 2018 or later returns only, leave lines 24, 28, and 29 blank. Fill in all other applicable lines.

Where do u add EIC and UC benefits and 1099R?

Hi! For the new return form that we have to submit additionally to this form, when they say to put “Amended” on top is it by hand?

Yes, correct

Hi ! I have a question... I filled 1040 instead 1040NR... can I fill 1040X to amend my taxes ?

Here's what the 1040X instructions say:

Resident and nonresident aliens. Use Form 1040-X to amend Form 1040NR or Form 1040NR-EZ. Also, use Form 1040-X if you should have filed Form 1040 (or, for years before 2018, Form 1040, 1040A, or 1040EZ) instead of Form 1040NR or 1040NR-EZ, or vice versa. To amend Form 1040NR or 1040NR-EZ, or to file the correct return, do the following: • Enter your name, current address, and social security number (SSN) or individual taxpayer identification number (ITIN) on the front of Form 1040-X. • Don’t enter any other information on page 1. Also, don’t complete Parts I or II on page 2 of Form 1040-X. • Enter in Part III the reason why you are filing Form 1040-X. • Complete a new or corrected return (Form 1040, 1040-SR for amended 2019 and later returns, Form 1040NR, etc.). • Across the top of the new or corrected return, write “Amended.” • Attach the new or corrected return to the back of Form 1040-X. For more information, see Pub. 519, U.S. Tax Guide for Aliens.

My question is what if you ONLY need to change your filing status. Do I need to enter ALL the same information again? Or can I just Change the filing status and submit the form?

Yes you do because your tax rate will be different.

What about state taxes? don't you have to amend them also?

Yes, if your income or deductions change you need to amend your state return as well.

Is there an Android App that will allow Self Calculation? Or will this work best on a desktop? Adobe sign & fill won't work.

Just desktop.

i went to link you left in the description and theres on 1040 form no 1040x and i need 1040x to amend tax right

The IRS hasn't released the 2018 revision of 1040X yet. Probably not till mid February.

Free?

What happens if you end up with a negative on Line 5 Column C ?????

Then you don't have any taxable income.

Hello, do you have a self-calculating 1040x for tax year 2016?

Sorry. We don't

Great Video

pleas help me. I accidentally filed as independent. How do I change my status to dependent using this form?? pleeease provide the exact box number because I cant find it!!

Depends on which year you are amending.

im trying to use this to make an amend but im head of household and I had a dependent, when im entering the ss for my son it don't let me type in the hole ss number only the first 3, how can I fix this?? thank you!

Sorry about that.Try downloading this updated version from here:

www.pdftax.com/

Thank you

HOW DO YOU ADD BANK ACC INFO ON THE 1040X?

IRS doesn't allow that.

I need this in plain english please. I filed my taxes and later realized that I forgot to put in my social security benefits information.

Where I find this on TurboTax?

its not on turbo tax. Turbo only allows you the current year unless you purchase the physical copy of a CD rom

What do I do with mt SSA-1099 and my 1099-MISC

You're amending your return because you didn't previously report these? SSA-1099, social security income may or may not be taxable depending on how much other income you have. 1099-MISC income usually gets reported on schedule C of form 1040 if it is for non-employee compensation, which is the usual case.

I forgot to include health insurance but I have it. Can this be amended?

Yes it can.

pdftax thanksZ

Do I need to fill out the entire form if my only change was submitting a 1095A for health ins? Thanks!

same question here, except I have form 8965 to add for exemption.

Great video, but I'm still stuck on line 18😭😭

Me too, line 18 does not make sense. My payment was twice larger than the tax owe but doing line 18 resulted in tax owe. My refund should total payment minus tax owe, not so with line 18. Maybe I'm doing something wrong.

@@kimchee94112 I'm also stuck on line 18. Did you end up figuring it out?

Your not explaining anything u jus putting in numbers

So I filed about a month ago and already got my return but then robinhood sent me my 1099 since I'm new I didn't know I was getting one since I only made $211.17. So what do I do?

Did you ever figure this out?

Who’s here because they didn’t get their stimulus check because your parents filed you as a dependent

I'm here cuz I accidentally said I was a dependant.

@@red_astr0382 did you figure out how to fill it out? I'm on the same boat as you

I'm here cuz we got married 2- 14-2020 and filed our taxes too and it wasn't noticed.

@@babyjudyx212 I'm sorry but I'm in the same situation, can you help me and answer a couple of questions?

This is a great walk through. All the tax services in SA TX charge $148 for this. You are doing gods work my brother, keep it up!!!!!

I accidentally put myself as dependent instead of independent, what would I need to change? Also, since I only need to change that one thing, do I still need to fill everything else in?

Same boat omg

SAME BOAT TOOOOO!!!!!!

Same 😂😂

Same

I need this answer please! I could get my stimulus check!

