Winning Forex Strategy - Master Pattern Advanced Theory - Trading Masterclass, Lesson 10

HTML-код

- Опубликовано: 19 июн 2024

- Description:

Elevate your trading proficiency with this insightful level three tutorial on the master pattern methodology. Discover four unique niche strategies derived from the master pattern framework that have been utilized by trade ATS to optimize daily trading. These strategies include Incycle Communication, Identifying Efficient vs. Inefficient Markets, Order Block Projections, and Multileg Expansion. This lesson is tailored to deepen your understanding of the master pattern and empower you to develop your personalized approaches to trading.

Key Takeaways:

- Incycle Communication (1:25 - 2:22): Understand how cycles within larger cycles play a crucial role in predicting market movement.

- Efficient vs. Inefficient Markets (2:40 - 4:02): Learn to distinguish between markets with balanced and skewed supply-demand dynamics.

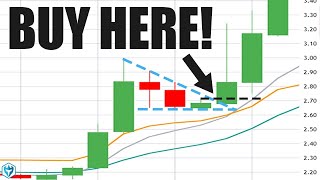

- Order Block Projections (4:30 - 6:00): Explore the use of order block heights for setting accurate price extensions and profit targets.

- Multileg Expansion Patterns (0:32 - 1:20): Recognize patterns indicating insufficient accumulation of inventory, crucial for trend phases.

This lesson offers valuable insights into the intricacies of the master pattern, enabling traders to fine-tune their strategies for greater success. For more advanced trading techniques and insights, visit www.tradeats.com.

---

Chapters:

0:00 Introduction to Advanced Master Pattern

1:25 Incycle Communication

2:40 Efficient vs. Inefficient Markets

4:30 Order Block Projections

6:00 Multileg Expansion Patterns

7:58 Conclusion and Key Takeaways

---

Hit the bell icon to stay updated on our latest releases!

You guys are speaking my language. I've been trading using these measurements for years. Talking markets to people in my inner circle is always on deaf ears, so even if seeing this video is as close as I come to knowing someone else gets it, then it is good enough for me. Thanks

They are just measured moves, I thought everyone used them!

Absolute solid information. I know I've never commented on your videos before but you are the reason for my trading success. I've watched you video's on the side lines for the past 4 years now. You really made things click for me. Thank you. Up most respect to you!

If only biggers graph i could graps easier please,the photos or charts are so small i could hardly recognize the contraction phase,even the expansion pahse if small,thank you but I know if i use this principle then i will not be guessing always,bless the Lord halelujah and thank you Lord for bringing me to this site and I thank people like you in sharing their knowledge free of charge,our great great great God will superduperly bless your company in Jesus mighty name bless the Lord halelujah!!!

wow!!! you can write the best day trading book with these 12 classes... thank you ...

Glad you think so!

thank you for the amazing video wade. Really grateful you are putting all this information out for free. God bless you.

My pleasure!

I applied this to crude last Friday and managed a $1.20 price move to the short side. Having plotted potential profit take level the price dropped to the exact order block projection I'd drawn onto my chart. I kept a screen shot of the trade for future reference. Thank you Wade, another legendary tutorial. 👏

Very nice! Great work!

Steidlmayer and wyckoff would be proud of you😇

Thanks! 😌

The good thing about knowing the measured moves is that you are less likely to be shaken out before the price target is reached once you prove to yourself the measured moves are valid and do work.

Love this one 💸❤️

Thanks!

Thank you boss, appreciate all your work❤

My pleasure!

Thanks alot

awesome!

Thanks!

Perfect explanation one question? where could i find some videos about the Master Pattern Strategys.

Thanks for sharing this strategy …seems to be really profitable

You bet!

Wade, this is such a cool way to observe structure and understand value in the market. I am still processing how to incorporate this into strategy, but thank you so much. I watched this video this morning for about the 5th time since you released it a few weeks ago to try and understand. I have actually made some mental progress this morning. Thank you.

Thanks!

I used this technique today on the SP500 futures market (identified the swing low from value to project the potential high-side target. It literally went to the tick before pausing and then proceeded much much higher. Very very cool. Thank you for showing people how to do this. It really lends greater confidence in holding to the target.

Hey Wade asked this question a couple days ago but I been noticing on some charts that on the 1hr timeframe sometimes it tends to take out swing highs or swing lows on previous expansion lines are you able to still use those as order block projections even tho a new expansion has started thanks…👍👍👍

what is your typical confirmation before entering a trade? just as long as its below or above the value line at the LTF? nothing more?

Great explanation on master pattern. But I saw that price always settle down in above or below to fair market value line after expansion. So why can't we go on that direction after. That have high potential to go with your favour no???

Screen time is all one need to figure out what works for him/her

base on the patterns created by this master pattern and

how the market react around this patterns.. psychology is key here.

I wish they would focus more on time frames a retail trader would be looking at.

We always recommend to trade on higher time frames because the success rate is much higher. But overall our advice is to trade on time frames you can monitor effectively. If you are trading a 5 minute, then make sure you can check your charts at least once every 5 minutes. Apply that same logic to all time frames, pick a set and stick with them for a long time.

Is this different to ICT's power of three, or AMD, accumulation manipulation and distribution. They all look the same?

Was wondering are you able to use the 1hr higher timeframe and the 3 minute lower timeframe the same exact way????

And also what if the expansion of the current contraction takes out previous swing high or swing low of previous expansion phase??

@tradeats

Is the best. Is my cheat code

this needs to be in NT8

When price action becomes confined, cant that also just be because of lack of trading volume in that asset at that particular time, and not necassarily it being priced at fair value? Seems most contraction ranges happen in after hours… Thanks

Volume can make a difference to some degree, but ultimately it is the Market Makers and Institutions who can move price. Any place they decide to contract price is defined as fair value from their perspective. Therefore, we do not only look for fair market value during after hours.

how to find the little box

Can I apply this to binary options trading?

Stay away from Binary options in my opinion. Very shady operations and terrible odds to win.

Spanking intense topic...

Thanks!

Nice strategy i must say. I didn't earn as much as this video claim but i earn about 240K every week and i don't do that using video

What do you do then? What's your strategy?

ATS!!!!!!!! I am eternally grateful, it changed my trading for me it is my SAT Nav, I use the Institutional Mode in conjunction with the Expansion Lines is more than 80% accurate.

E.W.T

Megaphone pattern.

scam, this indicator causes more confusion and mess than good for 2 years and I have not earned anything from it.

lol