- Видео 21

- Просмотров 306 371

Sian Eaton

Добавлен 20 май 2016

Видео

ACC5027 Coursework brief 2019 20

Просмотров 5895 лет назад

A briefing on the 2019/20 Decision Making for Business & Finance coursework 2019-20

Internal rate of return

Просмотров 2,3 тыс.5 лет назад

A short description of the internal rate of return

Accounting rate of return

Просмотров 58 тыс.5 лет назад

A short description and example of one method of calculating the accounting rate of return

Invest App NPV

Просмотров 2,1 тыс.5 лет назад

Simple explanation of net present value calculations using the tables. Please have presenta value tables available when watching

standard costing 1

Просмотров 2,1 тыс.6 лет назад

This video contains a brief introduction to Standard Costing

correlation

Просмотров 3177 лет назад

A basic description and demonstration of the calculation of the correlation coefficient and coefficient of determination

Sales variances

Просмотров 14 тыс.7 лет назад

demonstration on how to calculate sales price and sales volume variances

Standard costing 2

Просмотров 9227 лет назад

Video demonstrating how to calculate the fixed overhead variances

maximax, maximin, minimax regret

Просмотров 12 тыс.7 лет назад

Video describing how the Maximax, Maximin and Minimax regret modle works

Linear programming and shadow prices

Просмотров 26 тыс.7 лет назад

Linear programming and shadow prices

Preparing several functional budgets

Просмотров 2,3 тыс.8 лет назад

Preparing several functional budgets

Thank you 😊

Video was helpful.

Thankyou

Thank you beautiful

Thank you very much ma'am. However, I am unclear why you preferably used 105 as a regret in scenario 3 instead 65. Anyone can help me explain please!

Madam, your teaching is truly amazing and easy to understand. Thank you so much. I watched this after 6 years from when you originally published it. ❤😊. Keep it up you are the best❤

OMG THANK YOU SO MUCH !!! I’VE BEEN TRYING TO UNDERSTAND THIS TOPIC & MY LECTURER IS NOT GOOD AT EXPLAINING BUT YOU SAVED ME 😭😭😭 I’M SITTING FOR FINAL TEST IN 2 WEEKS !

i like this

Wow...im so happy

Explain net profit value with examples

where 40000 you used to get additional time came from

Thank u ma'am

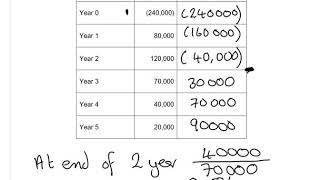

i don't understand about calculating payback period in undiscounted cash flow

Thank you too much

Thank you ❤️❤️❤️❤️❤️ what a beautiful soul

why didn't you do in the denominator capital +salvage value divided by 2

Thanks for clear understanding

This is the best video on payback period

What if the fifth year is the last negative cash flow in the communicative discounted cash flow, and there are no more years, should I divide it by the discounted cash flow of the same year (year 5) or do I divide it by 0?

How did you got the 2.571 years

and the purchase price of 9 were is it from

Life Saver

Thank you soo much!!!!! This was very helpful.

A textbook, university professor and 3 other accounting RUclips channels until I found yours and it FINALLY CLICKS

Thank youuu

Thank u so much

TYSM!!!

Thank you so much

Thank you so much

thank you

Well explained

How did you get the profit of 28000

better now :) thanks for the explanation. a quicker method

Thank you for the video..

Where does 28 000 come from?

Thank you .

Have a test tomorrow and this cleared everything up. You’re a lifesaver!!

20x = 299 - how did you get that? then x = 14.95?

she subtracted both the constrains, she was technically solving both the constraints

Thank you

Thank you

Thank you 🙏🏽 😊

very comprehensive and concise...

Can you please tell me what happens when we have money coming in in year 0? An investment that takes 3 months to make and then it starts generating income for the remaining 9 months of year 0.

Thank you..it is very informative

what If the residue value is zero? how can be solved?

Well done , you saved me

Thank you very much for the videos. This is really really helpful!

Thank you ma'am for this video😊😊

very clear. Thank you!

Shouldn't it be 40,000 ÷ 270,000?

No it should not. This is how to calculate the fraction of a year at the end of the payback period