IAS 12 - deferred tax - ACCA Financial Reporting (FR)

HTML-код

- Опубликовано: 6 фев 2025

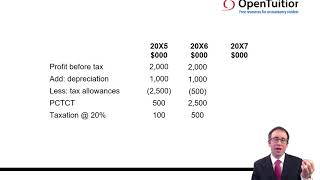

- IAS 12 - deferred tax - ACCA Financial Reporting (FR)

Free lectures for the ACCA Financial Reporting (FR) Exam

To benefit from this lecture, visit OpenTuition to download the notes used in the lecture and access all ACCA free resources.

Access to all Financial Reporting lectures, and Ask the ACCA Tutor Forums

Please go to opentuition to post questions to our ACCA Tutor, we do not provide support on youtube comments section.

** Complete list of free ACCA lectures is available on opentuition.co... **

Thank you Mr Chris, i was able to get 84 in my fr exam thanks to your explanations

Gotta love RUclips. I could never have learned this through a book or a class. I can only learn it through video/replay/on my schedule. Thanks for your clarity and brevity.

Same here. That's one good thing that Covid brought- online/ recorded lectures. I learn soooo much better this way

One thing which stands out about Chris is his practical , real life xperience in finance. This gives him a massive edge over technical reading material & makes his lectures very useful to working pofessionals. 👍

My favourite lecturer! In love with open tuition

Eish...finally I get it. Thank you for the clear, simplified explanation.

Simple explanation for an easy understanding, thank you

I gave this link to one of my board members as I couldn't explain it so well!

Excellent explanation

Wow I got it

Hello lecturer,

I have one question if company don’t have the profit this year do I need calculate deferred tax or not?

Can I have an email of the teacher (For queries about the topic)? Actually I have this question in mind which is why do we record Deferred Tax on Revaluation Surplus of the asset when in actual Tax authorities will not allow us the depreciation on the revaluation surplus of the asset? and what about the transfer of revaluation surplus to retained earnings for incremental depreciation?

Any questions to our tutors post on opentuition website on ask the tutor forums

For any queries please ask in our free Ask the Tutor Forum on our website, and our tutor will be happy to answer your questions :-)

I think,

It's relates to IAS 16 revaluation method the gain shows OCI, so the impact of the gain related deferred tax will shown in OCI-REVALUATION SURPLUS, SOFP-REVALUATION SURPLUS