Diluted Earnings Per Share | Convertible Preferred Shares

HTML-код

- Опубликовано: 9 дек 2024

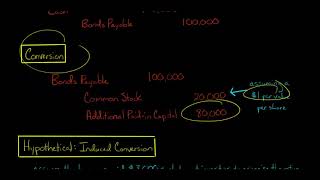

- Preferred stock can affect the calculation of basic earnings per share (EPS) because preferred dividends are subtracted from net income when calculating earnings per share. But CONVERTIBLE preferred stock can also affect DILUTED earnings per share if those convertible preferred shares are convertible into common shares.

To calculate diluted earnings per share when there are convertible preferred shares outstanding, you need to do two things:

(1) Don't subtract preferred dividends for the convertible preferred shares from net income in the numerator of the diluted EPS equation (with diluted EPS, you're assuming the preferred shareholders would have converted their shares to common shares, and thus the company wouldn't have had to pay preferred dividends)

(2) Add the number of common shares that the preferred shareholders will be receiving (with diluted EPS, you assume the preferred shareholders would have converted their preferred shares to common shares at the beginning of the period, and that the company issued new common shares to satisfy the conversion)

-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

eepurl.com/dIaa5z

-

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

edspira.thinki...

-

LISTEN TO THE SCHEME PODCAST

Apple Podcasts: podcasts.apple...

Spotify: open.spotify.c...

Website: www.edspira.co...

-

GET TAX TIPS ON TIKTOK

/ prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

www.edspira.co...

-

CONNECT WITH EDSPIRA

Facebook: / edspira

Instagram: / edspiradotcom

LinkedIn: / edspira

-

CONNECT WITH MICHAEL

Twitter: / prof_mclaughlin

LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

www.edspira.co...

michaelmclaugh...

Wow!!! What an excellent way of explaining it.

Would you mind sharing what note-taking application you use? I love your content and have always wondered.

What one is more appropriate measure for investment decision ?

I belive that EPS and dilluted EPS should be used together as they measure different (but both very important) details about profitabillity. EPS is the most generally used because it's quick easy to understand and gives a basic benchmark to compare companies, and good for understanding trends especially for cyclical markets. While dilluted EPS is better for comparing companies that are in different markets, for risk assessnent and also for analysing the cost of equity compensations

Pretty easy to grasp. What’s the hard stuff? Auditing & Tax Codes?