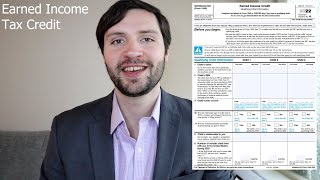

Earned Income Tax Credit (EITC) Explained

HTML-код

- Опубликовано: 6 фев 2025

- In this video I go over the Earned Income Tax Credit (EITC) and the qualifications one needs to meet in order to take the credit. I briefly go over how to report the credit on one's tax return (Form 1040). The credit ranges from $560 if you are single all the way up to $6,935 if you have three children.

![BLACK BAG - Official Trailer [HD] - Only in Theaters March 14](http://i.ytimg.com/vi/Du0Xp8WX_7I/mqdefault.jpg)

![Seungmin "그렇게, 천천히, 우리(As we are)" | [Stray Kids : SKZ-PLAYER]](http://i.ytimg.com/vi/kAzmhLHePqU/mqdefault.jpg)

This was incredibly helpful for my exam, thank you so much.

Confused on a point about the EITC Estimator. When inputting the info, under the heading AGI, the Estimator asks for the information in "Box 1" on your W-2s. What's contained in Box 1 on a W-2 is "Gross Income," not AGI. In that the EITC Estimator asks about filing status (mine would be married filing jointly w/ no children which qualifies), is that then what takes into account AGI because the "Estimator" is figuring in the Standard Deduction for that filing status? If not, that changes everything in terms of outcome. Also, in that there are no children involved, would it be safe to say that the printing of the result would act as evidence of the claim when filing? Thanks for answering this. I think the IRS does a poor job when it comes to explaining all the lines where information is asked for as so many are not taken into account.

the heck man, three kids and turbotax said "no" on that EIC line.... we fit ALL of the requirements for 2019 it seems..... not very happy with turbotax right now :/ EDIT: We were less than two hundred over 😂

Did the earned income change to Three kids

You should have made up 200 bucks in expanses

Can you claim eitc when filling jointly. one person has a social and the other one has a itin?

I am on SSDI and Teacher pension. I made $60 working in 2023. Can I qualify for EITC?

Are early ira cash withdrawals included in the earned income calculation to determine the eitc credit? IRS audited my eitc due to my failure to include the cash withdrawal.

Im single filer with a declared wages of $ 12789. My IRA cash withdrawal was 523.

If my federal tax refund came (direct deposit 8888) deposited in my bank, will the earned income credit also be direct deposit too?

Can you still get EITC even without claming kids?

I guess not

Yes you can a credit up to 17,000

@Danny-xk5wj yep you can

if i file before 24 year old but my taxes are accepted and refund comes on my birthday making me 25 will i stil get theEITC payment or do i have to file a amended return

No

I don’t think so, but I think that’s ridiculous to have a minimum age requirement. My son’s not 25 until this summer, but took over my mom’s house when she passed. Paid all the property taxes along with every bill, while working for the school district. It’s bullshit.

What form do you use to claim this credit

You have to complete a schedule on your Form 1040 called Schedule EIC.

Hi thanks a lot for this. How to claim it for free? I mean without using turbotax etc.. Can I just file tax return offline?

Can but it'll take forever doing it by mail way longer e filing is way better and use freetaxusa to file they make calculations easier

My efile was accepted on 1/25/23. I did qualify for the Eitc. Does the irs start the average count of 21 days from that acceptance date or from mid February when they actually start processing the eitc returns?

Hi Dan, the IRS expects to start providing refunds related to EITC around February 28th. You can check the status of your refund on the IRS website located here: www.irs.gov/refunds.

So basically if I am only income person then i will get only 600$ ?

No you would qualify for 17,000$

Look at the chart

There is a chart online and it explains the 600 is like the amount credited to each like 1,000 dollars its credit plus it maximizes your refund by allot if you do it right

If I get $79k agi for a household member with 1 child and considered single will I be able to claim tax credit for the child? Also if you claim a relative as a dependent since if you paid for everything would that be considered a secondary dependent

Yep

If my income is w2 from my c corp. and my c corp generated income do I still qualified for EITC?

EITC also stands for the (from a business point of view) “best” company ever!

You failed to mention 1 important fact. Child must be under age 17

its free money

Emmet Vista

❤

Darn it, no kids

Don't need none

@@hazelhazzel5998so you can still apply with no children?

Hi Sean! Taxation is theft.

Go back to the Soviet Union, this is America !

*promo sm*

I net 80 and can barely live on my own this crap is crazy rent 1100 car insurance 300 car note 500 I live in southeast Michigan. I mean this is basically for people not working full time and either have government assistance or they live with a family or have roommates. Come on I paid the federal government more than 3x my return every pay week and I get no credits they crushing the middle class to handout checks to everyone

No it ain't the literal main qualification is that you worked show a w2 , make less than 65,000 a yr ages 25-64

They’re getting rid of the middle class. You’re either low income or upper class I guess. Ridiculous. Can’t afford anything being middle class anymore 😢

Having kids shouldn’t give you a break

Its not a break. Lol. Wait till you have kids then you see the expenses that come with that and you would understand

Hush

Said by a man who clearly has no children

But I’m glad I do, I’ve gotten up to $7,000 in credits 🤑

Yes tf it should. Don't be mad that you can't have kids🤡

2878 Huels Coves