Thank you John, for this step by step video! I had to watch the video at least a dozen times... and it took me 4 hours to flip back and forth from the video to my 1040x form to finish both pages. I wanted to be certain that all of my calculations were done correctly!! I didn't have the money for a tax consultant to help me complete the form, and your video saved me a nice chunk of money! (Maybe not the time, but now I know how to do it myself!) Again, thank you so much, this video was VERY helpful for me.

thank you so much, you just saved me from paying a tax preparer

Hello!

Great video! I am in a situation now that I have to amend my 2017 Tax status from single to Married filing separate, How do I go about doing this?

Thank you much!

Check the box for MFS amended return filing status.

@@pdftax8031 I have the exact same question. I know i need to check the box for married filing jointly now but in the original amount do i include both our incomes? I'm so confused

@@veznha No just yours

Thank you so much, this helped me after I had a w2 sent to the wrong address therefore had to fill out a 1040X

Hello, I filed ira 2k in original tax, but was denied at bank because pass the dead line of 4-18-22?

Please advise. Thank you 🙏

Ps. Do you have to send in all the original ( 1040, schedule a,b etc...) again with this amended one ?

Thank you for making this step by step! Super helpful! Quick question, if only one spouse has a corrected W2 do we still document both wages/taxes. Additionally, how will they know which individuals W2 is being corrected (or does it not matter)?

i did my wifes taxes, i wrote them under spouse and checked "married filing spereate" but when we submitted they did it jointly,,,, was i supposed to leave spouse blank?

Thank you, this was very helpful, butt question is what do I do with line 7? My original form is 0 for credits, but in the instructions for an amendment, it states : If you made any changes to Form 1040x,lines 1-6, be sure to refigure your original credits

Hi Sir, this is such a great explanation. I just have one quick question. I was wondering what other documents I would have to send along with my 1040-X form. Could you please let me know?

Thanks for sharing. So if i do not agree with the IRS , should i just re enter the same figure onto the 1040x to confirm that I did not owe anything? Appreciate any suggestion and help.

Is this the form I should use if the IRS claimed my child didn't exist even though he definitely does? We need to repeal the 16th Amendment, this is a nonsensical mess...

I am filing a 2019 amended tax return. The only thing I need to change is the dependents section and claim the child tax credit. I don't know how to complete form. Help

Where do I find this particular form that does the calculations for me as your form does?

I really need help with filing my 1040x I need to add my unemployment from 2021 and add my other child that was not claimed.

Thanks! Just saved me $200 that H&R Block wanted to charge me.

SAME

So I got audited and never got why I was to get 14568 and got 5000 how do I amend that as a small business owner

How do you adjust taxes when you forgot file credits for self employed 1099?

My 1099G wasnt filed in 2020 and 2021. Can I file it using this form?

Can you please do a video filling form 7202?

Great form and helped me out a lot. I had 1098 correction that increased my deductions. Just getting around now to do it ....$300. Watching you also helped me where my error was.

it was clear but I'm still lost! last time I do my taxes by myself. I'm about to be audited. . .

A common unanswered question goes to entry format. Whether a blank is equivalent to zero. For example, if taxable income at line 11 is zero, my accountant entered nothing additional on the form through and including line 23.

There are a HUGE number of things like this that written or video form information ignores as if everyone "just knows".

hey if i didnt file for 2018,2019,2020,2021,2022 i would like to amend those because i never recivbed any stimulus checks and never got my pua

If you never filed for those years file an original return, not an amended return.

I’m what box should we put education expensss that were not seclared

Thank you. This is helpful. I need help on the 1040x, My friend took out 35,000 during covid time. She didn't have to pay back for 3 years. Now the IRS asked her to file a deficiency and along with 1040x for her 2020 tax year. How would she go about doing this?

I am a non-resident alien. I accidentally filed form 1040. I need to submit form 1040X and a completed form 1040-NR-EZ. The instructions for this sort of change are below. These instructions do not say anything about checking the box to indicate the calendar year. Should I check the box to indicate the year or leave all those checkboxes blank?

Additionally, should I indicate my filing status even if I am not changing the filing status. Form 1040X says I must check the box even if I am not changing my filing status, however the instructions for this form from the IRS (as below) say the only things I should enter are my name, current address, SSN OR ITIN, and nothing else on page 1.

To amend Form 1040NR or 1040NR-EZ, or to file the correct return, do the following:

• Enter your name, current address, and social security number (SSN) or individual taxpayer identification number (ITIN) on the front of Form 1040-X.

• Don’t enter any other information on page 1. Also, don’t complete Parts I or II on page 2 of Form 1040-X.

• Enter in Part III the reason why you are filing Form 1040-X.

• Complete a new or corrected return (Form 1040, 1040-SR for

amended 2019 and later returns, Form 1040NR, etc.).

• Across the top of the new or corrected return, write “Amended.”

• Attach the new or corrected return to the back of Form

1040-X.

can you amend a 2021 return and add to your ira to reduce your tax burden?

Hello. My employer reported $2,000 as social security tax withheld while $3,000 was withheld.

