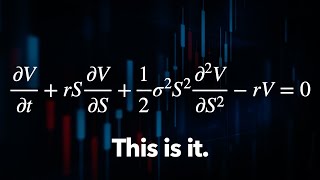

The Statistical Limit of Arbitrage

HTML-код

- Опубликовано: 15 май 2024

- Dacheng Xiu of University of Chicago Booth School of Business presents his paper, "The Statistical Limit of Arbitrage" followed by discussion by Yao Zeng, assistant professor of finance at Wharton, at the Jacobs Levy Center's 2023 Frontiers in Quantitative Finance Conference.

Led by Professors Chris Geczy, PhD, C'90 and Craig MacKinlay, PhD and established through the vision and generosity of Bruce Jacobs, PhD, G'79, GRW'86 and Ken Levy, WG'76, G'82, the Jacobs Levy Equity Management Center for Quantitative Financial Research at the Wharton School of the University of Pennsylvania is dedicated to the advancement of quantitative finance, at the intersection of theory and practice, through the creation and dissemination of innovative knowledge.

#QuantitativeFinance #WhartonFinance #arbitrage #wharton

-----

Founded in 1881 as the world’s first collegiate business school, the Wharton School of the University of Pennsylvania is shaping the future of business by incubating ideas, driving insights, and creating leaders who change the world.

With a standing faculty of 241 renowned professors, Wharton has 5,000+ students across four degree programs: undergraduate, MBA, executive MBA, and doctoral. Each year 13,000+ professionals from around the world advance their careers through Wharton Executive Education’s individual, company-customized, and online programs - with 200,000+ others earning certificates from Wharton Online since 2015. More than 104,000 Wharton alumni form a powerful global network of leaders who transform business every day.

Learn more about Wharton: www.wharton.upenn.edu/

Subscribe to the Wharton RUclips channel: ruclips.net/user/thewhart...

We proved this only to evolve it and disprove it via standard deviation outlier outcomes in the twoplustwo forums, circa 2006. The work ethic the young men displayed through their understanding of the flaws is impressive and I encourage them to focus on uncorrelated results and an assumption that time fools us all, and deduce from those the inverse of the problem presented.

very interesting!

Interesting paper

I did attend dr ross seminlar while in my junior years...in facts most of his works is from computational stats class....so the limits if apt is macro vs micro econ model...

✒👔

Can someone summarize this

There's a quote from a well known quant which boils down to "you can't capture 100% of any trade simply because of physics. At a certain level the heat produced by the electrons being transmitted in the cable submitting/carrying your buy and sell orders will impact transmission and processing times and therefore alter your returns."

Macro vs micro