On which line should I report the correct amount of the social security tax withheld on 1040-X?

hi, very good video, I learn a lot, now i'm making my 1040x, I make under 10,000.00, single self employ, I need help, I did on line 2019 and I have to pay 300.00 My mistake was in food I only wrote 160...this is my first time doing by myself...thanks

Thanks for the video. What if I forget to report a 1099-D (for dividends) because I received the form later after I’ve already filed my taxes. Where do I enter the dividend income? It’s around $160 total

Hello, if my 2016 taxes were kicked back only due to the fact the IRS didn't send me my PIN # (that they NEVER sent me), do I have to file a 1040X??? I mean, am I able to just put this years PIN on it and resend the information???

John, can you help?? My husband failed to file his business returns for 2016. I was not aware of this until IRS and State sent letters. At first thought is was a scam. Now I know differently. I filed married/jointly because the tax preparer stated it would be better for us to do so. Now I have to pay IRS and State. I want to amend and show the losses for the business and hopefully get my money back that I have paid in. This is his business I have no part of it. I am the sole provider for our household. He does not work and this is a hobby for him.

I watched your video but I became confused. I have tried to do it on my own but am at a loss as to what I am doing. I tried to go back to the preparer but he is no longer in business.

Please show me how.

Thank you Sue

I have a rental property and had many repairs done. When I filed I used an online service that didn't allow depreciation using the form 4562. Can I use the 1040x to amend that return and would I also send in a form 4562 for depreciating the cap ex improvements of around 20k?

Thanks so much for this video! I have a question I need to make an amendment after receiving the refund payment, I received my 1099 R in the mail. taxes were taken out the distribution before it was dispersed but how would I document the amount I got for the tax refund payment on the 1099x form ?

Thanks for explaining this so clearly!! So I have one more week to amend my 2020 tax return?

the link doesn't have a 1040x, Amend Tax Return self calculating, which is what I need. But, thank you for the video.

Hi there, I clicked the link that takes to the self-calculating IRS forms, but this form 1040-X is not available :(

Any way to contact you for help on the 26th to amend my federal and state this will be the first time and would love if you could help me bro

FINALLY someone who speaks English. Thanks so much for this video boy imma tell ya I was bout to mess up big time in this form til I watch this video damn dodged bullet on that one phew

There was a 1099 reported on my 1040, which needs to be taken off(should have not be on my 1040). The IRS overpaid made adjustments, refund me an amount and charge me a fee(which I paid). I want to correct to get the proper refund(which was less, so id owe) and receive the payment penalty fee back after the corrected 1040x. The funds I owe(due to original over refund less the actual refund) to the IRS can be taken from the payment I made to the IRS pre 1040 x correction. Is that possible? Please help and let me know if this is clear. You assistance would be golden.

Do you use this for cancelation of debt as well ?

Where do I find agi on the original tax return

Could I pay for you to fill one out for me

If I did not entered one 1099 detail information but I did include the income as other income when I filed the return, how can I do the amended return while I don’t have any increased tax liability

I downloaded and purchased the 1040x . not sure if the code is working. plz help

Did you contact support?

I just filed my 2020 tax return and it was accepted. But I need to remove one of my dependents and I have absolutely no idea how to do this? I need help please!!!

I forgot to add a 1099 G unemployment

Would I put that amount in the same box you put their missing W2?

You put in the single standard deduction on the video. You are showing Married Filing Jointly. Helpful video though.

My daughter marked that no one could claim her, so her Father wasn't able to, though she lived with us and attended school and only worked part time. Can this be amended? Also, does it carry over to the State return, or is that a separate amendment?

Very helpful video, thank you! What forms must I include with this? Do I include my original 1040 form with it?

John, If I have business (organizational/startup) expenses from my single-member LLC, I was told I can add them to my personal taxes (Schedule C). I want to amend my original 1040, using 1040X/Schedule C, to include these expenses. Doable you think? Thank you SO very much for the videos & resources, you are truly AWESOME!!

Hi thank you for the video, but you might want to cover up your clients socials yes the video was helpful by the way

What if i forget to put in my missing $1,400 3rd stimulus check?

Then it's a good idea to file an amended return.

This video helped me file for my military severance pay taxes. Thanks so much!

U figured out to fill out the form for severance pay .. I have a some questions about it... when he fill out the changes and add the taxes and etc.. we will leave the open.. right.. since it should not be taxed...help please...I wish a example could be shown for the ones filing the Severance pay...

Where should I put an IRA contribution? I filed then invested. Does it go under a deduction of wages?

I have a very, very time sensitive question. For line 5 of the 1040 X Rev July 2021. For line 5 it says subtract line 4b from line 3. If result is zero or less, enter 0. Which column do I put the zero sum? My relative had no taxable income so would I put the zero in column A B or C?

How can i do one for 2019 year

I did this and now I owe $3,000 lol

Hi very good video but still a little confused. But my question on this form it includes the previous w2 s and the one you might have forgotten as well?

If all I need to do is remove a dependent would I not fill out anything for the tax part of the form & only adjust the dependent box on the 2019 form?

If so, which box is it?

Do you have form 1045 as an example of how to fill out.